China Cuts Reserve Ratio By 0.5% Unleashing 1 Trillion Yuan In Liquidity To Boost Economy

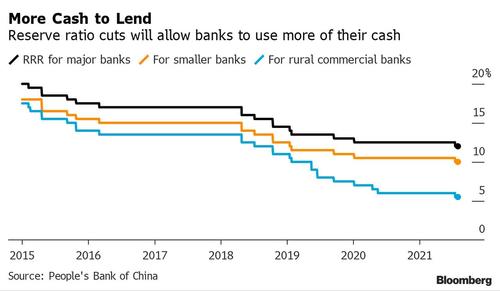

Just two days after we said that “China Prepares To Cut Rates As Economy Stalls“, this morning China did just that when the PBOC announced it is cutting the Required Reserve Ratio by 0.5% for most banks, a move that will unleash about 1 trillion yuan ($154BN) of long-term liquidity into the economy and will be effective July 15.

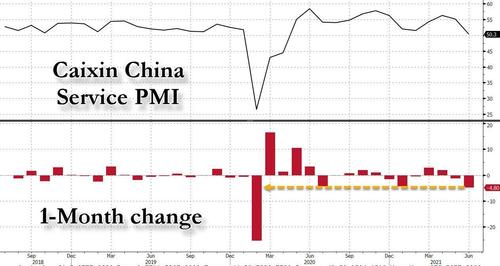

The announcement reduces the amount of cash most banks must hold in reserve in order to boost lending to the economy as growth has sharply waned, and is expected to prop up China’s slowing economy, which as noted earlier this week saw its Caixin Service PMI drop to the lowest level since the covid crisis, badly missing expectations.

The last time the bank cut the main ratios was during the first wave of the pandemic in 2020, when it was trying to boost the economy after the Covid-19 outbreak which started in a Wuhan lab shut down the economy.

The RRR cut was signaled earlier this week, when as we reported on Wednesday, China’s State Council hinted the central bank would make more liquidity available to banks so they could lend to smaller firms hurt by rising costs. But the rushed timing and magnitude of the move, coming a week before second-quarter growth data, suggests mounting concerns about the economy’s outlook, economists said.

“The PBOC came in broader and sooner than expected, highlighting the policy urgency to support the China economy,” said Mizuho FX strategist Ken Cheung. “Such firm easing measures could further fuel concern over China’s growth outlook in the second half as well as the upcoming second-quarter GDP figures in the coming week.”

The rate cut comes at a time when Beijing is again posturing with its noble but futile intentions to delever the economy: China has been wary of overstimulating the economy, and the central bank said in a statement that the cut doesn’t mean there’s been a change to the “prudent monetary policy.” The PBOC will maintain the “stability and effectiveness of monetary policy, keep a normal monetary policy, and won’t flood the economy with stimulus,” it said. Well, define “flood.”

“The magnitude of the RRR cut is more than expected. The RRR reduction paints quite a stark contrast to PBOC’s very cautious stance on its liquidity injections in the first half of the year,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc in Hong Kong. “Even though the central bank said the cut shouldn’t be seen as a sign it’s shifting its policy stance, the market will interpret the move as a tilt toward looser monetary policy in the second half.”

Thanks to liquidity injection, China’s FTSE A50 futuress rose as much as 1.1%, while 10-year government bond yields pared gains of as much as four basis points after the RRR cut, standing little changed at 2.99% as of late Friday.

The response was muted because overall liquidity in the economy will basically be stable, as the extra funds will be used to repay maturing medium-term loans, fill any liquidity gaps due to the tax season from mid to late July, and raise long-term capital, the bank said.

Curiously, the RRR cut announcement came just minutes the release of the latest monthly data showing that credit growth in June was much stronger than expected, with much of that expansion coming from bank loans.

Below we share some hot takes from Wall Street analysts and strategists:

- David Qu, China economist: “The People’s Bank of China’s isn’t taking any chances with the recovery — the surprise 0.5 percentage point cut to the required reserve ratio will inject 1 trillion yuan into the banking system, helping juice growth that’s poised to slow in the second half. The RRR cut and a larger-than-expected jump in June credit mark a decisive turn to an easing stance.”

- Kelvin Wong, an analyst at CMC Markets: “The timing of China’s reduction in the reserve requirement ratio is rather significant given the bloodbath we have seen in China Big Tech this week. Likely to be positive for equity markets as credit impulse indicators in China have been showing more tightening liquidity conditions versus the rest of the world. Should bode well for consumer discretionary shares for now.”

- Liu Xiaodong, fund manager at Shanghai Power Asset Management: “The cut to the required reserve ratio, which comes just two days after signaling from China’s cabinet may not provide a huge boost to stocks. I read this as neutral news for the market as this will dampen earnings outlook for banks, which are heavy enough to drag down the index. This is meant to replenish the liquidity for the real economy and new energy companies, rather than to bolster the market.”

- Sebastien Galy, macro strategist at Nordea Investment Funds: “China’s move to reduce the reserve ratio requirement earlier than expectation “should give a fillip” to its stock market even as some investors might wait for economic-data reports next week to gauge the extent of the economic slowdown. The Move comes ahead of the “release of 2Q GDP data, which might well disappoint amongst lingering weakness in consumption and disruptions in the supply chain as well as the impact of health restriction.”

- Iris Pang, chief economist, Greater China, with ING Bank NV: “The PBOC’s move to cut its reserve ratio raises concern that the nation’s banks may be further exposed to bad loans. This gives me a sense of uneasiness. Are banks under stress of capital? If this is the case, it implies that there could be more bad loans. Increased stress may be coming from China’s deleveraging reform efforts, especially in the real estate and fintech industries.”

- Jian Shi Cortesi, a fund manager at GAM Investment Management: “China reducing the RRR will have “a minor impact” on the nation’s equities as the focus right now is on the regulatory crackdown toward the technology sector and the U.S.’s monetary policy. Investors should note that money supply may remain stable as the RRR cut also partially offsets the liquidity shortage due to tax payments in mid July.”

Tyler Durden

Fri, 07/09/2021 – 07:05

via ZeroHedge News https://ift.tt/3qWpbFT Tyler Durden