President Donald Trump hates the trade deficit. On the campaign trail back in 2016, he argued that this gap—the imbalance between the value of America’s imports and exports—was a sign that China, and others, were “stealing our businesses, stealing our jobs, stealing our money.” If elected, he promised, he would “end our chronic trade deficits.”

Many politicians make promises on the campaign trail but never really try to deliver on them. Unfortunately, Trump really did make the reduction of the trade deficit a top priority as soon as he got into the White House. His policies to achieve this: an erratic mix of angry tweets, unilateral tariffs hikes, and threats to tear up trade agreements if the original signatories refuse to renegotiate them on Trump’s terms.

As these moves set off a global trade war, Trump’s defenders formulated—or, more accurately, dusted off—protectionist arguments for forcing other nations to import more from, and to export less to, the U.S. This, they told us, would bring factories back to the U.S.

That was the plan, anyway. What happened instead followed the path that free traders predicted.

As they explained, a country’s trade balance is determined overwhelmingly by factors such as the U.S dollar serving as a reserve currency, the ratio of savings to investment opportunities at home and abroad, and the relative attractiveness of that country’s investment climate. As long as the United States is growing and remains an attractive place to invest, we Americans will continue to run trade deficits with the rest of the world.

What tariffs can do, they continued, is affect bilateral trade balances with the individual countries against which the tariffs are applied. But this mostly leads American buyers to shift their purchases of imports from one nation to another—say, from China to Vietnam—so U.S. manufacturing is not increased and America’s overall trade deficit isn’t affected. If there is a reduction in our trade deficits, that won’t be because manufacturing is “returning.” It’ll be because both imports and exports are falling, with the former coming down more than the latter.

Underneath Trump’s policies is a profound ignorance of the tight connection between imports and exports. Foreigners sell goods and services to U.S. buyers in order to acquire American dollars. They want these dollars, in part, to buy American exports. So when U.S. imports grow, so do U.S. exports. The reverse is also true: reducing American imports causes Americans to shrink.

More important, and often overlooked: Foreigners want dollars also to invest in America’s powerful economy. That includes (but of course isn’t limited to) buying U.S. Treasury bonds. In consequence, every dollar Americans spend on foreign goods and services comes back to us. As the U.S. trade deficit rises, investment flows into America increase by the same amount. As the nerds say, the current-account deficit is a mirror image of the capital-account surplus. This is why Mark Perry of the American Enterprise Institute describes imports as “job-generating foreign investment surpluses for a better America.”

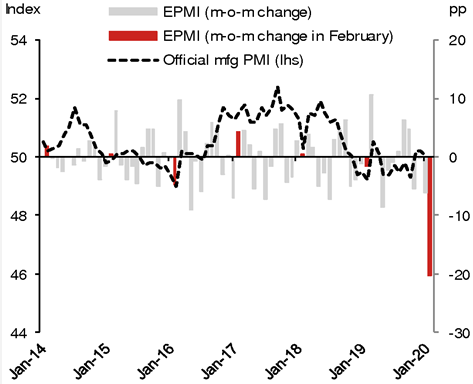

It is thus no surprise that as the American economy grew, the trade deficit also grew. This also explains why, as the U.S economy cooled in 2019—in part because of the Trump’s trade wars and the rampant uncertainty they created—the trade deficit started to shrink. As this chart shows, higher U.S. trade deficits tend to be associated with faster, not slower, U.S. economic growth.

The bottom line: Absent any major changes in the aforementioned macro factors, over which this president has little control, any reduction in the trade deficit would likely be accompanied by weaker economic growth, as was true during the Great Recession or the Great Depression.

Trump and his supporters have started to cheer the $10.9 billion reduction of the trade deficit in 2019 as a sign that his policies worked. Trump and his defenders also trot out anecdotes of manufacturing jobs returned to the U.S. as evidence that the newly renegotiated trade deals are succeeding. The reality is quite different. As tariffs increase prices for American buyers (particularly manufacturers), manufacturing activity slowed down and is now bordering on recession. And that trade deficit reduction, as recent Census data reveal, is the product of both imports and exports falling.

Something else in those Census numbers: Tariffs on Chinese imports may be reducing our bilateral trade deficit with China, but that doesn’t mean Americans are buying from U.S. producers instead. Instead, places like Vietnam, Mexico, and Malaysia are picking up the slack.

So the free traders were right. If you want to lower the trade deficit, your best bet is to reduce both imports and exports—or just to have an economic crisis. Who really wants that?

from Latest – Reason.com https://ift.tt/39Q6ji3

via IFTTT