The Other Biden Problem: Joe’s Brother Now Facing Allegations Of Influence Peddling

If reports are accurate, influence peddling may be something of a family cottage industry. While Congress continues to look at the Hunter Biden contract and his effort to sell his name to foreign companies, the brother of Joe Biden is facing the same allegations in an expanding controversy over his selling of his connection to the former vice president. James Biden was anything but subtle in his pitching his connections to his brother.

While it has received little attention in the media, James Biden has leveraged his connection with his brother for years in open pitches for contracts with major business like Americore (which is now in bankruptcy and the subject of a FBI investigation that is not contacted to Biden). Biden arranged for Americore founder Grant White to meet his brother.

Former Americore executive Tom Pritchard and others allege that Biden promised a large investment from Middle Eastern backers while he openly referenced his access to his brother and his family name. Biden is facing a wide array of litigation over allegedly fraudulent activities as well as a personal loan acquired through Americore before it went into bankruptcy.

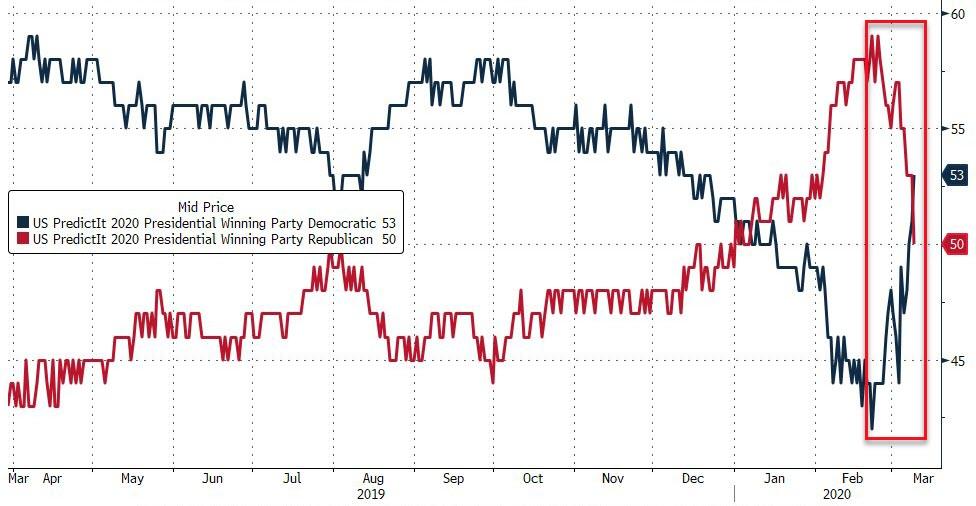

The effort of Hunter and James Biden to peddle access and influence with Joe Biden could become an even greater issue in the 2020 election. Joe Biden has bizarrely continued to claim that “no one has suggested that my son did anything wrong.” He seems to be drawing a distinction between what is criminal and what is not — as if the criminal code is the only measure of wrongdoing or unethical conduct. Now a pattern exists of not just his son cashing in on his influence but his brother. That is wrong regardless of whether it is criminal. The expanding litigation surrounding James Biden could force a broader debate about that distinction.

For decades, I have written against this form of corruption as family members receive windfall contracts as a way of circumventing bribery laws. This remains the preferred avenue of the Washington ruling class to cash in on their positions. When confronted, they then (as did Biden) object that critics are attacking their family or their children. For that reason, little has been done to crackdown on such deals. For some in the media, there is a tendency to look the other way when they support the candidate or oppose the other party. The fact is that it is all corruption and influence peddling and it is all perfectly legal . . . and perfectly wrong.

Tyler Durden

Tue, 03/10/2020 – 13:10

via ZeroHedge News https://ift.tt/2IBrnx3 Tyler Durden