Authored by Jorge Viclhes via The Saker blog,

Thirty two years ago Germans enthusiastically took down the Berlin wall. Now, captured by cunning Anglo-Saxon global elites, Germans are helping other European “useful idiots” to erect a much higher and thicker wall to cut themselves off from Russia leading them into a war economy. But as Hungarian Prime Minister Viktor Orbán has warned… “the approach has clearly failed — sanctions have backfired — and our car now has 4 four flat tires” … Question: vehicles don´t carry more than 2 spare tires on them, do they? So, one quick and innocent way to explain such unfathomable European miscalculation is to assume the EU leadership is immersed in a deep hypnotic trance and just blindly following US-UK instructions under Stoltenberg-Johnson war-mongering policies. Per “The Telegraph”

Ref #1 https://www.rt.com/news/559682-johnson-uk-nato-ukriaine

Ref #2 https://www.rt.com/news/559785-orban-eu-gas-war-economy/

suicidal non-supply

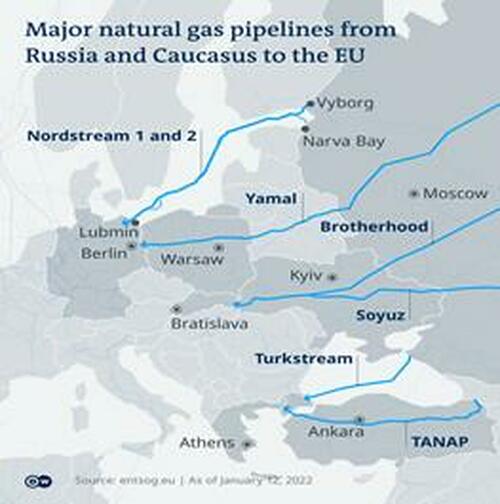

The supply lines that up to 2022 successfully linked Europe and Russia took decades of very hard work to develop. This now means that almost all of such over-abundant contracts necessarily have no effective substitute because (a) no other vendors have such high quality at low price plus decades of vetting and proven experience + (b) the un-replaceable short freight distance and shipping time from nearby Russia. So, by definition, both (a) + (b) mean that today no equivalent supply lines could ever be found no matter how much Europe tried simply because it would be either too soon or too far …and always too hard and too pricey. So short cuts will be taken and corners rounded-off…. Been there, done that, got the T-shirt. The impact of the above cannot be overstated though as the now-broken Euro-Russian supply lines were essential for the Just-In-Time strategy that Europe and world markets still require and cannot wait years to develop and iron out. Logistics 101: proven experience and performance with excellent price plus quick delivery from nearby sources cannot be substituted fast enough, or possibly ever. On purpose, Europe´s worst enemies couldn´t have inflicted worse harm than what a US-UK mesmerized Europe (what else ?) is doing to itself.

So EU sanctions are now cutting off dozens of key and highly varied Russian produce without which Europe as we know it will cease to exist. This involves foodstuffs, minerals of every sort, energy re oil & gas & coal & refined products thereof, etc., etc., plus key technologies and products from space rocket engines to nuclear fuels. Even Roscosmos announced that Russia will withdraw from the International Space Station (ISS) project with the West after 2024 while by that time with an orbital station of its own. At any rate, the new European vendor problems for hundreds of products include each and every aspect of sales & procurement, sourcing & logistics, negotiations, pricing, contract terms, payment, banking procedures, sampling and testing, delivery pathway coordination, additional trucking, roads, vessels and inland waterways for shut down pipeline delivery, on-the-fly solutions for new problems, railroads, loading and unloading yards, ports, process alignment & upgrade, synchronization, scheduling, building and adapting key infrastructure, insurance, guarantees, new administrative matters, buffer storage, vendor vetting, multiple regulatory compliance, etc., etc. So the most efficient and swift Euro-Russian trade routines have today turned into logistical and management nightmares. Europe now and for the near future — in most unfavorable circumstances — needs to run unexpected risks to re-do all such hard work in a hurry and for every banned Russian product, not just coal & oil & nat-gas. And it is not a “plug & play” process either. It takes time. Tons of changes have to be made even after finding a trustworthy vendor. It is costly, cumbersome, and prone to project creep & fatigue. All fully unnecessary and chaotic.

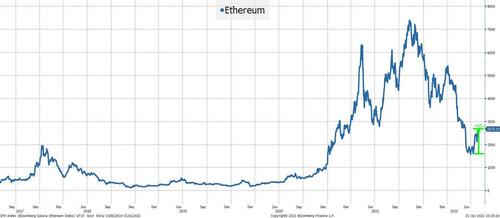

No country in the EU is anywhere ready for any of the above, let alone all of Europe at the very same time with the very same deadline. Furthermore, an impaired Germany would mean a very different Europe something which at this late stage cannot be avoided even if Germans wanted to get their feet wet in a hurry. Jim Rickards now says that “Almost everything you heard about the war in Ukraine from U.S. media over the course of March, April, and May was a lie.” Furthermore, the Western news regarding the impact of the Ukraine war contained very few truths that can confuse just as much. Per Rickards “The economies of the U.S. and the EU are in or very near to recession. Inflation is out of control in the West and commodity shortages will lead quickly to food shortages and more empty shelves in supermarkets… as economic sanctions have backfired ”. And now labor unions add fuel to the fire fully knowing they have the leverage to worsen inflation which is the hottest political topic nowadays. So they now demand better working conditions “with protests turning up at all spots in the global supply chain, including railways, trucking, warehouses, and ports…” At any rate, today Russia is taking full control and will probably retain for itself what up until 2022 were Ukraine´s best assets. That includes its industrial core, its enormously large and specialized natural resources, a most fertile land reminiscent of the Argentine Pampas, and all the ports and the major rivers with Russian territory unscathed. No wonder Hungarian Prime Minister Viktor Orbán wants plain “out” of the current European non-strategy despite that Euroclear is raking in dozens of millions in profits from seized Russian bank accounts.

Ref #3 https://www.rt.com/russia/558846-us-uk-eu-sanctions/

Ref #4 https://news.antiwar.com/2022/07/24/hungarys-orban-says-us-russia-peace-talks-needed-to-end-ukraine-war/

Ref #5 https://dailyreckoning.com/needless-death-and-misery/

Ref #6 https://www.zerohedge.com/markets/labor-has-leverage-protesting-supply-chain-workers-threaten-worsen-worlds-inflation-crisis

Ref #7 https://www.bloomberg.com/news/articles/2022-07-24/world-s-key-workers-threaten-to-hit-economy-where-it-will-hurt?sref=6uww027M

Ref #8 https://www.rt.com/business/559647-eurozone-profits-frozen-russian-assets/

Ref #9 https://www.rt.com/russia/559598-jens-stoltenberg-calls-allies-pay/

add a low Rhine…

The Rhine River directly affects trade and industrial logistics of several key European countries namely, Austria, Switzerland, Germany, France, and the Netherlands while indirectly affecting many others or, in some cases, all the others. In particular, the über-important German inland transportation system – and therefore its entire supply chains network – depends upon normal levels of Rhine River waters. Because it´s not only a matter of sourcing the right quality, quantity and price of any produce. It is just as important to receive it Just-In-Time at process destinations such as refineries or power plants as explained later. Simultaneously, all European stakeholders are competing with each other tooth and nail struggling to find, contract and retain exactly the same resources in order to solve the same unexpected problems all at once and by the same date. And it´s not only coal or oil or natural gas — and many other raw materials in and of themselves — but also for the means required to transport, deliver and process all of them.

So everybody and his sister would now in Europe be modifying the same things at the same time with the same resources by the same date. For example, looking for the very first – and certainly bad – resource, namely trucking fleets of every size and type and humongous amounts of EU-certified drivers thereof. This additional heavy truck traffic would require upgrading newer roads and building new ones. Also, the different processes required for these different commodities also require all-around modifications at refineries, new-feedstock power plants, petrochemical plants, etc., etc., etc. Furthermore, there were no plans for any of this nor for the abundant technical human resources required and/or vetted management staff. Managerially speaking, this is not a contingency. It is a fully unexpected European-wide revolution with a terribly demanding time frame and critical failures as the most probable result. This involves strategic value-chain upstream items with EU captive consumers cascading into multiple supply chain failures thru lack of nat-gas, rare earths, inert gases, potash, sulfur, uranium, palladium, vanadium, cobalt, coke, titanium, nickel, lithium, plastics, glass, ceramics, pharmaceuticals, ships, inks, airplanes, polymers, medical and industrial gases, sealing rings & membranes, power transmission, transformer and lube oils, neon gas for microchip etching, etc., etc.

Thousands of yet unknown people are needed to execute all of these projects with yet to be defined job descriptions, yet to be interviewed, hired, trained, teams put together, deployed, etc. Many oldies will be called back from retirement

For many good reasons – mostly obvious — roads & trucks many times cannot compete with seaborne or internal water-ways freight either by volumes shipped or final destination delivery requirements. Furthermore, the supply lines/production system is already set up in a given way and any change introduced to previous logistics is fully unforeseen. For instance, high-load storage facilities and high-consuming processing plants, refineries, power stations and the like are conveniently located for vessel access or pipelines or railways, not trucks. So, now with everyone scrambling for ultra-hard-to-find solutions, EU products will require higher transportation costs by, for instance, having to replace sintering ores with concentrates or pellets. And it is unlikely for higher costs to be absorbed by the market under current conditions of falling demand. So profit margins will get yet narrower – or negative – as already under heavy pressure from high energy prices and labor costs in an inflationary vicious cycle. Sooner or later this leads to either very high inflation, or recession… or even depression. Also, a tremendous food problem has arisen as a consequence of the EU sanctions, involving final produce and intermediate outcomes such as fertilizers which in turn affect yields.

hypnotized food

EU sanctions have prevented operations with Russian grain, including insurance and the admission of Russian ships to foreign ports and entry of foreign ships to Russian ports. Russia cannot solve that nor contribute to solving that in any way, shape, or form. Only the EU can solve that problem. What Russia can and will do is to develop its economy by counting on reliable partners instead of Western countries not willing or able to comply with the agreed terms of trade. No (Russian) gas no fertilizers, less (Russian) gas less fertilizers for everyone including Third World economies.

Higher oil prices – or no oil – mean more expensive distillates such as diesel oil required for farming food produce.

In view of less Russian gas, BASF has slashed ammonia production which is an essential component for fertilizers.

Ref #10 https://www.zerohedge.com/commodities/basf-prepares-slash-ammonia-production-germany-amid-worsening-natgas-crunch

hypnotized energy

Up until Jan. 2022, coal (“brown” coal, the dirtiest of them all) was only responsible for 33% of power generation in Germany… but not anymore (more on that later). Let alone the case of oil & gas with ultra simplified door-to-door delivery of excellent, cheap products through quick and clean pipelines. BTW, the case of now badly-needed coal is probably the worst of all, as its complete phase-out was planned for 2030 but now fully reverted with de-commissioned coal-fired power stations most probably returning as Germany´s first line energy suppliers. Less Russian natural gas means less heating, less hot water, less power and less fertilizer among other important things. And the EU cannot print natural gas or Rubles.

“ Despite the aggressive Western sanctions… Russia has been very restrained as far as counter-measures are concerned. So after loudly saying that the EU wants nothing to do with Russian energy or Russian pipelines, the EU should hardly be upset if Russia is tired of laboring not to give them what they asked for, an economic divorce. The problem is Europe is now upset that it’s getting what it acted like it wanted.” – Yves Smith – “Naked Capitalism”

Ref # 11 https://www.nakedcapitalism.com/2022/07/the-end-of-cheap-russian-gas-turning-the-lights-out-in-europe.html

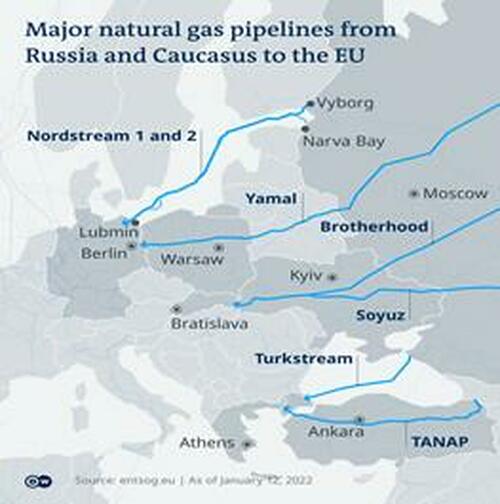

On a recent press conference Russia´s President Vladimir Putin explained that the EU energy security problem is definetly not Russia nor Gazprom. Very simply put: with long winters, less sun, low winds, and EU banks that will not finance fossil fuels investments, plus insurance companies that do not insure them, and local governments that do not allocate land plots for new projects, so then pipelines are not built… while demand keeps growing. Then for political reasons the Ukraine government shuts down a pipeline station. Then the Siemens-Canada problem as, by contract, turbines require regular maintenance and repairs. In sum, the EU has shut-down — on its own — two Russian pipeline routes as Ukraine and Poland effectively cut off the Yamal-Europe pipeline.

Ukraine overtly, Poland by refusing to pay under the new gas for roubles scheme. The EU has also sanctioned one turbine while not commissioning North Stream 2, thus completely tying down Gazprom´s hands. Furthermore, the documentation that Gazprom received from Canada and Siemens did not respond to the turbine sanctions-waiver questions. Also, Gazprom is unable to fully use another route as Ukraine has been rejecting its transit applications. In sum, Europe does not have a strategy. Add to that the shut-down of nuclear power stations. And as Foreign Minister Sergey Lavrov has said, Russia no longer cares to relate to Europe – or the West at large — as it is not “agreement-capable”.

As if all of the above were not enough, many EU members now have to deploy the DE-conversion from natural gas and the RE-conversion into polluting coal. This back-to-coal ´solution´ is (a) very dirty and against Europe´s Green Plan plus other climate pledges and regulations (b) ultra-expensive (c) a major industrial, logistical and social upheaval that would not make it by this coming winter soon knocking on the European doors, and probably not even for next winter 2023-2024. This separate – yet overlapping – set of major madhouse back-to-coal projects also imply enormous logistics risks and major modifications and tight schedules all around, bids, bidders, contract oversight, certification, commissioning, etc., etc., etc for which nobody involved is prepared, neither regulators, nor vendors, nor consultants or engineering firms, nor end users, nor households, nor labor unions, nor the industry at large.

hypnotized renewables

Renewables have various serious problems including their variable power generation limitations. For example, in low wind or low sun seasons such as 2021-2022 which Europe suffers today. Renewables also have very poor optics – “not in my back yard” — plus impact upon bird life with unavoidable and undesirable consequences. And although there is more to be said, let´s conclude with the all-important de-commissioning problem in view of their rather shortish life-span. Furthermore — in order to see the light of day — manufacture of renewables requires humongous loads of nat-gas, oil, coal, minerals and commodities, all of them necessarily sourced in Russia not anywhere else. Unless the problem were to be compounded and worsened on purpose something quite in fashion today in Europe. For instance, manufacturing of wind turbines requires thousands of tons of nickel and rare earth minerals. Also, any such large structures and components thereof are to be transported to temporary and final destinations — and erected — with Russian fossil-powered equipment. Such is also required for the inevitable regular maintenance and end-of-life decommissioning. Solar photovoltaic energy requires humongous amounts of silver beyond belief, a process which also consumes (Russian) fossil fuels in enormous quantities, including the manufacture of the mining equipment required. Furthermore, as soon as renewables in large quantities are added to any electrical grid, costs go up – not down — as they have to be backstopped by fossil-fueled thermal plants that today should also run on Russian fuels. Please understand and accept that the more renewables added, the more natural gas that is needed. People do not accept rolling brown-outs let alone black-outs, so fossil fuel backstops are mandatory. With current existing technologies, promoting fully counter-productive and subsidized renewables expansion as Germany has and continues to do is reckless. EV lithium batteries require lithium mining which in turn has a whole new set of problems to be resolved

Ref #12 https://www.zerohedge.com/geopolitical/lighting-gas-under-european-feet-how-politicians-journalists-get-energy-so-wrong

hypnotized toilet paper

Per “Zeit On-Line” the new European hygiene status is now ready to deploy forces into rolling brown-out territory.

Is this another bad result of the hypnotic spell ? Ref #13 https://www.rt.com/business/559698-germans-warned-toilet-paper-shortage/

hypnotized fish´n´chips

Russian sanctions would leave British pubs without fish’n’chips.

Ref # 14 https://www.rt.com/news/559748-fish-chips-uk-sanctions/

bottom line

Rachel Marsden at RT has summarized it very precisely as follows: “The conflict in Ukraine risks creating the ultimate nightmare for Western elites: an alternative group of allies over which the West has no control, but with the capacity to offer opportunities that are competitive with what their own governments or countries are offering… Western elites are doubling down in Ukraine to save the world order that protects their own selfish interests, thinking that it’s the way to prevent a parallel option from emerging. It’s as simple as that. And they don’t care if it’s the average citizen who has to pay the price”. Ref #15 https://www.rt.com/russia/558490-liberal-world-order-explained/

By banning Russian produce, the EU will bring the European sourcing matrix down on its knees, something which by now has already dawned on the average European also realizing that – at the very best and if not corrupted — their political class is just a bunch of ignorant fools. With these ´Russian sanctions´ EU politicians have unnecessarily set Europe up for hundreds of overlapping, cross-borders, gargantuan projects impossible to fulfill simultaneously, with absurd sequencing and scheduling coordination, plus peremptory timing limitations and deadlines, with countless of well- synchronized engineering specialties and very risky, highly demanding logistics, plus overwhelming legal, political, and environmental aspects. Accordingly, this glorious mismanagement in a decisive decade has the whole EU economy fully at risk with the obvious additional pain of potentially making non-performing rushed and poorly designed modifications everywhere.

Furthermore, Europe will spend a fortune it cannot afford while probably deploying soon-to-fail and trouble full reconversion projects ending up with many half-finished facilities that will not be anywhere ready on time, or ever.

The EU strategy regarding Russian sanctions and arming Ukraine has failed miserably as Europeans are being un-relentlessly ashamed with EU leaders despicably cheating on them and everyone else among other things per non-compliance of the Minsk Accords. Ukraine cannot ever come anywhere close to winning this war, corruption is everywhere rampant and the more weapons Ukraine receives from the West the longer their war will last and the larger territory that Ukraine will lose.

Massive migrations to Club Med countries (mostly PIGS) are highly probable even starting during 2022

Per The Guardian, “…Come October, it’s going to get horrific, truly horrific…a scale beyond what we can deal with”.

Ref #15 https://www.theguardian.com/business/2022/apr/19/energy-chiefs-fear-40-of-britons-could-fall-into-fuel-poverty-in-truly-horrific-winter