“Fallen Angel” Day Arrives: $140 Billion In Energy Debt At Risk Of Imminent Downgrade To Junk

Back in November of 2017, this website was the first to suggest that a flood of “fallen angels”, or the lowest, BBB-rated investment grade bonds that are downgraded to junk, will be the event that triggers the next corporate debt crisis. In “Hunting Angels: What The World’s Most Bearish Hedge Fund Will Short Next“, we quoted from the IMF’s Oct 2017 “Global Financial Stability Report” which issued an ominous warning:

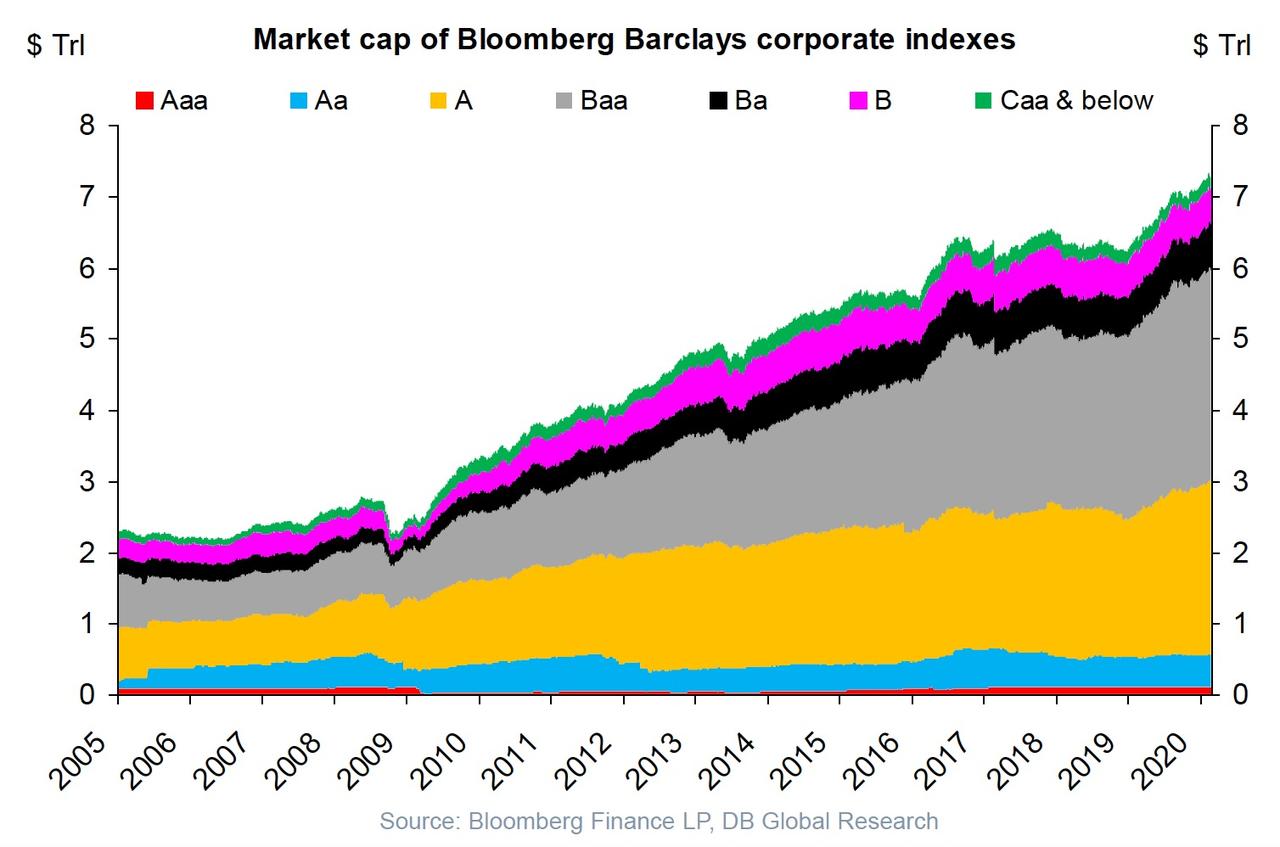

… BBB bonds now make up nearly 50% of the index of investment grade bonds, an all time high. BBB bonds are only one notch above high yield, and are at the greatest risk of becoming fallen angels, that is bonds that were investment grade when issued, but subsequently get downgraded to below investment grade, or what is known these days as high yield. It then points out that investors have never been more at risk of capital loss if yields were to rise. In addition, it notes volatility targeting investors will mechanically increase leverage as volatility drops, with variable annuities investors having little flexibility to deviate from target volatility

Following this article, the topic of a tsunami in “fallen angel” credits took on greater urgency, because with over $3 trillion in bonds on the cusp of downgrade, as we discussed in “The $6.4 Trillion Question: How Many BBB Bonds Are About To Be Downgraded“, countless asset managers warned (here, here and here) that this was the biggest threat to the credit pillar of both the US economy and stock market (recall the bulk of BBB rated issuance was used to fund the trillions in buybacks that levitated the stock market over the past few years).

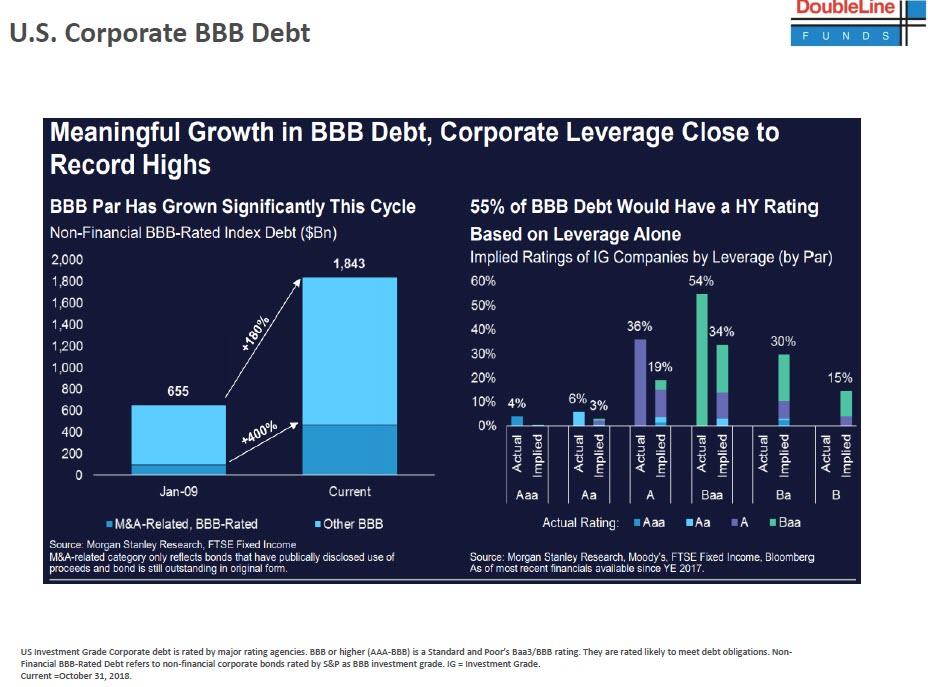

However, despite a few close scares, and the downgrades of some massive IG names to junk such as Ford and more recently, Macy’s, there never emerged a clear catalyst that would trigger a wholesale downgrade of IG names to junk, especially since the Fed ending its monetary tightening in late 2018 and unleashed another rate cut cycle coupled with QE4 in 2019 sent IG and HY yields and spreads to record lows, even though as Morgan Stanley pointed out no less than 55% of BBB-rated investment grade bonds, would have a junk rating based on leverage alone.

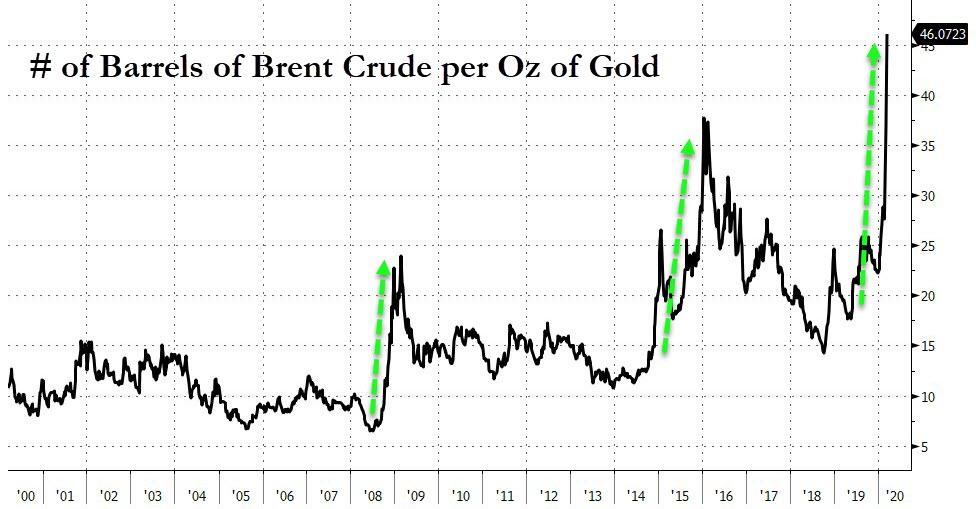

But the bandwagon of fallen angel optimism that prompted the mockery of anyone who warned about the risk of a fallen angel tsunami resulting a corporate bond crash, came to screeching halt on Monday when Saudi Arabia started an all-out price war with Russia and US shale producers, destroying the OPEC cartel overnight and causing the biggest one-day drop in oil prices in almost 30 years.

As Bloomberg Intelligence analyst Spencer Cutter writes, following Monday’s plunge in oil prices, more than $140 billion of bonds issued by North American energy companies are at risk of losing their investment grade status, noting that a number of bonds from high grade rated oil producers already trade with credit spreads approaching distressed levels. Worse, according to Cutter, “a prolonged downturn could affect an additional $320 billion of triple-B rated midstream debt.“

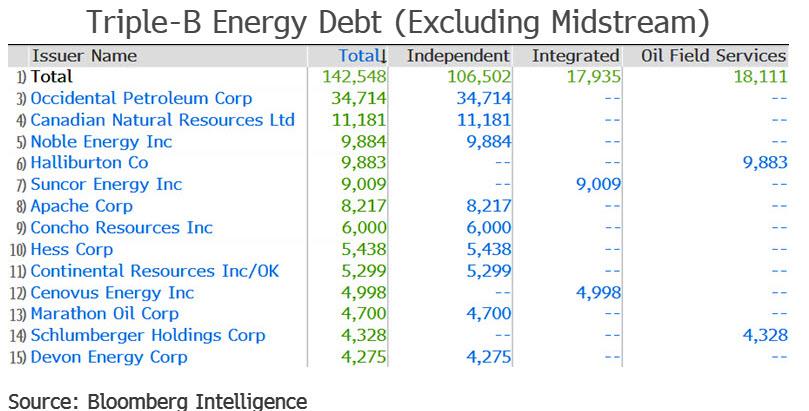

Here is what we know: as of this moment, over $140 billion of debt issued by independent oil and gas producers, oilfield services providers and integrated energy companies has triple-B credit ratings from Moody’s or S&P and is now at risk of falling to junk status.

In the 2015-16 downturn, both credit-rating companies lowered their commodity-price expectations, driving a wave of rating cuts. Occidental Petroleum, which yesterday slashed its dividend for the first time in almost two decades to preserve cash flow, is the largest issuer, with almost $35 billion of debt and credit ratings of Baa3/BBB. As further shown in the table below, other significant potential fallen angels include Canadian Natural Resources (Baa2/BBB+), Noble Energy (Baa3/BBB), Apache Corp. (Baa3/BBB) and Concho Resources (Baa3/BBB-). A number of companies already have one foot in the high yield camp including Devon Energy (Ba1/BBB-), Hess (Ba1/BBB-) and Continental Resources (Ba1/BBB-).

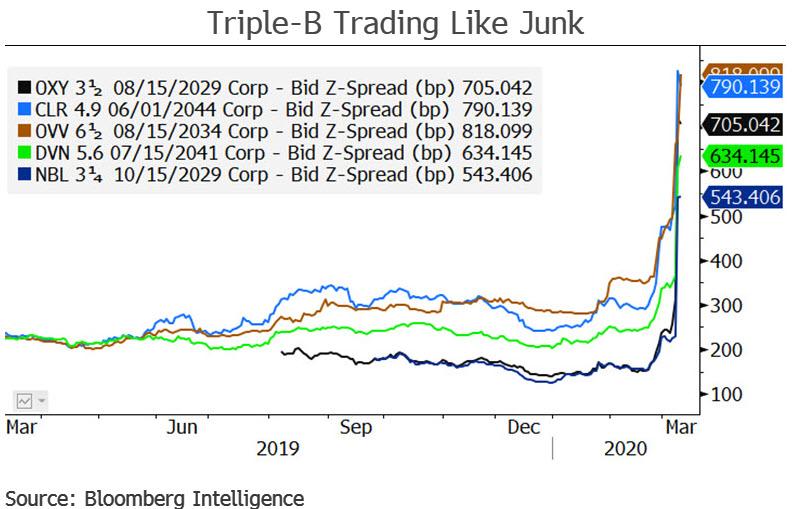

And while in the past rating agencies have been painfully behind the curve and slow to adjust to changing fundamentals (for obvious conflicted reasons – after all the last thing their clients want us to see their bonds crater following a downgrade to junk), this time they have no choice as the market has already repriced the relevant debt.

As Bloomberg notes, since the recent plunge in oil prices, bonds issued by several oil and natural gas producers with triple-B credit ratings have already started to trade with high yield-like credit spreads. In the case of Ovintiv and Continental Resources, which have crossover ratings of Ba1 at Moody’s and triple-B from S&P and Fitch, spreads on their unsecured bonds have climbed to about 800 bps, close to the 1,000 bp-plus level, which typically qualifies as distressed. Spreads on Occidental Petroleum notes due in 2029 have climbed north of 700 bps, while Devon Energy and Noble Energy benchmark bond spreads have jumped to 630 bps and 540 bps, respectively. In January, none of the bonds had a credit spread above 300 bps.

Putting those spread in context, the FT noted that almost 12% of the $936BN of bonds issued by US oil and gas companies are were trading on Monday with a yield more than 10% points above Treasuries — a commonly used definition of distress. Among junk-rated borrowers, issuers with ratings below triple-B, which account for $175bn of the total, the proportion of debt in distressed territory has risen to almost two-thirds.

Ok, some may counter, $140BN is a lot but there is just over $3 trillion in total BBB rated credits. This is hardly a disaster.

The problem is that the threat of imminent downgrade to junk is not only in the E&P space: one it strikes, it will certainly affect the midstream as well.

To be sure, while midstream companies aren’t as directly exposed to swings in commodity prices, a prolonged downturn will result in sustained lower throughput volume and an effort to restructure gathering, processing and transportation contracts by their oil and natural gas producing customers. A wholesale review of credit ratings across the sector could affect $320 billion of bonds that have triple-B ratings from Moody’s or S&P, according to Bloomberg. At Baa3 and BBB- rated, Energy Transfer and Sabine Pass Liquefaction each have the lowest level of investment grade rating. While rated high grade by S&P and Fitch, Plains All American already carries junk ratings from Moody’s. Other producers at risk include Williams (Baa3/BBB), Kinder Morgan (Baa2/BBB) and MPLX (Baa2/BBB).

In other words, between just the oil producers and the midstream cos, some $360BN is at risk of near-term downgrade to junk. Assuming that’s all there is, it would increase the size of the $1.2 trillion junk bond market by nearly 30%, resulting in an unprecedented selloff in an asset class that has become an anchor to yield-starved speculators who will be forced to liquidate most if not all of their credit exposure, which would then also drag down the rest of the IG space, resulting in a catastrophic crash in the credit market.

All of this, of course, assumes that the rest of the $3 trillion in Investment Grade names are not downgraded. However with the coronavirus pandemic now assuring not only a bear market, but a recession, guaranteeing that the bulk of the IG names are hit by at least a one notch downgrade, the only question is whether all those names, which MS calculated at roughly $1.6 trillion, that already have junk bond fundamentals, will be downgraded. Alas, even if it is a modest portion, it would still be enough to create a cascade that shuts down the US credit market first, and then spills over to every capital market in the world.

Tyler Durden

Wed, 03/11/2020 – 12:00

via ZeroHedge News https://ift.tt/33h7R2A Tyler Durden