Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

Back in January I wrote a piece called, “Who’s Afraid of Jerome Powell?” Then I discussed the incipient wailing and gnashing of teeth coming from those terrified of a hawkish Fed.

Our entire society has become so addicted to cheap dollars and easy credit that it created a “Ballers” mentality society wide.

Ballers is all about the corruption money brings to those few thousand people in the NFL and their organizations because of the millions of people who spend too much money on a passing fancy, entertainment.

The NFL, like all pro sports, is nothing but a money funnel with a Federal Reserve sized Hoover attached to it. It’s the ultimate corruption of e pluribus unum. From many to one.

Take a little bit from all of us, time and again to help us relieve the stress of the shitty world they’ve built. Give some of it to the rubes who play the game, who blow it on hookers, high end cars, and drugs, while the lion’s share gets sucked right back up into the same oligarch class that created it in the first place.

But it’s no different than you or me, buying shit we don’t need on credit, self-medicating with pro sports, alcohol, video games, day-trading cryptos on Robinhood, yelling at racists on Twitter or my personal favorite, a ridiculous board game collection.

We’re all ballers to one degree or another, spending easy money on distractions rather than facing the reality that the most unsustainable thing about our society is the money which makes it all happen.

Here we are eight months later and Powell has done exactly what I’d hoped he’d do, aggressively raise rates and begin shrinking the Fed’s balance sheet once his second term as FOMC chair was confirmed.

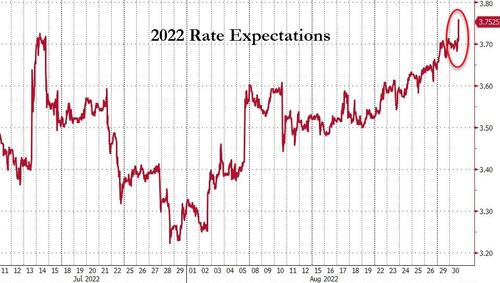

After July’s second 0.75% rate hike in as many meetings the talk was all about the ‘hints’ embedded in Powell’s demeanor and presser that the Fed was on the verge of pivoting and reversing rates. This talk has been going on since before the first 0.25% rate hike in March.

It reached a fever pitch after the July meeting because of a number of factors which have almost nothing to do with US domestic economic data or the needs of the US as a country. As I’ve discussed ad nauseum, the group most exposed to an aggressive Fed is not the US economy, which is what the headlines are now focusing on, but the European Union and the ECB.

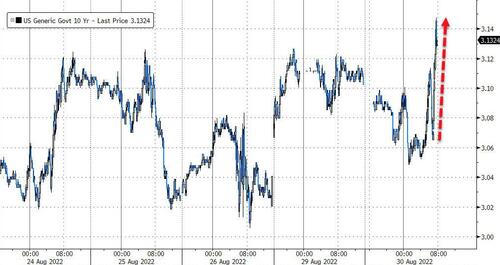

I never expected Powell to indicate any kind of pivot talk at Jackson Hole last week. His nine-minute speech was the exact opposite of that. It was a complete dispelling of the illusion that the Fed has any mind to change course any time soon.

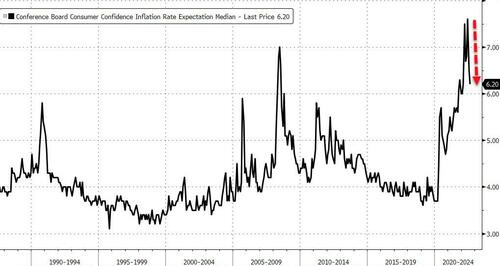

Powell explicitly addressed that this policy will lead to a prolonged recession. Moreover, he admitted that the current problem is a sincere mismatch between supply and demand. And, in the shock of all shocks, admitted what myself and a few others have been saying for months now, the Fed’s tools are not capable of dealing with the supply side of the economy, only demand.

In short, we have an oversupply of economic activity that supports the Baller lifestyle of the past and a deficit of things that support that lifestyle. All the Fed can do at this point is restore lost credibility with the markets and protect its future.

This, in my opinion, is exactly what they are doing.

The question is who is the Fed trying to protect itself from? It has been my contention for months that the Fed is no longer on board with coordinating Central Bank policy globally to suit the needs of foreign actors, in particular the European Union and the ECB.

By refusing to fold to the pressure earlier in the year and going forward with hiking farther and faster than anyone (including myself) thought they would or could the Fed has placed the ECB into a bind. Powell’s speech at Jackson Hole made tightened that bind to the breaking point.

Since most of our prominent politicians are on Team Davos the wailing will never stop. It took Elizabeth Warren all of twenty minutes to find a microphone to screech into:

“Do you know what’s worse than high prices and a strong economy? It’s high prices and millions of people out of work. I am very worried that the Fed is going to tip this economy into recession,” Warren told CNN on Sunday.

Yes, of course the Democrats are 1) still denying that we’re in a recession and 2) that it’s not their fault. But Warren, being the good destructionist she is, refuses to admit that there comes a point where you can no longer spend money to prop up an economy with these levels of imbalances.

This was precisely Powell’s point in his speech at Jackson Hole. And if Warren or any other so-called leader we have on Capitol Hill was willing to stop bitching and listen they would see what is clear to everyone.

The Baller Days are behind us.

The yacht’s trashed, the caterer left, the punch bowl empty and the credit cards maxed. Oh, and now there isn’t a new contract on the table. There’s no money left for trillions in giveaways to buy votes from people with no skin in America’s game.

But, since Lizzie works for those trying to destroy the US, of course she’s worried for the future. Where are her checks going to come from?

While the Fed has the magic money tree, even it, sometimes has to be watered and fertilized with something that looks like savings.

This is why everyone was afraid of Powell in January. They had rightly guessed that he was serious about the job of bringing back credibility to not just the Fed but the US as well.

The real pivot wasn’t the one that everyone wanted from Powell in some nebulous future. The real pivot occurred back in July when the ECB raised rates and announced their newest program to shuffle dec chairs, the TPI — Transmission Protection Instrument.

There ECB President Christine Lagarde announced she would defend internal European credit spreads to manage the risks within the EU as it now was being forced to raise interest rates.

But Lagarde never wanted to raise rates. But, as far behind the curve as Powell was in January, Lagarde was on a different track in July. This was her Mario “We will do whatever it takes” Draghi Moment and it fooled the markets for about a month.

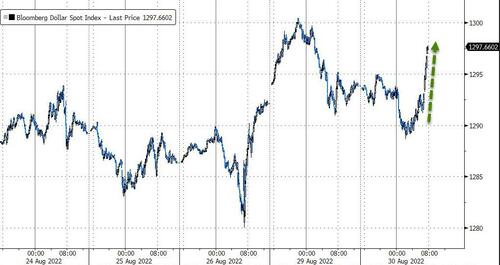

And then the old trends reasserted themselves. The euro bounced to $1.04 and collapsed to a new low. German-US 10 year spreads blew out to 1.966% and has since contracted… hard.

So, while Lagarde is furiously trying to keep things under control in Europe, relative to the US it is losing ground now daily quickly. The US/German spread is a bet on the relative ‘safe haven’ status within each of these economic zones.

It doesn’t help that the EU is continuing to commit economic and political hara-kiri by engaging in idiotic energy policy across the continent in order to punish Russia for Europe’s crimes in Ukraine.

The WEF midwits put in charge of the EU to effect this policy refuse to change course.

I wrote when it happened that I thought Powell’s aggressive rate policy indirectly was responsible for the collapse of the Draghi government in Italy.

You know I believe the Fed is working to re-establish US primacy over its own monetary and fiscal policy, which tracks with the way Powell has raised rates and caused heart attacks within the Eurodollar system.

Moreover, when you look at the failures of the Biden administration to get any traction globally to isolate Russia you see a Davos agenda that is failing completely.

It then tracks that weak newcomers to the Italian Swamp, like those in M5S, may have finally been given enough assurance that the situation has changed. July’s 9.1% US CPI print was enough to really begin breaking things.

The Anti-Davos factions within the US are strong enough now for them to throw off the Davos yoke, as represented by Draghi, Mattarella and former PM Matteo Renzi, and begin Italy’s bid for independence.

The Fed responds to Davos taking out {The UK’s Boris} Johnson by taking out Draghi and putting the EU on a path to disintegration. The euro broke parity with the US dollar on this news. Now the ECB is staring at a vortex of higher rates as the Fed is clear to raise another 75-100 bps in two weeks.

Less than two weeks later, Draghi was gone, the ECB raised 50 bps and began crushing credit spreads while the Fed hiked another 75 bps.

But the ECB can never admit this or it destroys the idea of it being any kind of independent agent. Remember, central banking rests on the dubious idea that these people are apolitical and make their decisions only with respect to their domestic needs.

If Lagarde were to publicly attack Powell’s policy she would be admitting the ECB is subordinate to the whims of the Fed and that the only thing she’s good at is picking out neck scarves to wear at public speeches.

The pressure on the EU from their catastrophic energy policy now has them openly calling for an end to the Union’s political arrangement. German Chancellor Olaf Scholz just called for an end to single country veto power on fiscal and foreign policies. This is a naked power grab by Germany to enforce its will on the whole EU, ending any pretense of national sovereignty.

It’s not like this wasn’t expected. It’s always been the plan by Davos to consolidate power in Brussels under the direction of German Greens. The excuses of Climate Change and the need to punish Russia is now their twin casus belli against any opposition to their rule.

“Where unanimity is required today, the risk of an individual country using its veto and preventing all the others from forging ahead increases with each additional member state,” the German chancellor said.

According to Scholz, “the principle of unanimity only works for as long as the pressure to act is low,” citing the example of Russia’s military offensive in Ukraine, which has challenged the way the EU approaches policymaking.

The German leader also wants the EU to switch to majority voting in areas such as taxation and foreign policy, adding that he knows “full well that this would also have repercussions for Germany.”

This is a direct consequence of their losing multiple political battles here in the US and it is forcing them to go for the gold now versus in the future. Powell’s Fed is forcing this moment to its crisis point and the Eurocrats of Davos are not letting that crisis go to waste.

At the same conference they are now talking about price caps on energy the same way the G-7 did this summer. So, nothing has changed in Europe. They will go it alone if they have to in saving the world from Climate Change and Russians.

You rock on guys, winter is coming, after all. The only people who are against a hydrocarbon-fueled future are the ones without any significant reserves of hydrocarbon fuels. Let that sink and that should tell you what you need to know about European policy. The US is about power, but we have the natural resources to sustain our lifestyle.

Europe got so used to living a Baller lifestyle on cheap Russian gas, they thought they could do so forever and dictate terms to the world to subsidize it. It was so cheap Credit Suisse’s Zoltan Poszar calculated it as “$2 Trillion Of German Value Depends On $20 Billion Of Russian Gas.” And I guess they weren’t satisfied with that. It had to be more than 100x leverage, apparently.

They have to do this now because they are terrified of what Powell said on Friday. As is everyone else.

The virtuous cycle of infinite credit expansion is over.

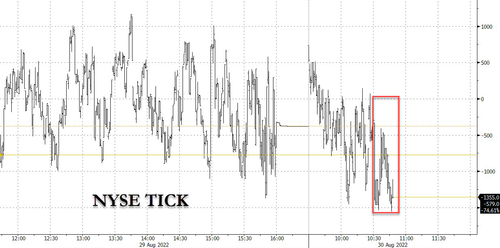

I found this article at Zerohedge discussing the ECB’s shenanigans during Powell’s speech particularly illuminating. It seems Europe was trying to create a 1000 point drop in the Dow to ‘bad mouth’ Powell and manufacture consent that he’s the villain in this new psychodrama they have planned for us.

But it’s simply not going to work.

With each new headline out of Europe no matter how much they try to play the victim of US imperial ambitions the reality is that Europe did this to themselves.

You can’t virtue signal yourself out of a depression of your own making. Those with money will simply abandon you. And those who you thought were your friends were really just guys who wanted free chicken wings, beer and a nice place to crash. It certainly beat starving in Africa.

They had a clear choice, just as we had decades ago. They chose poorly.

And now we get to watch their quest for fire and material pursuit of power for its own sake come to naught. The orgy of debt is over. And the best part is that Misters Powell and Putin didn’t even have to ask the Germans to turn out the lights before they left, they did that themselves.

* * *

Join my Patreon if you like indoor lights