Beige Book Shows US Economy Turning More Sluggish

The Fed’s latest beige book released this afternoon was a boring affair, one signaling the US economy remained sluggish at best, and describing economic activity as “little changed overall in April and early May.” Four Fed districts reported small increases in activity, six no change, and two slight to moderate declines. Expectations for future growth deteriorated a little, though contacts still largely expected a further expansion in activity. A summary of the big picture:

- Consumer expenditures were steady or higher in most Districts, with many noting growth in spending on leisure and hospitality.

- Education and healthcare organizations saw steady activity on balance.

- Manufacturing activity was flat to up in most Districts, and supply chain issues continued to improve.

- Demand for transportation services was down, especially in trucking, where contacts reported there was a “freight recession.”

- Residential real estate activity picked up in most Districts despite continued low inventories of homes for sale.

- Commercial construction and real estate activity decreased overall, with the office segment continuing to be a weak spot.

- Outlooks for farm income fell in most districts, and energy activity was flat to down amidst lower natural gas prices. Financial conditions were stable or somewhat tighter in most Districts.

- Contacts in several Districts noted a rise in consumer loan delinquencies, which were returning closer to pre-pandemic levels.

- High inflation and the end of Covid-19 benefits continued to stress the budgets of low- and moderate-income households, driving increased demand for social services, including food and housing.

Turning to labor markets, the Beige Book notes that “employment increased in most Districts, though at a slower pace than in previous reports.” Overall, the labor market continued to be strong, with contacts reporting difficulty finding workers across a wide range of skill levels and industries. That said, contacts across Districts also noted that the labor market had cooled some, highlighting easier hiring in construction, transportation, and finance. Many contacts said they were fully staffed, and some reported they were pausing hiring or reducing headcounts due to weaker actual or prospective demand or to greater uncertainty about the economic outlook. Staffing firms reported slower growth in demand. As in the last report, wages grew modestly.

And turning from wage inflation to broader inflation, the report notes that prices rose moderately over the reporting period, though the rate of increase slowed in many Districts. Contacts in most Districts expected a similar pace of price increases in the coming months. At the same time, consumer prices continued to move up due to solid demand and rising costs, though several Districts noted greater price sensitivity by consumers than in the prior report. Overall, nonlabor input costs rose, but many contacts said cost pressures had eased and noted price declines for some inputs, such as shipping and certain raw materials. Home prices and rents rose slightly on balance in most Districts, after little growth in the prior period.

Turning to the specific regional Feds, we found the summaries:

- Boston: Business activity was flat on average. Modest revenue increases were reported among retail, restaurant, and manufacturing contacts. Labor demand weakened for a wide range of positions but headcounts declined only slightly. Wage and price pressures eased further on average but some sizable price increases were reported. The outlook was cautiously optimistic.

- New York: Regional economic activity declined at a moderate pace, with ongoing weakness in the manufacturing sector. Still, the labor market has remained solid, though there have been scattered signs of cooling due to heightened uncertainty. Inflationary pressures remained persistent. Conditions in the broad finance sector continued to worsen.

- Philadelphia: Business activity continued to decline slightly during the current Beige Book period. Contacts reported positive consumer sales, but that relatively high profit margins mean that volumes may be down. Labor availability improved, and employment grew slightly. Wage growth and inflation continued to subside. Contacts worried about the debt ceiling and bank failures but maintained positive expectations for growth over the next six months.

- Cleveland: Economic activity and employment were generally stable in the Fourth District, while cost and price pressures were little changed. Most firms indicated they were somewhat concerned about the standstill in Congress over raising the debt ceiling; however, these concerns did not appear to impact firms’ outlooks for activity in the coming months.

- Richmond: The regional economy was little changed in recent weeks. Consumer spending on retail goods declined slightly but spending on travel and tourism picked up moderately. A lack of inventory ordering by retailers was felt in the manufacturing and transportation sectors. Commercial real estate activity and lending softened. Employment increased modestly and price growth eased slightly but remained robust, overall.

- Atlanta: Economic activity grew gradually. Labor markets became less tight, and wage pressures eased. Nonlabor costs moderated, on balance. Retail sales softened. Sales of new autos were solid. Leisure travel softened to pre-pandemic levels, and business travel increased. Housing demand was strong. Transportation activity declined. Energy demand was robust. Agriculture conditions slowed.

- Chicago: Economic activity was little changed. Employment increased moderately; nonbusiness contacts saw a small increase in activity; consumer and business spending were flat; and activity decreased modestly both for manufacturing and for construction and real estate. Prices and wages rose moderately, while financial conditions tightened modestly. Expectations for farm incomes in 2023 decreased some.

- St. Louis: Economic conditions have remained unchanged since our previous report. Labor markets remained tight, but reports of easing increased. Firms reported margin compression due to an inability to pass on input price increases. Residential real estate was largely unchanged, but demand for commercial properties weakened. The outlook worsened slightly due to concerns about weakening demand and macro uncertainty.

- Minneapolis: The region’s economy grew slightly since early April. Labor demand was healthy, and wage pressures were high, but there were also significant layoffs. Price increases were generally modest, but levels remained high. Some manufacturers said input costs decreased, but most reported no change. Consumer spending rose modestly, and travel was strong. Minority-and women-owned firms saw a slight decrease in activity.

- Kansas City: Total economic activity across the Tenth District changed little during May. Job growth continued to slow, despite the number of job openings remaining elevated, as businesses were reportedly more selective in their hiring. Most businesses indicated price growth for finished products will likely moderate over the coming year. Growth in housing rental rates was also expected to moderate, even though it remains elevated in many parts of the District.

- Dallas: Modest growth continued, with revenue gains in the service and retail sectors. Housing contacts noted a decent spring selling season and stable prices. Credit conditions tightened further, and loan demand continued to decline. Payrolls rose moderately, and wage growth remained stubbornly elevated. Outlooks continued to worsen, and contacts voiced concern over waning demand, rising interest rates, and the overall health of the economy.

- San Francisco: Economic activity expanded somewhat. Employment levels were stable amid tight labor market conditions, while wage and price growth moderated further. Retail sales grew modestly, and activity in the services picked up somewhat. Manufacturing activity was robust, while conditions in the agriculture sector weakened slightly. Residential and commercial real estate activity fell, and conditions in the financial sector worsened modestly.

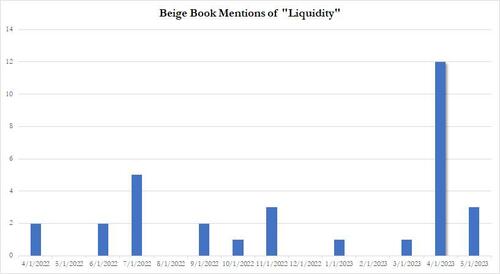

As for the cause of the recent apprehension about loans, lending standards and tightening conditions, one look at the chart above showing the frequency of mentions of one key word in recent Beige Books should be sufficient at just how much more comfort the Fed now has.

Tyler Durden

Wed, 05/31/2023 – 15:13

via ZeroHedge News https://ift.tt/PrDijvA Tyler Durden