Mike Bloomberg: Trojan Horse For Clintonista Revival

Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

It’s been obvious to me since he declared that Mike Bloomberg is not a serious candidate for the Democratic nomination. He is everything the Democratic base doesn’t want — white, billionaire, oligarch, Wall St. 0.000001%’er.

Oh, and until just a couple of years ago, he was a Republican. Billionaires like Bloomberg change parties to where ever they see their money will go the farthest for them achieving their goals.

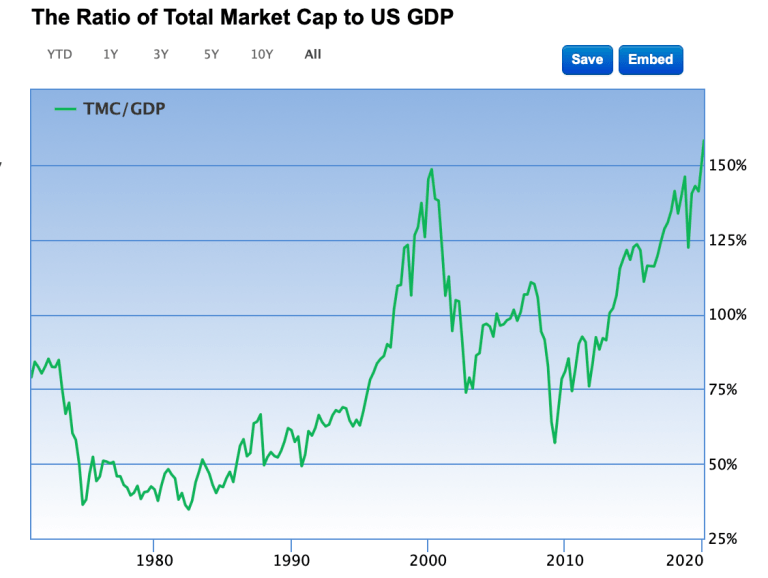

Right now, that is the quickly fracturing Democrats, who are staring at a revolt to Bernie Sanders that doesn’t sit with Wall St. at all.

It’s also obvious that Bloomberg is animated by personal animus towards Donald Trump that I suspect is as much about Mike’s ego as it is his desire to protect Wall St. from having any of its dirty laundry aired during a Trump 2nd term.

Because with the failure to convict Trump in the Senate those that were behind that coup attempt are now uniquely exposed to his retribution. And that trail of tears for all involved leads right back up to Hillary Clinton’s poisoned garden of a 2016 presidential bid.

With the Democratic presidential field a uniquely inept mix of the hopeless and insane Bloomberg using saturation advertising to buy himself wins in delegate-rich red states with weak Democratic parties like North Carolina, Florida and Texas is a good strategy, if he was interested in winning.

But he’s not. He’s running to clear the field for Hillary.

Because the fight over these early states are as much about splitting the delegate count as possible, to strip Bernie Sanders of his chance at the nomination. Hillary is still angry at Bernie for challenging her in 2016.

She still wants another chance to fulfill her life’s ambition and if she can screw over all the men that she feels denied her that then it will be all the sweeter when it happens.

Because, honestly, Bloomberg isn’t interested in being president anymore than I am. He’s 78. He’s not campaigning. What he’s doing is a pantomime of a campaign covering for a very sophisticated form of campaign finance evasion.

And he’s doing it to figure out what is necessary for a ‘centrist’ Democratic candidate to say (and where) to steal electoral college votes from Donald Trump in November.

Bloomberg is spending this money today knowing that a targeted campaign which can figure out how to undermine Trump where he is strong can shift the map enough to sneak out a victory.

So Mike will spend more than $1 billion as an in-kind contribution to the DNC in the form of campaign advertising to get this done.

Because, let’s get serious here for a second. None of the candidates, including Bernie Sanders, has a hope in hell of beating Trump this fall. Any mistakes Trump’s made dwarf the basic message that he believes in the U.S. in a way that is genuine, even that vision of America is flawed.

The wizards at the DNC know this. Impeachment was their last real hope. That’s why it was rushed through and so shoddily done, they didn’t have anything substantive. And all it did was cement Trump’s base to him more thoroughly than it was before.

Their best shot is running a moderate who can out-Trump Trump on the issues and raise a ton of money along the way for 2024 while retaining some control over the party proper.

The intention is to hoover up delegates, confound the map and throw up roadblocks to Bernie. This paves the way for Hillary’s emergence at a brokered convention to hand her the rematch she, Wall St. and the DNC want.

The messaging has already begun. Drudge ‘broke’ the story the other day about Bloomberg being open to Hillary as his running mate. Oh please! It’s the other way around.

And I’ve been running that story since October. Tulsi Gabbard unmasked Hillary’s manipulating events no-to-subtlety.

It’s clear the DNC want Hillary and another beta-male, Pete Buttigieg, as her running mate.

So, less than 48 hours after Drudge ‘breaks’ this story, video of Bloomberg just happens to show up and go viral showing him saying disparaging things about farmers and metalworkers.

To top it off, he wants to save healthcare by letting old people die.

We all know Mike hates poor people. He’s a geezer auditioning for the top job in the U.S. who hates old people. He’s a thorough authoritarian and corporatist whose disdain for the plebiscite is palpable.

Nothing says U.S. Presidential material like the blatant disregard for human suffering. On second thought, maybe Mike is the perfect candidate?

All of this was known before, so why these things now?

These videos and quotes are out there to undermine him, casting him in the role of the out-of-touch oligarch.

This is designed to outrage the Deplorables. It’s designed to put a cap on Mike’s likability. It gives Hillary a wedge to drive in and say, “No, Mike you can be MY running mate!”

Mike Bloomberg: billionaire, entrepreneur, media mogul, three-time Mayor of New York, bond vigilante… beta-cuck.

So thoroughly Hillary.

This way, he can have his turn as the front-runner, rising far enough on his money to earn some delegates and ensure a brokered convention. Then hand them to Hillary as a gracious peace offering.

This is about manufacturing Hillary as the unity candidate of a failing Democratic Party while sidelining Bernie in the process. That’s the game plan folks.

It’s not tough, honestly.

If it wasn’t all so painfully obvious it would almost be clever. But it’s not because these people simply don’t understand why no one likes them.

Because they suck.

Bloomberg, Hillary, Biden, Warren, Buttigieg, Booker, Harris and the rest of the crazies, including Bernie, they all suck. Bernie may be honest that he’s a Commie, but that’s what makes him un-electable, if a little more likable.

And for 2020, the DNC would rather roll the dice with two-time loser Hillary, ensuring a candidate acceptable to Wall St. wins, than put Bernie up as the nominee.

Because no matter what happens the Democrats become the Commie and Crazy-Cat Lady party with Bernie as the nominee. And that creates a clear delineation between them and the Republicans.

But, that’s the worst possible result. Because, the most important thing to Bloomberg, Hillary and those they represent is that the illusion of choice between globalist dirtbags remains in place. This is the true face of Democracy in the U.S.

That’s the key to understanding the game he and Hillary are playing.

And once you see that for what it is there’s no unseeing it.

If Bernie sees it clearly, then he will take his Bros, extend his hand to Gabbard and run an independent campaign to split the Blue Wall and destroy these people for real.

If he doesn’t then he’s the same feckless schmuck I pegged him to be in 2016.

Either way, this is now Hillary’s nomination and Bloomberg is the latest goat on its way to her altar.

* * *

Join My Patreon if you want to join the cool kids who see the world differently. Install the Brave Browser if you want to take control over your data and internet experience.

Tyler Durden

Tue, 02/18/2020 – 11:05

via ZeroHedge News https://ift.tt/37HHVgR Tyler Durden