BoJo Kicks Off COP26 Summit By Comparing Climate Change To “Bond Villain”

After the G-20 members gathered over the weekend to discuss critical issues like climate change ahead of the two-week-long frenzied UN climate crisis which has taken on the unfortunate nickname of COP26, which even UK PM Boris Johnson has criticized as “too vague”.

Heading into the summit, perhaps the biggest criticism among world leaders is that the international community still hasn’t managed to come anywhere close to reaching the goals from the Paris Climate Accords from six years ago. As Mike Shedlock put it: forget COP26, we still haven’t met COP-09 and COP15.

But the G-20 still managed to come up with its own “communique” (readers can find the rest of that one here).

Analysts and journalists jeered at the mediocre progress made during the G-20 talks involving the world’s most powerful leaders (with the notable exception of Vladimir Putin and President Xi, who also don’t appear inclined to attend the summit in Glasgow).

At least one photographer left us with this hilarious photo of President Biden trying to keep his composure just at the edge of the frame (that’s Biden in the far left first row)…

As COP climate talks kick off with a procession of world leaders setting out their plans for curbing global warming, all eyes are on the biggest emitters: China, India, and the U.S., while Brazil — long a climate laggard — is expected to come up with a new roadmap.

The summit in Glasgow, Scotland, is happening under the shadow of an energy crisis that’s shifted some of the dynamics of climate diplomacy and forced (mostly European) governments to think more about security of supply (ie submitting to Russia).

One of the most ironic tendencies of the summit is that President Joe Biden and other leaders have come to the conference pushing for more emissions cuts, and more commitments to green energy while also pushing oil producers at OPEC+ ramp up supply to help spare the US and Europe from a brutal winter. Given these contrarian commitments, the summit should allow Russia, China and others to throw the West’s virtue-signaling when it comes to climate change – right back in its face.

What’s even more ironic is that the two-week summit is happening under the shadow of the UK’s own energy crisis. Which means that those who are in a position to try and cut greenhouse gasses are simply in too difficult a situation to try and fix it now. (hence Putin’s decision to skip it).

UK PM Boris Johnson (the nominal host) kicked off his speech with an elaborate James Bond analogy to really drive the point home, while also taking a jab at the climate movement’s teenage figurehead: Greta Thunberg.

“Bond is strapped to a doomsday device as a red digital clock ticks down remorselessly to a destination that will end human life as we know it,” he told delegates.

“We are in roughly the same position, my fellow global leaders, as James Bond, today,” Johnson said.

“The tragedy is that this is not a movie and the doomsday device is real.”

“We are in the same position as James Bond today. Humanity has long since run down the clock on climate change.”

At one point, Johnson echoed everybody’s favorite teenage climate activist Greta Thunberg, telling world leaders they need to deliver on the promises they made in Paris in 2015 to arrest global warming.

“All those promises will be nothing but ‘blah blah blah,’ to copy a phrase from Greta.”

But he warned that the anger and impatience of the world would be “uncontainable” if world leaders failed to take decisive action.

BorisJohnson: If we don’t get serious about climate change today, it will be too late for our children to do so tomorrow. pic.twitter.com/6xicwq75Ie

— Smith140910 (@smith140910) November 1, 2021

In a sign of a growing focus on the actions of the business world, United Nations Secretary General Antonio Guterres also announced at the opening ceremony that he would establish an expert group to develop a standard for measuring and analysing corporate net zero pledges.

Guterres called for countries to be forced to update their climate plans every year if COP shows that current efforts aren’t good enough. That’s in line with a call from the most climate-vulnerable nations to get polluters to keep ratcheting up their plans until they’re strong enough to slow global warming. This theme is shaping up to be a big one at the summit — how quickly countries will be told to revise their homework.

“There is a deficit of credibility and a surplus of confusion over emissions reductions and net zero targets, with different meanings and different metrics,” UN secretary-general António Guterres said.

Meanwhile, President Biden needed a nap after his own doomsday speech…

“There’s no more time to hang back or sit on the fence or argue amongst ourselves,” Biden said.

“This is the challenge of our collective lifetimes. The existential threat to human existence as we know it.”

“And every day we delay, the cost of inaction increases. So let this be the moment that we answer history’s call here in Glasgow. Let this be the start of a decade of transformative action that preserves our planet and raises the quality of life for people everywhere,” he continued. “We can do this. We just have to make a choice to do it.”

NEW – Biden falls asleep at #COP26 “climate change” conference. pic.twitter.com/Y5hR7CCghn

— Disclose.tv (@disclosetv) November 1, 2021

The elite arrived in the private jets, and their internal-combustion-engine limos choked off the Scottish city’s streets…

Side streets around #COP26 are choked up with chauffeur-driven cars and vans, many with their engines idling. Interesting look for a climate conference. pic.twitter.com/9NO83ydN0w

— Ciaran Jenkins (@C4Ciaran) November 1, 2021

So far, it looks like the epic climate conclave is getting off on the wrong foot.

As Mish concluded perfectly succinctly, expect no new commitments of any substance at COP26. If by chance there are any, they will be as meaningful in practice as commitments made at COP09.

Given the G20 have spoken, and not acted, should we perhaps cancel COP26 and save all the carbon that will expended on it?

Looking ahead, here’s what’s to come:

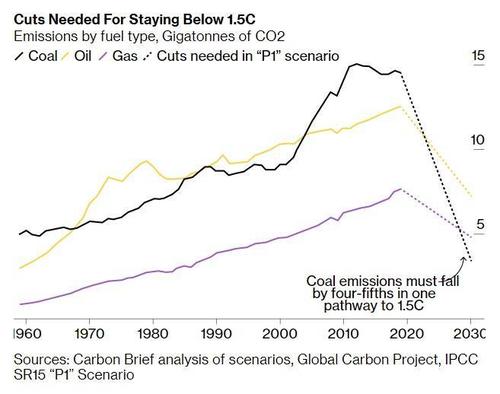

November 4: Energy Day – Alok Sharma will fight to “make coal history”. There will be new signatories to the UN’s No New Coal pact but China and the US won’t be among them.

November 5: Expect noisy protests from Greta Thunberg. This goal will certainly be met but it will not accomplish a damn thing.

November 10: Transport day, with focus on cutting carbon from cars. Key moment: Boris Johnson will hope for new national bans on petrol and diesel car sales. If there is anything to cheer it will come in this sector. But there will not be meaningful bans on petrol other than perhaps diesel cars. Most of the success will happen anyway from car makers.

November 12: Negotiations are due to end, so expect last minute scuffles to delay proceedings. Key moment: release of the negotiated text. No climate target, but nations are likely to reaffirm support for 1.5C goal. The text is sure to disappoint climate change activists.

For those who aren’t familiar with the concept behind these conclaves, the COP26 is the 26th annual Conference of Parties on climate change. The goal of these meetings is to agree to methods of limiting global warming to 1.5ºC above pre-industrial levels by 2100.

In short, countries will do what they want, when they want, but the media will always praise Saint Greta.

As an aside, one wonders when the nuclear option will be accepted as necessary as part of the green push: yes, it can go very wrong – but have you ever seen what can happen with hydrogen? Even post-Fukushima Japan, where PM Kishida has just won re-election, is considering it.

Tyler Durden

Mon, 11/01/2021 – 14:21

via ZeroHedge News https://ift.tt/3nU9Kgq Tyler Durden