Rabobank: “In Any Other Context, The Bloomberg Story Would Represent Criminal Market Manipulation”

Submitted by Michael Every of Rabobank

Common People

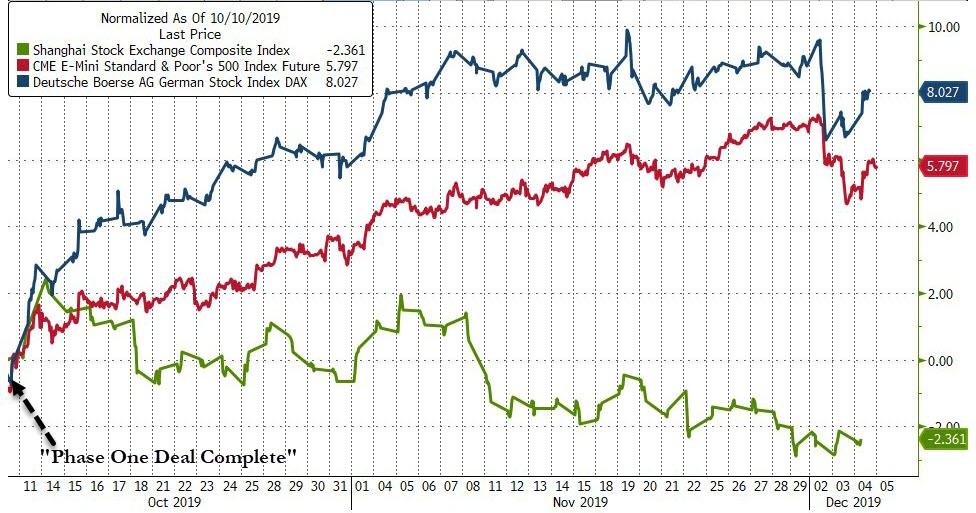

I’m from a generation that still gets a buzz from the opening lines of Pulp’s Common People: “She came from Greece she had a thirst for knowledge; she studied sculpture at St Martins College; That’s where I, caught her eye.” In an age of populism, and in the run-up to the UK election, it seems particularly timeless. Yesterday the market also sang along happily (stocks up, US 10-year yields reversing half their previous plunge, CNY firming) when Bloomberg reported that based on the insider views of some “people”, China’s anger over US legislation on Hong Kong, and pending on Xinjiang, won’t get in the way of a phase one trade deal; and from the US side it is just a matter of crossing the Ts and dotting the Is on tariff roll-back (which China is making 100% clear is needed) and this will all be done before 15 December.

It may or may not be true – and we won’t have to wait long to find out. If this doesn’t happen within 9 days, will there be a belated retraction published? I also laughed at the padding to what was the latest reiteration of the same one-sentence story: “Trade Deal Still On: People”. In particular, Bloomberg noted “Stocks rallied in Europe and US equities rebounded from declines on Tuesday tied to Trump’s comments that he didn’t have a deadline to sign an agreement with Beijing. The offshore yuan reversed declines to gain as much as 0.25%.” Yes – on the back of their story! And it added “Investors are closely watching for any signs of progress on a phase-one deal as worries increase that Trump may slap more tariffs on China later this month” Yes – and their story was the only news of progress we got. Effectively the story was talking about itself in the third person when it was the story. Which is very Bloomberg at the moment, isn’t it?

The irony is that if this were the stock of a publicly-listed firm making cardboard boxes or paperclips and we were getting unsourced “people” spreading info like this, knowing full well what the market reaction would be, it would likely represent criminal market manipulation. This is high geopolitics, and impacts all kinds of markets globally – and it’s perfectly OK to do it. In fact, it’s encouraged. Indeed, it’s rinse and repeat and rinse and repeat on this ‘trade deal news’ – or at least until 15 December, when something has to happen. I do agree there is little appetite on either side for that new round of tariffs – but what breakthrough can either side offer in an increasingly-strained political atmosphere?

Moreover, surely Trump has a stronger political position always promising a great trade deal that he’s going to be super-tough over that never actually arrives, but which still lets markets hit all-time highs, than trying to sell what will be a milquetoast trade deal when it actually does arrive. But let’s not worry about that. Rinse and repeat on trade-deal news, and then when things do go wrong just sell like everyone else and say “Whocouldanooed?” while waiting for a central-bank bailout. Indeed, in the present environment even after new tariffs have been slapped on and the US and China are at loggerheads we can probably trade the optimism of when trade normality will return – because it must, right? “People” will demand it.

As a friend very-usefully pointed out to me yesterday when I complained right now it might not be worth looking at yields or stocks or FX for what the underlying truth is on the trade-deal: try soybean futures, which while well off their 2019 lows are also well of their 2019 highs, and have been trading as if “people” don’t know what they are talking about since the start of October.

And from soybeans to soyboys, as the other major headlines are that with NATO in London Trump made nice with Erdogan, who is playing his pivotal geostrategic role to perfection; cancelled his press conference; and called Trudeau “two-faced” for nasty comments. (Trump pique, or an observation that the videos of Trudeau released pre-election did indeed show him to have two different faces?) He also reiterated that tariffs might be used to incentivise NATO members to spend 2% of GDP on defence (and on US stuff, no doubt).

One other conclusion from NATO was that it needs a raison d’etre and lots of voices are suggesting balancing out China fits the bill., including Secretary General Stoltenberg, who said “We see them in the Arctic, we see them in Africa, we see them investing in European infrastructure and of course investing in cyberspace” Trade deal now on the back of that national-security sentiment, obviously.

NATO-related question of interest: How would current “people”-centric markets trade an actual war if one ever happened? One asks as North Korea promises a “Christmas gift” to the US and President Trump talks about a military response; and as Trump sends 14,000 US troops to the Middle East as insurance against suggestions Iran might attack US interests there. Presumably said markets would trade Comical Ali headlines that all is well(?) I do grant you, however, that for now geopolitics is not driving volatility on the view that it is all mouth and no trousers, as common people say.

But back to data, where it is worth mentioning that the US ISM services survey yesterday saw the headline come in at 53.9 vs. 54.5 expected but with a big bounce in the employment sub-index along with a further slump in import activity; and ADP employment was disappointing at just 67K vs. 135K expected, which doesn’t line up that well. Again we wait for more real direction.

Aussie trade data were as bad news as the building permits slump was for tradies, with the surplus AUD4,502m vs. an expected AUD6,500m. Take away net exports and there isn’t a whole lot holding the economy up right now. Certainly not retail sales flat m/m in October vs. a 0.3% consensus, as households keep paying down debt with tax cuts and a sudden mini-bubble in Sydney and Melbourne property doesn’t make people want to spend more as they are forced to borrow AUD200-300,000 more in order to buy a home – thanking the RBA all the way, of course.

New Zealand is meanwhile sighing in relief as the RBNZ released its decision on capital buffers for banks and stated they need to rise to 16% of risk-weighted assets as planned, which has been causing serious concern that borrowing costs would have to rise (by as much as 20.5bp according to the RBNZ); but this can be done over seven, not five, years as first flagged. So the need to prepare for serious global financial turbulence is there, but won’t hit New Zealand until 2027(?) That implies at least one RBNZ cut to offset, but over a long time-frame. We will be getting more than one cut and far sooner than that though, I assure you.

And back to the last week of the UK election: I took her to the supermarket; I don’t know why; But I had to start it somewhere; So it started there; I said ‘Pretend you’ve got no money”; She just laughed and said “Oh, you’re so funny”; I said “Yeah? Well I can’t see anyone else smiling in here.”

Tyler Durden

Thu, 12/05/2019 – 15:40

via ZeroHedge News https://ift.tt/34Q0crQ Tyler Durden