Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

All I hear is that lonesome sound

The Hounds of Winter

They harry me down

– Sting

By a narrow margin Boris Johnson’s clownish Defense Minister Liz Truss will become the next Prime Minister of the United Kingdom. She doesn’t have a lot of time to put together a government lest the U.K. have to suffer through yet another general election.

Truss, by virtue of her full-throated support for Ukraine against Russia, was the choice of those Tories committed to maintaining the UK’s relationship with the US, leaving it nominally more independent from the European Union.

Davos man-child Rishi Sunak, the darling of the Remainers of City of London the true hounds of winter here, failed to overtake Truss in the end. What started as a Davos-style decapitation of Johnson, who rightfully deserves to be jailed for his undermining Russian/Ukrainian peace talks in April, ended with the female version of him in office.

While I’d like to say I’m happy to see Davos lose another major conflict in Europe, empowering the US neoconservatives is not a win here. In the end, the deep ties between the US and UK intelligence and military services won out in the Tory leadership battle.

Again, there are no winners from our perspective, here.

Truss comes in vowing to fix everything, from lowering taxes (good) to dealing with an energy crisis she helped create by leading the charge to sanction Russian energy to hell and back. She’ll deficit spend like she’s supposed to because making peace with Putin or breaking with Davos over developing Scotland’s energy reserves is verboten.

She wants to be thought of as the new Thatcher, but she has neither the support Maggie had nor one-third her talent or smarts.

And she doesn’t have the trust of the London banks, who themselves are now rightfully staring at a black hole thanks to her manifest stupidity and belligerence.

Truss is a typical midwit just smart enough to know who’s giving the orders and how to make them manifest but not smart enough to rise above that. I remind everyone that this is a woman so unqualified for the job she had that she doesn’t know where the borders of Russia and Ukraine are but believes in the ‘territorial integrity of Ukraine.’

Like all good servants of the elites she represents, she was rewarded for her incompetence.

The choice between Truss and Sunak was another classic Hobson’s Choice — continued war with Russia across every vector (Truss) or the surrender of the UK to the EU and the reversing of Brexit (Sunak).

Either way there is not much hope this morning if you are a Brit.

At best she will be an even weaker leader than Johnson was, since she has no issue to rally the country around, like Brexit, which she won’t even discuss in public. This was reflected in the final party leadership vote where 20% of Tories stayed home.

So, even if Truss is able to cobble together a government and presents it to the Queen to rubber stamp, she will do so with the Tories having been thoroughly discredited as a party. Not that Labour is any useful opposition here.

While the old guard of British politics may have won this fight, it is a Pyrrhic victory for them. It’s still a country with no friends as long as Biden is in power.

British politics have been frozen for months because of this ridiculous affair. All it did was extend everyone’s misery as the UK warmongers cling to the vestiges of their former power.

What’s truly sad is that Johnson backed a Hail Mary in Ukraine surrounding the Zaporizhia Nuclear Power Plant (ZNPP) that may now have to be considered the British version of the Bay of Pigs, but with far vaster implications.

The massacre that occurred last week was a plan so retarded it reveals the mendacity and desperation of both British Intelligence and former Prime Minister Boris Johnson to escalate the conflict, remain in power and advance their ultimate agenda of weakening global support for Russia at the UN.

The Ukrainian Armed Forces, with significant help from British ‘advisors,’ staged a multi-pronged commando amphibious landing north of the ZNPP. The goal was to attack it and take it over while the Russian garrison had been mostly removed while awaiting the IAEA inspectors.

The idea being to shame the Russians out of the ZNPP to show that it wasn’t being used as a military staging area and attack it while it was lightly defended. Then… and this is the insane part… take the entire IAEA delegation hostage but doing so POSING AS RUSSIAN TROOPS.

Here’s the link to the plan from Intel Slava Z’s Telegram Channel, of course salt to taste.

The Kremlin was aware of the plans of the Main Intelligence Directorate of the Armed Forces of Ukraine to take advantage of the arrival of the IAEA mission and carry out an amphibious landing in order to try to seize the Zaporizhzhya Nuclear Power Plant and make statements for days that it was Russian special forces. Under ideal conditions for the work of the DRG, they calculated the task of taking the mission itself hostage and keeping the nuclear power plant under mines, making demands for the complete withdrawal of Russian troops to the territory of Crimea.

Boris Johnson brought the plan of operation and some of the instructors with him as a demobilization chord of his premiership, but if the GUR was successful, he would have refused to transfer power, referring to an international emergency threatening a catastrophe on a planetary scale. At the moment, 47 DRG fighters have been destroyed, three have been taken prisoner (!), Two are in serious condition between life and death. A group of 12 people is blocked on three sides and cut off from the water and boats, by 15:00 CTO will be over. Zelensky’s statement on this situation is expected in the late afternoon, the head of the IAEA Mission has already been notified of the situation, as well as UN Secretary General Guterres. The operation was coordinated by MI6 officers from their headquarters in the suburbs of Kyiv.

All 64 DRGs have recently completed training in the UK and traveled from Warsaw to Odessa on 29 August.

Now, clearly this is a Russian version of events. But it is backed up by the statements coming from the UN in the aftermath, praising the Russian military for securing the safety of the IAEA inspectors, something they would never have done.

Even if the whole ‘impersonating Russians holding IAEA inspectors hostage’ plan failed, the story is still deeply disturbing, because this type of multi-pronged (5 different invasion points of the area) operation had to have been planned well in advance.

The Russian Ministry of Defense’s version of the story is similar if cleaner, for diplomatic reasons if nothing else. They leave out the ‘impersonating Russians’ part but leave in all of Ukraine’s attempts to insert friendly Western media into the delegation who would then give us the ‘official story’ of what happened.

Moscow has suggested that Kiev’s plan was to capture the nuclear plant and then use the staff of the UN nuclear watchdog as “human shields” to maintain control over it.

What this means is that the Johnson and the US Dept. of Defense/National Security Council (all staffed by the move virulent Neocons) have been planning something like this for months which is why they refuse to allow the Ukrainians to surrender.

It’s also why the EU/Davos (who clearly want out of this insanity) are throwing Johnson under the bus for blowing up April’s peace talks. Russian President Vladimir Putin keeps tightening the screws on the energy-starved Europeans causing all kinds of havoc there politically.

The timing of his announcement Gazprom was shutting down Nordstream 1 indefinitely while the IAEA inspectors were at the ZNPP is yet another clue to what the real story was. Moreover, note that since this inspection went off without a hitch there was little to no breathless reporting on it.

It vanished from the media as quickly as the prospects for the UK’s economic recovery with the announcement of Truss’ big win.

The Brits under Johnson and Truss have been trying to create a false flag incident to justify official NATO involvement in the Ukraine conflict since the beginning of the war.

The excuse of a multi-country nuclear meltdown incident would more than provide that justification.

This was their big operation to finally turn the entire world against the Russians by saying that in order to suppress the real story at the ZNPP Russia kidnapped peaceful IAEA inspectors and used them as political hostages.

Because even if Ukrainian forces stormed the plant, do you think the lying British media would tell you a story even remotely pro-Russian?

No. These are the same people who have been trying to convince you that Russia was shelling its own troops there for weeks now.

This may have allowed Neocon-backed Johnson to stay in power through emergency powers and set the precedent for Biden to do the same thing before the mid-terms. Truss’ election as the head of the Tories in the UK ensure this type of insanity will continue uninterrupted because she’s too stupid to see the obvious ploy to discredit both the UK and the US while Europe plays the victim.

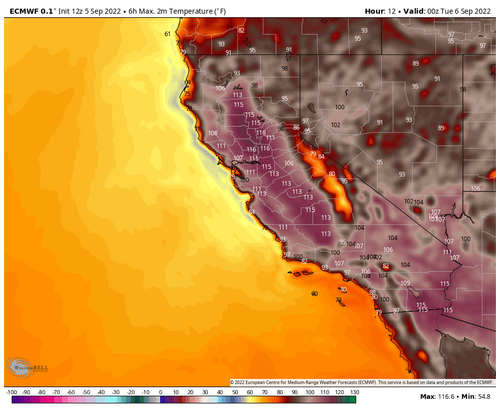

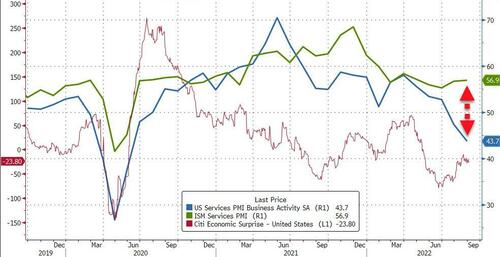

Playing through their strategy, any kind of ‘accident’ at ZNPP can be coordinated with a collapse of capital markets as NATO officially gets involved in Ukraine and vast nationalization of whole swaths of the West’s industrial base then ensues.

Thankfully the Russians escorting the IAEA inspectors into the ZNPP and the amphibious assaults vaporized (which they have), this entire disgusting affair ends.

I bring this up not because I believe the entire story. I don’t. But it is emblematic of the mindset of the people in charge.

There is more than a whiff of desperation and fear emanating from all across Europe, but especially from the UK as they have been brought to the edge of extinction by inept leadership refusing to accede to the reality that not only has the sun finally set on the British Empire, but it’s not likely to rise again anytime soon.

The only hope the UK had was in the US supporting its bid for independence from the EU via Brexit. Once Biden was selected that hope died, minus an Oliver Cromwell moment.

What they got was Liz Truss.

The reason I’m so set on my thesis about the Fed being against Davos is the actions of the UK in this conflict. It was clearly an operation that both the US/UK neocons and the Davos globalists saw common ground in using Ukraine to attack Russia.

Their interests aligned all during the eight year lead up to Russia’s invasion.

They really did believe their own clownish stories about the fragility of Putin’s government, Russia’s economy and the depth of the West’s financial and legal power to extract pain from those that defied them.

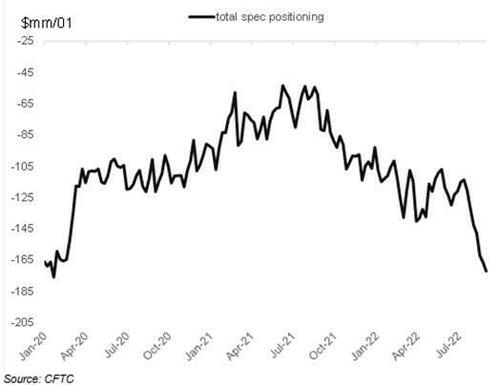

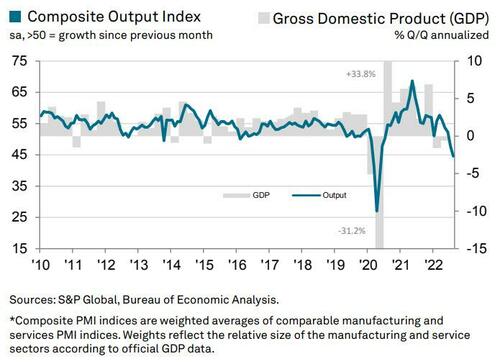

Once it became obvious that the economic ‘shock and awe’ campaign to isolate Russia had failed and Putin’s Energy Counter-Offensive began, the cracks in the relationship opened and the power of ‘Outside Money’ — gold, commodities — exposed the weakness of ‘Inside Money.’

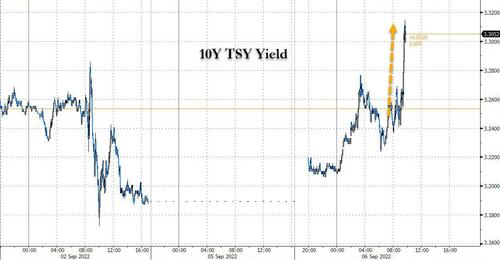

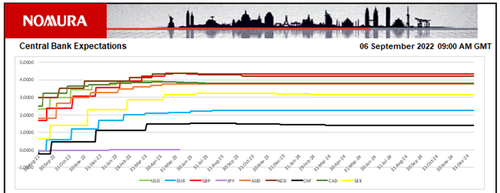

The failure of the Biden junta to secure the Fed means that not only did the Davos/Neocon alliance crack but US sovereigntist forces saw the opportunity to take out City of London and Amsterdam in the chaos. Now both the UK and the EU are caught between the Fed draining them dry in the capital markets and the Russians refusing them much needed energy.

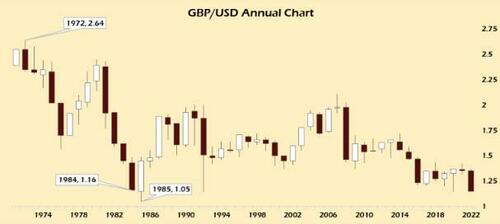

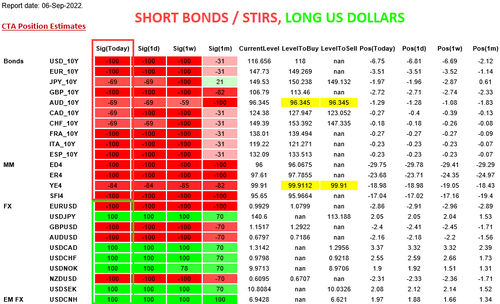

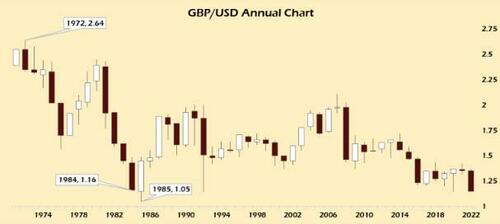

When I look at a long-term chart of the British Pound all I see is oblivion.

It’s on pace for the lowest close in history this year. And thanks to Gordon Brown there are no gold reserves left to back the currency nor any new energy sources to stabilize it. It, along with the Canadian dollar are the ultimate form of ‘Inside Money.’

And Inside Money is falling fast, first to the US dollar (USDX knocking on 110 and rising) and then to the broad commodity sector and eventually gold itself.

The Euro chart is worse.

Russia and Putin understand this and all they have to do is continue doing nothing, or more explicitly pumping nothing, and the collapse will finally be complete. All the Fed has to do is stay its course.

So, while City of London thought they were circling the Brexiteers and Russia going for the kill, they were themselves encircled by the real dogs of war.

Maybe Davos wants this collapse. Sure, they talk a good game about Building Back Better and the Great Reset, but they didn’t imagine it would be on someone else’s terms, namely both the Americans’ and the Russians’.

Yes, they are selling the carbon-free future to their people but at what price and with what capital?

Yes, they believe they can consolidate their financial problems in the ECB, a European-style Resolution Trust bad bank, then default through George Soros’ idea of Perpetual Bonds and emerge with a clean balance sheet. But who is going to invest in them ever again after the pain they put everyone through?

Not Russia. Not China. Maybe a weakened US. Europe will be a smoking ruin for decades if this happens.

Putin is not only interested in finally besting Russia’s centuries-old enemy, Britain. He’s also no longer smitten with the ideas of old Europe. If there is to be détente between Europe and Russia it will be on Russia’s terms, not Europe’s.

So far the EU is doubling down on its stupidity because it fits their plan, as stupid as it is, much as I expect Truss to double down on Johnson’s because of legendary British arrogance and stubbornness. Just don’t expect Putin or Powell at the Fed to come to their rescue anytime soon.

Liz Truss is a woman more bloodthirsty than Hillary Clinton with one-tenth of her gravitas. The British people certainly deserve better because no one should be treated to such depravity. She is a band-aid on an open wound festering as the hounds of winter circle in for the kill.

* * *

Join my Patreon if you understand why Winter is Coming