By Michael Every of Rabobank

“One Thing to rule them all; one Thing to find them

One Thing to bail them all and in the ‘market’ bind them.

In the land of More-dosh, where the Shadow Bankers lie.”

Today sees the long-awaited release of a gigantic work of creative fiction on which rides billions of dollars: and apart from US payrolls, Amazon Prime is releasing ‘The Lord of the Rings: The Rings of Power’. It’s a long wait for that jobs number, so I’m going to kill some time with some high fantasy of my own. Watch me weave my magic!

As someone who lived and breathed Tolkien 24/7 until he was old enough to go into pubs, and then lived and breathed pipe weed, I have zero interest in this new TV show. It was always clear this was going to be a fanfiction Tolkien calendar made by people who don’t know about days, months, or years: or Tolkien, given they are compacting thousands of years of his legendarium into just a few to make the story easier to follow. That is like saying you want to make a respectful TV show about British history, because you love Britain, and then you make one where Boudicca, Elizabeth I, Florence Nightingale, and Joan Robinson all decide to go paintballing, as Queen Victoria and Victoria Beckham smash into them in a flaming meteor.

The early reviews are in, and some people love it, with a 83% critic score on Rotten Tomatoes. Then again aggregate critic reviews or cheering social-media bots are like ratings agencies post-2008: nobody thinks they mean anything. The actual market of viewers will do its own thing.

Yet even some ‘ratings agencies’ are crying ‘junk!’ Entertainment Weekly says: “This series is a special catastrophe of ruined potential, sacrificing a glorious universe’s limitless possibilities at the altar of tried-and-true blockbuster desperation.” The Daily Mail gives it one star out of five, and says: “Turkey is not the word. No turkey, however bloated and stupid, could ever be big enough to convey the mesmerising awfulness of Amazon’s billion dollar Tolkien epic. This is a disaster dragon – plucked, spatchcocked, with a tankerload of Paxo stuffed up its fundament, roasted and served with soggy sprouts. The Lord Of The Rings: The Rings Of Power is so staggeringly bad, it’s hilarious. Everything about it is ill-judged to a spectacular extreme. The cliche-laden script, the dire acting, the leaden pace, the sheer inconsistency and confusion as it lurches between styles – where do we start?” If only those working on the show could write as well as the Mail channel T.S. Eliot’s orcish under-current.

That I have zero interest in this Tolkien-a-rama is partly due to me being a purist: I even had problems with the bathos of Jackson’s film trilogy, and the feebleness of his odd attempts to re-write things to make them ‘more exciting’; ‘The Hobbit’ trilogy was a bad videogame.

However, it also partly reflects the embarrassment of riches fantasy fans have today. As a boy, I had to survive with only a beloved VHS copy of Ralph Bakshi’s own spatchcocked ‘The Lord of the Rings’ cartoon: it was the first video I ever rented, and I can still recall watching it to the end, wondering where ‘The Return of the King’ part was, and trying to play the tape upside down to see if it was on the B-side. (It wasn’t.) That aside, we only had very thin fantasy gruel such as ‘Hawk the Slayer’, which I am surprised Netflix aren’t already remaking into something they can immediately cancel.

In my fevered imagination, all of this still ties back to the payrolls number today, even though Tolkien infamously hated allegory.

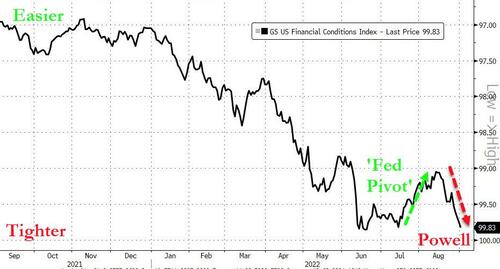

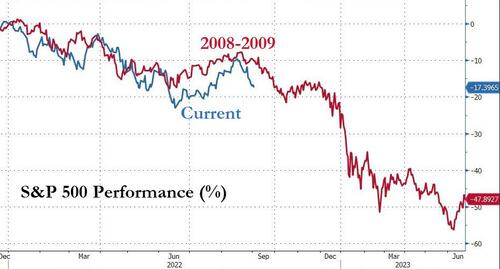

First, that TV studios can throw so much money at a show –the Mail adds: “There’s no doubt we can see the budget. It casts a throbbing glow over the screen like a chestful of gold”– and it still be so bad in the eyes of some reviewers shows parts of the economy still have too much money. Moreover, talent is rare, and not all that glitters is gold. Indeed, the rareness of talent –and of ‘gold’– versus the abundance of money is why central banks are having to be Hawks the Slayers for markets. When Amazon Prime is remaking that title on a shoestring then we are back towards the right territory. After yesterday’s US ISM data, markets will be hoping today’s payrolls number will be bad enough to blunt the Fed’s vorpal blade. However, even a bad print and a weak CPI number next time would still see a 50bps hike in September: and if we get an upside print in either, the market will be trembling about another 75bps.

Second, this is not just about supply-demand balancing. It is about power. Power was what the One Ring in Tolkien’s masterwork, and this fanfiction, represents. It isn’t simply “evil”, but rather has the ability to dominate others wills; and cruelty and malice eventually flows from the corrupting influence of that power to dominate – even when it starts with good intentions.

As such, it can be argued the Dark Lord Sauron’s true opposite is not would-be king Aragorn or the wizard Gandalf, but bucolic Tom Bombadil, who has no desire to dominate anyone or anything, and hence cannot be dominated: and so he gets cut out of the films. Take that allegory wherever you like re: markets, but I have a few destinations in mind.

Third, central banks are raising interest rates more than markets had dreamed possible –we now expect the ECB to hike 75bps at its next meeting; and the Aussie press is warning that falling housing prices won’t stop the RBA hiking– because of power. Not just rising energy prices, as crude slumps for another day (but call options for December soar), despite Germany fears further cuts in gas flows from Russia in October, though this is a huge part of our current problem.

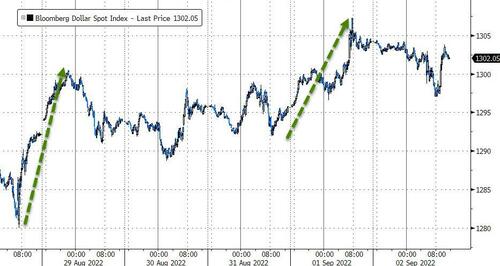

Rather, it is about who holds the power to dominate others. Is it Western central banks and their not-so glittery, not-so gold, and not-so commodity currencies; or is it shadowy and shadow-banky lands who prefer glittery, goldy, and ‘commodity’ currencies, e.g., as Russia considers buying $70bn of CNY and “friendly countries’” FX?

Raise rates more than markets expect, and keep them there longer than they expect, and find out who is ‘The Lord of the Things’ and what the real ‘Things of Power’ are!

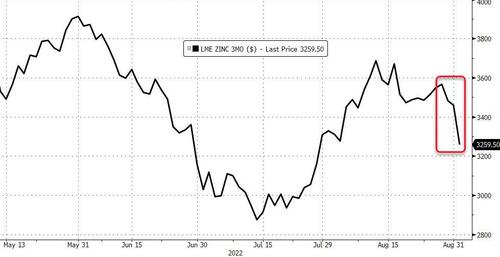

So, yields are surging, commodities are under pressure, and the US Dollar is still the Dark Lord on its Dark Throne – JPY tested past 140, perhaps close to triggering a domino effect across Asian FX. Ironically, this is because the Dollar isn’t in More-dosh, where the Shadow Bankers lie.

Fourth, for those who like epic struggles, presumed next UK PM Truss –who looks a bit like the action-figure kick-ass version of Galadriel in the trailers for ‘The Things of Power’, without the chainmail– is reportedly to embrace a new foreign policy approach of “geoliberalism”. (See, I kept saying we had to have a new “-ism” to sell policy shifts to a public.)

This odd-sounding “-ism” calls for already-floated ideas: a “Network of liberty” of democratic nations (where she also called for the G7 to be an ”economic NATO”); more AUKUS-type deals; a hawkish line against Russia and China; more sanctions and weapons to help Ukraine; and a UK-US FTA. If you combine that with analysis suggesting Truss backs de facto MMT, as flagged earlier this week in ‘Bank of England Dreaming’, then we have arrived at the Western policy response to a crumbling global order flagged here since 2015. It’s almost as if real, not larping, Elves and Orcs suddenly appeared on our streets, as in ‘Bright’.

Of course, this could be more British high fantasy, as Build Back Better and Levelling Up were. There will be no UK-US FTA while Northern Ireland remains unsettled. Moreover, MMT is very high risk/high reward: “One does not simply walk into More-dosh!” Even so, the key point is we lack any alternative business-as-usual options. On which note, and on ‘The Things of Power’:

“I wish it need not have happened in my time,” said Frodo.

“So do I,” said Gandalf, “and so do all who live to see such times. But that is not for them to decide. All we have to decide is what to do with the time that is given us.”