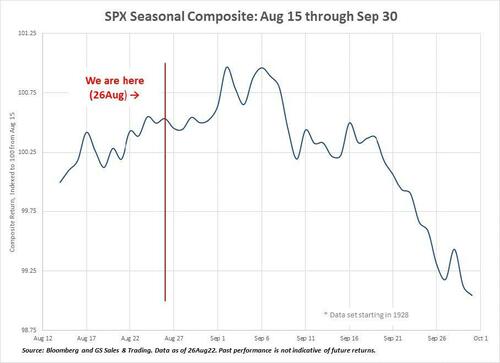

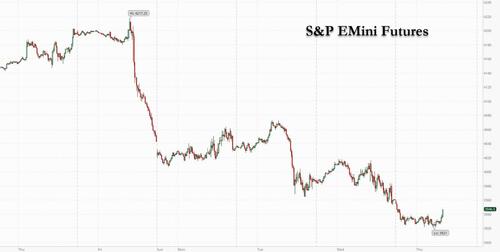

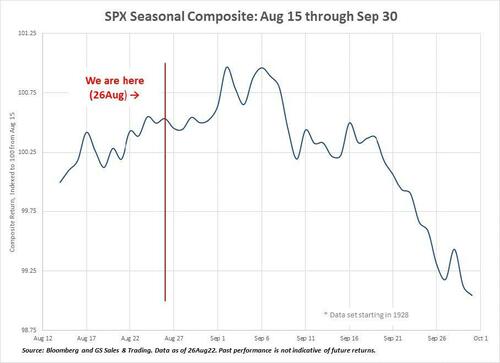

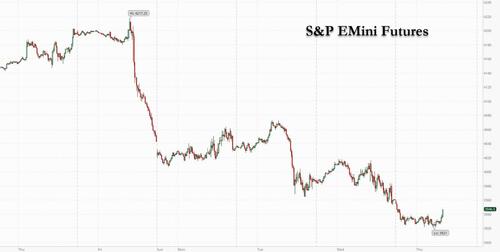

With September already historically the ugliest month for markets of the entire year…

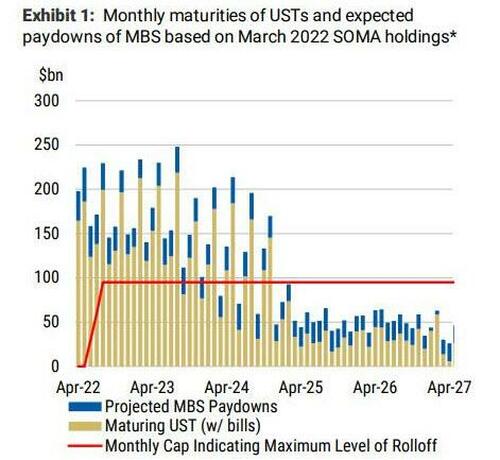

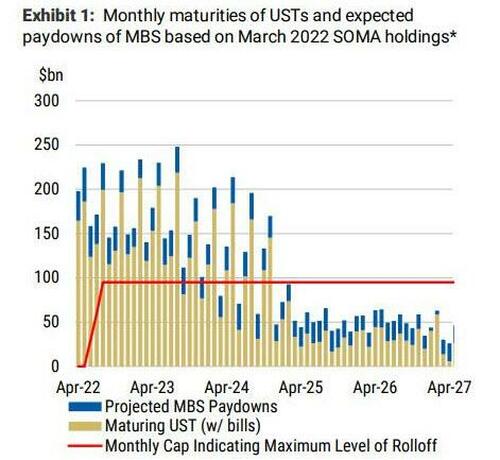

… an underperformance which this year will likely be on steroids thanks to the Fed’s doubling of QT to $95BN starting today…

… especially with stocks having gone from overbought to oversold in two weeks as bullish sentiment imploded…

… it’s not like stocks needed an additional impetus to dump, yet they got just that overnight when first China announced that it would put 21 million citizens living in its megacity of Chengdu on lockdown (as part of Beijing’s “Zero Covid” policy of blaming China’s slowdown on 1 or 2 cases of covid per city and promptly locking down whole swaths of the economy, you know, for the kids), and second in a major escalation, Taiwan shot down an unidentified drone off the Chinese coast; the news sent S&P 500 futures sharply lower on the first of the month, dropping as much as 0.9%, with Nasdaq futures down as much as 1.3% after another sales warning from Nvidia sent chipmakers in retreat on new China export rules.

The US 10-year Treasury yield rose to 3.20% and threatening to break above the previous level, a move which would be seen as especially bearish. The dollar gained and oil tumbled for a 3rd day amid fears about Chinese demand, even as OPEC+ is preparing to announce some sort of price stabilization intervention. Industrial metals fell after China locked down Chengdu’s 21 million residents, while oil and natural gas retreated as Europe considers various measures to intervene in the energy market. Commodity-linked and Group-of-10 currencies weakened, while the yen dropped to a 24-year low.

The market jitters come after August’s losses, reflecting fears of an economic downturn alongside restrictive monetary policy to choke inflation. A global bond rout saw the two-year Treasury yield touch 3.50% for the first time since 2007.

In premarket trading, US chipmakers fell in premarket trading after Nvidia warned that new rules governing the export of artificial-intelligence chips to China may affect hundreds of millions of dollars in revenue. Nvidia fell 6%, AMD -3.5%, Intel -1.2%, Micron -2.3%. Bank stocks were lower as investors await the release of jobs data. Here are other notable premarket movers:

- Okta shares slumped as much as 15% in premarket trading after results, which analysts said were “muted” and spurred worries over billings growth and demand.

- MongoDB shares fell 17% in premarket trading, after the database software company gave a “conservative” full-year forecast.

- C3.ai shares were down 14% in premarket trading after the application software company cut its full-year revenue forecast amid an uncertain macro environment.

- Bed Bath & Beyond shares slid as much as 6.3% in premarket trading, with other meme stocks also down, as investors continue to assess the home-goods retailer’s turnaround plan.

- Five Below reported second-quarter results that failed to meet estimates. While disappointed, analysts said they weren’t surprised. The stock rose 3.2% in thin premarket trading.

“The Fed effect is now melding with other global factors such as China’s growth slowdown and Europe’s stagflation to create a more fraught global macro environment with higher rates and lower growth,” said Alvin Tan, strategist at RBC Capital Markets in Singapore. “It is this combination of hawkish central banks led by the Fed, China’s slowdown and Europe’s stagflation that is now driving volatility across global markets.”

European stocks also declined, Euro Stoxx 50 slumps 1.6%. IBEX outperforms, dropping 0.9%, CAC 40 lags, dropping 1.7%. Miners, real estate and consumer products are the worst-performing sectors. Miners led declines in Europe as commodities dropped amid concerns that aggressive tightening and China’s slowdown will lower demand. Among individual moves, Reckitt Benckiser Group Plc’s shares fell on news that Chief Executive Officer Laxman Narasimhan will step down at the end of the month to pursue a new opportunity in the US. Here are the other notable European movers today:

- Jet2 shares rise as much as 4.2% with HSBC saying the tour operator’s AGM statement was reassuring for the short- term

- EuroAPI gains as much as 6.1%, the most since June, after the company presented its 1H earnings. Oddo BHF says the strong report shows EuroAPI’s strategy is “beginning to bear fruit.”

- Chrysalis Investments climbs as much as 5.7% as the Telegraph newspaper’s Questor column says now is “the best time to buy” shares in the investment firm

- Basic Resource stocks fall the most in seven weeks, the sector’s longest losing streak since mid-June, as a slide in metal prices accelerated amid demand concerns over fresh Covid lockdowns in China

- The European real estate sector is among the day’s worst performers on the regional equity benchmark, weighed down by concerns around hawkish central banks

- Luxury-goods stocks slide in Europe after a new Covid lockdown in the key market of China and as HSBC downgraded a bunch of the sector’s biggest firms

- Reckitt Benckiser drops as much as 5.7%, the most since July 2021, after the unexpected news that CEO Laxman Narasimhan will step down

- Zur Rose slumps as much as 11% after an offering of shares priced at CHF39 apiece, representing a 15% discount to the last close

- Warsaw’s WIG20 index continues its retreat, widening this year’s drop to 34% as appetite for commodity stocks wanes amid growth fears and a decline in energy prices in Europe

Some of Wall Street’s biggest banks now expect the European Central Bank to hike rates by 75 basis points at next week’s meeting, while the latest economic data underlined a parlous outlook for China. Meanwhile, Russia said it is considering a plan to buy as much as $70 billion in yuan and other “friendly” currencies this year to slow the ruble’s surge, before shifting to a longer-term strategy of selling its holdings of the Chinese currency to fund investment.

Earlier in the session Asian stocks traded mostly lower following the weak handover from global counterparts amid the higher yield environment and following a surprise contraction in Chinese Caixin Manufacturing PMI data. Hang Seng and Shanghai Comp were subdued after weak factory activity data from China and with Meituan among the worst performers in Hong Kong after reports its shareholder Tencent is planning about USD 14.5bln of divestments from its equity portfolio including a partial divestment of its stake in Meituan, while the mainland was cushioned after further policy support pledges by China’s cabinet.

Japanese stocks closed lower ahead of a raft of US data that may back the case for the Federal Reserve to continue raising interest rates. The Topix index fell 1.4% to 1,935.49 at the 3 p.m. market close in Tokyo, while the Nikkei 225 declined 1.5% to 27,661.47, closing beneath the 28k alongside the broader risk aversion with further currency weakness and an upgrade to Japanese PMI data doing little to inspire a turnaround. Toyota contributed the most to the Topix’s decline, decreasing 2.3%. Out of 2,169 stocks in the index, 226 rose and 1,879 fell, while 64 were unchanged. Shares also slid as parts of China went back into lockdown.

In Australia, the S&P/ASX 200 index fell 2%, the most since June 14, to close at 6,845.60, dragged by losses in banks and mining shares. The materials sub-gauge was the worst performer, slumping to the lowest since July 27, as commodity prices tumbled and as BHP, the benchmark’s heaviest-weighted stock, trades ex-dividend. In New Zealand, the S&P/NZX 50 index was little changed at 11,609.83.

In FX, the Bloomberg Dollar Spot Index advanced as the greenback strengthened against all of its Group-of-10 peers apart from the Swiss Franc. The euro slumped but managed to hold above parity against the dollar after Germany July retail sales rose 1.9% m/m vs estimated 0.1% decline. Italian bonds and bunds slid for a fifth day, lifting Italy’s 10-year yield above 4% for the first time since June 15 as money markets continued to raise ECB tightening bets ahead of next week’s policy outcome. The Swiss Franc snapped a four-day loss against the dollar. A report showed that Swiss prices increased by 3.5% in August, above July’s reading of 3.4% — already the highest in three decades. The pound extended declines, dropping to a 2 1/2-year low against a broadly stronger US dollar. Sterling was set for its fifth- straight day of declines, after August saw its worst month versus the greenback since 2016. The yen dropped to 139.68 per dollar, its lowest since 1998 as surge in Treasury yields heaped more pressure on the currency, prompting a warning from a Japanese government official that did little to stem the tide. Australian and New Zealand dollars fell as a stronger greenback boosted by rising Treasury yields and a drop in iron ore prices weighed.

The offshore yuan fleetingly extended gains against the dollar on reports that Russia is considering buying as much as $70 billion in yuan and other “friendly” currencies. The yen pares some declines to trade at 139.24/USD after falling to weakest level since 1998 as US-Japan yield spread keeps widening. Bloomberg dollar spot index rises 0.2%, while CHF outperforms G-10 peers.

In rates, Treasuries were narrowly mixed as US trading gets under way Thursday with the yield curve steeper after the 2-year failed to sustain its first breach of 3.5% since 2007. 2-year yields are lower by 1.4bp at 3.479% after rising as much as 1.8bp to 3.511%; 30-year higher by 2.2bp near day’s high; inverted 2s10s spread steeper by 1.6bp at -29bp, 5s30s by nearly 4bp at -2.2bp. Wednesday’s month-end close entailed bear-flattening that continued until 5pm New York time, an hour after the Bloomberg Treasury index rebalancing, and was especially pronounced in TIPS. The US 10-year trails steeper yield increases for UK and most euro-zone counterparts. Treasuries’ 2.5% August loss was the market’s biggest since April; paced by UK and euro-zone yields, it was driven by more hawkish expectations for Fed policy that lifted 2- and 5-year yields by more than 60bp. Gilts push lower, with the yield on 10-years up 7 bps to 2.87%, while European bonds extend declines. Italian 10-year yield went briefly above 4% for the first time since June 15. Bunds also slipped, leaving the two-year rate within a whisker of its June peak.

In commodities, WTI crude fell to around $88; gold loses ~$5 to near $1,705. European natural gas declines for a fourth day. Spot gold is meandering just north of USD 1,700/oz after testing the figure to the downside. Base metals are lower across the board following the downbeat Chinese manufacturing PMI overnight alongside news of stricter Chinese lockdowns in some regions. US Treasury Secretary Yellen and UK Chancellor Zahawi discussed efforts regarding a price cap on Russian oil to lower global energy prices and restrict Russia’s revenue, according to the US Treasury Department. It was separately reported that US and allies are to set out a plan on Friday to limit the price of Russian oil with a strategy that aims to cut Russian energy revenues without increasing global oil prices, according to WSJ. OPEC+ JTC acknowledges the relevance of the Saudi Energy Minister’s comments on volatility and thin liquidity of crude markets, via Reuters citing a document.

Bitcoin remains under pressure and below the USD 20k mark, fairly in-fitting with its Ethereum peer in residing at the bottom-end of very narrow ranges.

To the day ahead now, data releases include the global manufacturing PMIs for August and the ISM manufacturing reading from the US. Otherwise, there’s also the US weekly initial jobless claims, the Euro Area unemployment rate for July, and German retail sales for July. Central bank speakers include the ECB’s Centeno and the Fed’s Bostic. Finally, earnings releases include Broadcom and Lululemon.

Market Snapshot

- S&P 500 futures down 0.8% to 3,924.25

- STOXX Europe 600 down 1.6% to 408.48

- MXAP down 1.9% to 155.53

- MXAPJ down 1.9% to 510.07

- Nikkei down 1.5% to 27,661.47

- Topix down 1.4% to 1,935.49

- Hang Seng Index down 1.8% to 19,597.31

- Shanghai Composite down 0.5% to 3,184.98

- Sensex down 1.6% to 58,581.55

- Australia S&P/ASX 200 down 2.0% to 6,845.60

- Kospi down 2.3% to 2,415.61

- German 10Y yield little changed at 1.63%

- Euro down 0.2% to $1.0032

- Brent Futures down 1.8% to $93.88/bbl

- Brent Futures down 1.9% to $93.87/bbl

- Gold spot down 0.6% to $1,701.34

- U.S. Dollar Index up 0.19% to 108.91

Top Overnight News from Bloomberg

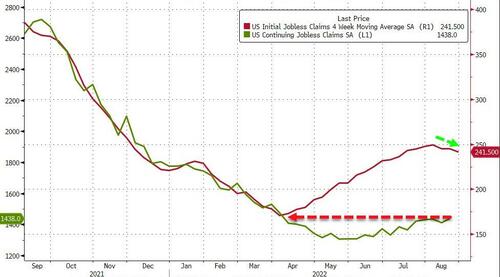

- The hotly anticipated US jobs report has the potential to tip the scales toward a third jumbo-sized hike in interest rates later this month after a wave of data that point to a resilient consumer and high labor demand

- The Chinese metropolis of Chengdu will lock down its 21 million residents to contain a Covid-19 outbreak, a seismic move in the country’s vast Western region that has largely been untouched by the virus

- Europe is considering various measures to intervene in the energy market, including price caps, reducing power demand and windfall taxes on energy companies as surging prices threaten the economy and push households toward poverty

- PMIs for the 19-nation euro zone slipped to 49.6 in August from 49.8 in July, according to S&P Global — a reflection of dwindling demand as consumers face surging costs for energy and a broadening range of goods and services. Germany and Italy both saw the worst readings in 26 months

- Russia is considering a plan to buy as much as $70 billion in yuan and other “friendly” currencies this year to slow the ruble’s surge, before shifting to a longer-term strategy of selling its holdings of the Chinese currency to fund investment

- Japanese workers’ share of company earnings fell for the first time in four years, suggesting Prime Minister Fumio Kishida’s call for companies to pay more to employees is running into resistance

A more detailed summary of global markets courtesy of Newsquawk

Asia-Pac stocks traded mostly lower following the weak handover from global counterparts amid the higher yield environment and following a surprise contraction in Chinese Caixin Manufacturing PMI data. ASX 200 was dragged lower by the mining-related sectors after recent declines in underlying commodity prices. Nikkei 225 retreated beneath the 28k alongside the broader risk aversion with further currency weakness and an upgrade to Japanese PMI data doing little to inspire a turnaround. Hang Seng and Shanghai Comp were subdued after weak factory activity data from China and with Meituan among the worst performers in Hong Kong after reports its shareholder Tencent is planning about USD 14.5bln of divestments from its equity portfolio including a partial divestment of its stake in Meituan, while the mainland was cushioned after further policy support pledges by China’s cabinet.

Top Asian News

- China’s city of Chengdu will conduct mass COVID testing from September 1st-4th and the city government said all residents will stay at home from this evening, according to Reuters.

- Hong Kong will push ahead with a proposal that will allow more residents to travel to mainland China after completing a quarantine period locally, according to SCMP citing sources.

- UN Human Rights Office issued its assessment of human rights concerns in Xinjiang in which it stated that China’s government has committed serious human rights violations in Xinjiang and recommended China take prompt steps to release all those detained in training centres, prisons or detention facilities, according to Reuters and AFP.

- Chinese mission in Geneva said it expresses strong dissatisfaction regarding the UN report on Xinjiang and firmly opposes the report, while it added that the so-called assessment was a farce planned by the US, western nations and anti-China forces, according to Reuters.

- Hong Kong officials are targeting a conclusion to hotel COVID quarantines in November.

- Macau gov’t intends to gradually reopen the city to foreign travellers, via Reuters.

European bourses are underpressure amid continued hawkish pricing, but off lows as yields ease from highs, Euro Stoxx 50 -1.4%. Stateside, a similar picture to fixed with action in-fitting directionally but steadier in terms of magnitudes ahead of data, ES -07%; NQ -1.1% lags given elevated yields.

Top European News

- Russia is said to be mulling as much as USD 70bln in “friendly” currencies, according to Bloomberg sources; this is in order to slow the RUB surge “before shifting to a longer-term strategy of selling its holdings of the Chinese currency”.

- Lufthansa Pilot Union Calls for One-Day Strike on Friday

- Zur Rose Slumps Amid Offering at Discount, Convertibles Sale

- Russia Mulls Buying $70 Billion in Yuan, ‘Friendly’ Currencies

- Factory Slowdown in Europe and Asia Is Warning for Global Trade

Central Banks

- Fed’s Logan (2023 voter) said the number one priority is to restore price stability, according to Reuters.

- Japan’s Chief Secretary Matsuno provides no comment on every day-to-day FX moves, watching moves with a high sense of urgency; desirable for currencies to move stably, reflecting economic fundamentals.

FX

- DXY sits around USD 109.00 after seeing fresh lows amid Yuan appreciation.

- EUR, GBP AUD, NZD, JPY are all softer vs the USD to similar magnitudes.

- CAD and CHF are the G10 outliers, with the latter supported after Swiss CPI and the former hit by softer oil prices.

Fixed Income

- Core benchmarks are under pronounced pressure once more with yields across the board at fresh near-term peaks

- Pressure occurring despite geopolitical tensions as hawkish ECB pricing continues to increase, ~85% chance of a 75bp hike.

- Though, following the passing of hefty European/UK issuance, the magnitude of this downside has eased.

- USTs are directionally in-fitting but more contained overall awaiting ISM Manufacturing today and then NFP on Friday.

Commodities

- WTI and Brent futures have resumed downward action following an APAC session of consolidation.

- Spot gold is meandering just north of USD 1,700/oz after testing the figure to the downside.

- Base metals are lower across the board following the downbeat Chinese manufacturing PMI overnight alongside news of stricter Chinese lockdowns in some regions

- US Treasury Secretary Yellen and UK Chancellor Zahawi discussed efforts regarding a price cap on Russian oil to lower global energy prices and restrict Russia’s revenue, according to the US Treasury Department. It was separately reported that US and allies are to set out a plan on Friday to limit the price of Russian oil with a strategy that aims to cut Russian energy revenues without increasing global oil prices, according to WSJ.

- OPEC+ JTC acknowledges the relevance of the Saudi Energy Minister’s comments on volatility and thin liquidity of crude markets, via Reuters citing a document.

- EU Commission President von der Leyen will outline ideas on an energy price cap in more detail in a speech on September 14th.

- Four people killed in overnight clashes in Iraq’s Basra, according to security officials cited by Reuters.

US Event Calendar

- Aug. Wards Total Vehicle Sales, est. 13.3m, prior 13.4m

- 07:30: Aug. Challenger Job Cuts YoY, prior 36.3%

- 08:30: 2Q Unit Labor Costs, est. 10.5%, prior 10.8%

- 2Q Nonfarm Productivity, est. -4.3%, prior -4.6%

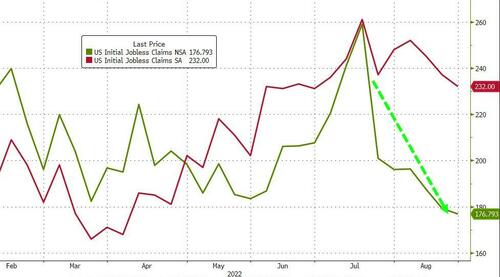

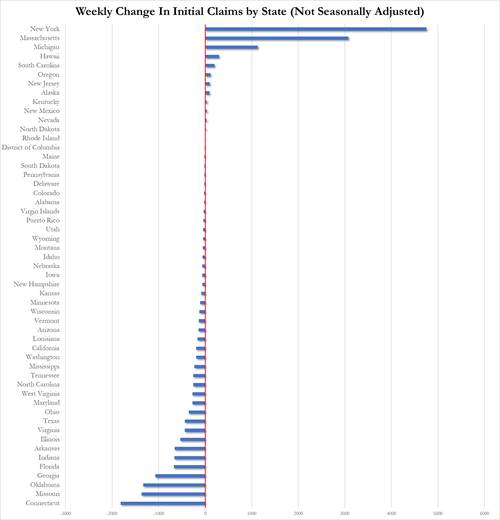

- 08:30: Aug. Initial Jobless Claims, est. 248,000, prior 243,000

- Continuing Claims, est. 1.44m, prior 1.42m

- 10:00: July Construction Spending MoM, est. -0.2%, prior -1.1%

- 10:00: Aug. ISM Manufacturing, est. 51.9, prior 52.8

- ISM Employment, est. 49.5, prior 49.9

- ISM New Orders, est. 48.0, prior 48.0

- ISM Prices Paid, est. 55.2, prior 60.0

DB’s Henry Allen concludes the overnight wrap

Welcome to September. Given it’s the start of the month, we’ll shortly be publishing our regular monthly review of financial assets across for the month just gone. August was very much a month of two halves when it came to risk assets, with most ending the month in negative territory. There were still plenty of headlines though, and in Europe we saw some of the largest rises in short-term yields in decades. For instance, yields on 2yr German debt haven’t risen this much in a month since 1981, and for their UK counterparts you also have to go back to 1986. The full report will be in your inboxes shortly.

When it comes to the last 24 hours, markets have been playing a familiar theme, with risk assets losing further ground as investors price in more rate hikes over the coming months. The big driver behind that yesterday was another stronger-than-expected inflation print from the Euro Area, where the flash CPI reading rose to a record +9.1%. We haven’t seen inflation that strong since the formation of the single currency, and it was also above the +9.0% reading expected by the consensus. The details didn’t look much better either, with core inflation rising to a record +4.3% too (vs. +4.1% expected). So a disappointment for those hoping we might have seen the worst of inflation by now, and another demonstration of how the energy shock is sending European inflation increasingly above that in the US.

Unsurprisingly, the high inflation bolstered the arguments of the hawks on the ECB’s Governing Council, and Bundesbank President Nagel said yesterday that “We need a strong rise in interest rates in September.” In addition, Austria’s Holzmann further said that he saw “no reason to show any kind of leniency in our positioning and our wish to reduce inflation”. That’s more voices bolstering the speakers we’ve heard from in recent days who’ve put a 75bps hike on the table, and investors themselves moved to price in a more aggressive ECB response too. Indeed, overnight index swaps are now pricing in a 69.0bps hike for the next meeting, which is noticeably closer to 75 than 50 now. And for the September and October meetings as a whole, 130.7bps worth of hikes are priced in, which is equivalent to at least one of them being a 75bps move and the other at 50bps.

In light of these developments, our own European economists at DB have changed their call and now expect that the ECB will hike by 75bps at the next meeting (link here for the full details). Their view is that the upside inflation surprise and the more vocal support from Governing Council members to have 75bps on the table has tipped the balance in favour of a larger hike. Remember that we’re just a week away from the next policy decision now, so not long until we find out, and it was only at the last meeting in July when the ECB went against their own forward guidance in June and hiked by 50bps rather than the 25bps they’d indicated.

For markets, the prospect of additional rate hikes knocked European sovereign bonds once again, meaning that for many country’s government bonds (including Germany and the UK) it’s been their worst monthly performance on a total returns basis for the 21st century so far. Yields rose across the continent, with those on 10yr bunds (+2.8bps), OATs (+1.9bps) and BTPs (+6.7bps) all moving higher. Gilts underperformed in particular with a +9.6bps move, whilst US Treasuries also lost ground as the 10yr yield rose +9.0bps to 3.19%. The move in Treasuries came as Cleveland President Mester said that her view was the “move the fed funds rate up to somewhat above 4% by early next year and hold it there”, saying in addition that she did “not anticipate the Fed cutting the fed funds rate target next year.”

For equities it wasn’t a great day either, with the S&P 500 (-0.78%) in negative territory for a 4th consecutive session, and leaving the index down by -4.08% over the month in total return terms. That came in spite of a decent performance at the open yesterday, when it had been up +0.73% at one point, but it couldn’t sustain those gains by the close. In Europe there was an even worse performance as the inflation data hurt risk appetite, and the STOXX 600 (-1.12%) fell to a six-week low. That said, in a contrast with recent days, megacap tech stocks were an outperformer, and the FANG+ index advanced +0.32%.

One brighter piece of news for the ECB yesterday was the latest decline in energy prices, which have continued to fall back from their recent highs. European natural gas futures shed -5.15%, bringing their declines since the start of the week to more than -29%, and German power prices for next year fell -5.61%, bringing their own declines since the start of the week to more than -40%. Oil lost ground too, with Brent Crude down -2.84% as it capped off its worst monthly performance since last November, with a -12.29% decline over August as a whole.

Those negative moves in the US and European equities are continuing in Asia this morning with many of the major indices seeing sharp losses. The Kospi (-1.89%) is the biggest underperformer followed by the Nikkei (-1.77%) and the Hang Seng (-1.52%) whilst the CSI (+0.09%) and the Shanghai Comp (+0.24%) have made modest gains. An important factor affecting sentiment this morning has been a new lockdown in the Chinese city of Chengdu, making it the largest city to be locked down since Shanghai earlier in the year. 157 cases were reported in the city yesterday.

We also got the latest manufacturing PMIs for August overnight, which painted a mixed picture across the region’s main economies. In China, the Caixin PMI showed the sector falling into contraction for the first time in three months with a 49.5 reading (vs. 50.0 expected), and in South Korea the reading fell to 47.6 (vs. 49.8 previously), which is its lowest level since July 2020. Meanwhile in Japan, the 51.5 reading was the lowest since September 2021, and the Yen has hit a 24-year low of 139.52 against the US Dollar overnight.

Elsewhere on the data side, we had the ADP’s report of private payrolls from the US ahead of tomorrow’s jobs report. That came in at +132k (vs. +300k expected) and marked the first release that uses an updated methodology. They also updated their previous data, and on the same basis the job growth in August was the slowest since January 2021.

Otherwise in the UK, there was a significant piece of news from the Office for National Statistics, as they said that the government’s £400 discount for energy customers this winter would not affect the Consumer Price Index. As our UK economist has written, that decision was an important one because if it had been counted as part of inflation, then the October RPI projections would have been affected by around 2.7 percentage points.

To the day ahead now, and data releases include the global manufacturing PMIs for August and the ISM manufacturing reading from the US. Otherwise, there’s also the US weekly initial jobless claims, the Euro Area unemployment rate for July, and German retail sales for July. Central bank speakers include the ECB’s Centeno and the Fed’s Bostic. Finally, earnings releases include Broadcom and Lululemon.

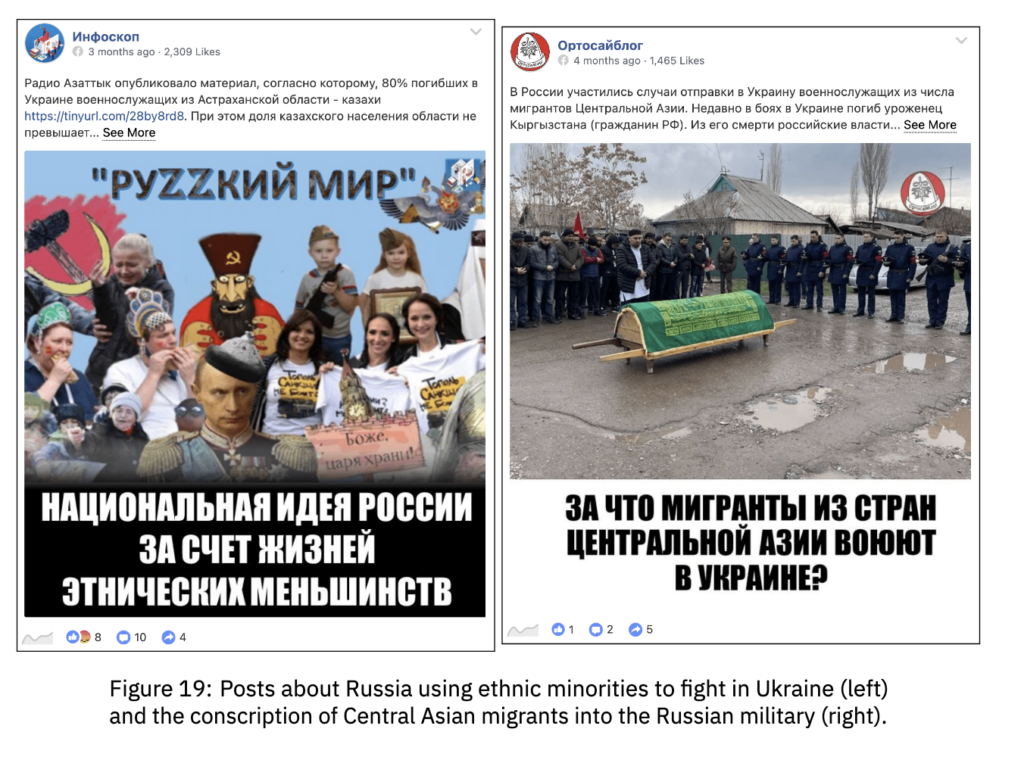

Overall, these accounts received very little engagement:

Overall, these accounts received very little engagement: