First Wave Out, Second Wave In: Where The World Is On The Corona Curve

Tyler Durden

Sun, 05/17/2020 – 20:10

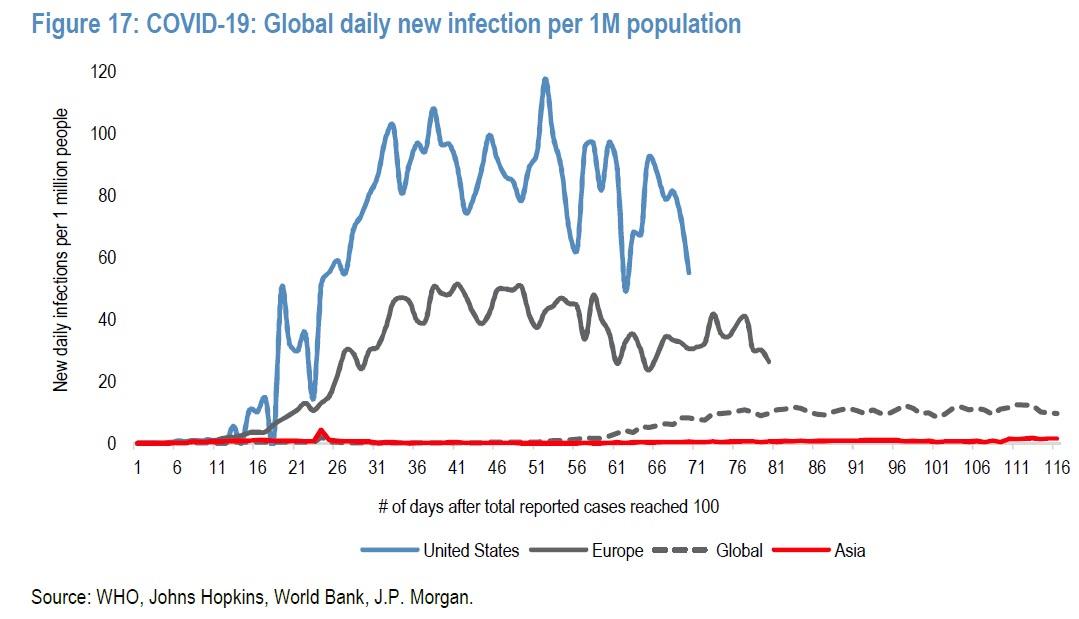

Global infection growth slowed from 20% W/W to 16% W/W last fortnight (total infections: 4,443,986, deaths: 302,468, 6.8% mortality rate). And as the rate of new infections is slowing, concerns emerge about a second wave of the coronavirus pandemic.

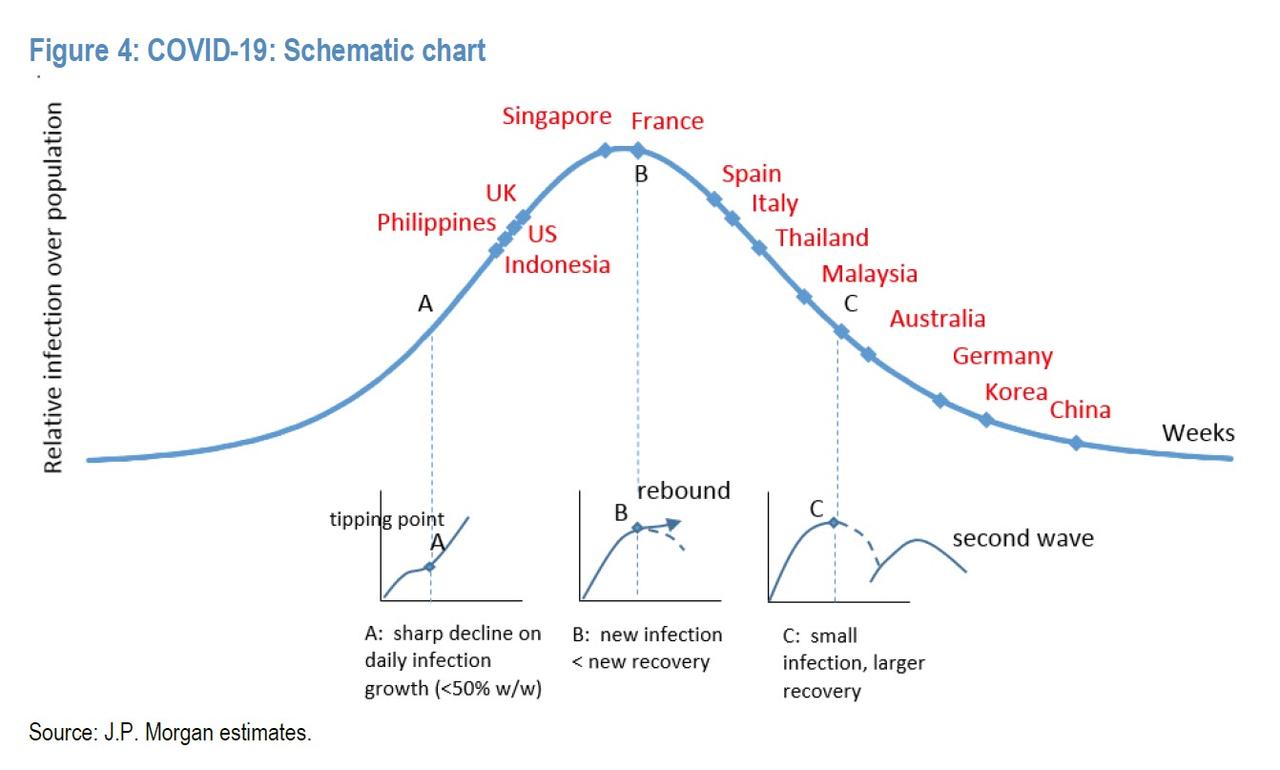

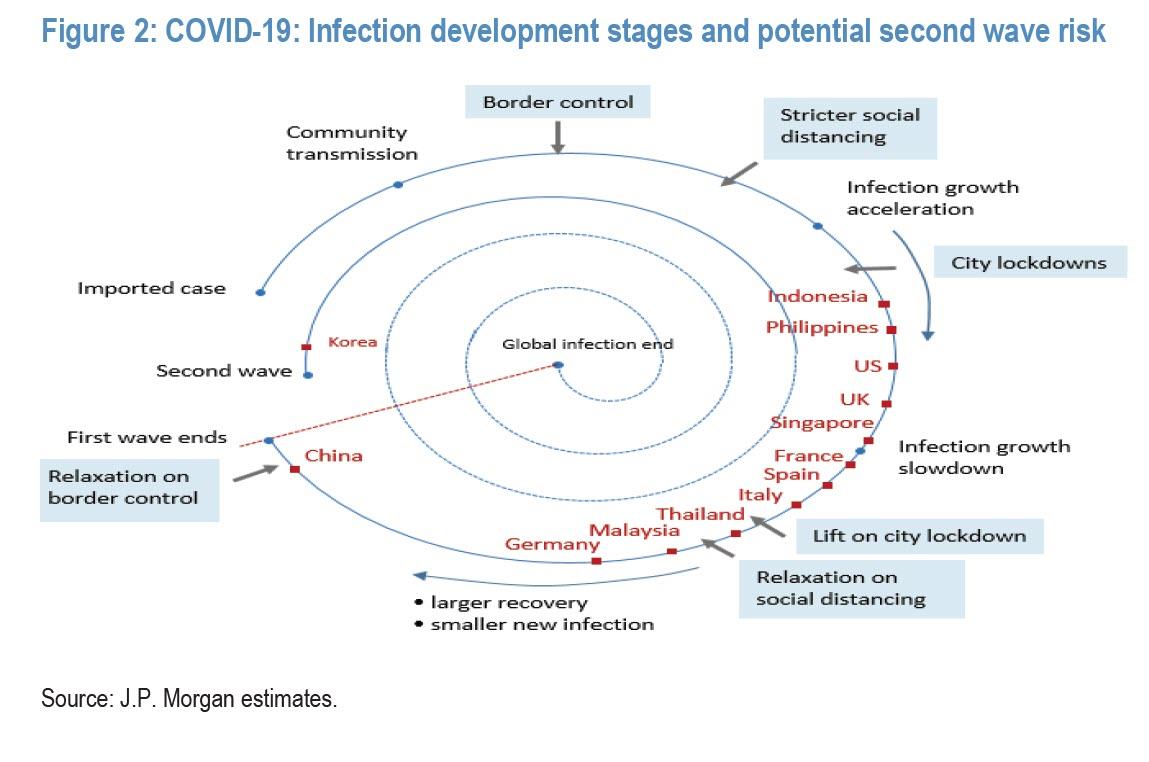

As JPMorgan’s MW Kim writes, China and South Korea are in the stage of full “recovery” from the first infection curve as 99.9%/ 91% of cumulative infections have been removed from the infection pool.

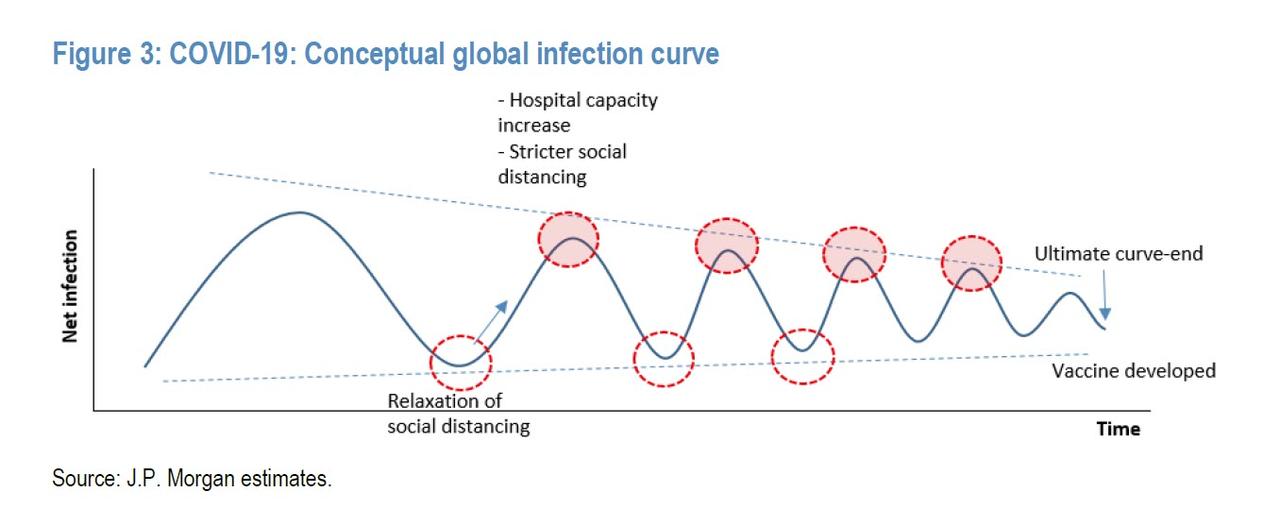

If we assume that the infection is just one-time outbreak, both countries’ progress in the infection cycle and large relaxation of social distancing should be plausible. However, based on both the bank’s conservative assumptions and epidemiologist observations, a full removal of COVID-19 would be almost impossible until the vaccine is available to the larger public. This suggests that increasing human mobility/ business activities would pose the risk of a second wave outbreak by way of faster transmission rate increase.

As China and Korea are heading toward being first-out of the curve, both countries have relaxed social distancing measures/ city lockdowns in April ahead of European/ ASEAN countries. Unfortunately, over the last 10 days, we are observing growing risk of a second wave in both countries as new infections start to increase. Thus, JPMorgan is now evaluating the risk of a second wave risk in China and South Korea.

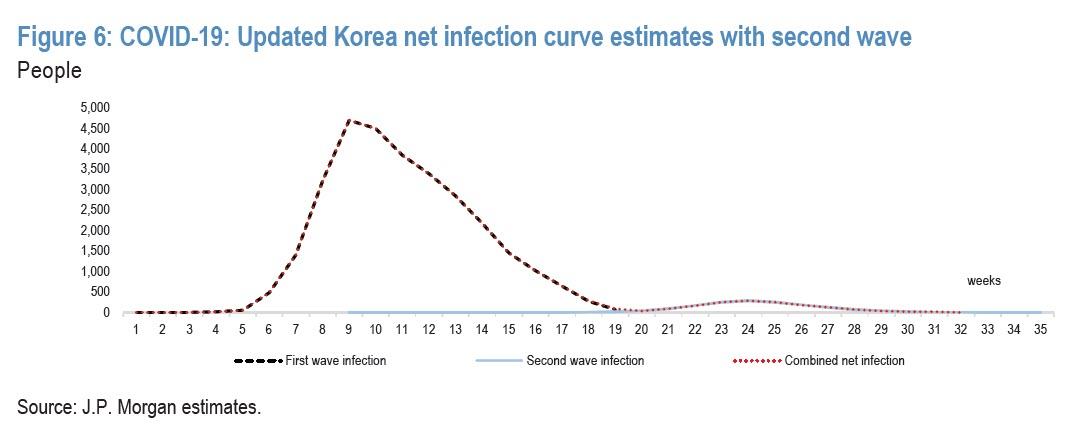

Based on JPMorgan’s assessment, Korea looks to be entering into the stage of second wave as new infection growth looks faster and larger scale. Therefore, the bank introduces the second curve forecast into its existing epidemiology modelling in Korea.

Separately, China’s new infection trend post the test outcome of China’s Wuhan city will also be closely watched by JPMorgan. As MW Kim notes, “as we factor this potential risk under the pessimistic scenario in epidemiology modelling in China, should there be a greater number of infections monitored, we would consider plugging this fine-tuning into the pessimistic scenario.” That said, he notes that “the second infection wave could be smaller scale in terms of total infections, mortality rate, and having a shorter period from infection to recovery. This is due to the government having experience from first wave infection management and the public largely being aware of potential infection risks with experience of social distancing.”

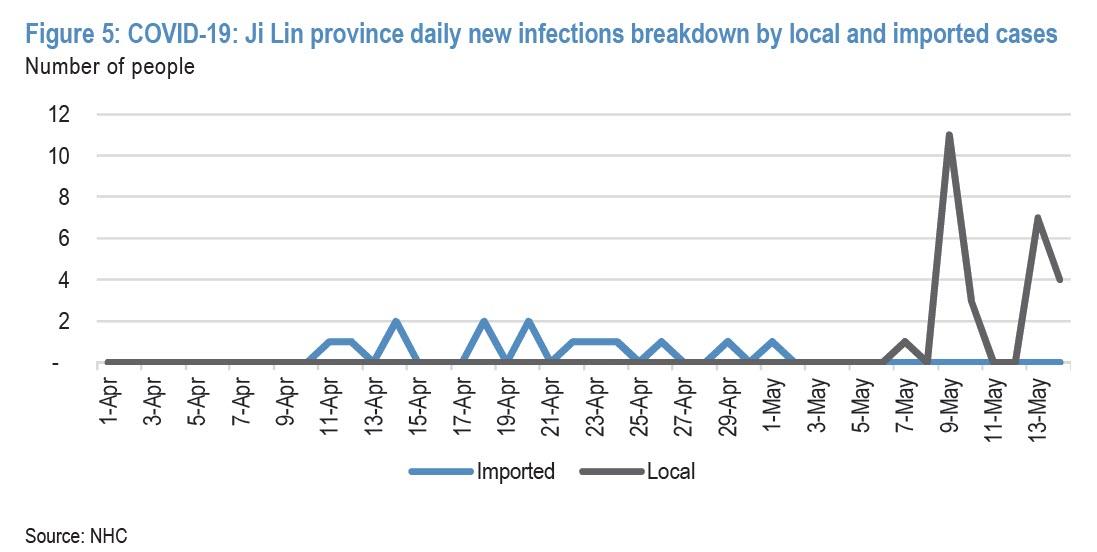

China: Rising daily new infections

Daily new local infections in China have started to rise since May 9th. 17/14 new infections were reported on May 9th and 10th and among those, 10/12 cases were local infections and mainly from Ji Lin and Hubei provinces. On May 10th, Shu Lan city of Ji Lin province announced city lockdowns again due to increasing local new infections. On May 11th, Wuhan government announced testing of the full population (~11M) in 10 days. China government’s surprising measures on new infection control may be read as an early wake-up call of the larger-scale second wave possibility instead of pre-emptive control measures.

At this stage, it is almost impossible to forecast the potential size of new infections including asymptomatic cases as current statistics suggest Wuhan is almost a COVID-19 free city through full recovery (based on official data which as has been repeatedly observed, is bogus at best). Therefore, after this large scale test is done, expected outcomes include (1) better understanding of potential infections out of total population post the curve-end; (2) % of immunity groups post one infection curve in the society; and (3) recurrence rate. These should be important statistics globally to gauge the risk of the second wave as many countries are planning to reopen the economy under relaxed social distancing measures

Shu Lan city of Ji Lin province lockdowns from May 10th

On May 7th, one local new infection was reported in Shu Lan city, Ji Lin province after 73 days of no new local infections province wide. On May 9th, 11 new local cases were reported, all in Shu Lan city and three new cases in Ji Lin city on the 10th. The risk level in Shu Lan city was raised from low to medium on the 9th and subsequently raised again from medium to high on the 10th. On May 10th, Shu Lan city government announced a city lockdown with strict control on mobility.

There has been one connected case found in Liao Ning province (a nearby province) that’s related to Shu Lan city’s confirmed case. At this stage, it is uncertain where the origin of the second wave in Ji Lin province came from. As Ji Lin province is located in the northeast of China and borders Russia, it is likely that imported cases have led to spread of the virus in the local community, at least if one believes the official government narrative.

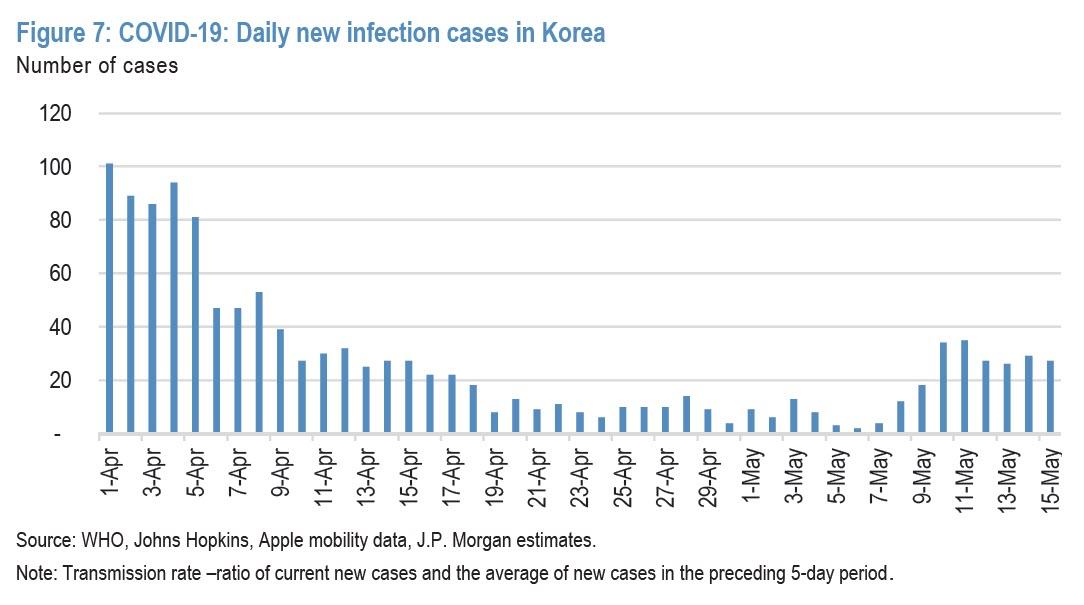

South Korea: Emergence of second infection wave

Korea relieved its strict social distancing measures starting from Apr 20, and relaxed them further on May 6, partially lifting work from home measures, and resuming activities in malls, parks etc. However in the past week, there has been a rise in daily new infections from the previous single-digit new cases per day to ~30 cases per day.

Total infections in the country stood at 11,018, as of May 15, with 260 total deaths. The recent outbreak is expected to add another 2,000 new infection to the curve and this should delay the curve end to mid August from the end of May.

Those cases, according to JPMorgan, “illustrate the risk of a second wave in the process of economic reopening” and “considering the first-in first-out (FIFO) concept of the infection curve, similar experiences perhaps are likely to be replicated in other countries in the recovery stage.”

via ZeroHedge News https://ift.tt/3fY9Lea Tyler Durden