S&P Futures Fail A Breakout Above 3,000 As Triple-Top Forms

Tyler Durden

Tue, 05/19/2020 – 08:19

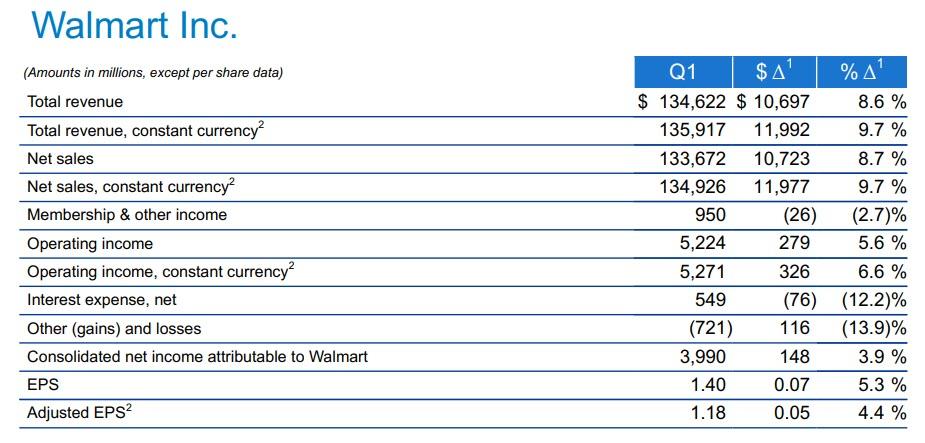

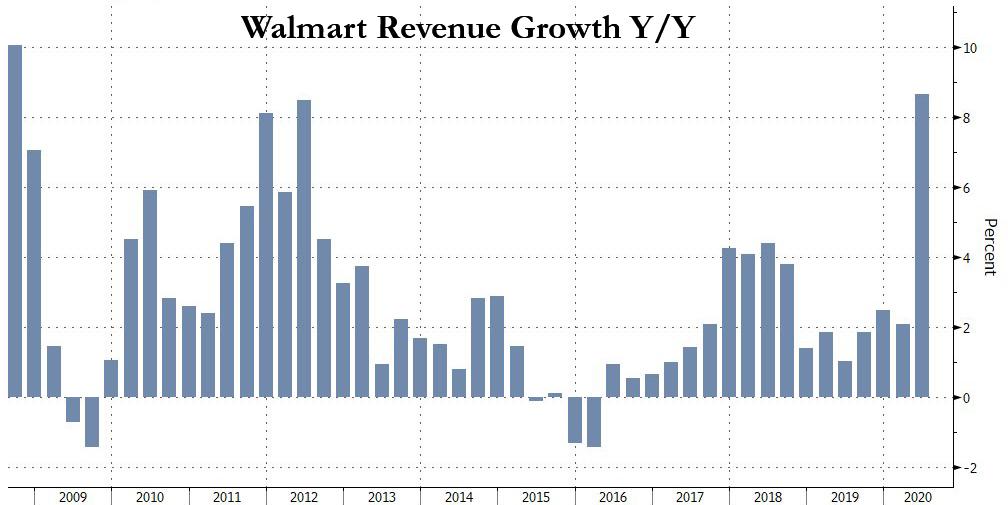

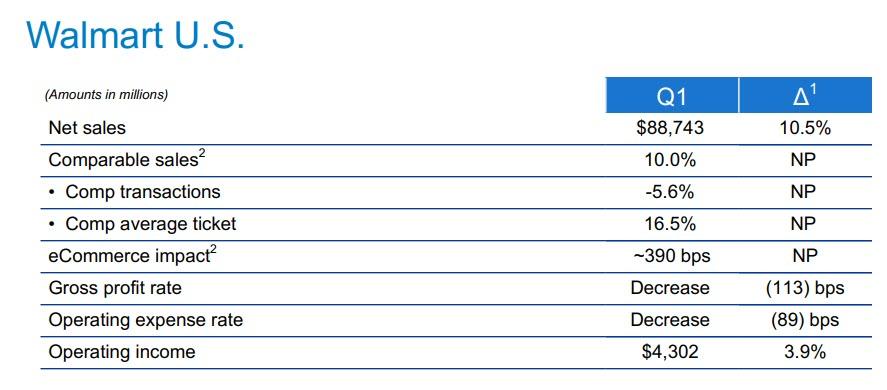

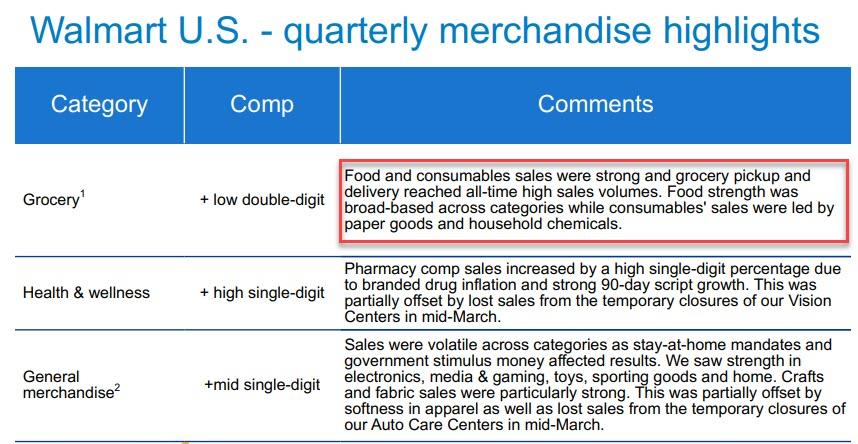

US equity futures tried, and failed, to stage a major breakout into 3,000 overnight, with the E-mini rising as high as 2,976 ahead of the European open (on virtually zero volume), before paring all gains alongside a drop and European stocks as investors weighed the return of the trade war against positive coronavirus news, while disappointing results from Home Depot weighed on sentiment and not even a huge beat by Walmart managed to reverse the mood.

What is more concerning is that now that the S&P has tried, and failed, to break out above the 2950 resistance level, a triple-top appear has formed, which suggests that the most likely next move is a retest of the support.

The Stoxx Europe 600 Index remained lower however as investors shrugged off both news of a $546 billion recovery fund for the region and a surprise jump in German investor confidence, with the ZEW Economist Sentiment surging to 51 from 28.2, beating expectations of a 32.0 print and far above the deeply negative print just two months ago.

European sentiment slumped after French Finance Minister Bruno Le Maire said that the European recovery fund proposed by France and Germany won’t be available until 2021 and still faces hurdles in “difficult” negotiations in coming weeks. “It probably couldn’t be available before the start of 2021,” Le Maire says speaking at the National Assembly finance committee. Le Maire says it will take time because procedures still need to be finalized and the fund will be linked to the EU budget. The finance minister also said Franco-German agreement on the fund was necessary but not sufficient and the two countries must still convince reluctant countries including Austria, Denmark, Sweden and the Netherlands.

Earlier in the session, Asian stocks were green across the board lifted by momentum from the US, and led by materials and industrials, after rising in the last session. All markets in the region were up, with South Korea’s Kospi Index gaining 2.2% and Hong Kong’s Hang Seng Index rising 1.9%. The Topix gained 1.8%, with Soshin Electric and Sony Financial rising the most. The Shanghai Composite Index rose 0.8%, with Fujian Start Group and Shanghai Lingyun Industries Development posting the biggest advances.

Stock started off the week with a bang after Moderna fueled hopes for a coronavirus vaccine, but investors are struggling to maintain the optimism as they continue to monitor efforts to both contain the pandemic and restart economies. Federal Reserve Chairman Jerome Powell is scheduled to speak on the state of the recovery Tuesday, amid expectations he’ll press for further fiscal support to address the steepest downturn since the Depression.

“Short-lived bounces in stock prices even while markets establish new lows are not unheard of,” Ashwin Alankar, head of global asset allocation at Janus Henderson, said in a note. “Forward-looking metrics such as earnings revisions and options prices, on the other hand, sound a more cautious tone both for the economy and stock prices.”

Meanwhile, headwinds remain for stocks, not least a deteriorating U.S.-China relationship. In a further sign of tightening scrutiny on capital flows to the Asian nation, Reuters reported late on Monday that the Nasdaq is set to unveil new rules for initial public offerings including tougher accounting standards that will make it more difficult for some Chinese companies to list on the exchange.

In rates, the 10Y Treasury was unchanged after yields blew out on Monday, while European government bonds were mixed, with peripheral yields falling on the recovery fund news.

In FX, the Bloomberg Dollar Spot Index fell; the euro and European peripheral bonds extended gains in the wake of a proposal by France and Germany to distribute money to member states. The yen fell to a one-week low against the dollar after the news that the Bank of Japan will discuss details of a funding program to demonstrate its resolve to support struggling businesses. The New Zealand dollar advanced, supported by purchases against the Aussie. Sterling strengthened after the U.K. announced plans for 30 billion pounds ($37 billion) in tariff cuts after Brexit.

China’s yuan fell to a two-month low against a basket of trading partners’ currencies, as the central bank’s reference rate stays close to the weakest since 2008. The Bloomberg replica of the CFETS RMB Index — which tracks the yuan against 24 currencies — declined 0.27% to 93.5, the lowest level since March 12. That comes as the People’s Bank of China kept the yuan’s fixings versus major exchange rates low. The authorities cut its reference rate versus the euro by the most in seven weeks Tuesday, while the fixing against the dollar was close to the weakest since 2008. But the yuan has been steady in the spot market, with the currency fluctuating within a narrow band of less than 0.85% on either side this month. That’s partly because traders expect the Chinese exchange rate to be stable ahead of the annual parliamentary meeting, which starts this week

In commodities, West Texas crude’s ascent kept it well above $32 a barrel, rising for a 4th day, though it came off highs touched in Asian trade. West Texas Intermediate crude increased 2.9% to $32.73 a barrel. In terms of underlying fundamentals, on the demand side, participants continue to eye reopening economies for any signs of potential risk of reclosures. Meanwhile looking at supply, OPEC+ cuts are underway, with eyes on the June 8th JMMC meeting for further details as to whether current cuts will be extended as per source which floated potential extension to year-end as opposed to a wind-down of agreed curbs. Meanwhile, unsurprisingly, OPEC+ cut oil exports sharply in the first half of May, according to trackers – which boils down to a function of lower supply and lower demand. WTI July meanders around 31.50/bbl whilst its Brent counterpart failed to reclaim USD 35/bbl to the upside, with both contracts contained within ~USD 2/bbl intraday bands. Elsewhere, spot gold trades flat in recent trade after failing to nurse some of yesterday’s sentiment-induced losses, with the yellow metal now waiting for the Powell/Mnuchin double testimony as a scheduled potential catalyst. Copper prices have given up overnight gains as the sentiment in Europe somewhat soured as US-Sino tensions remain elevated, whilst the EU still has to overcome obstacles before launch of their Recovery Fund, touted to be implemented January 2021.

Home Depot and Walmart are among companies reporting earnings

Market Snapshot

- S&P 500 futures down 0.4% to 2,937.75

- STOXX Europe 600 down 0.7% to 339.38

- MXAP up 1.7% to 148.14

- MXAPJ up 1.7% to 477.86

- Nikkei up 1.5% to 20,433.45

- Topix up 1.8% to 1,486.05

- Hang Seng Index up 1.9% to 24,388.13

- Shanghai Composite up 0.8% to 2,898.58

- Sensex up 0.8% to 30,281.28

- Australia S&P/ASX 200 up 1.8% to 5,559.52

- Kospi up 2.3% to 1,980.61

- German 10Y yield fell 2.1 bps to -0.488%

- Euro up 0.1% to $1.0925

- Italian 10Y yield fell 18.8 bps to 1.5%

- Spanish 10Y yield fell 8.2 bps to 0.651%

- Brent futures little changed at $3479/bbl

- Gold spot up 0.1% to $1,734.98

- U.S. Dollar Index down 0.1% to 99.56

Top Overnight News

- President Donald Trump escalated a spat with the World Health Organization, threatening to permanently freeze U.S. funding unless there’s sweeping reform. An experimental vaccine from Moderna Inc. showed early signs it can create an immune-system response to fend off the virus

- Nasdaq is set to unveil new rules for initial public offerings including tougher accounting standards that will make it more difficult for some Chinese companies to list on the exchange

- Federal Reserve Chairman Jerome Powell said the central bank is prepared to use its full range of tools and leave the benchmark lending rate near zero until the economy is back on track

- New Zealand’s central bank sees no need to adjust its monetary stimulus in the wake of the government’s stronger-than-expected fiscal spending package in last week’s budget

- Australia’s central bank board held a further discussion on risks to financial stability including a briefing on the resilience of households during its May policy meeting, when both the cash rate and bond-yield target were kept unchanged at 0.25%

- Oil’s rally extended to a fourth day as a combination of recovering demand, production cuts and promising test results for a coronavirus vaccine brightened the outlook for energy prices

- Argentina’s Exchange Bondholder Group is recommending the government give investors who hold discount bonds a contingent recovery instrument linked to the nation’s GDP, the group said on its website

- The U.K. set out its post-Brexit tariffs plan, cutting import duties on many products while protecting industries such as automotive and agriculture in global trade beyond Europe

- Optimism that economies may recover faster than expected should boost European stocks, tighten Mediterranean bond spreads and buoy the euro; yet options pricing and technical charts show these currency gains may prove fleeting, with developments in the crisis yet to prove game-changers

- Patients who test positive for the coronavirus weeks after recovering from Covid-19 probably aren’t capable of transmitting the infection, research from South Korea shows

Asian equity markets were higher across the board as the region took impetus from the global stock rally spurred by several bullish factors including the reopening of economies, coronavirus vaccine hopes and stimulus efforts after Germany and France proposed a EUR 500bln recovery fund. As such, ASX 200 (+1.8%) shrugged off the increasing Aussie-Sino tensions from China’s import duties on Australian barley and briefly climbed above the 5600 level with upside led by the energy sector after the gains in oil prices and as its top-weighted financial sector also outperformed. Nikkei 225 (+1.5%) coat-tailed on the recent favourable currency moves which helped participants overlook the weak earnings from the likes of Panasonic, while SoftBank shares eventually slumped as plans to tap into its Alibaba and T-Mobile stakes to raise funds failed to offset selling pressure from a record FY loss. Hang Seng (+1.9%) and Shanghai Comp. (+0.8%) conformed to the upbeat tone as China continued to tout more favourable policies including SOE reforms, interest rate liberalization, further opening up and lower tariffs, with the gains in Hong Kong exacerbated after rule changes in the Hang Seng Index which paves the way for the inclusion of Chinese internet giants such as Alibaba, Xiaomi and Meituan Dianping. Finally, 10yr JGBs are lower amid spillover selling in T-notes as the demand for safe havens was sapped by the heightened global risk appetite, while the BoJ presence in the market for JPY 770bln also did little to inspire a turnaround in JGBs.

Top Asian News

- China Mulls Relief as Deadline Nears on $211 Billion in Bad Debt

- China Mulls Targeting Australian Wine, Dairy on Virus Spat

- Sony Plans to Take Finance Arm Private for About $3.7 Billion

- Mitsui Is Said to Weigh Stake Sale in Indonesia’s Paiton Energy

European equities have shaved gains since the open and now reside in a sea of red [Euro Stoxx 50 -0.9%] – as the strained relations between US and China continue to hover as a grey cloud on investor sentiment. Meanwhile, despite Germany and France proposing a EUR 500bln European Recovery Fund, the unanimous approval itself could prove to be complex. Netherlands, Austria, Denmark, and Sweden are not fond of the fund being distributed as grants, whilst the touted launch in 2021 may further strain peripheries hit harder by the pandemic such as Italy and Spain. On that note, FTSE MIB (-1.4%) and IBEX (-2.3%) are the marked underperformers thus far whilst core indices see broad-based losses between 0.1-0.4%. Trade updates aside, today marks the first session since the European short-selling ban was remove, as per yesterday’s announcements, potentially providing price action with some influence. Sectors are mostly in the red; breakdown also sees broad-based losses across most sectors, but financials fare better on initial optimism on the EU recovery fund. In terms of individual movers: Thyssenkrupp (+5.4%) holds onto opening gains after it said it is mulling the sale of their steel and warships divisions. Sources also noted that talks with Tata Steel never broke off and both the Cos is still in talks about consolidation. Handelsblatt reported that SSAB and Baoshan Iron & Steel were interested in a majority of the steel unit. Meanwhile, Wirecard (-1.6%) extended on losses amid source reports Germany’s accountancy watchdog FREP last year opened a probe into the Co. following allegations of accounting fraud. Carnival (-0.5%) is weighed on after being downgraded to Junk at Moody’s.

Top European News

- European Lockdowns Knock Car Sales Into Record Monthly Drop

- German Investor Confidence Jumps on Hopes Worst of Pandemic Over

- U.K. Catering Firm Compass Plans $2.5 Billion Share Sale

- Sweden Plans Record 30-Fold Jump in Borrowing to Fight Crisis

In FX, the Kiwi has extended recovery gains in wake of commentary from RBNZ Deputy Governor Bascand indicating no rush to deliver more monetary stimulus via an expansion of QE or adopting NIRP, as the Bank waits so see how data pans out before deciding whether it needs to adjust policy further. Nzd/Usd topped out just shy of 0.6100 and Aud/Nzd has retreated sharply through 1.0800 as Aud/Usd respects resistance at recent peaks around 0.6570 and the Aussie reflects on reports that China may add more exports to the higher tariff list on top of barley. Note, no added insight on the RBA front from minutes overnight that merely reiterated the grounds for maintaining rates and asset purchases at present levels while monitoring the impact or recent actions including the introduction of YCC. Meanwhile, the Pound has regained some poise across the board following latest negative interest rate chat from the BoE via Tenreyro and irrespective of UK data revealing a bigger than forecast jump in the claimant count alongside slightly softer than expected wages, with Cable back up above 1.2200 and briefly nibbling stops at 1.2266 and Eur/Gbp easing from 0.8950+ even though the Euro remains elevated independently on additional fiscal support to combat the adverse effects of COVID-19.

- EUR – The single currency is consolidating towards the top of a circa 1.0956-03 range vs the Dollar and contributing to a depressed DXY around 99.500 in advance of US housing data, testimony from Fed chair Powell and comments from Rosengren. As noted above, another financial recovery fund for the Eurozone and agreement between Germany and France to issue joint EU debt as a means of paying for the Eur500 bn pot has given the Euro a boost amidst formative signs of an improvement in ZEW’s forward-looking economic sentiment indices.

- JPY – A previously unscheduled BoJ meeting to discuss bank funding measures preannounced in April and timetabled for this Friday prompted a bit more Yen weakness against the Greenback within 107.60-30 parameters, but the headline pair may be capped ahead of decent option expiry interest between 107.65-75 in 1.5 bn into the NY cut.

- NOK – The Norwegian Krona has pared gains alongside crude prices and waning risk appetite, with perhaps some acknowledgment of remarks from Norges Bank Governor Olsen repeating that the depo rate has likely reached its lower bound, but there is more room in terms of economic policy.

- EM – Usd/Try has now breached 6.8000 to the downside and reports that the CBRT has arranged swap lines with the BoE and BoJ are helping the Lira continue its retracement, while the Idr has been very volatile following the BI’s unchanged rate decision that confounded consensus for a 25 bp cut.

- RBA Minutes stated that members assessed the best course of action was to maintain current policy setting and monitor economic and financials outcomes closely as support package had been introduced only recently, while it noted that the board determined it would not raise cash rate until progress is made towards full employment and inflation targets. Furthermore, the RBA agreed that policy package was working broadly as expected but is prepared to scale up government bond purchases again if necessary, to achieve the yield target. (Newswires)

- RBNZ Deputy Governor Bascand said RBNZ could extend and expand asset purchase programme further but added they will see how data plays out and provide more stimulus if required. Bascand added no decision has been made to buy foreign assets or launch negative rates which are among the many options available to the committee, while he reiterated they asked banks to be ready to transact negative rates in wholesale markets by year-end. (Newswires)

In commodities, WTI and Brent futures trade mixed after intially eking mild gains in what seems to be a breather from yesterday’s pronounced upside – whilst WTI June heads into its futures expiry with its head above USD 30/bbl. In terms of underlying fundamentals, on the demand side – participants continue to eye reopening economies for any signs of potential risk of reclosures. Meanwhile looking at supply, OPEC+ cuts are underway, with eyes on the June 8th JMMC meeting for further details as to whether current cuts will be extended as per source which floated potential extension to year-end as opposed to a wind-down of agreed curbs. Meanwhile, unsurprisingly, OPEC+ cut oil exports sharply in the first half of May, according to trackers – which boils down to a function of lower supply and lower demand. WTI July meanders around 31.50/bbl whilst its Brent counterpart failed to reclaim USD 35/bbl to the upside, with both contracts contained withing ~USD 2/bbl intraday bands. Elsewhere, spot gold trades flat in recent trade after failing to nurse some of yesterday’s sentiment-induced losses, with the yellow metal now waiting for the Powell/Mnuchin double testimony as a scheduled potential catalyst. Copper prices have given up overnight gains as the sentiment in Europe somewhat soured as US-Sino tensions remain elevated, whilst the EU still has to overcome obstacles before launch of their Recovery Fund, touted to be implemented January 2021.

US Event Calendar

- 8:30am: Housing Starts, est. 900,000, prior 1.22m; Housing Starts MoM, est. -25.99%, prior -22.3%

- 8:30am: Building Permits, est. 1m, prior 1.35m; Building Permits MoM, est. -25.93%, prior -6.8%

DB’s Jim Reid concludes the overnight wrap

Hopes that the virus will be well and truly beaten surged yesterday as markets got very excited about the potential for a vaccine. There was also the encouragement of new solidarity over the recovery fund in Europe but there wasn’t a lot of new news here but markets just used it as a good excuse to extend the rally. On the vaccine hopes, Moderna announced yesterday that they’d found a promising candidate in their trials. They said that their vaccine produced antibodies that can help with Covid-19 in all eight initial participants. They also said that there weren’t any major safety issues and that the company expects to start a Phase 3 trial in July. In response, the company’s shares ended the day up +19.96%, the eighth best performer in the Russell 1000 index. United Airlines, TripAdvisor, and Park Hotels, who would all benefit greatly from a vaccine, were a few of the small number of companies ahead of them in the index.

The other major news yesterday came from Chancellor Merkel and President Macron, who agreed to support a €500bn recovery fund, which Merkel said would have the ability to borrow money. Macron indicated that the fund would not be reimbursed by the beneficiaries, which would mean that the fund would be financed through grants rather than loans or that the fund would directly invest in member states, thereby acting as grants. The mix of grant and loans was a point of contention at the last meeting and so we will see what support for such an arrangement looks like when the full European Commission comes together next week. I don’t think it’s any surprise that Merkel and Macron support such a fund so it shouldn’t be huge news, but the market liked it. As noted, there are other players to convince but a show of unity here is no bad thing.

All of the major equity indices rallied on both sides of the Atlantic, with the S&P 500 up +3.15% in its best performance in over a month and back above recent closing highs after the difficulties last week. In addition the Dow Jones (+3.85%) and the NASDAQ (+2.44%) also advanced. It was a broad-based rally, with every sector and over 92% of the companies in the S&P moving higher. The covid laggards clearly outperformed on the day with autos (+9.23%), Energy (+7.55%) and Banks (+7.18%) leading the way.

Over in Europe meanwhile, the STOXX 600 (+4.07%) and the DAX (+5.67%) both had their strongest days in over a month. Energy stocks led the rally, buoyed by the strong performance of oil prices as both WTI (+8.12%) and Brent (+7.11%) climbed to 2-month highs of $31.82/bbl and $34.81/bbl respectively. Copper was also up +2.62% while palladium rose by +6.15% to just under $2,000/oz. Gold came off its 7-year high however, down -0.64%, while the dollar index (-0.73%) had its worst day in over a month.

The momentum has continued for the most part in Asia this morning with the Nikkei (+1.81%), Hang Seng (+1.79%), ASX (+1.96%) and Kospi (+2.02%) all posting decent gains. That being said, in China the Shanghai Comp (+0.53%) and CSI 300 (+0.64%) have underperformed while futures on the S&P 500 are flat. That could be in response to the news that Nasdaq is expected to tighten IPO rules including tougher accounting standards that may make it difficult for companies from countries including China to list according to a story on Bloomberg. Elsewhere this morning, yields on 10y USTs are down -2.7bps to 0.70% while in commodities oil is trading flat.

Over in sovereign bond markets yesterday, there was a major narrowing of peripheral spreads in Europe that accelerated late in the day after the news of the recovery fund came out. The spread of Italian ten-year yields over bunds fell by -25.4bps to 214bps, the largest one-day tightening since mid-March after the ECB unveiled their Pandemic Emergency Purchase Programme. There was similarly a tightening in the spread of Spanish (-9.1bps), Portuguese (-9.1bps) and Greek (-13.9bps) yields over bunds. Sovereign bond yields in core countries saw notable rises however, with yields on 10yr Treasuries up +8.3bps to climb back above 0.7% again, while yields on 10yr bunds were also up +6.4bps. In a further positive sign, Bloomberg’s index of US financial conditions eased to its most accommodative level since early March.

In terms of other news yesterday, UK overnight interest-rate swaps began to price in the chance of rates going below zero by the Bank of England’s December meeting. It comes after the BoE’s chief economists’ comments over the weekend, who said that the BoE was looking at further unconventional monetary policies such as negative rates. Like the US, the UK didn’t experiment with negative rates after the financial crisis, so such a move would be unchartered territory in the history of the Bank of England, which dates all the way back to 1694. Later on, we got some comments from the MPC’s Silvana Tenreyro, who said that the longer the lockdown was in place, the longer stimulus would be needed and didn’t close the door on negative rates. For reference, our economists are expecting a further £125bn of QE at the June meeting.

In terms of other central bank speakers yesterday, the Atlanta Fed’s Bostic added to his colleagues’ comments that the second quarter was likely going to be “tough”, but that a number of the job losses would be temporary. He espoused the need for the reopening of the economy to be thoughtful, and that the eventual recovery would hinge on consumer confidence returning. He also indicated that he would not be looking to penalize the decisions of banks during the crisis, saying that banks have been encouraged by the Fed to deploy capital during this time and “reduce the stresses” businesses and people are feeling.

There was barely any economic data to speak of, though the NAHB’s housing market index from the US for May did show a recovery from the 7-year low it reached in April, rising to 37 (vs. 35 expected). We’ll get some more hard data on the US housing market for April today though.

To the day ahead now, and the highlight is expected to be Fed Chair Powell’s testimony before the Senate Banking Committee. The text of his speech was released last night and didn’t contain too many surprises and is more a reflection of what the Fed has done but the Q&A will probably be the most interesting part. Other speakers include the Fed’s Rosengren and Kashkari, as well as the ECB’s chief economist Lane, while the Indonesian central bank will be deciding on interest rates. In terms of data, there’ll be Germany’s ZEW survey for May, UK employment data for the three months to March, and US housing starts and building permits for April. Finally, we’ll get earnings releases from Walmart and Home Depot.

via ZeroHedge News https://ift.tt/3g3BScc Tyler Durden