Market sentiment has only deteriorated after Friday’s sharp post-Powell/ECB dump, and investors started the week with the bear market rally in tatters after the world’s biggest central banks huddled around a simple message in Jackson Hole this weekend: they are ready to fight runaway inflation with higher interest rates, even if it does some damage (in other words they want to crush demand, even as Biden’s debt relief plan and Inflation Reduction Plan hopes to stimulate demand). Powell quashed the idea of an early dovish Fed pivot (ensuring a much more forceful one later once all EMs fully blow up on the back of the soaring USD) and also said on Friday that the road ahead will “bring some pain to households and businesses” in the US, an “unfortunate cost of bringing down inflation” while ECB’s Isabel Schnabel said she and her colleagues had “little choice” but to continue tightening even if Europe’s economy tips into recession, which is becoming increasingly likely. As expected, Senator Liz Warren said she was worried the central bank will tilt the US economy into a recession, but for now Biden still thinks that soaring inflation polls worse than recession and/or global depression.

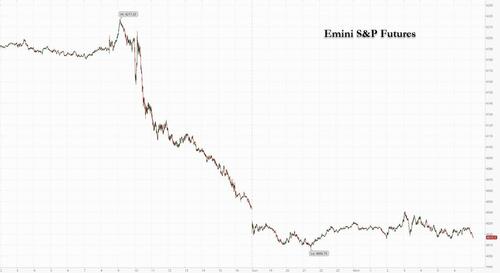

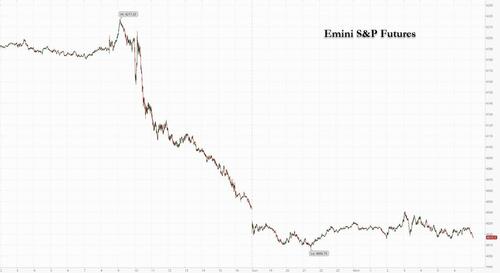

In any case, Powell’s signal of higher-for-longer interest rates rocked market on Friday and then followed through in Asia and Europe on Monday, sinking stocks and equity futures. S&P 500 futures slipped 1% as of 715 a.m. New York time, while Nasdaq futures tumbled 1.3%, as swaps traders boosted their expectation for where the Fed rate will be a year from now to 3.82%, from 3.68% a week ago.

Some more dismal data: the S&P 500 just posted its worst week since July and virtually all members tumbled Friday. Major indexes dipped below their 100-day price averages, which could indicate the potential for more losses. And the one-month percentage price change for all major indexes is negative. As Bloomberg puts it, the message is clear: interest rates will stay higher for some time, reducing the possibility of a soft landing.

Amid the rate back-up, 2Y Treasury yields rose to the highest since 2007, stopping just shy of 3.50%…

… as Bonds in Europe also tumbled with Germany’s 10-year yield rising above 1.5% after a string of European Central Bank officials also stressed over the weekend the need to act more forcefully to quash record inflation, effectively assuring that Europe will be pushed into recession or worse. The Bloomberg Dollar Spot Index pushed toward the record hit last month as investors sought a haven from spiking volatility. Commodity-linked currencies as well as the yen, the pound and the offshore yuan were under pressure. Bitcoin broke below the $20,000 level some view as a marker of a deeper slide in investor sentiment. Gold retreated, but oil made gains on supply risks.

In premarket trading, markets are honing in on the possibility of an economic slowdown: cyclical companies such as Freeport McMoran, Dow, Nucor and Ford are among the bigger decliners while shares of major US technology and internet stocks such as Tesla and Amazon.com also sharply lower with the group on track to extend a sharp selloff from Friday. Apple and Amazon each fall 1.3%, Nvidia 1.2%, Meta Platforms -1.1%, Microsoft -1%, Alphabet -1%.

- Cryptocurrency-exposed stocks may be active on Monday after Bitcoin extended its drop below $20,000 as part of a wider market retreat, amid concern about the Federal Reserve’s rate- hike path. Keep an eye on Marathon Digital (MARA US), MicroStrategy (MSTR US), Coinbase (COIN US), Bit Digital (BTBT US), Ebang (EBON US), Riot Blockchain (RIOT US), and Silvergate Capital (SI US)

- VBI Vaccines (VBIV US) is down 9.7% in US premarket trading after entering into a sales agreement for possible offering of up to $125 million in shares from time to time via Jefferies on Friday.

- Watch Walmart (WMT US) stock as the retailer proposed to buy all of the shares in its South African unit Massmart it doesn’t already own for 62 rand apiece, a 53% premium to the last closing price.

- Minerva Neurosciences (NERV US) shares rise 2.6% in US premarket trading after gaining more than 150% last week as it applied to the FDA for approval of its schizophrenia drug candidate and Point72 Asset Management disclosed an 8.8% passive stake in the stock.

“We maintain our view that the Fed will raise rates by another 100 basis points by year-end, with risks for more if inflation does not slow in line with our forecasts,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “With rates likely to stay higher for longer, our base case is for further volatility, earnings downgrades, and higher-than-expected default rates over the course of the next year.”

European equities also tumbled on Monday, adding to last week’s selloff amid concerns about the economic impact from further central bank tightening, which officials embraced in Jackson Hole. The Stoxx Europe 600 slid 1.2% with technology stocks underperforming as bond yields rose. Utilities also fell after comments from French Prime Minister Elisabeth Borne over the weekend heightened unease that a windfall tax could be imposed on “super profits.” UK markets were shut for a holiday. The benchmark has slumped to the lowest since July 21, breaking below its 50-day moving average, as worries about a downturn intensified after central bank officials said they are ready to follow through with higher interest rates, even if it does some damage. The region already faces a flurry of other headwinds, such as the prospects of gas rationing and political turmoil in Italy and the UK. Here are some of the biggest European movers today:

- Utilities are among the worst performing sub-sectors in Europe after comments from French Prime Minister Elisabeth Borne over the weekend heightened windfall tax concerns on “super profits”

- Technology stocks underperform all other sectors in the Stoxx 600 after central bank officials signaled they’re ready to follow through with higher interest rates, and as bond yields rose

- Bavarian Nordic falls as much as 15% after White House monkeypox coordinator Robert Fenton said after market close on Friday that the US has nearly all the monkeypox vaccines it needs

- Cryptocurrency-exposed stocks suffer on Monday after Bitcoin extended its drop below $20,000 as part of a wider market retreat, amid concern about the Federal Reserve’s rate- hike path

- BW LPG shares fall as much as 13.2% after the Norwegian LPG published 2Q results. Analysts note a soft report with a miss on adjusted Ebitda, and some exposure to prices on the 3Q spot market

- SAS shares slide as much as 17% after DNB cut its PT for the ailing Scandinavian airliner to SEK0.05 from SEK0.10, seeing “significant dilution” on the back of its Chapter 11 proceedings

Tech firms led losses for Asian equities, while progress in the US-China delisting spat helped to cushion Chinese stocks. Emerging-market stocks dropped and a gauge of major developing-nation currencies slumped by the most in more than two months.

In FX, the Bloomberg Dollar Spot Index rose to six-week high as the greenback advanced versus all of its Group-of-10 peers, and pushed toward the record hit last month as investors sought a haven from spiking volatility. The euro fell a second day but remained in its recent $0.99-1.00 range. The euro is trading close to its cycle lows, yet options show that bearish sentiment for the common currency is becoming steadily lower. The yen tumbled as much as 1% back toward the 140 per dollar level as the impact of hawkish Federal Reserve comments at Jackson Hole weighed on Japan’s currency. Signs from the option market suggested a renewed bias toward yen weakness on the part of asset managers, who boosted their net-short position by the most on record in the week to Aug. 23. Australia’s dollar fell for a second day as momentum accounts price in a more hawkish Fed after Jerome Powell’s speech at Jackson Hole. Sovereign bonds declined. Australian retailers powered further ahead in July, suggesting cashed-up households are coping well with rapid interest-rate increases. The yuan weakened to fresh two-year lows after Powell signaled higher-for-longer interest rates, prompting China’s central bank to set a stronger-than-expected fixing to cap the currency’s drop. South Korea’s won led declines, falling 1.4%, while the Thai baht slipped 1%. “The market has not been hawkish enough on the Fed’s path,” says Stephen Chiu, chief Asia FX & rates strategist at Bloomberg Intelligence in Hong Kong. “Last week’s deluge of Fed speakers including Powell basically told the market to retune their view. But we believe still not enough hawkishness is priced in. So the dollar may continue to rise versus Asian currencies.” Bank of Korea Governor Rhee Chang-yong said he would join the Fed in focusing on inflation if prices remain out of control, keeping the door open for another outsized rate hike

In rates, Treasuries remained under pressure but are off the cheapest levels of the session; the US 2-Year yield, sensitive to expectations around Fed policy, hit 3.47% in Asian trading, the highest since the global financial crisis. The 10-year yield climbed to about 3.10%. UK markets are closed for bank holiday. US yields higher by 4bp-8bp, 10-year by ~6bp at 3.10%, with most euro-zone 10-year yields higher on the day by at least 9bp. 2-year rose as much as 8.4bp to 3.48%, highest since 2007, exceeding its June 14 high by about 3bp. In early US trading, swaps referencing Fed meeting dates once again give higher than 50% odds to another 75bp rate hike at September meeting. European bonds lead the selloff following hawkish rhetoric from ECB officials over the weekend. while paring odds of rate cuts in 2023. IG credit issuance remains moribund, with lull expected to last through US Labor Day holiday Sept. 6.

Bitcoin tumbled below $20,000 amid broader tightening fears; in addition, Reuters reported that the Monetary Authority of Singapore is considering further measures to reduce the harm to consumers from cryptocurrency trading and MAS will issue public consultation on new measures by October.

In commodities, gold retreated, but oil made gains on supply risks. WTI and Brent contracts have been choppy on the first trading day of the week; gains are capped by risk aversion. Spot gold remains pressured under its 21 DMA (1,766/oz), 50 DMA (1,763/oz) and 10 DMA (1,749/oz). Copper declined in APAC hours, whilst the LME is closed today due to the UK bank holiday. Meanwhile, European natural gas prices plunged the most since March after Germany said its gas stores are filling up faster than planned ahead of winter.

It’s a quiet start to the week, with just the Dallas Fed report due at 10:30am.

Market Snapshot

- S&P 500 futures down 0.8% to 4,025.25

- STOXX Europe 600 down 1.0% to 421.91

- MXAP down 2.2% to 157.01

- MXAPJ down 1.9% to 515.30

- Nikkei down 2.7% to 27,878.96

- Topix down 1.8% to 1,944.10

- Hang Seng Index down 0.7% to 20,023.22

- Shanghai Composite up 0.1% to 3,240.73

- Sensex down 1.2% to 58,132.18

- Australia S&P/ASX 200 down 2.0% to 6,965.49

- Kospi down 2.2% to 2,426.89

- German 10Y yield lup 13 bps to 1.52%

- Euro down 0.4% to $0.9924

- Brent futures up 0.2% to $101.24/bbl

- Gold spot down 0.9% to $1,721.81

- US Dollar Index up 0.53% to 109.38

Top Overnight News from Bloomberg

- Top officials from the world’s biggest central banks coalesced around a simple message in Jackson Hole this weekend: They are ready to follow through with higher interest rates, even if it does some damage

- Federal Reserve Chair Jerome Powell’s stern message at Jackson Hole has made it clear for Bank of Japan Governor Haruhiko Kuroda that the weaker yen, a major source of concern for Japan’s economy, won’t be going away anytime soon

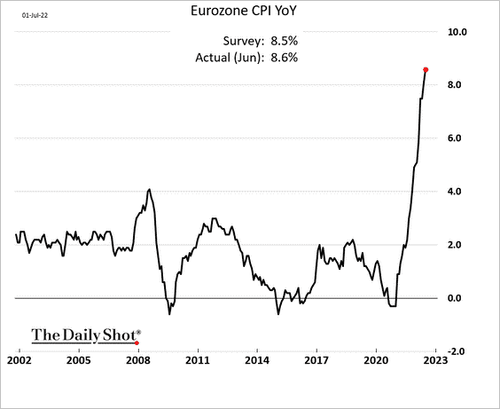

- The ECB is prepared to at least repeat the half-point increase in interest rates it delivered last month, with an even bigger move not to be excluded as inflation nears yet another record. That’s the message from ECB officials who joined the Federal Reserve’s annual Jackson Hole symposium, which wrapped up Saturday

- The rally that’s bolstered risk assets over the past month was just a blip in a bear market that’s likely to worsen from here. That’s the view of investors who seem to be finally getting the message that a resolutely hawkish Federal Reserve and central bank peers are planning to raise interest-rates at all costs to combat the hottest inflation in a generation

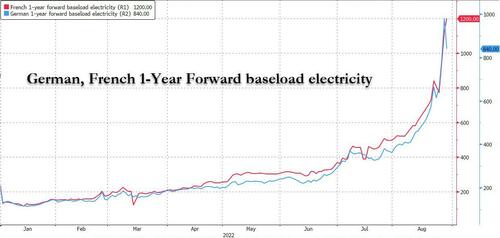

- German Power for next year, the European benchmark, broke through 1,000 euros ($993) for the first time as the region’s energy crisis intensifies

- Poland’s central bank may end or at least pause its series of interest-rate increases as early as the next week’s policy meeting, Governor Adam Glapinski said, adding that a turning point is near

- The Swedish Debt Office has decided to wind up a strategic position in the Swedish krona against the euro as “major changes” have occurred in the global economy, which has altered the conditions for the position in terms of cost and risk

- Swedish housing prices will continue falling until the middle of next year as the share of household income that goes toward mortgage interest payments is set to double, economists at the Nordic region’s largest bank said in a new forecast

- China is enforcing lockdown restrictions in areas around Beijing more intensively, and will mass test the nearby port city of Tianjin, stepping up its quest to wipe out Covid-19 ahead of a key meeting of the Communist Party’s top leaders

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks took their cue from Friday’s sell-off on Wall St amid higher yields and following hawkish central bank rhetoric from Jackson Hole including from Fed Chair Powell. ASX 200 was pressured as underperformance in tech led the declines across all sectors and with better-than-expected Retail Sales doing little to brighten the mood. Nikkei 225 gapped beneath the 28K level and shed around 800 points despite a weaker currency and reports of a potential further easing of COVID restrictions. Hang Seng and Shanghai Comp declined at the open although losses in the mainland were stemmed after Sichuan resumed power to most industries and participants digested a deluge of earnings releases, while the US and China reached a preliminary agreement on audit inspections. Agricultural Bank of China (1288 HK) – H1 2022 (CNY): net profit 128.95bln vs. prev. Y/Y 122.3bln. Will support local government efforts to complete construction of properties.

Top Asian News

- Chinese authorities informed the US Department of Agriculture that Chinese customs will suspend meat imports transported by Tyson Fresh Meat (TSN) from Monday after its pig trotters failed inspection, according to Global Times.

- Huaqiangbei, China has been ordered to shut between Monday and Thursday to contain a new COVID outbreak, via SCMP.

- Moody’s affirms China at A1, maintains Stable outlook. Driven by assessment that core strengths of the credit profile are likely to remain in the medium-term.

European bourses are under pressure amid the weekend’s central bank hawkishness, Euro Stoxx 50 -1.5%; note, FTSE 100 away for a Bank Holiday. US futures are similarly subdued, ES -1.0%, in tandem with Europe as specific updates are somewhat limited ahead of a packed week of data. Qualcomm (QCOM) – USD 991mln fine against the Co. which was rejected by an EU court will not be appealed by EU antitrust regulator, according to Reuters sources

Top European News

- UK Tory leadership frontrunner Truss is reportedly mulling cutting the 20% VAT by 5% across the board to help ease the cost-of-living pressures under a nuclear option, while other options include a more modest 2.5% reduction, according to a source cited by The Telegraph. Furthermore, Truss is under renewed pressure to outline the cost-of-living support with Tory MPs voicing increasing concerns regarding the impact of higher energy prices on households and small businesses, according to FT.

- A senior economist warned that UK Foreign Secretary and Tory leadership front runner Truss’s plan to cut tens of billions of pounds in VAT would crash public finances, according to The Times citing the Institute of Fiscal Studies Director.

- UK corner shops are calling for government support to offset energy costs and have warned that thousands risk going out of business if the government doesn’t provide support, according to FT.

- Goldman Sachs sees the UK economy entering a recession in Q4 and said the recession will be mild, while it lowered its 2022 GDP forecast to 3.5% from 3.7% and the 2023 GDP forecast to 0.6% from 1.1%.

- S&P affirmed Austria at AA+; Outlook revised to Stable from Positive.

Central Banks

- ECB’s Schnabel said both the likelihood and the cost of current high inflation becoming entrenched in expectations are uncomfortably high and said that central banks need to act forcefully in this environment, according to Reuters.

- ECB’s Villeroy said a significant rate increase is needed in September and that they should get rates to neutral by year-end with neutral somewhere between 1.00%-2.00%, according to Reuters.

- ECB’s Kazaks said the ECB should discuss 50bps and 75bps hikes in September and that a 50bps rate increase is the least the bank should do, while he added that Euro zone recession risk is substantial and a technical recession is likely, according to Reuters.

- ECB’s Rehn said its action time for the ECB with a weak Euro a key point and that a ‘significant’ hike in interest rates is needed in September, while he added it is too early to publicly discuss quantitative tightening, according to Bloomberg.

- SNB’s Jordan said there is no need to adjust the definition of price stability or broaden SNB’s mandate, while he added they are prepared to act decisively if price stability is at threat and that unconventional monetary policy instruments are likely to continue to have an important part to play in Switzerland, according to Reuters.

- BoJ Governor Kuroda reiterated the view regarding transitory inflation in Japan in which he stated they have 2.4% inflation but is almost wholly caused by rising international commodity and food prices, while they expect inflation to approach 2% or 3% by year-end but decelerate again to 1.5% next year.

- BoK Governor Rhee said it is premature to say inflation has peaked and that rates will increase until it is clear that inflation is falling. Rhee also commented they will intervene in FX markets if speculative forces are seen and that the KRW’s movement is in line with EUR and other major currencies, while he noted that a weakening KRW from the rally in USD is a bad factor for inflation and that BoK policy tightening is unlikely to end before the Fed, according to Reuters.

FX

- DXY printed a fresh YTD peak just shy of 109.50 overnight as APAC players reacted to the Jackson Hole Symposium, but the index then pulled back below 109.

- G10s are pressured to varying degrees but EUR/USD has been trimming losses though remains under parity as the DXY wanes.

- JPY is the clear laggard as the widening FOMC-BoJ pricing lifted USD/JPY to test 139.00 to the upside, ahead of the YTD peak at 139.39.

- The Yuan was in focus in APAC hours as USD/CNH topped 6.9000 before finding resistance around 6.9300.

Fixed Income

- EGBs slump following weekend Central Bank updates from ECB officials which follow on from and continue the tone of Friday’s hawkish sources

- At worst, Bunds lower by over 200 ticks while USTs have stabilised somewhat near lows of 116.26+ with yield curves elevated but somewhat mixed directionally.

Commodities

- WTI and Brent contracts have been choppy on the first trading day of the week; gains are capped by risk aversion.

- Spot gold remains pressured under its 21 DMA (1,766/oz), 50 DMA (1,763/oz) and 10 DMA (1,749/oz).

- Copper declined in APAC hours, whilst the LME is closed today due to the UK bank holiday.

- Austrian Chancellor Nehammer called for an EU-wide cap on power prices and said they must decouple the price of electricity from the gas price and bring it closer to actual production costs, while he added that they must finally stop the madness that is occurring in energy markets and cannot let Russian President Putin determine the European power price, according to Reuters.

- US temporarily waived truck driver hours of service rules to transport fuel to Illinois, Indiana, Michigan and Wisconsin following the unanticipated shutdown of BP’s Whiting refinery, according to Reuters.

- Ukraine PM Shmyhal said Ukraine will permit merchant sailors to leave Ukraine if they receive approval from their local military administrative body, according to Reuters.

- UN Coordinator for the Black Sea Grain Initiative said Ukrainian silos are still stocked with millions of tonnes from previous harvests and that much more grains need to shift to provide room for the new harvest, according to Reuters.

US Event Calendar

- 10:30: Aug. Dallas Fed Manf. Activity, est. -12.7, prior -22.6

- 14:15: Fed’s Brainard speaks at a FedNow workshop