Global Stocks Tumble, Futures Slide To One Month Low As Recession Fears Rise

Global markets slumped, S&P futures dropped and European bourses tumbled as the MSCI world index dipped 0.3% to its lowest since Sept. 5, after shedding 0.83% in the previous session, after the US manufacturing ISM tumbled to more than a decade low, sparking worries a recession may now be unavoidable as the fallout from the U.S.-China trade war spreads to the U.S. economy, whose slowdown would remove the last remaining bright spot in the global economy just as Europe is falling back into recession.

S&P index futures retreated with Asian shares as miserable manufacturing data from the world’s largest economy continued to reverberate around markets. The dollar advanced. The S&P Emini dropped to 2,920, the lowest level since September 4; one day earlier the S&P 500 lost 1.23% to hit four-week lows after a disastrous ISM print.

Markets had been expecting the index to rise back above the 50.0 mark denoting growth: “Historically, equity returns are worst when the ISM manufacturing drops from levels below the 50 threshold,” Patrik Lang, head of equity research at Julius Baer. “Uncertainty around the US-China trade war is obviously the main reason for the weakness, with companies exposed to global trade increasingly putting off investment decisions.”

European shares opened lower, with London stocks lagging the most on fresh Brexit drama. The pan-European STOXX 600 index was down almost 1 percent.

European stocks tumbled, the Stoxx 600 sliding more than 1%, with all sectors in the red led by miners, construction and chemical producers, falling 1.4% or more. The gauge slid for a second day after reaching a one-year high on Monday. The Basic Resources Index (SXPP) dropped for a third day, losing as much as 1.8%, as sentiment continues to sour following the string of poor data released on Tuesday: diversified miners all fell with BHP Group -1.7%, Anglo American -1.7%, Rio Tinto -2%, and Glencore -1.4%. The FTSE 100 was among the worst performers after PM Johnson issued a hard Brexit ultimatum to the EU and prepared to announce his final Brexit offer. Bunds drifted lower, peripheral spreads trade around the tightest levels of the week as curves continue to bear steepen.

Adding to investor anxieties, European companies are set for their worst quarterly earnings in three years as revenue drops for the first time since early 2018, according to the latest Refinitiv data.

“Our base case is that trade tensions will remain elevated, and we expect global growth to slow in 2020 to its slowest pace since the global financial crisis,” said Mark Haefele, chief investment officer at UBS Global Wealth. “We don’t rule out a worsening of the trade situation over the next six to 12 months.”

Earlier in the session, Asian stocks also dropped, with the MSCI ex-Japan Asia-Pac index dropping 0.8%, led by material and technology firms, as investors pared exposure to risk assets following dismal U.S. factory data and violent protests in Hong Kong. All major markets in the region were down, with Singapore and Indonesia leading declines, Australian shares falling 1.5% and South Korean shares shedding 1.95%. China markets are closed for a one-week holiday. Japan’s Nikkei slid 0.5% and the Topix dropped 0.4%, dragged by electronics makers including Keyence and Sony. Automakers also fell after weak U.S. auto sales in September.

While markets in China and India were closed for holidays, Hong Kong’s Hang Seng Index declined 0.2%, as Tencent Holdings and HSBC Holdings weighed. The index fell as much as 1.2% in early trade. On Tuesday, Hong Kong police shot a teenage protester, the first to be hit by live ammunition in almost four months of unrest in the Chinese-ruled city. Protesters and police battled across the city in some of the most serious clashes since widespread unrest began in June.

Adding to tensions in Asia, North Korea carried out at least one more projectile launch on Wednesday, a day after it announced it will hold working-level talks with the United States at the weekend. Japanese Cabinet Minister Suga said the launch did not directly impact Japan but one North Korean ballistic missile landed inside the Exclusive Economic Zone (EEZ) and one outside. Japanese PM Abe condemned the North Korea launches and added that it violates UN resolutions. Further, Japanese PM Abe will hold a meeting of the National Security Council to decide how to respond to the projectile firings. In terms of details, South Korean Defence Ministry said the missiles launched by North Korea have a range of circa 1300km and was likely launched at a higher apogee to decrease range and could have been fired from a submarine. Japan has not yet determined whether North Korea’s missiles were Submarine-launched ballistic missile and notes it may have been one missile which split into two. The White House said it is aware of the launch and is monitoring the situation.

In rates, yesterday’s early hours Rates selloff is all but a distant memory now, as a disastrous US ISM print has again kicked-off another “global growth scare” that is rallying Bonds / havens, as Nomura’s Charlie McElligott writes. Eurozone bond yields inched up after another speech from outgoing ECB chief Mario Draghi calling for fiscal stimulus to boost the region’s sluggish economy.

The recent poor data lifted the Fed funds rate futures price sharply, with the November contract now pricing in about an 80% chance the U.S. Federal Reserve will cut interest rates on Oct. 30, compared to just over 50% before the data. Even so, the dollar rebounded to fresh two years highs after sliding in Tuesday’s session. The index that measures the greenback against a basket of peers was up 0.16%.

Elsewhere in FX, the yen rose to 107.7 from Tuesday’s low of 108.47. The euro fell 0.15% to $1.0915 EUR while the Australian dollar traded at $0.6693, having hit a 10-1/2-year low of $0.6672 the previous day after the Reserve Bank of Australia cut interest rates and expressed concern about job growth.

In commodities, gold rose to $1,479.13 per ounce from a two-month low of $1,459.50 hit on Tuesday on the back of a robust U.S. dollar. The weak U.S. data pushed oil prices to near one-month lows, although a surprise drop in U.S. crude inventories helped them to rebound. Brent crude futures rose 0.2% to $59.01 a barrel, after hitting a four-week low of $58.41 on Tuesday, while West Texas Intermediate crude gained 0.69% to $53.99 per barrel after hitting a one-month low of $53.05.

Expected data include mortgage applications and ADP employment change. Acuity Brands, Lamb Weston, Lennar, and Paychex are among companies reporting earnings.

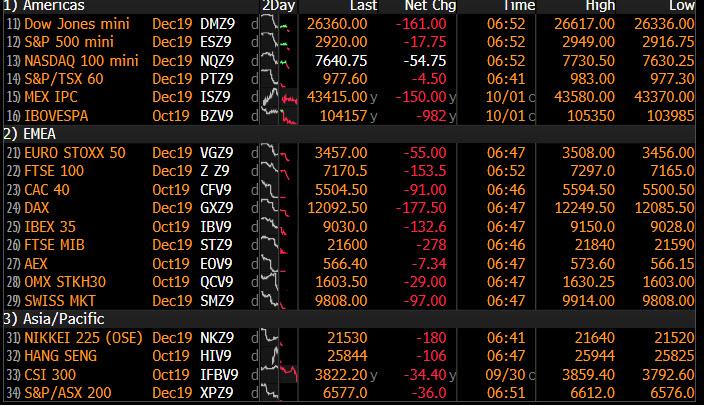

Market Snapshot

- S&P 500 futures down 0.4% to 2,926.50

- STOXX Europe 600 down 1% to 383.94

- MXAP down 0.6% to 155.99

- MXAPJ down 0.8% to 497.74

- Nikkei down 0.5% to 21,778.61

- Topix down 0.4% to 1,596.29

- Hang Seng Index down 0.2% to 26,042.69

- Shanghai Composite down 0.9% to 2,905.19

- Sensex down 0.9% to 38,305.41

- Australia S&P/ASX 200 down 1.5% to 6,639.94

- Kospi down 2% to 2,031.91

- German 10Y yield rose 2.5 bps to -0.539%

- Euro down 0.2% to $1.0914

- Italian 10Y yield rose 3.4 bps to 0.518%

- Spanish 10Y yield rose 1.5 bps to 0.167%

- Brent futures down 0.3% to $58.73/bbl

- Gold spot up 0.1% to $1,480.55

- U.S. Dollar Index up 0.2% to 99.32

Top Overnight News from Bloomberg

- Boris Johnson is poised to issue an ultimatum to the European Union on Wednesday: negotiate Brexit on his terms within the next nine days, or face a no-deal divorce. A key EU player has already rejected the prime minister’s plan

- The ECB began its official transition to a new benchmark short-term interest rate Wednesday, as global regulators move away from tainted Libor gauges. The new rate, known as ESTR, which reflects overnight borrowing costs of banks in the monetary bloc, fixed at -0.549% for Oct. 1, the central bank said on its website

- Germany’s five leading research institutes slashed their forecasts for economic growth, as manufacturers in Europe’s biggest economy struggle with waning global demand and lingering trade disputes. GDP will expand by 1.1% in 2020, they predicted, down from 1.8% forecast in April

- Japan’s struggling government bond market shows just how vulnerable it can be to the whim of the central bank. JGBs generated the smallest return among all 46 sovereign debt markets tracked by Bloomberg in the third quarter, gaining less than 0.6% amid a global bond rally. They lost 1.1% in September

- North Korea fired what appeared to be a ballistic missile designed for submarines, testing President Donald Trump’s tolerance for weapons tests just hours after agreeing to restart stalled nuclear talks with the U.S.

- European Union governments have discussed giving the U.K. a major concession on Brexit by possibly time-limiting the contentious backstop mechanism for the Irish border, two people familiar with the matter said. A time limit would only be on offer if the U.K. accepted a backstop which would keep Northern Ireland in a customs union with the bloc

- Brazilian President Jair Bolsonaro’s proposal to overhaul Brazil’s pension system and rein in public debt passed a first of two votes on the senate floor late on Tuesday.

- North Korea fired what appeared to be a submarine-based ballistic missile off its eastern coast Wednesday in an escalation that came just hours after saying it would resume stalled U.S. nuclear talks

- The European Central Bank begins its official transition to a new benchmark short-term interest rate Wednesday, as global regulators move away from tainted Libor gauges

- Ukrainian President Volodymyr Zelenskiy said he never met or talked by phone with Donald Trump’s personal lawyer Rudy Giuliani, whose contacts in Ukraine are part of an impeachment inquiry in Washington

Asian equity markets took the cue from the negative lead on Wall Street where the major indices declined on the first day of Q4 after US ISM Manufacturing PMI contracted to its worst level since June 2009. Losses in ASX 200 (-1.5%) accelerated after NAB shares tumble 3% amid an additional AUD 1.2bln charge relating to increased provisions for customer-related remediation, whereas upside in the Nikkei 225 (-0.5%) was limited by the unfavourable currency flow, whilst Toyota shares slumped due to poor North American vehicle sales and Sony remained near the bottom of the index after cutting streaming prices ahead of Google’s Stadia launch. Elsewhere, the Hang Seng (-0.2%) climbed off lows after returning from a long weekend, albeit oil giants remained pressured after Norway’s Sovereign Wealth Fund received the green light to sell USD 6bln worth of oil and gas stocks, meanwhile upside in the index was capped by the ongoing situation in Hong Kong as protestors vowed to step up action after a police officer shot a teenager yesterday. Meanwhile, South Korea’s KOSPI (-2.0%) was pressured after North Korea fired short-ranged projectiles towards the East Sea. As a reminder, Mainland China and Indian markets were closed today due to public holidays.

Top Asian News

- U.K. Protests Slows Down Mainland Visitor National Day Arrivals

- Israel Plans to Boost Supply in Landmark Gas Deal With Egypt

- Bears Retreat From Turkey Stocks as Real Returns Draw Buyers

- SoftBank Debtholders Hope For More Caution After WeWork Woes

Major European Bourses (Euro Stoxx 50 -1.3%) are firmly lower, amid a lack of fresh bearish fundamentals, as the region more takes its cue from a negative AsiaPac lead; sentiment was downbeat overnight following Wall Street underperformance after bad US ISM Manufacturing data, the latest missile test launch out of North Korea and ongoing tensions in Hong Kong. Looking ahead, at 15.00 BST the WTO is expected to announce its decision on the US’ right to retaliate to against the EU over their Airbus (-0.8%) subsidies, a potential source of impetus. Prior reports have suggested the ruling will allow the US to impose tariffs on roughly USD 8bln of EU imports on a wide range of products. Sectors are also firmly in the red; Materials (-2.1%), Industrials (-1.7%) and Energy (-2.0%) (despite slightly higher crude prices) are leading the sectors lower while Consumer Staples (-0.9%), Telecoms (-0.8%) and Utilities (-1.0%) hold up comparatively better. In terms of individual movers; Flutter Entertainment (+18.4%) shot higher on the news of the co.’s merger with Stars Group, pulling other betting names higher such as William Hill (+4.3%) higher in tandem. Nestle (-0.2%) shares are being supported by the Co.’s sale of its Skin Health unit. Tesco (+0.6%) managed to reverse early losses and now trades higher, after the co. released decent earnings premarket, but its CEO resigned. Pernod Ricard (+0.7%) is higher after being upgraded at Jefferies. Luxury names including LVMH (-2.0%) and Richemont (-2.1%) underperformed the market, with bad retail data out of Hong Kong (the largest decline on record) weighing.

Top European News

- ECB Begins Transition of Benchmark Short-Term Interest Rate

- German Fiscal Stimulus Already Creeping In, Whatever Merkel Says

- Lenders Selling Loan Exposures to Thomas Cook at 90% Discount

- Metro Bank Founder Hill to Leave Board Early as Stock Slides

In FX, the Dollar has clawed back some losses following yesterday’s abrupt U-turn from new 2019 highs in the DXY with the index bouncing firmly ahead of 99.000 towards 99.420, as attention switches to NFP via ADP and hopefully better news from the services side of the US economy after the more pronounced ISM manufacturing activity slowdown. However, the Greenback is also benefiting from renewed weakness in rival currencies and general risk aversion awaiting the WTO ruling on the extent that the US can counter EU subsidies for Airbus and repercussions in Brussels after UK PM Johnson delivers his latest/last Brexit proposal.

- CHF/GBP – The clear G10 underperformers, with the Franc deflated on weak Swiss CPI grounds, further SNB guidance from Maechler expounding the virtues of NIRP allied to direct FX intervention and the KOF cutting growth and inflation estimates, while the Pound has been hit by a dire UK construction PMI and the ongoing political/Irish border wrangling. Consequently, Usd/Chf is back up near parity and Cable has recoiled from 1.2300+ towards Tuesday’s low only a few pips away from the big figure below, with the focus turning to Johnson’s appearance at the Tory Party conference from noon.

- NZD/AUD – The Aussie and Kiwi are also unwinding/reversing post-US ISM manufacturing gains, as Aud/Usd returns to ytd lows circa 0.6670 and Nzd/Usd retests bids protecting 0.6200 alongside YUAN depreciation in holiday-thinned trade.

- EUR/CAD – Holding up a bit better than most major counterparts, but some way off best levels vs the Buck as the single currency failed to sustain momentum through 1.0950 and Loonie could not breach 1.3200 amidst confirmation of more German GDP forecast downgrades and a downturn in crude prices.

- JPY – Bucking the broad, if not overall trend, safe-haven demand/positioning has kept the Yen elevated between 107.90-55 against the Dollar, and from a chart perspective the 100 DMA in Usd/Jpy (now around 107.76) remains pivotal.

- EM – Rand in the spotlight ahead of ANC judgment on the latest SA growth plan and following the SARB’s semi-annual MPR, with some technical support coming from a pull-back from 1 month peaks in Usd/Zar around 15.4000 to almost 15.3000 at one stage.

- Goldman Sachs economists say the RBA’s internal economic model suggests the Central Bank will need to release a USD 200bln QE programme to achieve its unemployment and inflation targets. (AFR)

In commodities, the crude complex is mixed, giving away the majority of overnight gains, where the complex bounced from post US ISM Manufacturing data lows helped by a bullish headline API print, as risk sentiment took a turn for the worse at the European open. WTI and Brent currently sit just below the USD 54.00/bbl and USD 59.00/bbl levels respectively. To the downside technicians will be eyeing the USD 53.00/bbl handle in WTI; yesterday’s low and the late August/early September base. After yesterday’s choppy session, which saw Gold price swings of north of USD 40/oz, the precious metal is lacklustre and seemingly awaiting further macro drivers in the form of today’s ADP employment report, ISM Non-manufacturing tomorrow and NFP on Friday. In fitting with fragile risk sentiment, Copper remains under pressure as global growth concerns linger, albeit the red metal is off yesterday’s post ISM Manufacturing data lows.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -10.1%

- 8am: Fed’s Barkin Speaks at a Conference on the Rural Economy

- 8:15am: ADP Employment Change, est. 140,000, prior 195,000

- 9am: Fed’s Harker Speaks at Community Banking Conference

- 10:50am: New York Fed’s Williams Speaks in San Diego

DB’s Jim Reid concludes the overnight wrap

The warning signs that we got from the Chicago PMI data on Monday turned out to be correct with yesterday’s shocking ISM manufacturing print being the talk of the town in markets. Indeed the headline was the decade-low September print of 47.8, a 1.3pt decline from August and also well below expectations for a 50.0 reading. In fact it was below even the lowest economist’s forecast on Bloomberg. The details were arguably even more concerning though. New orders (47.3 vs. 47.2 previously), employment (46.3 vs. 47.4) and production (47.3 vs. 49.5) all either remained soft or deteriorated further.Only 3 of the 18 industries in the survey reported growth, the lowest figure since 2009. In addition, the leading indicator new exports component slumped to 41.0. The last time it was lower was during the depths of the GFC in March 2009, and if we look at the full 380 months’ of history, this index has only been lower than it is right now on 6 occasions.

We updated our simple equity versus PMI model last night following the latest slug of data and unsurprisingly the equity markets in Europe and the US now appear overvalued on this metric. This is most severe in Germany (20%), Italy (16%) and the Eurozone (14%) as a whole. The S&P 500 is 6% overvalued relative to the latest ISM however interestingly it’s the reverse in Asia where the Nikkei and Shanghai Comp are actually 8% and 13% cheap respectively. For Europe it’s worth noting that current equity market pricing imply PMIs around 50 while the S&P 500 implies an ISM of 50.4. So pricing bad news but not this bad. Although this analysis is based on the historical relationship between PMIs/ISMs and equities it’s fair to say that rarely has there been such a long standing and wide gap between manufacturing and services. So there is still hope if services buck the historical trend and hold up but there have been cracks of late. So all eyes on tomorrow’s services readings.

What is hard to argue with is that the global manufacturing sector is now very much in a recession. This now makes an already important Fed meeting later this month even more of a crucial risk event. With that in mind it’s worth noting that there are only 20bps of cuts priced in for this month’s meeting, albeit up from 14.5bps on Monday. Markets do seem to be having a somewhat hard time pricing in a more dovish Fed, though the pricing could also reflect expectations for another IOER adjustment. Our US economists do expect a cut this month.

By the end of the session yesterday, the S&P 500 was down -1.23%, off -1.75% from its pre-ISM highs. The NASDAQ (-1.13%) and DOW (-1.28%) were down similar amounts. In Europe the STOXX 600 (-1.31%) turned in its worst performance in six weeks. The domestic PMI revisions hardly made for any more comfortable reading on the continent (more on those below).

Meanwhile the trend in rates prior to the ISM was for yields to move higher following the big sell-off in JGBs just over 24 hours ago. That quickly reversed once the data was out with 2y and 10y Treasuries closing down -7.8bps and -2.9bps respectively, and -13.4bps and -12.0bps off the intraday highs. President Trump tweeted shortly after the data came out and called the Fed “pathetic” and that “they don’t have a clue” however that didn’t move the dial in markets. The curve steepened +5.5bps to 8.9bps last night and sits at 10.4bps this morning while in Europe Bunds retraced a +6.1bps selloff to end the session just +0.7bps higher. Elsewhere, the end result in credit was for US HY spreads to widen +8bps while the risk off helped Gold (+0.55%) and safe haven currencies like the Yen (+0.36%) and Swiss Franc (+0.55%).

Separate from the macro news, stock markets were also jolted yesterday by the announcement by Charles Schwab Corp (-9.74%) that they will eliminate online trading commissions for stocks, ETFs, and options. The prominent brokerage is locked in a price war with its main competitors as more and more assets shift toward lower-fee and passive investment strategies. E*Trade Financial (-16.43%) and TD Ameritrade (-25.83%) both saw steep selloffs in response.

This morning in Asia equity markets have followed the US lower, with the Nikkei (-0.65%) and the Hang Seng (-0.54%) both losing ground. South Korea’s KOSPI (-1.35%) was one of the worst performers, which came as the country’s military said that it detected a North Korean missile launch that flew 450km. It comes just hours after North Korean state media said that they would start further denuclearization talks with the US this weekend. Meanwhile 10yr JGBs are down -1.9bps at time of writing, 10yr USTs back up +2.5bps, with S&P futures up +0.20%.

Onto Brexit where there’s been a lot of developments over the last 12 hours with more likely today. A Bloomberg story as London went home caused a bit of a stir yesterday, which suggested that the EU is considering accepting a time limit on the Irish backstop, though it did later emphasise that the deliberations have only been between EU capitals, not with the UK. An EU spokesperson later said that the EU are not considering this, while an Irish government spokesman said it hadn’t been discussed.

Mr. Johnson will give a key speech today at the Conservative Party conference where more Brexit news will follow. It’s expected firm Brexit proposals will be sent to the EU soon after the conference ends – possibly within 24 hours. So a potentially big couple of days ahead. The overnight reporting suggested that he will offer a plan which will include “two borders for four years;” with a time-limited backstop for Northern Ireland that is separate from the UK. If so and as mentioned above, it is unlikely that the EU will agree to such a plan, which would require customs checks between Northern Ireland and the Republic of Ireland. The Irish finance minister has already been quoted as saying that if this is the plan then “that in itself is bad faith”. So today could be the beginning of the end for any hopes of a deal ahead of the EU council meeting in two weeks.

Back to the data yesterday, where the PMIs in Europe where little changed at the final revision. Indeed the Eurozone reading was nudged up 0.1pts to 45.7 with Germany revised up 0.3pts to 41.7 but France revised down 0.2pts to 50.1. The countries outside of Germany and France were within the margin of error of what was implied by the flash PMIs while the US reading was revised up 0.1pts to 51.1 and contrasting with the more widely followed ISM equivalent. Overall we counted a total of 35 manufacturing PMIs/ISMs around the globe yesterday and 18 were below 50 with the unweighted average being 48.9. Award for the highest reading went to Greece! And the lowest South Africa.

Away from the data and on to the policy front, where there was a slew of speeches from Fed and ECB officials yesterday, but almost no new substantive information. In the US, Vice Chair Clarida and Governor Bowman both spoke but avoided talking about the economy or rates. Chicago President Evans reiterated his recent (surprising) hawkish shift by repeating that he expects policy to be on hold “for some time.”

As for the ECB, outgoing President Draghi spoke again about the need for fiscal support and cited an argument we used in our long term study that fiscal is much more powerful when monetary policy is close to the effective lower bound (see pages 47-51 of the note here ). Meanwhile Bundesbank President Weidmann pushed back against the Draghi’s recent call for unanimity. Last week, Draghi had said in testimony that “the form in which dissent is made known is very important (…) in order not to undermine the effectiveness of our decisions.” Weidmann yesterday criticised that argument, albeit without singling Draghi out by name, saying that “intensive discussions” regarding policy, including QE, are “absolutely necessary.” Incoming President Lagarde will have her hands full when she inherits the Presidency next month.

To the day ahead now which is a very quiet one for data releases with the only print due this morning being the September construction PMI in the UK, while in the US the September ADP employment change is due. The consensus for the latter is for a 140k print, following a 195k reading in August. Away from the data we’ve got scheduled comments from the Fed’s Barkin, Harker and Williams this afternoon.

Tyler Durden

Wed, 10/02/2019 – 07:38

via ZeroHedge News https://ift.tt/2ovZiAI Tyler Durden