Sen. Joe Manchin (D–W.Va.), whose vote may very well determine the eventual fate of President Joe Biden’s biggest legislative initiative, reiterated his opposition to any bill that adds to the national debt or risks adding fuel to inflation.

“I’m open to supporting a final bill that helps move our country forward, but I’m equally open to voting against a bill that hurts our country,” Manchin said at a press conference Monday. He noted that both Medicare and Social Security are on track to become insolvent—an arrangement that would impose mandatory benefit cuts across the board—within the next 12 years. Without addressing those looming concerns, Manchin said, any bill that “expands social programs and irresponsibly adds to our $29 trillion in national debt” would be unwise.

When Democrats decided in the spring to split President Joe Biden’s proposed “Build Back Better” plan into two pieces, it was supposed to set up a delicate legislative pas de deux. Instead, they’re playing a game of chicken. The roughly $1 trillion infrastructure plan (which includes about $500 billion in new spending and another $500 billion in repurposed spending) enjoyed bipartisan support when it cleared the Senate in July. But it has languished in the House since then: Progressive Democrats are unwilling to send it to Biden’s desk until the Senate agrees to pass a social spending package that would likely include a series of tax increases.

That spending bill, which Democrats hope to maneuver through the Senate via the reconciliation process, started out as a $3.5 trillion measure. Last week, Biden announced a supposed compromise in an attempt to appease Manchin and Sen. Kyrsten Sinema (D–Ariz.), who have opposed the higher taxes and borrowing necessary to finance the larger proposal.

Manchin’s comments suggest that the senator will not give his approval to that slimmed-down proposal without additional scrutiny.

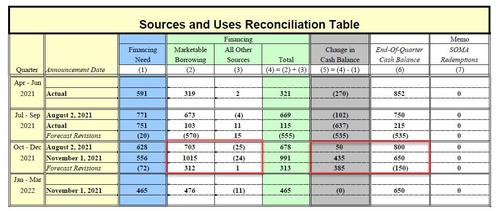

“What I see are shell games,” Manchin said. “Budget gimmicks,” he said, would make Biden’s $1.75 trillion proposal cost almost twice that much in the long run.

One of the biggest gimmicks in the bill has to do with the expanded, refundable child tax credit program, which will cost about $110 billion annually. Democrats are proposing to extend it for only a single year, thus making the bill’s long-term costs seem significantly lower than if they had to account for 10 years of spending, as is the norm. The framework also seems to overestimate how much revenue would be generated by various proposals, potentially leaving big gaps that would have to be filled by borrowing.

“This is a recipe for an economic crisis,” Manchin added. “None of us should ever misrepresent to the American people what the real cost of legislation is.”

Manchin offered pointed criticism of the progressive wing of the House Democratic caucus, saying that lawmakers in the lower chamber should be given the opportunity to vote on the infrastructure plan even if the Senate has not approved the social spending bill. On Friday, Biden urged House leaders to vote on the infrastructure bill, but the impasse continues. Holding the infrastructure bill “hostage,” Manchin said, “is not going to work in getting my support for the reconciliation bill.”

The game of chicken continues.

from Latest – Reason.com https://ift.tt/3w7tGje

via IFTTT