Blain: “You Can’t Spend & Promise Yourself Out Of A Natural Disaster”

Authored by Bill Blain via MorningPorridge.com,

Buy Dips or Sell Rally?

“The Renaissance took place in an era of chaos and plague”

After yesterday’s sea of red, stock prices are green again. Phew…! Everyone breathe easy and buy the dip? Does that mean we forget yesterday’s cataclysm of clichés: “carnage”, “bottomless”, “rampant uncertainty”, “volatility storm”, and some unimaginative analyst even opined it was a “perfect storm”? Forget the fact Italy has gone into a countrywide lockdown – the market is apparently confident promises of further easing, relief packages, and even Donald Trump reversing from his earlier “Virus is Fake News” calling for payroll tax cuts and industrial sector bailouts, means everything will be “tickety-boo”.

Bollchocks to that!

First, you can’t spend and promise yourself out of a natural disaster, and second, yesterday’s crash was entirely predictable.

We know the virus is spreading, and likely to turn Pandemic, and we knew the Saudi/Russia axis was wobbly. As the virus takes hold, the fear levels will continue to rise. Yesterday was a new chapter where all the negative aspects of the unfolding exogenous shock narrative were suddenly amplified by an oil shock. They reinforced each other to create a Black Monday that’s worth putting in the history books. But, it isn’t over yet. In fact, I suspect its still only beginning.

Contagion has swept through the whole market.

It’s not just stocks and oil. Corporate bonds are now as illiquid as set concrete, while dealers aren’t able to find bids for corporate bond ETFs. We’ve all suspected ETF liquidity would be thin – but this is the first time liquidity has really been tested in recent years. I confidently predict massive liquidity failure will trigger further unintended consequences – especially when retail starts trying to exit daily liquidity funds. Who will be the first to Gate a fund? How embarrassing.

However, this market crisis feels very unlike previous crashes. It seems to be happening in slow motion. I’ve worked through all the big ones since 1987 (although the great Perp Disaster of 1986 was my very first experience of market meltdown). This morning I’m looking at the wreckage from yesterday and thinking the Oil Shock aspect is probably done and dusted. (We will still have to see what happens to Shale producers – but that likely puts a floor on the market.) A falling out between Russia and Saudi was always on the cards as both chase different strategic objectives. The instability enveloping Saudi leader Prince MBS is a repeating factor. Does that mean it’s time to pile into oil stocks after they took a particularly heavy beating y’day? Or should we wait to see what the Virus does next?

That depends on your read of current market events:

A) Is the current volatility just a reaction to the unexpected Coronavirus shock, with the strong likelihood positive market direction will be restored once the authorities have “sorted-it-out”?

or

B) Is this the first act in a spectacular Götterdämmerung of an overlong bull market, as the virus signals the collapse of an overpriced stock bubble, fuelled by foolishly low interest rates which could now trigger secondary corporate and even sovereign debt corrections?

Your answer to the above determines whether you buy the dips or sell the rallies.

As Italy shows, there is plenty of virus pain to come. Yesterday’s oil crash would have been a massive over-reaction in a normal market, but as the current virus narrative shows increasing transmission and rising infection clusters – these will keep everything on edge for longer. Even when we see signs transmission rates are under control, we’ll still have to figure just how deep the damage has gone in terms of corporate leverage, supply chains and default contagion.

There is lots of news about how China cracked contagion through its authoritarian containment efforts. These can’t be replicated in the West. And we don’t actually know theses measures have worked in China – yet. As workers start to return to work, the authorities are clearly nervous about the Virus erupting again.

At the moment I suspect most governments are making lots of public noise about their Coronavirus contingency planning, but are praying for Spring and warmer weather to put the threat to sleep – for a while. They are gambling on the weather! If it pays off it will give them till the autumn to get a new vaccine in place – it will be tight. Try this from the Torygraph – How long will we have to wait for a coronavirus vaccine? And we can pretty much guarantee (from the observed behaviour of previous Covids) that it will be back.

Today the Coronavirus is generating the market moving stories. Tomorrow – when it comes – will be about the longer-term consequences. Tourism has effectively died across Asia – which could prove critical for global growth for years. This is not going to be a here today, forgotten tomorrow narrative.

If you want a different take on just what a global reset this may be, try this from my old chum David Murrin: When Denial Is Swamped by Reality (If you need access to his site, tell his bot “Bill sent you.”

And if you still think the Coronavirus story is hype and overjuiced by the media, read some of the stories coming out of Italian hospitals suddenly swamped by patients needed urgent ventilation and intervention because they can’t breathe and their internal organs are going into toxic shock. Italian Hospitals short of beds as coronavirus death toll jumps. This isn’t anything like the flu. For the 20% of patients who get it bad.. they are getting it very bad indeed.

The big Virus story this morning will be news President Trump proposing to bail out airlines and shale oil producers. He’s heading along the right lines – these will be major business sector contagion vectors for economic damage if/when we start to see a run of defaults. A slew of shale defaults will increase the lockdown in corporate bonds. Fiscal handouts will certainly be more effective than trying to reanimate the economy through rate cuts. (As one talking head said: rate cuts aren’t going to get people flying again..) However, his powers to enact fiscal spends are limited.

Trump could still prove a critical aspect of the unfolding Coronavirus narrative. He was dismissing it as Fake News a few days ago. Let’s see what happens if we get clusters of infections create mini-Italys across the US, triggering too-late containment efforts, panic buying and health pressures. I suspect small-town hospitals across the UK and US are likely to be swamped. I was reading a critical issue in China to predict the severity of infection has been blood-pressure. That’s not great for small-town America or the UK!

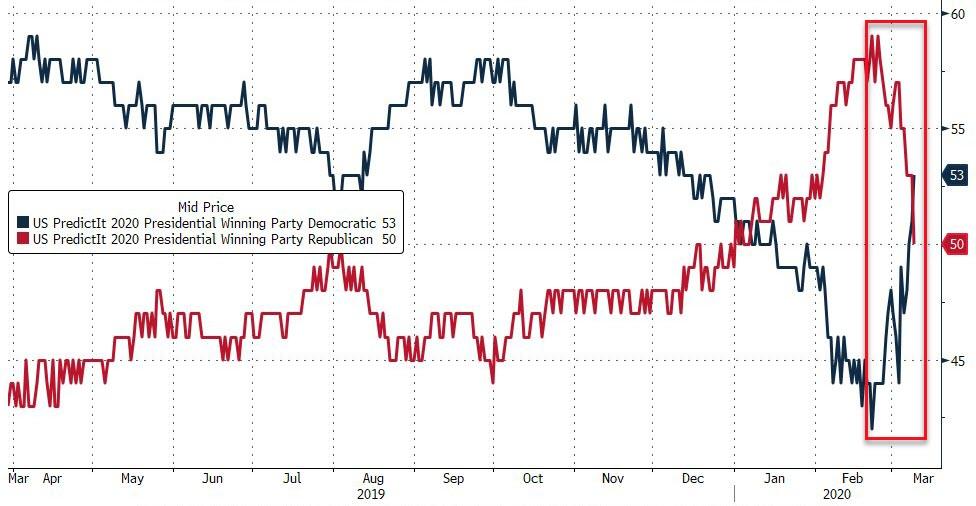

We could even see the next few weeks influence the November election. Coronavirus may be a slightly worse flu – but Americans are unlikey to forgive Trump if America proves unprepared and the blame is laid at his door – unless he persaudes his supporters it was Joe Biden’s doing!

From a market perspective, keep looking. There are definitely opportunities out there. And I’m still thinking about the oil majors. Maybe… just maybe this is a moment..

Tyler Durden

Tue, 03/10/2020 – 12:30

via ZeroHedge News https://ift.tt/2TCRObW Tyler Durden