Dagny discovered that the FBI had seized the contents of her safe deposit box—about $100,000 in gold and silver coins, some family heirlooms like a diamond necklace inherited from her late grandmother, and an engagement ring she’d promised to pass down to her daughter—almost by accident.

She’d been asked by a friend to recommend a convenient and secure location for keeping some valuables. Dagny searched Yelp to find the phone number for U.S. Private Vaults, a Beverly Hills facility where she’d rented a safe deposit box since 2017. That’s when she saw the bad news.

“Permanently closed.”

After a brief moment of panic, some phone calls, and several days, Dagny and her husband Howard (pseudonyms used at their request to maintain privacy during ongoing legal proceedings) figured out what happened. On March 22, the FBI had raided U.S. Private Vaults. The federal agents were armed with a warrant allowing them to seize property belonging to the company as part of a criminal investigation—and even though the warrant explicitly exempted the safe deposit boxes in the company’s vaults, they were taken too. More than 800 were seized.

Howard tells Reason there was no attempt made by the FBI to contact him, his wife, or their heirs—despite the fact that contact information was taped to the top of their box. Six weeks later, the couple is still waiting for their property to be returned. (Both individuals are supporters of Reason Foundation, the nonprofit that publishes this website.)

The FBI and federal prosecutors have “no authority to continue holding the possessions of some 800 bystanders who are not alleged to have been involved in whatever USPV may have done wrong,” Benjamin Gluck, a California attorney who is representing several of the people caught up in the FBI’s raid of U.S. Private Vaults, tells Reason.

Legal efforts to force the FBI to return the items seized during the March 22 raid have so far been unsuccessful, but at least five lawsuits are pending in federal court.

A federal grand jury indicted U.S. Private Vaults (USPV) on counts of conspiracy to distribute drugs, launder money, and avoid mandatory deposit reporting requirements.

In legal filings, federal prosecutors have admitted that “some” of the company’s customers were “honest citizens,” but contend that “the majority of the box-holders are criminals who used USPV’s anonymity to hide their ill-gotten wealth.”

Whatever the original motivation for the raid, the FBI’s seizure of hundreds of safe deposit boxes held by U.S. Private Vaults raises serious Fourth and Fifth Amendment issues. In order to have the contents of their boxes returned, federal authorities are asking owners to come forward, identify themselves, and describe their possessions. Some owners may be unwilling to do that—U.S. Private Vaults allowed anonymous rentals of safe-deposit boxes—while others may rightfully object to being subjected to the scrutiny of federal law enforcement when they have done nothing wrong.

“The constitution does not abide guilt by association,” argues Robert Frommer, an attorney with the Institute for Justice, a libertarian law firm, in an op-ed published by The Orange County Register.

“What the government has done here is completely backward,” writes Frommer. “The government cannot search every apartment in a building because the landlord is involved in a crime. After all, when somebody rents an apartment, that apartment is theirs.”

Indeed, the unsealed warrant authorizing the raid of U.S. Private Vaults granted the FBI permission to seize the business’s computers, money counters, security cameras, and “nests” of safe deposit boxes—the large steel frames that effectively act as bookshelves for the boxes themselves.

Importantly, the warrant “does not authorize a criminal search or seizure of the contents of the safe-deposit boxes,” according to a copy of the warrant contained in court filings. The warrant also states that it “authorize[s] the seizure of the nests of the boxes themselves, not their contents.”

But the FBI’s own policies seem to have allowed a roundabout legal rationale for seizing the boxes as well. Agents are required to take into custody any property that could otherwise be stolen or left “in a dangerous manner” after carrying out a warrant. To put it in the context of a simpler situation: If the FBI seized a truck carrying cargo, it would not simply dump the cargo on the side of the road. Instead, there is a specific procedure for law enforcement to follow, which involves identifying and notifying rightful property owners, as well as securing the property.

In court filings, however, Gluck and other attorneys representing anonymous plaintiffs argue that the seizure of the nests “does not appear to be the government’s true purpose here.”

“A reasonable person could easily conclude that taking and searching the contents of the boxes was the true purpose of the USPV seizure, not just an unintended but avoidable byproduct as the government seeks to portray and justify it,” they write.

Now that the FBI has nearly 1,000 safe deposit boxes in its custody, anyone who comes forward to identify themselves and claim their possessions risks becoming the target of a criminal investigation. The U.S. Attorney’s Office for the Central District of California told the Los Angeles Daily Journal, a legal industry publication, last month that “each box is being considered on a case-by-case basis, and we will investigate the boxes, or claims made on them” to determine if “the contents are related to criminal activity.”

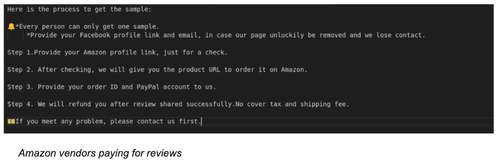

Attorneys for the plaintiffs argue that this amounts to an admission that prosecutors intend “to use any information gleaned in the claims process in order to conduct criminal investigations.” U.S. Private Vaults had assured its customers that their anonymity would be protected, and people could have valid, non-criminal reasons for wanting to keep their identities a secret.

The rights violations are bad enough, but the FBI raid seems to have had serious procedural shortcomings as well. One 80-year-old woman represented by Gluck—and identified in court documents only as “Linda R.”—may have lost a significant portion of her life savings due to what legal filings say are shoddy inventories of the safe deposit boxes’ contents.

In a lawsuit filed on April 26, Linda R.’s attorneys argue that the FBI “failed to account for or return” 40 gold coins worth an estimated $75,000 that had been stored in a safe deposit box housed at U.S. Private Vaults. Department of Justice documentation detailing the contents of Linda’s box makes note of “miscellaneous coins” without any specific amounts or other identification of the coins—Linda’s attorneys note that the description could apply to everything from a pair of pennies to a box full of 1933 double eagle gold coins, some of the rarest and most valuable coins ever minted. For now, it remains unclear whether the government even possesses an accurate accounting of what was in her safe deposit box when it was seized.

Despite the broad claims of criminality from prosecutors, Linda has been charged with no crimes but may have lost tens of thousands of dollars of her retirement savings anyway. Even if the FBI’s raid of U.S. Private Vaults eventually uncovers criminal activity relating to some of the safe-deposit boxes stored there, that hardly seems to justify the potential losses incurred by innocent bystanders like Linda, who kept her retirement savings there because she distrusted the banking system, according to court filings.

“It was improper that the government seized these possessions in the first place, unconscionable that they are using them as hostages to pressure owners to divulge private information, and outrageous that they apparently treated the possessions so carelessly that they seem to have lost at least some of them,” Gluck tells Reason.

Jeffrey B. Isaacs, an attorney for another anonymous customer of U.S. Private Vaults—identified in court records as “James Poe”—tells the Los Angeles Times that the FBI’s raid is “as illegal a search and seizure as I’ve ever seen.”

For Dagny and Howard, the situation seems particularly cruel. They’d rented the box at U.S. Private Vaults after having their home burgled several years ago. They have the key and rental agreement for the box—and, Howard notes, they paid for the box with a credit card, hardly the sort of thing you’d do if you were trying to hide your identity from the feds or engage in criminal conduct. None of that has made a difference so far.

Because this time, the burglars wore badges.

from Latest – Reason.com https://ift.tt/33t2Tk2

via IFTTT