“Rates VaR-Shocked In Full-Blown Stop-Out Fashion”

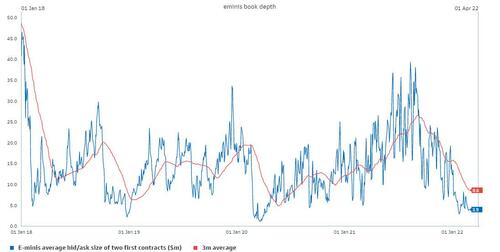

With most traders glued to screens and following every tick in the chaotic mess that is the Emini, where liquidity has collapsed to levels not seen since the March 2020 crash…

… the real action is in bonds, where as Nomura’s Charlie McElligott writes in his morning note that we are seeing a “paradigm shift” in rates as a result of the spike in “unknown unknowns” from the Ukrainian war, which has prompted comments such as this one from the ECB suggesting that central bank normalization plans may have just died a gruesome death…

- *ECB SHOULDN’T EXIT STIMULUS BEFORE ASSESSING WAR IMPACT: REHN

and immediately following:

- *TRADERS DELAY 25BPS ECB HIKE BETS TO MARCH 2023 FROM JANUARY

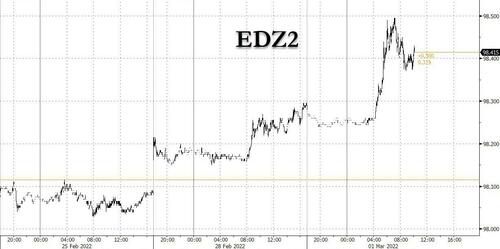

… and which means that the market’s massive front-end short positioning – where “six or seven” rate hikes had become the market’s flawed baseline – is being VaR-shocked in full-blown stop-out fashion, leading to the EDZ2 +46 ticks from Friday low to this morning’s highs…

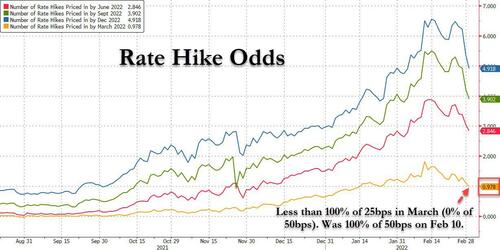

… which in-turn is pricing-out implied hikes in both Europe and the US.

As a result, as shown above, McElligott notes that the first full ECB hike is now pushed-back into 2023 (after having pushed close to two implied hikes being priced-in by EOY just a few weeks back), while Fed implied liftoff is now a UNDER a full-hike in March (i.e. the debate has turned from “25 or 50” to now “0 or 25”) and down to btwn 4.5 and 5 hikes by the end-of-year Dec (which after the last CPI beat traded up to 7 hikes implied intraday on 2/10/22).

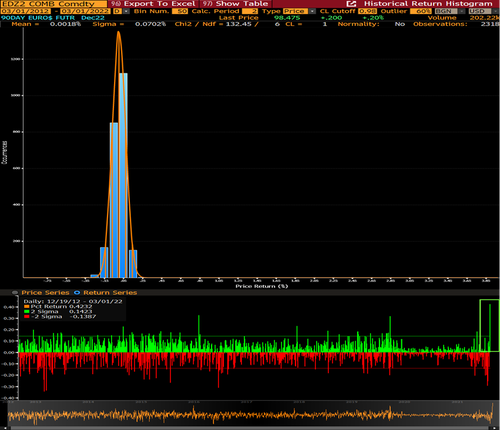

Of course, the magnitude of the short-squeeze (the 2d rally in ED1 is > +6 z-score move going-back 10 years to 2012!) was not purely about a new “dovish” CB view around the implications of the Ukraine Geopol shock in-and-of-itself—the scale of the move was of course too due to the enormous crowding / asymmetry in “hawkish” front-end shorts, where we are seeing a similar move to the epic snapback in stocks last Thursday.

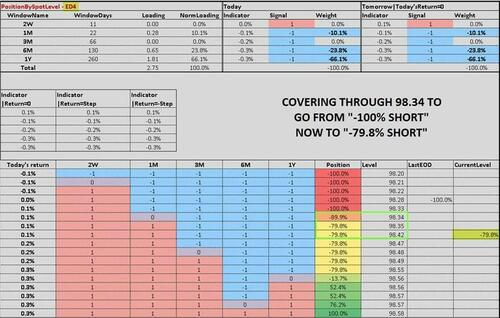

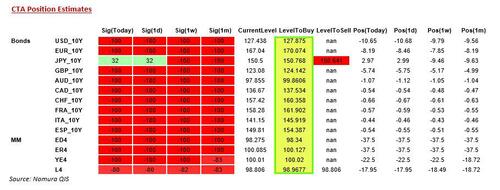

And as yet another “100% consensus” trade implodes, it will come as no surprise that Eurodollar and Euribor futs signals have both been “-100% Short” since ~Oct ’21 according to the Nomura X-asset strategist, and most importantly had accumulated into the two largest exposures across the entire CTA Trend model — but now today, we see both being partially forced to cover some of that legacy “short,” as the signal is reduced down to “-79.8% Short” after the 1m and 3m buckets flipped “long”: ED covered at a 98.34 “trigger” and ER covered at 100.127, kicking off very large implied notional buying / squeeze.

More critical is that the next “cover” triggers from here are immediately proximate, depending on the magnitude of further stop-outs, and will see both ED and ER flip outright “+100% Long” in the CTA Trend model, leading to havoc in the STIR space:

- ED goes to “+100% Long” on a move and close above 98.57

- ER goes to “+100% Long” on a move and close above 100.18

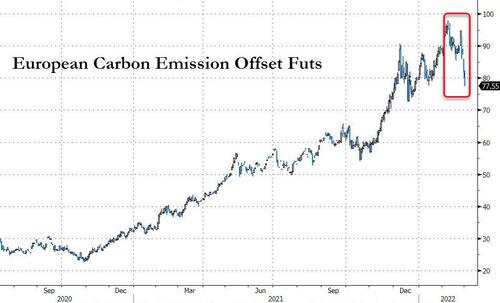

As pertains to the market’s shock repositioning from last week’s “hawkish” stance into what is now “an almost certain stagflationary” economic outlook for Europe” (and we would add the US here), Charlie warns that the risk of slowing growth (ECB projections of potential 1% EZ growth hit) against persistently higher inflation is very much real (just today, Italian CPI surged to new Euro-era highs), as are risks of “worst case” war outcomes in the worst kind of “risk-off” fashion (Lavrov this morning talking about US nukes as unacceptable in Europe, all while a 40 mile column of weaponry, troops and support advances toward Kyiv), so this “hawkish Rates” trade and ensuing risk-off “dovish stop-out” remains “binary” from a macro catalyst- and price-signal- perspective, and could continue to “chop” again,particularly into next week’s potentially “still hot” US CPI print.

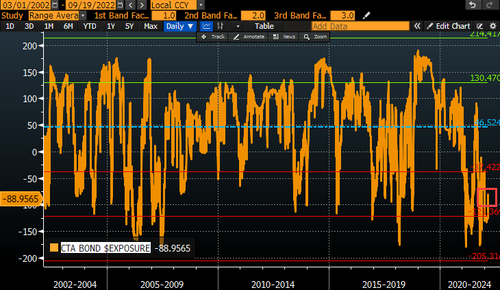

Finally, it’s not just Short-Term Interest Rates that are turmoiling: due to the sheer speed of the two-day rally, we have violently exploded near “buy to cover” stop-levels in legacy G10 Bond “-100% Short” positions as well across the CTA model:

One final point: the CTA position in aggregate G10 Bonds remains at a -2 sigma extreme dating back to 2002, so as McElligott warns, there is plenty of “wood to chop” on further short-squeeze, one which would then collapse the entire yield curve.

TL/DR Bottom line: the Fed is about to lose control, with the market saying it is unable to hike into what everyone now realizes is a major stagflationary shock.

Fed about to lose control pic.twitter.com/GzcQUBriY5

— zerohedge (@zerohedge) March 1, 2022

Tyler Durden

Tue, 03/01/2022 – 10:55

via ZeroHedge News https://ift.tt/BaA4kHS Tyler Durden