Market Rollercoaster Returns: Futures Crash As Stimulus Hope Fade

First the good news: after S&P futures crashed limit down on Monday, then rebounded limit up on Tuesday, on Wednesday the market’s unprecedented volatility has been just a bit more contained, and futures have so far failed to drop or surge by the 5% limit. Now the bad news: after yesterday’s tremendous surge (which in turn followed Monday’s near record drop), after Trump promised late on Monday that he would unveil a “major” stimulus package on Tuesday, only to be a no-show yesterday and failing to outline any tangible steps, the futures rollercoaster is back, with the Emini down sharply overnight, sliding by over 2.6% and cutting yesterday’s gains in half.

“Despite the hopes for fiscal stimulus everywhere, we see significant downside risks,” said Guillaume Tresca, a strategist at Credit Agricole SA in Paris. “As long as uncertainties remain on the number of cases, and central banks’ actions and fiscal stimulus plans are not lifted, we see few reasons for a protracted and long-term rebound.”

As Reuters puts it, the latest plunge was due to “investors growing frustrated about the lack of details on fiscal stimulus floated by President Donald Trump to combat the coronavirus epidemic.” Investors also realized that any plan the White House introduces will need to be approved by both houses of the U.S. Congress, a proposition that may be challenging as flashbacks of the (first) failure of the TARP bailout, which unleashed a historic crash in 2008, floated through their heads.

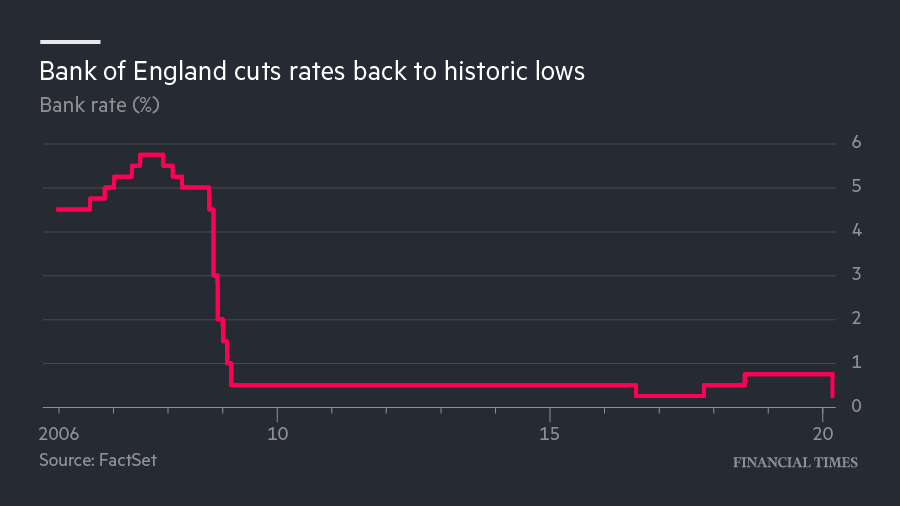

Futures also shrugged off a surprise move by the Bank of England to cut interest rates by 50bps and support bank lending, which had lifted sentiment in Europe and Asia overnight, as central bank credibility rapidly fades. At 7:31 a.m. ET, Dow e-minis were down 570 points, or 2.4%. S&P 500 e-minis were down 66 points, or 2.5% and Nasdaq 100 e-minis were down 184 points, or 2.2%.

On Monday, the three main indexes came within a hair’s breadth of confirming bear market territory, implying a drop of 20% from record highs, following a collapse in oil prices. The S&P 500 is now about 15% below its all-time high hit just three weeks earlier.

In Europe, the Stoxx 600 gained as the European Central Bank indicated it may act as soon as this week and the Bank of England BoE which — on the day that Britain’s budget is set to open the taps on spending — announced an emergency 50bps rate cut and revealed measures to support bank lending, lifting shares after a lacklustre session in Asia. The BoE did not announce new quantitative easing measures but it did launch a new scheme to support lending to small businesses.

But the Stoxx 600 trimmed much of its gains as travel and leisure shares dropped and Adidas SA slumped after warning the coronavirus would cut profit. Earlier in the session, most Asian benchmarks fell amid growing disappointment with the lack of stimulus, while the yen rallied.

The BOE’s emergency move came a week after the Federal Reserve slashed its main rate, and as ECB President Christine Lagarde warned of an economic shock similar to the financial crisis unless leaders act urgently – comments which suggest the bank may join the wave of crisis easing when it sets policy on Thursday. The U.K. is expected to unveil an expansionary budget later Wednesday, and Germany and Italy have also announced fiscal support.

“It is the only thing central banks can do in a public health crisis,” said Neil Dwane, global strategist and portfolio manager at Allianz Global Investors. “They are trying to take the shackles off the banks to ensure we don’t get a cash crunch.” But after a decade of extraordinary monetary policy, investors say the impact of easier policy has clear limits and increased government spending must bear the brunt of the policy response to the economic consequences of the outbreak.

“For the ECB their problem is that there is even more pressure because they face the third-largest euro zone economy — Italy — in dire straits,” Dwane said. As of Tuesday’s close, $8.1 trillion in value has been erased from global stock markets in the recent rout. The MSCI all-country index has lost more than 15% of its value since it peaked on Feb. 12, and was 0.13% lower on Wednesday.

In FX, sterling initially fell sharply following the BoE decision before rebounding. It was last up 0.4% at $1.2925 but down 0.3% versus the euro at 87.66 pence. The dollar resumed its decline against the yen, the Swiss franc and the euro, weighed down by uncertainty about the U.S government’s response and the drop in U.S. Treasury yields. The greenback remained significantly above levels seen on Monday, however.

In rates, U.S. 10-year Treasury yields fell 5 basis points to 0.7035%, more than double Monday’s record low yield of 0.3180%. Market participants largely expect the Fed to cut rates for the second time this month at next week’s scheduled policy meeting, after it surprised investors with a 50-basis-point cut last week. German government bond yields rose after the BoE cut supported sentiment, while Italian yields — which had shot up on worries the country with Europe’s worst outbreak of the virus is sliding into a recession — tumbled 20 basis points as bets on ECB stimulus grow.

In commodities, WTI slid 2.5% to $33.49 per barrel, while Brent crude dropped 2.31% to $36.36 after Saudi Aramco announced plans to raise its production capacity at the same time as the coronavirus was set to weaken demand. On Monday, oil prices plunged as Saudi Arabia and Russia clashed openly over management of supply. Spot gold rose 1% to $1,665 per ounce as investors sought safety in the precious metal.

To the day ahead now, where data releases include January industrial production and trade data for the UK, as well as the February CPI report and monthly budget statement in the US. The aforementioned UK budget will be a focus while the OPEC monthly oil market report will be released.

Market Snapshot

- S&P 500 futures down 1.7% to 2,816.50

- STOXX Europe 600 up 1.5% to 340.70

- MXAP down 1.6% to 148.53

- MXAPJ down 1.1% to 488.53

- Nikkei down 2.3% to 19,416.06

- Topix down 1.5% to 1,385.12

- Hang Seng Index down 0.6% to 25,231.61

- Shanghai Composite down 0.9% to 2,968.52

- Sensex up 0.5% to 35,811.98

- Australia S&P/ASX 200 down 3.6% to 5,725.87

- Kospi down 2.8% to 1,908.27

- German 10Y yield rose 3.5 bps to -0.755%

- Euro up 0.4% to $1.1327

- Italian 10Y yield fell 9.5 bps to 1.158%

- Spanish 10Y yield fell 0.3 bps to 0.341%

- Brent futures down 2.1% to $36.43/bbl

- Gold spot up 0.6% to $1,658.94

- U.S. Dollar Index down 0.2% to 96.23

Top Overnight News

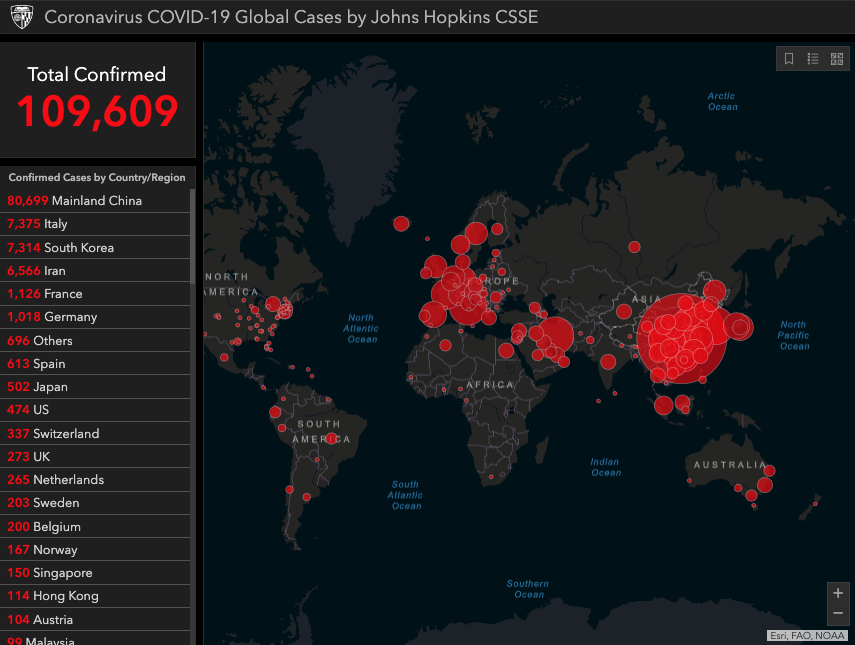

- The global death toll from the coronavirus climbed above 4,000, and the director of the Centers for Disease Control and Prevention said some parts of the U.S. are now beyond containment efforts. Italy cases topped 10,000 as it attempted a nationwide lockdown, while a U.K. health minister tested positive for the disease

- Donald Trump told Republican senators on Tuesday that he wants a payroll tax holiday through the November election so that taxes don’t go back up before voters decide whether to return him to office, according to three people familiar with the president’s remarks

- The Bank of Japan is considering expanding its annual purchases of exchange-traded funds from the current target of 6 trillion yen ($57 billion), Kyodo News reported, without attribution

- U.K. Chancellor of the Exchequer Rishi Sunak will promise record spending on infrastructure across the country, as the government is set to use a huge increase in borrowing to end the era of austerity

- Prime Minister Giuseppe Conte is preparing to increase Italy’s fiscal stimulus program for the fourth time in a month, officials said, after the European Union agreed to stretch its budget rules to the limit to help member states fight the coronavirus

- Oil extended a rebound from its biggest crash in a generation as the prospect of U.S. stimulus to shield against the fallout from the coronavirus tempered fears over an unprecedented supply-demand shock

- RBA Deputy Governor Guy Debelle signaled in a speech that following the Bank of Japan’s QE method, which sets a target for government bond yields — known as yield curve control — rather than buying a certain amount of bonds a month is the preferred approach

- Joe Biden won the Michigan primary over Bernie Sanders, taking the biggest prize in Tuesday’s six-state round of primaries and further widening his lead in the Democratic nomination race

Asia-Pac stocks were lower as the prior session’s firm rebound on Wall St that was spurred by stimulus hopes, failed to resonate across the region and US equity futures also pulled back after the White House press conference provided very few details regarding economic measures and where President Trump was a no-show, which overshadowed the Democrat Primaries where mainstream candidate and former VP Biden is set for another decisive victory. ASX 200 (-3.6%) and Nikkei 225 (-2.2%) were lower with the former dragged by heavy losses in gold miners and its largest weighted financials sector to finish in bear market territory, while the Japanese benchmark extended its retreat from the 20k level to reach its lowest level since 2018 as USD/JPY slipped back below 105.00. Hang Seng (-0.6%) and Shanghai Comp. (-0.9%) were indecisive amid a lack of fresh catalysts and as the PBoC continued to withhold from liquidity operations, while the latest update from mainland China showed a slight pick-up in the number of additional coronavirus cases and related deaths although this was only marginal and in-fitting with the stabilization narrative. Finally, 10yr JGBs traded slightly higher amid weakness in Tokyo stocks and following the swings in T-notes, while the BoJ were also present in the market today for JPY 430bln of JGBs mainly concentrated in the belly.

Top Asian News

- China’s Credit Growth Slumps as Virus and Holidays Cut Lending

- Over 100 Homebuilders Go Bust in China as Virus Strains Deepen

- Indonesian Stocks Fall After 1st Reported Death From Coronavirus

- Abe Faces Rising Calls for More Stimulus as Virus Hits Economy

Sentiment has recovered from the downbeat tone in the APAC regions as futures resurfaced into positive territory following the surprise BoE rate reduction in a bid to cushion the impacts of the virus outbreak. Cash markets also opened higher to the tune of ~2% [Eurostoxx 50 +1.8%] with broad-based gains seen across the board, but with UK’s FTSE choppy and moving from the top gainer to the laggard on Sterling action ahead of the UK budget unveiling later today (Full preview available on the Newsquawk Research Suite). Sectors are mostly in the green with the exception of the energy sector given the decline in prices in the oil complex whilst financials lead the gains. Unsurprisingly, UK banks have received a tailwind from the BoE cut – with Barclays (+1.5%), Lloyds (+2.0%), Standard Chartered (+3.3%) and HSBC (+1.6%) all in firm positive territory. However, analysts at Goldman Sachs see the announcement of the New Term Funding Scheme as a positive for smaller banks and negative for larger banks as it reduces the latter’s potential hedge from mortgage pricing. Elsewhere, Adidas (-6.4%) shares plumbed the depths post-earnings after noting that the virus outbreak had a material negative impact on China revenues – which are expected to be between EUR 0.8-1.0bln below the prior year’s levels. Similarly, Puma (-3.3%) also issued a negative warning regarding virus impacts, as such these cautious comments have brought down the likes of Kering (-0.7%) and Richemont (-1.1%) in sympathy. Other earnings-related movers include Clas Ohlson (-4.4%) and Mediaset (-0.1%). Meanwhile State-side, desks note US democratic candidate Sanders’ poor performance on Super Tuesday is a mild positive for stocks, although Biden could eventually prove to be a headwind to stocks as the market would prefer a second Trump term.

Top European News

- Telecom Italia Jumps as Carrier Ends Six-Year Dividend Drought

- European Stocks Climb With U.K. After BOE Cuts Rates on Virus

- Europe Isn’t Ready for a Full Work-From-Home Lockdown

- Swedbank Gains Amid ‘Relief’ On Scale of Potential U.S. Sanction

In FX, not the biggest net mover by any means, but the Pound has been among the liveliest majors following the pre-Liffe, UK Budget and timetabled March MPC policy meeting ½ point rate cut. The emergency action induced all round Sterling weakness akin to the Dollar’s post-50 bp FOMC ease decline last Tuesday, as Cable recoiled from 1.2900+ to sub-1.2850 and Eur/Gbp jumped to circa 0.8840 from just under 0.8800. However, as the BoE statement and subsequent presser underscored the coordinated nature of measures taken, including funding for SMEs and a 1% reduction in counter-cyclical buffers for banks to zero, and fiscal loosening to come from the Chancellor, Cable and the cross retraced all and more of their initial moves while largely if not totalling shrugging off data in the form of January GDP, IP and output plus trade.

- NZD/JPY/AUD/EUR/CAD/NOK – All firmer vs the Greenback, as the DXY fades alongside recovering risk sentiment partly due to the lack of anything material from the US in terms of major steps to counter the adverse economic/social impact of COVID-19, not to mention a degree of disappointment that President Trump was conspicuously absent from the official White House event. The Kiwi is currently top G10 performer, albeit consolidating gains on the 0.6300 handle with the aid of favourable Aud/Nzd tailwinds as the Aussie lags in wake of dovish sounding remarks from RBA Assistant Governor Debelle (underlining QE and forward guidance as potential anti-nCoV contagion tools). Aud/Usd is pivoting 0.6500 and the cross is hovering just above 1.0300, both some distance from recent peaks. Elsewhere, the Yen has pared losses between 105.67-104.11 parameters on the aforementioned flagging risk appetite after Tuesday’s part revival as the Japanese Government prepares supplementary budget initiatives, but the Euro has retreated further from Monday’s near 1.1500 highs to straddle 1.1300 awaiting tomorrow’s ECB meet and the bloc’s fiscal response to the coronavirus. Conversely, the Loonie continues to nurse losses around 1.3700 in the run up to Canadian Q4 cap u that is due alongside US CPI, but also eyeing crude prices like the Norwegian Krona and Russian Rouble that are losing momentum due to crude topping out – Eur/Nok back above 10.8500 and Usd/Rub over 71.5000 again.

- RBA Deputy Governor Debelle said coronavirus is causing large increase in risk aversion and uncertainty, while he added the global economy will be materially weaker in Q1 and period ahead but also noted lower interest rates will help offset demand shock from virus. Furthermore, Debelle also stated that there are scenarios where QE would have to be considered and that they would also consider forward guidance as well as keeping bond yields low. (Newswires)

In commodities, another wild ride so far in the energy complex with WTI and Brent front month-futures sliding from overnight highs in wake of further supply prospects and the readying from major oil producers for a prolonged period of low energy prices. Saudi Aramco has received a directive from the Energy Ministry to increase maximum sustainable capacity from 12mln BPD to 13mln BPD, with oil production capacity to be raised to 13mln BPD as soon as possible. This follows yesterday’s Aramco announcement that it will be supplying customers with 12.3mln BPD starting April 1st – the timeframe for 13mln BPD output is unclear thus far. Furthermore, Saudi Arabia has asked government departments to submit proposals for 20-30% cuts to their budgets, according to sources. This alludes to the Kingdom readying for a longer period of low energy prices to balance its books. Meanwhile, Russia has shown no signs of caving in – the Finance Ministry highlighted that Moscow is better prepared than any other country with oil revenues. That said, Energy Minister Novak stated that dialogue with OPEC will continue and representatives will be present at the March 19th JTC meeting. UAE has also become the latest producer to increase output, with ADNOC stating that they are in a position to supply markets with 4mln BPD in April and will accelerate to 5mln BPD capacity target, brought forward from 2030. As mentioned above, the contracts have wiped up overnight gains with WTI Apr’20 slipping from USD 36.28/bbl to a current low of ~USD 33.08/bbl whilst Brent Apr’20 similarly declined from a high of USD 39.60 to a low of ~USD 35.73/bbl. Subsequently, UBS lowered its Brent price forecast for end-June to USD 30/bbl vs. Prev. USD 40/bbl & WTI to USD 28/bbl vs. Prev. USD 37/bbl. Elsewhere, spot gold retains an underlying bit given the weaker Buck, with the yellow metal drifting further north of USD 1650/oz. Copper prices meanwhile remain within yesterday’s range and above USD 2.5/lb as the red metal bides time for fresh macro news-flow.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 15.1%

- 8:30am: US CPI MoM, est. 0.0%, prior 0.1%;CPI YoY, est. 2.2%, prior 2.5%

- 8:30am: US CPI Ex Food and Energy MoM, est. 0.2%, prior 0.2%;CPI Ex Food and Energy YoY, est. 2.3%, prior 2.3%

- 8:30am: Real Avg Weekly Earnings YoY, prior 0.0%; Real Avg Hourly Earning YoY, prior 0.6%

- 2pm: Monthly Budget Statement, est. $236.8b deficit, prior $234.0b deficit

DB’s Jim Reid concludes the overnight wrap

Markets yesterday saw massive intraday moves while the prospect of fiscal stimulus first disappointed and then hope came back into town late in the US session. However hopes have again faded in the Asian session with another wild ride in prospect today. To take you on a recap of the rollercoaster, early yesterday it looked like markets would stage a significant recovery and reverse over half of Monday’s selloff with S&P 500 futures up as much as +5.25% at their peak before the open. However not long after the US walked in markets quickly nosedived and went down to erase the entire day’s gain, before headlines came out of a President and Senator meeting surrounding a tax holiday for consumers and targeted fiscal stimulus to industries most affected by the virus. There was also news of a more joined up response from EU leaders and signs of big infrastructure spend in the UK budget today which we will discuss below.

The S&P 500 ended +4.94% but the futures contract are now down -3% as we type. Who knows where it will be between pressing send and you reading this. There were similar swings for the DOW (+4.89%) and NASDAQ (+4.95%) yesterday while in Europe we saw the STOXX 600 closing -1.14% which shows how much it missed the boat before the late US rally. At the highs it was up +4.09%. It was a similar story in credit where CDX HY opened some -60bps tighter in spread terms before ending the session only -15bps tighter, while Cash HY spreads ended +14bps wider which puts the overall spread level at 647bps with a three-day move of +102bps. Energy spreads were +56bps wider and now sit at 1,488bps.

This morning Asian markets are also trading lower with the Nikkei (-1.52%), Hang Seng (-0.60% ), Shanghai Comp (-0.02% ), CSI (-0.50%) and Kospi (-2.75%) all seeing losses. As we go to print, the Australia’s ASX has closed down -3.60% today and has entered what many see as bear market territory as its now down more than 20% from its peak. As for FX, all the G10 currencies except for the Australian dollar are up against the greenback with the Japanese yen (+1.38%) leading the advances.The US dollar index is down -0.43% after advancing by +1.60% yesterday. Also, as volatility continues to remain high, yields on 10y USTs are back down -14.5bps this morning to 0.660% while those on 30y are down -13.1bps to 1.15%. In commodities, brent oil prices are up a further +2.53% this morning with gold +0.88%.

The latest on the virus is that the total number of confirmed cases in the US has now reached 1,001 according to the John Hopkins University tally which includes 67 cruise ship cases. These tend to be well ahead of the official WHO numbers who have a stricter criteria. As the number of cases in the US grow, Robert Redfield, director of the US CDC said that the US had lost valuable time tracking the virus and some regions now can merely try to cope with its spread rather than stop it. My favourite headline yesterday was that the Council on Foreign Relations canceled a “Doing Business Under Corunavirus” conference this Friday due to the spread of the virus.

Away from the virus and on to the democratic primaries held yesterday, Joe Biden continued with his new found momentum as he won the primaries in Mississippi, Missouri, and Michigan – the biggest delegate prize of the night which Sanders had won in his 2016 presidential bid. The results from primaries held in North Dakota, Idaho and Washington are still awaited. Meanwhile, the RealClearPolitics is now showing that Biden is set to win the democratic presidential nomination as he polls at 53.5% vs. 35.5% for Sanders. PredictIt now have Biden at over 90% probability with Hillary Clinton now above Sanders.

Back to yesterday and it was hope of emergency fiscal spending that fueled both the early optimism during the Asian session and the late NY trading rally. However the initially underwhelming announcements and a walk back by the Trump administration quickly caused markets to reassess in the early US session. CNBC headlines mid-way through the day suggested that White House was not ready to roll out “specific economic proposals”. Germany’s Minister for Economic Affairs & Energy, Peter Altmaier, was also quoted as saying that government measures to cushion the impact of the coronavirus are worth several billion euros. That is equivalent to ‘only’ around 0.2% of GDP though. Chancellor Merkel was also reported as telling lawmakers that Germany does not need a stimulus plan now but rather liquidity injections. That didn’t suggest imminent meaningful activity. European Commission President Ursula von der Leyen said that “we will make full use of the flexibility which exists in the Stability and Growth Pact”. The Commission President also confirmed that rules will be clarified for member states and guidelines issued by the end of the week.

Markets turned when President Trump tried to offer more details by stating that he wants a payroll holiday through to the US elections. This was followed by some US Senators, especially Texas Senior Senator John Cornyn (representing his constituent’s oil fields), advocating for targeted subsidies for virus and oil affected companies. House Speaker Pelosi also met with Secretary of Treasury Mnuchin and indicated that “more would need to get done” to address the virus. Following Merkel’s comments, Italian Prime Minister Conte spoke on a call with other EU leaders on the need for coordinated fiscal and monetary stimulus and for Lagarde and the ECB to do “whatever it takes”. He was discussing stimulus leeway of up to EUR 16 billion, which would be roughly 0.9% of GDP, and would be just north of EUR 100bn if replicated across Europe. We’re a long way from that but as Mark Wall told me last night the post GFC European fiscal package was around $150bn for context.

Staying with stimulus, today, here in the UK Chancellor Sunak will deliver one of the most highly anticipated budgets since the financial crisis. See our economists full preview here. There were headlines across the board last night of a likely plan to increase infrastructure investments by £100bn over the next 5 years which would be more aggressive than most people’s expectations.

However the reason for much of this stimulus talk across the globe is that activity is soon going to see serious downside. Indeed as an example, Merkel said yesterday to lawmakers that “everything non-essential should be canceled” according to Reuters. That’s pretty aggressive language and the worry is that large parts of Europe will mirror the rise in new cases seen in Italy over the next 5-10 days and will also impose economically stringent containment and delay measures. As we said yesterday there is hope from what has happened in South Korea where although case numbers now stand at 7531, according to WHO, the rate of growth over the last 7 days are 11%, 8%, 9%, 8%, 5%, 3%, and 2% and clearly slowing for now. The same pattern has been seen in China outside of Hubei. So if Europe follows that model we will get the rate of case growth slowing by month end. By then the streets might be ghost towns anyway.

Back to yesterday where oil staged a rebound with Brent up +8.32% to 37.22$/bbl, just off the highs of the session of 38.34$/bbl. The S&P 500 Energy sector also bounced back +5% on the commodity move. In bond markets 10y Treasury yields were up +26.2bps and finished higher than they closed last Friday, up to 0.803%. Yields in Europe rose, but in a slightly more muted fashion. 10 year Bund yields were up +6.6bps to -0.79%, the first day they finished higher on the day since 26 February and only the 3rd in the last 19 sessions. Italy actually saw its 10yr yields fall -9.6bps, only the 2nd time yields fell in the last 12 sessions. With the market finishing in a risk-on fashion gold fell -1.85%, even as the VIX finished over 40 points for the second day in a row, which is the first time it has done that since March 2009.

In other news, with the ECB meeting now the next point of call for most looking for a central bank response, an MNI story out yesterday suggested that the ECB was looking at a package that could include a 10bps cut and targeted loans. The story also suggested that officials were looking at more asset purchases but further debate was needed. Meanwhile, former senior official in the ECB’s supervision arm, Ignazio Angeloni, said that the ECB could decide not to increase banks’ capital requirements on virus related new loans for a certain period of time.

To the day ahead now, where data releases include January industrial production and trade data for the UK, as well as the February CPI report and monthly budget statement in the US. The aforementioned UK budget will be a focus while the OPEC monthly oil market report will be released.

Tyler Durden

Wed, 03/11/2020 – 07:59

via ZeroHedge News https://ift.tt/3cOJGNd Tyler Durden