“Biggest Quant Quake” Since Tech Blowup Era Sparks Fears Over Low/Min Vol Funds

Today’s carnage in the quant space – among the largest in history (and as big as the tech blowup era)…

Final quant quake post-mortem: Days bigger than this for momentum & value below. Momentum: financial crisis recovery days, then #dotcomcrash era. Value: Today’s moves take us back to the tech blowup era. Is this an inflection point, or just an interest rate proxy trade … ? pic.twitter.com/4wb7F20ZGO

— Michael Krause (@michaelbkrause) September 9, 2019

Reminded us of warnings that Academy Securities’ Peter Tchir recently sent about the potential for trouble ahead from the flood into low/min vol funds over the last year.

I am increasingly concerned about the amount of money flowing into low volatility funds or minimum volatility funds. I believe that these flows represent ‘weak’ hands, clinging to the market and are highly susceptible to selling pressure on any surprise.

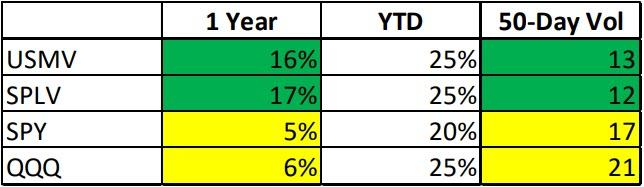

Low volatility funds, like the $13 billion SPLV, invest in stocks that exhibit low volatility.

Minimum volatility funds, like the $34 billion USMV, attempt to create a portfolio that is less volatile than the market as a whole. For example, the largest holding in USMV is Newmont Goldcorp Corporation (NEM). The 50-day historical volatility for NEM is 26 compared to 17 for the S&P 500. It is included, because on a portfolio level, it tends to reduce risk. It tends to zig when other stocks zag, making this relatively volatile stock an ideal pick for a minimized volatility strategy – at least when looking at past data. These strategies are clearly appealing to investors as the fund flows have been staggering.

USMV and SPLV Assets Under Management Increasing Rapidly Since September 2018

Source: Bloomberg

These two products have taken in over $23 billion since September of last year.

As flows have exited the broader market ETFs.

Source: Bloomberg

I assume, as I always do, that the ETF flows are merely the tip of the iceberg. I am not opposed to these strategies as a whole, but like everything else, they have their time and place and I’m starting to get concerned that these funds will be a weak part of the market for several reasons (they might be a really interesting hedge opportunity, especially as options are cheaper on these funds than the broad market).

I am increasingly concerned because:

1. I believe the buyers of these funds are ‘weak’ hands.

People are not buying these funds as a gateway to taking on more equity risk, but because they feel obliged to stay in the market and believe that this is a relatively ‘safe’ way to do it.

I hope I’m wrong, but I cannot stop imagining this scene playing out over and over”

Client: We’ve had a great run on stocks, but I’m nervous here, let’s sell some.

Broker: But your equity allocation is already lower than I’d like to see.

Client: Yes, but if we are headed to recession, I don’t want to give up these gains.

Broker: There might be a way to keep your equity exposure, but not the risk.

Client: Ok, that’s interesting.

Broker: We can put you into a low vol fund. Get the equity exposure but not the downside.

Client: Isn’t that too good to be true?

Broker: Yes, there are risks, but some big clients and smart people have been allocating to this and doing very well.

Client: Sure, let’s do that. Shift some out of equities into these low vol strategies.

Maybe I’m wrong, but I suspect a lot of investors aren’t fully aware of what they’ve bought and aren’t aware that these strategies at times have led the market lower and underperformed the broad market in a down market.

2. These Funds Have Underperformed in Down Markets

These funds have a good track record, especially of late, but they can lead the market down. Aside from the ‘weak’ hand theory, where I believe holders of these funds may be quicker to sell on losses than many expect, there are other reasons for this.

-

What was low volatility before, might not be low in the future. Both the low volatility and minimized volatility funds rely on historical data for portfolio selection. Past performance is no guarantee of future performance. While the ‘factor’ these funds are targeting is low volatility, they may be actually tracking other factors that over the recent past have coincided with lower volatility.

-

On the minimized volatility portfolios, I’ve spent too much time with correlation traders to be overly comfortable. Correlation is brilliant when it works and mind numbingly confusing when it doesn’t. If every investor was fully aware of what they were buying, I’d be less concerned, but to the extent I’m correct, investors who thought they wouldn’t underperform on the downside, who were already nervous about markets, might be quick to sell.

-

What if not being a meaningful component of a big ETF reduced a stock’s volatility? I haven’t been able to figure out how to run numbers to analyze this, but for instance, let’s say that not being a big component of a big ETF reduces volatility because there is less trading in a stock (not sure that is true, but doesn’t seem easy to dismiss). In that case, as these funds grow, they themselves become large ETFs which could make their components more volatile (not sure if that is a paradox or not, but it hurts my head to think about it). What we do know, with a high degree of certainty is that inflows into a fund boost the stock prices of those stocks in the ETF (all else being equal). This “momentum” effect may be masking what would otherwise be increased volatility of the stocks in that ETF, or in the worst case, sowing the seeds for their own future underperformance.

-

With these returns it isn’t difficult to understand why the strategies are attracting so much new money. These strategies often make sense, I am just starting to think it is very overdone and could be far weaker than many expect.

The contrarian in me isn’t pounding on the table, yet, but I am knocking on the door as this strategy has caught my attention again (as it had several years ago as well) and I think it could be far more susceptible to a sharp pullback than the strategy names suggest.

Since I think these funds can do worse in a downturn and options on them are much cheaper than the broad markets, I’d focus some hedging attention here.

Money for nothing? I don’t think so.

Tyler Durden

Mon, 09/09/2019 – 16:45

via ZeroHedge News https://ift.tt/2LIQkI0 Tyler Durden