Futures Flat, Europe Sinks As Oil And Gas Soar On Russia, OPEC+ Doubleheader

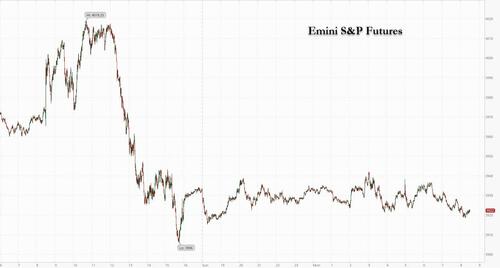

Ever since Russia’s shocking announcement late on Friday it would cut natgas supplies via Nord Stream 1 it was clear that Monday’s Labor Day holiday in the US would be chaos, and sure enough, with US futures relatively flat and rangebound after the worst week for world shares since June….

… European stocks slumped and the euro fell Monday as the region’s worsening energy crisis guaranteeing a stagflationary recession for European, added to risks for a global economy already facing high inflation and a wave of monetary tightening.

Gazprom announced its decision to cut European gas after Group of Seven leaders agreed to implement a price cap on Russian oil as the Kremlin continues its war in Ukraine. Natural gas surged more than 30% in Europe and nations there could roll out special steps at the end of the week to rein in power costs. Germany plans a $65 billion package to shield consumers.

“Economies have been preparing for some sort of energy constraint and the prospect of rationing, but obviously compared to expectations at the beginning of the year, this is pretty close to the worst outcome,” Wei Li, BlackRock global chief investment strategist, said on Bloomberg Television. “So as we head into rest of the year, underweight equities at this juncture feels appropriate.”

The view that global shares already hit their bear-market low back in June is looking increasingly precarious. Europe’s intensifying energy crisis is the latest hit to sentiment, which was already under pressure from a wave of monetary tightening.

The Stoxx Europe 600 Index fell 1.2% after Russia’s Gazprom halted its key gas pipeline indefinitely, and on Monday clarified it would not resume pumping until sanctions have been lifted. Steelmaker Thyssenkrupp AG, car-parts manufacturer Valeo, chemicals firm BASF SE, cement maker Cie de Saint-Gobain and gas utility Uniper SE were among the worst performers. Energy stocks were among the few gainers on the Stoxx Europe 600 benchmark as oil rallied after OPEC+ unexpectedly announced it would cut output by 100Kb/d. Here are the other notable movers:

- Philips advance as much as 1.5% after UBS raised the Dutch medical technology firm to neutral, saying “consensus estimates and valuation better reflect the risks ahead”

- Abcam jumped after Panmure Gordon upgraded the biotech company to buy ahead of interim results next week, which the broker expects to generate a “positive reaction” from the market

- Countryside Partnerships shares rise as much as 7.4% after Vistry Group agreed to acquire the UK homebuilder, with analysts noting the cash-and-stock deal makes strategic sense

- European utilities underperformed after Gazprom’s decision to keep the crucial Nord Stream pipeline shut worsened the bloc’s crisis and makes this winter’s outlook gloomier

- European auto stocks slide to the lowest since July 15, as the region’s escalating energy crisis makes rationing look more likely, while Morgan Stanley strategists downgraded the sector to underweight

- Campari and Remy Cointreau shares fall, underperforming in Stoxx 600 Food & Beverage sector, following downgrades of both stocks by Exane BNP Paribas, with Diageo and Fevertree also downgraded

- German stocks on its DAX index benchmark fall the most since mid-June, amid growing recession fears and as the country unveiled a relief package that may cap energy company profits

- Asos shares fall as much as 5.1% after it had its FY23 sales and pretax profit estimates lowered at Peel Hunt, along with a cut to the price target due to macro-economic risks and other concerns

- Corbion shares decline as much as 3.1% after Berenberg further reduced its Street-low price target on the biochemicals firm due to the de-rating of its peers in the polylactic acid business

- Aston Martin shares dropped as much as 8.4% after the carmaker raised GBP575.8m via a 4 for 1 rights issue, with irrevocable committments from PIF, the Yew Tree Consortium and Mercedes-Benz

Earlier in the session, Asian stocks declined, paced by losses in Hong Kong, where tech shares slid as traders weighed the risk of curbs on investment from the US. China reduced the amount of foreign-exchange deposits banks need to set aside as reserves for the second time this year to boost the yuan after the currency hit a two-year low.

Asia-Pac stocks lacked firm direction amid cautiousness ahead of this week’s key events including central bank meetings and tier-1 data releases, while better than expected Chinese Caixin Services PMI is offset by China s COVID-19 lockdowns and ongoing European energy woes. ASX 200 (+0.2%) was just about kept afloat by strength in the commodity-related sectors with outperformance in energy as underlying prices gained following the indefinite shutdown of the Nord Stream 1 pipeline. Nikkei 225 (-0.1%) was subdued alongside disruptions as the region braces for Typhoon Hinnamnor. Hang Seng (-1.4%) and Shanghai Comp. (+0.1%) were mixed with Hong Kong pressured by underperformance in auto and tech stocks, while the mainland was choppy after Chinese Caixin Services PMI topped estimates and following the extension of COVID restrictions in Chengdu and Shenzhen.

The dollar strengthened as commodity-linked currencies joined the euro’s retreat to a two-decade low. The pound was steady as the UK’s Conservative Party named Liz Truss as its leader, clearing her way to become prime minister. Her plan to “turbo-charge” the economy by slashing taxes is already worrying investors amid double-digit inflation.

Cash Treasuries and US stocks are closed because of Labor Day.

Oil surged as a OPEC+ agreed to make an unexpected, if symbolic, oil supply cut for October of 100,000b/d.

Elsewhere, Bitcoin dropped below the $20,000 level. Gold was little changed.

Monetary authorities including Europe’s central bank are set to keep hiking interest rates this week to fight inflation despite the darkening global economic outlook due to risks such as power shortages.

* * *

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks mostly lacked firm direction amid cautiousness ahead of this week’s key events including central bank

meetings and tier-1 data releases, while better than expected Chinese Caixin Services PMI is offset by China’s COVID-

19 lockdowns and ongoing European energy woes. ASX 200 (+0.2%) was just about kept afloat by strength in the

commodity-related sectors with outperformance in energy as underlying prices gained following the indefinite shutdown

of the Nord Stream 1 pipeline. Nikkei 225 (-0.1%) was subdued alongside disruptions as the region braces for Typhoon

Hinnamnor. Hang Seng (-1.4%) and Shanghai Comp. (+0.1%) were mixed with Hong Kong pressured by

underperformance in auto and tech stocks, while the mainland was choppy after Chinese Caixin Services PMI topped

estimates and following the extension of COVID restrictions in Chengdu and Shenzhen

European stocks drifted lower, with Germany announcing it would spend EUR 65bln on its third package which aims to tackle the effects of inflation on consumers and businesses, according to a government document cited by Reuters. It was also reported that Germany is to levy a windfall tax on energy groups to fund the aid package, according to FT. Volkswagen (VOW3 GY) – Porsche will be holding a board meeting on Monday to discuss the IPO. Uniper (UN01 GY)/ Siemens Energy (ENR GY) – Gazprom said the transport of gas to the Nord Stream pipeline has been completely halted until faults are rectified, no timeline for fixing turbine nor restart of gas supply; during routine maintenance works oil leakage was detected. (Newswires)

DB’s Jim Reid concludes the overnight wrap

I’m still recovering from seeing an 18-foot Burmese Python wrapped around my twins at their 5th birthday party yesterday. They wouldn’t go near the Lizzie the crocodile or even the bearded dragon. I joked to my wife that I thought she was the oldest person at the party until the ancient tortoise came out! She wasn’t amused.

Recovery from such an event would normally be helped by the week after payrolls tending to be quieter for data, as well as today being US Labor Day and a closed market Stateside. However, the week in Europe could get off to a slightly fraught start after news just after the European trading close on Friday that Nord Stream 1 would remain shut due to a “leak” after the three-day maintenance period. It had looked earlier in the day that it would reopen this past weekend, but the late news was thought by some to be signs that Russia was using its full leverage over Europe. It could have been related to the G7 finance ministers’ decision to implement price caps on Russian oil a few hours earlier.

Europe has done a very good job over the last couple of months, relative to expectations, in getting gas storage levels high and increasing imports from elsewhere, but if no more gas flows from Russia we are likely touch and go in terms of getting through the winter without notable restrictions/rationing. Russia will be aware of this. Indeed, in this job there is now something else we may have to pretend we’re experts on. Epidemiology was a recent example and now we’ll have to add meteorology to that list as the weather in Europe this winter could be a swing factor as to whether compulsory gas rationing has to be implemented. The good news is that the start of the winter heating season in October looks mild at the moment. However all I would say is I played golf on Saturday and didn’t take my waterproofs as the forecast gave less than 5% chance of rain. Halfway round there was the biggest downpour I have seen for some time and I got absolutely soaked.

So all eyes on gas futures this morning and the aftermath to the NS1 news. European stock futures are around -3% lower in Asia so that has set the tone for the open. This Friday EU energy ministers meet so that will be a key meeting. Expect to see more government action over the next few days and weeks. Indeed Germany yesterday announced a fresh $65bn package to help consumers. This is now the third such package.

Elsewhere the new UK PM will be announced today with Liz Truss being the overwhelming favourite. Her reaction to the energy/cost of living crisis will be very much in focus, especially as it pertains to fiscal policy. This might come out more over weeks than days (emergency budget speculated for September 21st) but could signal a meaningful shift in policy.

All this has slightly overshadowed a big week for central banks with all eyes on the ECB meeting on Thursday, as well as Fed Chair Powell’s speech the same day. On Wednesday, we will get the Fed’s Beige Book and a likely 75bps hike from the BoC. For the ECB our economists’ preview here lays out the case for a 75bps hike following last week’s higher than expected flash CPI print for the region and an array of hawkish ECB comments of late from ECB officials.

In terms of data the US services ISM (tomorrow) will be a highlight given that last month saw a surprisingly strong (to the market) 56.7 print. 55.2 is expected this month which would remain way above normal recessionary levels. In Europe Industrial production for Germany (Wednesday) and France (Friday) might be the highlights given recent energy travails. By contrast, Asia will have a busier week. China’s CPI and PPI (Friday) will be the key data release. Current median estimates on Bloomberg point to a slight YoY uptick in the CPI (2.8% vs 2.7% in July) and easing PPI pressures (3.2% vs 4.2%). This price data will be preceded by trade balance figures on Wednesday. We’ve already seen the Caixin services PMI this morning which came in at 55.0 for August (v/s 54.0 expected), recording the second highest level since May 2021 despite softening from July’s 55.5.

Staying in Asia, equity markets have started the week on a negative footing amid growing fears about an energy crisis in Europe, Chinese Covid lockdowns and geopolitical tensions. The Hang Seng (-1.66%) is the largest underperformer across the region with the Kospi (-0.25%) and the Nikkei (-0.14%) also slipping in early trade. Mainland Chinese stocks are mixed with the CSI 300 (-0.56%) edging lower while the Shanghai Composite (+0.06%) is struggling for direction this morning.

We also got Japan’s latest services PMI data with the index dropping to 49.5 in August, lower than 50.3 in July, marking the first contraction in services since March. Elsewhere, the final estimate of Australia’s S&P Global services PMI came in at 50.2 in August, dropping from July’s 50.9.

Over the weekend, Shenzhen shut down its city center with Chengdu extending lockdown curbs for most parts of the city as the nation is facing a steady rise in Covid infections just weeks ahead of a high-profile Communist Party congress.

On the inflation front, amid the heightened volatility in crude futures of late and recent comments from Saudi Arabia officials, today’s OPEC+ meeting will be in focus to gauge whether the cartel believes supply adjustments are needed to support prices. As I type, Brent futures (+1.85%) are trading higher at $94.74/bbl with WTI futures up +1.83% at $88.46/bbl. The full day by day week ahead is at the end as usual.

Recapping last week, it was a difficult one for markets as investors grew increasingly concerned about the risks to global growth. In particular as discussed above the news at the end of the European session on Friday, that the Nord Stream gas pipeline from Russia would remain closed after its 3-day maintenance period, saw a late sell-off which will have implications for this week. All in all, that meant global equities lost ground for a 3rd consecutive week, with the S&P 500 down -3.29% (-1.07% Friday), and the STOXX 600 down -2.38% (+2.04% Friday before NS 1 news). Tech stocks underperformed, with the NASDAQ shedding -4.21% (-1.31% Friday), and the FANG+ index down -4.61% (-1.91% Friday). However, banks did somewhat better thanks to the more hawkish rhetoric from central banks and higher sovereign bond yields, with the STOXX Banks index in Europe up +3.25% (+3.12% Friday).

Ahead of the gas pipeline news, there had actually been signs of a recovery in markets following the post-Jackson Hole selloff. That was given momentum from the US jobs report for August, which was just about weak enough that it led investors to dial back slightly their expectations for another 75bps hike from the Fed this month but without destroying the growth narrative. In terms of the details, the headline nonfarm payrolls number was broadly in line with expectations at +315k (vs. +298k expected), but the two previous months saw downward revisions of -107k. The unemployment rate also ticked up to 3.7% (vs. 3.5% expected), although that was driven by a rise in labour force participation to 62.4% (vs. 62.2% expected) as more people came back into the workforce. This will be a small amount of good news for the Fed. Fed funds futures reduced the hike expected this month by -3.7bps on Friday to 63.9bps, so nearly at the mid-point again between 50 and 75bps

The more dovish implications of the jobs report still weren’t enough to prevent sovereign bonds from losing ground for a 5th consecutive week, with 10yr Treasury yields up by +14.9bps (-6.4bps Friday), and 10yr bund yields up by +13.6bps (-3.6bps Friday). That came as expectations ratcheted up that the ECB would hike by 75bps at their meeting on Thursday, not least following the stronger than expected flash CPI print from the Euro Area earlier in the week, which hit a record +9.1%. Commodities were another asset class to struggle, which wasn’t helped either by the latest Covid lockdowns in China that have raised questions about the strength of global demand. Against that backdrop, Brent crude oil prices fell -7.89% (+0.71% Friday) to $93.02/bbl, and the industrial bellwether of copper fell -7.45% (+0.21% Friday).

Tyler Durden

Mon, 09/05/2022 – 08:57

via ZeroHedge News https://ift.tt/eAjiwSK Tyler Durden