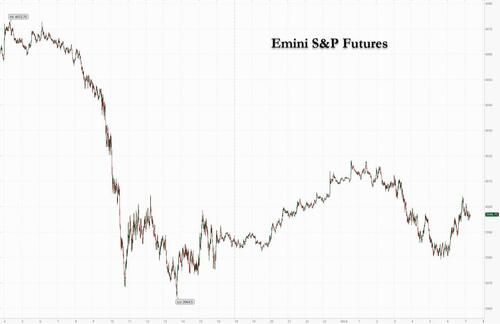

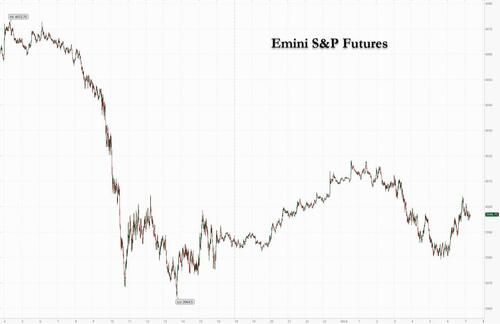

After three days of steep declines, S&P futures traded between modest gains and losses as global markets headed for the third consecutive weekly decline and another monthly drop on concerns that aggressive central bank tightening will push the global economy into a hard recession. At 7:15am ET, futures were up 0.2% and Nasdaq futures rose 0.7%, after trading both higher and lower earlier in the session. The dollar rose, Treasury yields jumped after another record CPI print in Europe, while the bizarre oil slump extended.

In premarket trading, Bed Bath& Beyond plunged after the home-goods retailer filed a form to sell an unspecified number of shares.

HP also fell 6.8% after the company reported quarterly sales that missed estimates and cut its annual profit forecast as demand for personal computers and printers slowed. Analysts noted that the PC maker will need a couple of quarters to correct its inventory. Here are other notable premarket movers:

- Robinhood (HOOD US) falls 2.3% as Barclays cut its rating to underweight from equal weight

- ChargePoint (CHPT US) shares rose as much as 2.1% in US premarket trading, after the electric vehicle charging network operator’s second-quarter revenue came in ahead of estimates, with analysts positive on the company’s gross margin performance amid supply-chain woes

- HP Enterprise (HPE US) narrowed its full-year adjusted earnings per share forecast and reported in-line revenue for the third quarter. Analysts were bracing for the worst, after Dell’s disappointing outlook last week. Shares fall 1% in premarket trading

- PayPal shares rise 2.9% in premarket trading after Bank of America upgraded its rating on the payments stock to buy from neutral previously

- Morgan Stanley resumes coverage of Welltower (WELL US) at overweight and a $90 PT with the broker bullish on a recovery for the US senior housing market

“What’s clear is that predicting this market is not clean cut,” Angeline Newman, a managing director at UBS Global Wealth Management, said on Bloomberg Television. “We are living in a world where conflicting economic signals are making the path of monetary policy very difficult to determine.”

Market bets on a shallower trajectory for Federal Reserve tightening are receding, raising the prospect of more losses for stocks and bonds in an already difficult year. Investors are scouring incoming data for clues on the policy path, with August US jobs figures on Friday the next key report.

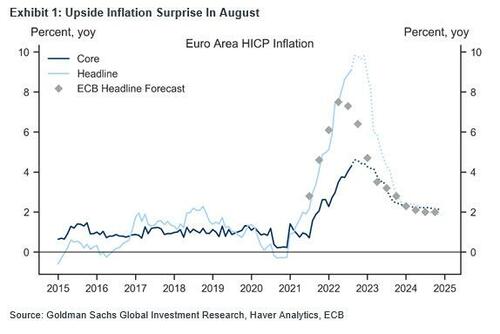

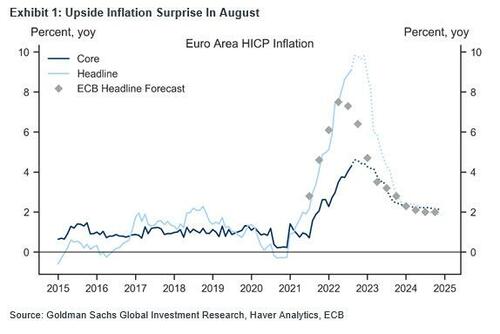

European shares reversed earlier gains to trade at the lowest level in more than six weeks, after Euro-area inflation accelerated to another all-time high, strengthening the case for the European Central Bank to consider a jumbo interest-rate hike when it meets next week. ECB Governing Council member Joachim Nagel urged a “strong” reaction, hinting at a 75bps hike just as Europe braces for an energy disaster with winter coming. Paradoxically this pushed the EUR to session lows.

In Europe, the Stoxx 50 fell 0.7%, with the FTSE 100 lagging, dropping 1%. Energy and autos slump while utilities is the worst-performing sub-index in the European gauge on Wednesday, extending their selloff to a fourth session as investors fret over Russian gas supplies at the start of a three-day halt of the key Nord Stream pipeline. Slump is lead by Drax (-4.3%), National Grid (-4%), Italy’s Terna (-2.3%), Germany’s Uniper (-4%) and Fortum (-3%). Some renewables also take a hit, including Orsted (-2.4%) and Verbund (-1.4%). Citi says utilities had to put up more than EUR100b of additional collateral versus 2020 levels because of record levels of future power and gas prices. Here are the biggest European movers:

- ASML rises as much as 3.4%. It is among the “most attractive names” in the current uncertain macro environment, UBS says in a note upgrading the semiconductor-equipment company to buy from neutral.

- Stadler Rail shares climb as much as 6% after reporting mixed results, with 1H sales beating estimates and a strong order intake, offset by more cautious comments on margins and a negative currency impact, according to analysts.

- CFE shares surge as much as 23% after the Belgian construction and development company’s 1H results, with Degroof raising its estimates.

- Ackermans & van Haaren rises as much as 7.5% after KBC upgrades its rating on the industrial holding company to buy from hold following first-half results, which the broker describes as “resilient” in tough times.

- Lundbergforetagen shares rise as much as 5.5%, the most since May, after DNB reiterated its buy recommendation for the Swedish real estate investment firm, while trimming its PT to SEK485 from SEK530.

- Utilities are among the worst-performing sub-index in the European gauge on Wednesday, extending their selloff to a fourth session as investors fret over Russian gas supplies at the start of a three-day halt of the key Nord Stream pipeline.

- European energy stocks underperform for a second day after oil erased initial gains on Wednesday to head for a third monthly decline as rate hikes by major central banks and China’s Covid Zero strategy increase the likelihood of a global economic slowdown.

- Brunello Cucinelli shares fall as much as 7.2% after the Italian luxury fashion company reported 1H results; Deutsche Bank says the update is “largely as expected” with guidance appearing “relatively conservative.”

Europe’s weakness was sparked by the ongoing rout in oil, which headed for a third monthly drop – the longest losing run in more than two years – hampered by the likelihood of slower global growth, yet which as Goldman says is now the best asset to own having priced in a recession more than any other asset class. European natural gas advanced after a two-day slump, with traders weighing risks to Russian supplies against the continent’s drastic efforts to curb the energy crisis.

Earlier in the session, Asian equities climbed in a mixed day that saw tech shares advance but Japan’s bourses retreat as traders digested China’s weak economic data while technology stocks rebounded. BYD Co. plunged in Hong Kong after Warren Buffett’s Berkshire Hathaway Inc. trimmed its stake in the electric vehicle maker. The MSCI Asia Pacific Index erased an earlier loss to trade up as much as 0.6%. Chinese benchmarks underperformed the region after factory activity contracted on power shortages spurred by a historic drought. Stocks were also weak in Hong Kong as Warren Buffett’s sale of shares in BYD Co. fueled general risk-off sentiment, countered by advances in the city’s tech shares. Traders also weighed US job and consumer confidence numbers, which were seen backing the Federal Reserve’s rate-hike plans.

“The dented risk sentiment from tighter-for-longer central bank policies is likely to weigh on sentiment in the region,” Jun Rong Yeap, a market strategist at IG Asia Pte, wrote in a note. He added that further headwinds including Covid lockdowns may weigh on Chinese equities. Taiwanese stocks rose, even amid a potential escalation of cross-strait tensions, while South Korean shares also advanced on gains in tech names. Indian and Malaysian markets were closed for holidays.

Investors are also contending with mounting friction between Beijing and Taipei after Taiwanese soldiers fired shots to ward off civilian drones and evaluating the latest Chinese data, which indicated factory activity shrank for a second month. Power shortages, a property sector crisis and Covid outbreaks all took a toll.

In Japan, stock dropped amid concerns over the potential for Federal Reserve tightening and data that showed weak factory activity in China. The Topix fell 0.3% to 1,963.16 as of the market close Tokyo time, while the Nikkei 225 declined 0.4% to 28,091.53. Sony Group Corp. contributed the most to the Topix’s decline, decreasing 1.7%. Out of 2,169 stocks in the index, 683 rose and 1,381 fell, while 105 were unchanged. “US stocks, which plummeted on the Jackson Hole meeting last week, have fallen further and Japan stocks are matching that,” said Kiyoshi Ishigane, a chief fund manager at Mitsubishi UFJ Kokusai Asset Management.

In Australia, the S&P/ASX 200 index fell 0.2% to close at at 6,986.80, weighed by losses in mining and energy shares. Asia-Pacific energy-related stocks fell as oil headed for its third straight monthly decline, the longest losing run in more than two years, on prospects for slower global growth. In New Zealand, the S&P/NZX 50 index fell 0.4% to 11,601.10

In FX, the Bloomberg dollar spot index rose again, up 0.2%, as it reversed a loss as the greenback rebounded, with most Group-of-10 peers swinging to a loss in the European session. AUD and JPY are the strongest performers in G-10 FX, NOK and CHF underperform. The euro fell to a session low of $0.9974 as euro-area inflation accelerated to another all-time high of 9.1% from a year ago, exceeding the 9% median estimate in a Bloomberg survey. Norway’s krone plunged by 1% against the euro and even more versus the dollar after news that the nation’s central bank will ramp up its purchases of foreign currency to 3.5 billion kroner ($350 million) a day in September from 1.5 billion in August as it deposits energy revenue into the $1.2 trillion sovereign wealth fund. The pound neared the lowest since March 2020 against the greenback that was touched yesterday, yet options suggest a short-squeeze could be due. The Australian and New Zealand dollars held up well amid month-end demand after earlier gains in US stock futures following China PMI data. The yen was steady. Board member Junko Nakagawa said that the Bank of Japan’s forward guidance for interest rates isn’t necessarily directly linked with its Covid funding program.

In rates, Treasuries are off session lows as US trading gets under way Wednesday, selloff paced by gilts with UK yields higher by 9bp-13bp. US 2Y barely exceeded Tuesday’s multiyear high. US yields are higher by 3bp-5bp, 2- year rose as much as 5.3bp to 3.275%, Treasury 10-year yield adds 4bps to around 3.14%. Curve spreads are little changed, inverted 5s30s around -5.7bp, near lowest level since mid June; month-end index rebalancing at 4pm New York time will extend the duration of Bloomberg Treasury index by an estimated 0.12 year. European bonds slide across the curve, led by gilts, after hotter-than-expected euro-area inflation data. Gilts 10-year yield is up 11 bps to 2.82%, while German 10-year yield rises 3.6bps to 1.55%. Peripheral spreads widen to Germany with 10y BTP/Bund adding 2.2bps to 233.4bps.

Bitcoin has managed to reclaim USD 20k after slipping to a USD 19.7k low, overall the crypto remains in fairly tight sub-1k parameters.

In commodities, crude futures extend declines. WTI drifts 2.6% lower to trade near $89, while Brent falls 3% to the $96 level. Base metals are mixed; LME tin falls 2.5% while LME nickel gains 1.4%. Spot gold falls roughly $10 to trade near $1,714/oz. Spot silver loses 1.5% near $18.

Looking to the day ahead now, data releases include the flash CPI reading for the Euro Area in August, as well as the country readings for France and Italy. On top of that, there’s the ADP’s new report of private payrolls for August and the MNI Chicago PMI for August. Finally, central bank speakers include the Fed’s Mester and Bostic.

Market Snapshot

- S&P 500 futures little changed at 3,986.25

- STOXX Europe 600 down 0.6% to 417.39

- MXAP up 0.2% to 158.39

- MXAPJ up 0.3% to 519.46

- Nikkei down 0.4% to 28,091.53

- Topix down 0.3% to 1,963.16

- Hang Seng Index little changed at 19,954.39

- Shanghai Composite down 0.8% to 3,202.14

- Sensex up 2.7% to 59,537.07

- Australia S&P/ASX 200 down 0.2% to 6,986.76

- Kospi up 0.9% to 2,472.05

- German 10Y yield little changed at 1.54%

- Euro down 0.1% to $1.0003

- Gold spot down 0.5% to $1,715.78

- U.S. Dollar Index up 0.14% to 108.92

Top Overnight News from Bloomberg

- Forget about a soft landing. Federal Reserve Chair Jerome Powell is now aiming for something much more painful for the economy to put an end to elevated inflation. The trouble is, even that may not be enough. It’s known to economists by the paradoxical name of a “growth recession.”

- France said the nation’s natural gas storage will be full in about two weeks, enabling the country to ride out the coming winter even as Russia turns the screw on deliveries of the fuel

- UK statisticians decided that a £400 ($466) government grant to help households with energy won’t lower headline inflation numbers, a move that will protect the returns of some bond holders but increase payments made by both the Treasury and consumers

- Sweden’s Riksbank hopes to be able to avoid a recession as it is prepared to do what is necessary to bring soaring inflation back to the central bank’s 2% target, deputy governor Anna Breman said

- The People’s Bank of China set stronger-than-expected yuan fixings for six sessions to Wednesday and people familiar with the matter said at least two local banks pushed back against the weakness when submitting data for the reference rate. Traders still expect it to weaken past the psychological 7 per dollar level, even if the moves slowed the decline

- China’s retail activity flatlined in August with e-commerce demand especially weak, according to satellite data, suggesting that consumer caution due to the ongoing Covid Zero policy and elevated unemployment remain major drags on the world’s second-largest economy

- Russia’s seaborne crude shipments to Asia have fallen by more than 500,000 barrels a day in the past three months, with flows to the region hitting their lowest levels since late March

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks were mostly negative following the losses across global counterparts owing to recent hawkish central bank rhetoric and with geopolitical concerns stoked after Taiwan fired warning shots at a Chinese drone. ASX 200 was subdued by weakness in commodity-related stocks with the energy sector the worst hit after the recent slump in oil prices, while a surprise contraction in Construction Work added to the headwinds and feeds into next week’s GDP release. Nikkei 225 declined but held above 28k after encouraging Industrial Production and Retail Sales. Hang Seng and Shanghai Comp were pressured amid a heavy slate of earnings releases and with US regulators said to have selected a number of US-listed Chinese companies for audit inspections including Alibaba, while participants also reacted to the Chinese PMI data in which the headline Manufacturing PMI topped estimates but remained in contraction territory.

Top Asian News

- Japanese PM Kishida said he has fully recovered from COVID-19 and returned to normal duty. Kishida added that they will begin administering Omicron variant targeted vaccines earlier than planned, while he announced to increase the daily upper limit of entrants to Japan to 50k on September 7th and will look into further loosening of border controls.

- South Korean vice-Finance Minister says they received “positive signs” during talks with FTSE Russell, FX environment has not emerged as a hurdle in discussions. Possibility is high for S. Korea’s inclusion to the FTSE’s WGBI watch-list in September

- Chinese NBS Manufacturing PMI (Aug) 49.4 vs. Exp. 49.2 (Prev. 49.0); Non-Manufacturing PMI (Aug) 52.6 vs Exp. 52.2 (Prev. 53.8) Chinese Composite PMI (Aug) 51.7 (Prev. 52.5)

- Japanese Industrial Production Prelim. (Jul P) 1.0% vs. Exp. -0.5% (Prev. 9.2%); Retail Sales YY (Jul) 2.4% vs. Exp. 1.9% (Prev. 1.5%)

- Australian Construction Work Done (Q2) -3.8% vs. Exp. 0.9% (Prev. -0.9%)

Initial upside in Europe faded as broader price action took another hawkish turn amid inflation data, Euro Stoxx 50 -1.0%. Stateside, futures are mixed around the unchanged mark, ES -0.2%, though are similarly well off best levels with data and Fed speak due.

Top European News

- UK’s ONS rules that energy bill rebate does not directly affect inflation statistics directly; “concluded that payments under the scheme should be classified as a current transfer paid by central government to the households sector.” i.e. the payment is being treated as a fiscal transfer as opposed to a price adjustment.

- UK government could reportedly fast-track nuclear power projects to help ease the energy crisis, according to The Telegraph.

- UK government is considering caps on rent to protect social housing tenants as part of a wider effort to ease the soaring costs of living, according to FT.

- Former UK Chancellor Sunak warned that Foreign Secretary Truss’s campaign promises could increase inflation and borrowing costs, according to FT.

- German Economy Minister Habeck said they would reject the idea of ‘capping’ energy prices; Finance Minister Lindner says the hurdle to an excess profit tax is high (re. energy); Chancellor Scholz says the early steps on energy means we will get through the winter period, will take measures to ensure energy prices “do not go through the roof”.

FX

- A session of gains for the DXY with upside spurred by haven bids, as the broader market sentiment deteriorated shortly after the European cash open.

- EUR/USD sits as one of the laggards with minimal immediate reaction seen in wake of hotter-than-expected August flash CPI for the EZ, although the upside for the pair may be capped by Nord Stream 1 jitters.

- The antipodeans are mixed as AUD leads the gains as the outperforming G10 peer on the back of better-than-expected Chinese official PMI metrics; Petro-currencies are softer as the slide in crude oil resumes.

- The JPY remains somewhat resilient in the face of the USD strength, likely amid the risk aversion across the market.

Fixed Income

- Core benchmarks experienced a fairly contained start to the session, though this proved to be shortlived and pronounced action occurred on inflation release.

- Bunds remain sub-147.50, though off worst, as initial French-CPI induced upside was reversed following hot Italian and subsequent EZ-wide Flash August HICP; market pricing for 75bp remains just above 50%.

- Gilts are the standout laggard as on the ONS treats the Energy Support as a fiscal transfer, thus Ofgem Energy adj. will be fully reflecting in CPI; Gilts sub-130 ticks in wake.

- USTs are directionally downbeat but comparably contained in terms of magnitudes, ADP and Fed’s Bostic/Mester due.

Commodities

- WTI and Brent futures resumed selling off in tandem with the broader risk-mood.

- Dutch TTF futures are on a firmer footing today following yesterday’s near-10% slump.

- Spot gold is pressured by the firmer Dollar and approaches USD 1,700/oz to the downside.

- 3M LME copper has been extending on gains with a boost from the above-forecast Chinese PMI metrics, but the contract remains under USD 8,000/t.

- OPEC+ JTC upgrades 2022 oil market surplus forecast by 100k BPD to 900k BPD, according to a report via Reuters; sees market surplus rising to 1.4mln BPD in November from 0.6mln BPD in October.

- OPEC+ JTC report says rising energy costs “may lead to a more significant reduction in consumptions towards year-end”, via Reuters.

- US Private Inventory Data (bbls): Crude +0.6mln (exp. -1.5mln), Cushing -0.6mln, Gasoline -3.4mln (exp. -1.2mln), Distillates -1.7mln (exp. -1.0mln).

- Oman crude OSP calculated at USD 97.00bbl for October vs. USD 103.21bbl in September, according to DME data.

Central Banks

- BoJ’s Nakagawa says the central bank decided to maintain easy policy bias in July, and hopes to discuss at the September meeting whether it should continue doing so based on data. Must remain vigilant to downward economic pressure from pandemic.

- BoJ is to conduct fixed-rate purchase operations for the cheapest-to-deliver 357th JGB notes for an extended period of time as of September 1st.

- ECB’s Rehn says the economic outlook has darkened, normalisation of monetary policy progressing consistently. Rates will increase in September, will be necessary to hike further at future gatherings.

- Riksbank’s Bremen says it is of the utmost importance to defend the inflation target as anchor for price setting and wage formation; adds inflation is too high. Inflation outcomes have been higher than expected recently, inflation risks are on the upside. Does not rule out a 50bps or 75bps hike at the 20th September meeting.

- Norges Bank Currency Purchases (Sep) NOK 3.5bln (prev. NOK 1.5bln)

US Event Calendar

- 07:00: Aug. MBA Mortgage Applications -3.7%, prior -1.2%

- 08:15: ADP resumes publication of jobs report with new methodology

- 08:15: Aug. ADP Employment Change, est. 300,000

- 09:45: Aug. MNI Chicago PMI, est. 52.1, prior 52.1

Central Banks

- 08:00: Fed’s Mester Discusses Economic Outlook

- 18:00: Dallas Fed Holds Event to Introduce New President Lorie Logan

- 18:30: Fed’s Bostic speaks on role of fintech in financial inclusion

DB’s Henry Allen concludes the overnight wrap

Was back in the office yesterday after a two-week break but needed an extra day recovery before I started the EMR again as Monday was the twin’s 5th birthday. To say they were excited would be an understatement. More is to come as they have their birthday party and 30-40 kids coming round our house on Sunday. After another dry spell Sunday brings rain again apparently! We’re used to this adversity as the first day of our Cornwall holiday saw a dramatic storm and the first rain for 2-3 months. A few days of typically chilly, breezy, and slightly wet UK beach weather followed. In my second week off back home I played 5 rounds of golf so that was the proper holiday. My handicap is now the lowest it’s ever been so there’s life in the multiple operated on old dog yet! Back to the real world now though and not only has the world got darker since I’ve been off but so have work hours. I always take these two weeks off every year and it always marks a depressing reality that winter is coming. Before I go away it’s just about light when I get up. However, by the time I get back from holiday it’s firmly dark waking up for the EMR. It’ll be a good 7-8 months before I see light again on the early EMR shift.

The dark mirrors the mood in markets which has seen a rapid deterioration since Jackson Hole, with the S&P 500 shedding a further -1.10% yesterday to move back beneath the 4000 mark. The index is now -7.85% below its mid-August intra-day highs and -5.08% since last Thursday’s pre Jackson Hole close. We’re still +8.71% above the June lows though. Ironically, strong US data releases prompted the latest sell-off, as they showed that consumer confidence was more resilient and the labour market was tighter than expected. But in today’s high-inflation environment, good economic news is enabling the Fed to be even more aggressive on rate hikes, and the market developments yesterday were very much in keeping with that theme. We actually reached an important milestone yesterday too, as the futures-implied Fed funds rate for December ticked up +3.0bps to 3.73%, which surpasses the previous high of 3.72% seen back in June after the bumper CPI report for May came in. So for 2022 at least, markets are pricing in their most aggressive pace of hikes to date which makes a lot more sense than where we were a few weeks ago.

In terms of the specifics of those data releases, an important one was the JOLTS data, which showed that job openings unexpectedly rose to 11.239m in July (vs. 10.375m expected). That marked a break in the trend of 3 consecutive declines, and shows that the Fed still have significant work to do if they want to bring labour demand and labour supply back into balance. Another indicator we’ve been tracking is the number of job openings per unemployed worker. That also bounced back up to 1.98 in July, which is just shy of its record high of 1.99 in March. So even with 225bps of Fed hikes by the July meeting, that measure of labour market tightness has barely budged. Then we got the Conference Board’s consumer confidence data for August, which came in at a 3-month high of 103.2 (vs. 98.0 expected), with rises for both the expectations and the present situation indicators.

This positive news on the economy gave investors growing confidence that the Fed are set to keep hiking into 2023, and sent yields on 2yr Treasuries up +1.8bps to 3.44%. That’s their highest closing level since the GFC, and on an intraday basis they even hit 3.49% at one point. Longer-dated yields also increased, albeit to a lesser extent, with those on 10yr Treasuries flat. FOMC Vice Chair and New York Fed President Williams emphasised the point, saying that rates will need to stay in restrictive territory “for some time”, so the days of pricing rate cuts early next year are over for now. The fed funds futures curve currently has policy rates peaking around 3.90% in the second quarter of next year, with the first full -25bp cut from those highs not until November of next year, as of last night’s close.

The trend towards increasing hawkishness was echoed at the ECB as well yesterday, where the prospect of a 75bps move next week is being increasingly discussed by officials. In the last 24 hours alone, we heard from Estonia’s Muller, who said that “75 basis points should be among the options for September given that the inflation outlook has not improved”. Furthermore, Slovenia’s Vasle said that he favoured a hike “that could exceed 50 basis points”. Germany’s Nagel echoed the ECB chatter from last week, that they should not delay rate hikes just for fear of recession, instead arguing the call for earlier rate hikes to prevent later pain. Further, Pierre Wunsch of Belgium argued the current bout of inflation had structural roots, which called for a quick move to restrictive policy. While neither Nagel nor Wunsch explicitly endorsed a 75bp hike, their comments don’t push back on it.

So overall it’s clear that officials are contemplating a larger hike, and overnight index swaps continue to price a 75bps move as more likely than 50bps for the September decision, closing yesterday pricing +65.8bps worth of hiking for next week’s meeting. It’s set to be a big one!

We should get some additional clues on how fast the ECB might hike with the release of the flash CPI data for the Euro Area this morning. But there weren’t any big surprises in either direction from the country readings ahead of that yesterday. In Germany, the EU-harmonised reading rose to a fresh high of +8.8%, but that was as expected, and it was a similar story in Spain where the harmonised reading fell back to +10.3% as expected.

A complicating factor for the ECB relative to the Fed is the stagflationary impulse coming from the ongoing energy shock, where prices have soared to new records in the last week. However, the last 24 hours brought some further declines that built on Monday’s moves lower, with natural gas futures coming down -7.21% to €253 per megawatt-hour. German power prices for next year came down by an even bigger -21.05%, on top of the -22.84% decline on Monday, although even that -39.09% total decline hasn’t erased the previous week’s gains. One other thing to keep an eye out for from today will be the start of maintenance on the Nord Stream pipeline, which is set to last for 3 days if you take the statement at face value. But as with the shutdown in July, there are concerns that gas flows won’t resume again afterwards, so that’s definitely one to watch.

Oil futures took a big slide, with brent futures down -4.79% and WTI down -5.54%. The proximate cause appeared to be unsubstantiated rumours that the US and Iran had reached a deal to reinstate the nuclear deal. However, a US State Department spokesperson later denied the rumours, and we’ve already heard from OPEC+ that any supply increase from Iran would be offset by supply cuts among the cartel. So if oil prices stay around these levels, perhaps the market is pricing in more global demand slowdown than unmitigated supply expansion.

For sovereign bond yields, the more hawkish noises from the ECB outweighed the effect of falling energy prices yesterday, with the 2yr German yield up +6.1bps. Similarly to the US, the increases in yields were concentrated at the more policy-sensitive front end of the curve, with longer-dated yields seeing smaller moves, including those on 10yr bunds (+0.8bps), OATs (+0.7bps) and BTPs (+1.7bps).

On the equity side, the risk-off tone took the major indices lower on both sides of the Atlantic, with the S&P 500 (-1.10%) experiencing a 3rd consecutive decline. The more cyclical sectors led the moves lower, and the more interest-sensitive megacap tech stocks continued to struggle, with the FANG+ index down a further -2.04%. In Europe, the STOXX 600 was down -0.67% yesterday, although that decline was somewhat exaggerated by the fact that London equities were returning after Monday’s declines. Indeed, the DAX actually ended the day up +0.53%, although that was the exception as the CAC 40 (-0.19%) and the FTSE MIB (-0.08%) both posted modest declines.

The more negative mood of the last few days has continued into today’s Asian session, with the Nikkei (-0.40%), Hang Seng (-0.39%) and the Shanghai composite (-1.18%) all losing ground this morning despite earlier better-than-expected economic data from China and Japan. Starting with the former, both manufacturing (49.4 vs 49.2 expected) and non-manufacturing PMI (52.6 vs 52.3 expected) were ahead of estimates but the manufacturing gauge stayed in contraction territory. In Japan, we got strong beats for industrial production (+1.0% vs -0.5% expected, MoM) and retail sales (+0.8% vs +0.3% expected, MoM). US Treasury yields are up across the curve, with the 2y yield (+2.1bps) gains ahead of 10y ones (+0.9bps).

To the day ahead now, and data releases include the flash CPI reading for the Euro Area in August, as well as the country readings for France and Italy. On top of that, there’s German unemployment for August, Canada’s GDP for Q2, and in the US there’s the ADP’s report of private payrolls for August and the MNI Chicago PMI for August. Finally, central bank speakers include the Fed’s Mester and Bostic.