A Debt Jubilee Of Biblical Proportions Is Coming… Are You Ready?

Authored by Nick Giambruno via InternationalMan.com,

Four thousand years ago, the rulers of ancient Babylon discovered a technique to stave off violent revolts.

In ancient times, people often became hopelessly indebted to their creditors. As debts mounted, social unrest would boil over, threatening the stability of the entire ruling system.

The rulers of the ancient world understood this dangerous dynamic.

Their solution was radical yet effective: enact widespread debt cancellation—a debt jubilee.

Debt jubilees acted as societal pressure release valves when no other options remained.

The practice spread throughout the ancient world and became codified in various civilizations.

For instance, the Book of Leviticus formalizes debt jubilees as the conclusion of a 49-year biblical cycle—seven cycles of seven years.

I believe this ancient practice is poised for a major comeback as government, corporate, and personal debt levels today have reached unsustainable heights.

The social, political, and investment implications will be profound.

Debt Jubilees: Redistribution, Not Wealth Creation

It’s important to note that debt jubilees do not create new wealth—they simply redistribute it.

Debt jubilees are government decrees that trigger massive wealth transfers, creating big winners and losers.

President Biden’s plan for student loan forgiveness marks the beginning of modern debt jubilees.

His student loan forgiveness plan is unprecedented. Unilateral executive action of this scale has never occurred during peacetime. Moreover, Congress, not the president, is supposed to make spending decisions of this magnitude.

Even Obama’s former chief economic advisor, Jason Furman, criticized Biden’s move, calling it:

“Pouring roughly half a trillion dollars of gasoline on the inflationary fire that is already burning—reckless.”

Beyond the inflationary impact—which I’ll address shortly—Biden’s student loan jubilee will set a precedent that will be hard to undo.

Consider how those who acted prudently feel.

Many avoided student debt by choosing less expensive career paths, cutting back on spending to pay for college without borrowing, or paying off their student loans entirely.

These people are probably feeling like suckers now.

Not only do they receive no relief, but they also face the burden of footing the bill for those whose loans will be forgiven.

I imagine these people will be angry and probably have considerable car, mortgage, and credit card debt, as many Americans do. So they will want debt relief, too… and I bet they will get it.

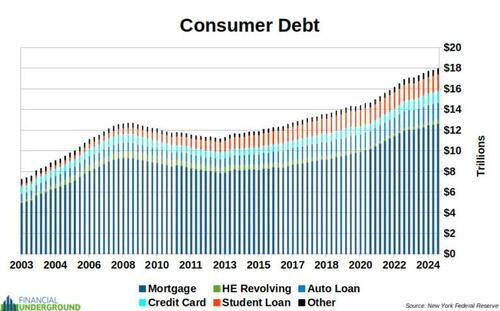

Amid rising prices, consumer debt is skyrocketing. It is at an all-time high of nearly $18 trillion, as seen in the chart below.

With interest rates rising recently, the cost of servicing this record debt is becoming unbearable for many.

As Americans hit their financial breaking points, I believe debt forgiveness demands will only grow louder—extending far beyond student loans.

All it takes is a President’s pen stroke to wipe out hundreds of billions in debt.

The student loan jubilee will set a powerful precedent.

I don’t think it will be long before we see a credit card jubilee, a car loan jubilee, or even a mortgage jubilee.

How will the government pay for all these jubilees?

Raising taxes enough to cover them seems improbable.

Issuing more debt to cancel other debts would be contradictory.

That leaves money printing as the only viable option.

This is why future debt jubilees will pour “gasoline on the inflationary fire that is already burning.”

But it’s not just consumer debt that’s unsustainable. The biggest problem is the US government’s federal debt—a much larger issue looming on the horizon.

The Federal Debt Endgame: A Coming Crisis

The US federal government has the largest debt in the history of the world—and it’s growing at a rapid, unstoppable pace.

In short, the US government is fast approaching its financial endgame.

Here’s why…

Today, the US federal debt has gone parabolic, amounting to over $36 trillion.

To put it in perspective, if you earned $1 per second 24/7/365—about $31 million per year—it would take over 1,148,531 years to pay off the US federal debt.

And that assumes the debt stops growing, which it won’t.

The growth rate is not even going to slow down. It’s going to increase exponentially.

The truth is, the debt will keep piling up unless Congress makes some politically impossible decisions to cut spending.

For example, tens of millions of Baby Boomers—about 22% of the population—will enter retirement in the coming years. Cutting Social Security and Medicare is a sure way to lose an election.

With the most precarious geopolitical situation since World War 2, defense spending is unlikely to be cut. Instead, defense spending is all but certain to increase.

Former Secretary of Defense Robert Gates recently said: “Barely staying even with inflation or worse is wholly inadequate. Significant additional resources for defense are necessary and urgent.”

In short, efforts to reduce expenditures will be meaningless unless it becomes politically acceptable to make chainsaw-like cuts to entitlements, national defense, and welfare while reducing the national debt to lower the interest cost.

In other words, the US would need a leader who—at a minimum—returns the federal government to a limited Constitutional Republic, closes the 128 military bases abroad, ends entitlements, kills the welfare state, and repays a large portion of the national debt.

However, that’s a completely unrealistic fantasy. It would be foolish to bet on that happening.

In short, the US government is trapped. It’s game over.

They have no choice but to “reset” the system—that’s what governments do when they are trapped.

How Will the US Reset the System?

Nobody knows for sure. But I’d bet a debt jubilee of biblical proportions will be a major part of it.

So then, how will the US government repudiate its impossible federal debt burden?

My guess is that they won’t be explicit. That would look too much like a default. It would destroy the role of the US as the center of the world’s financial system.

Given a choice, I don’t think the US government would choose immediate self-destruction. Since power does not relinquish itself voluntarily, we should presume they’ll decide to stealthily implement their federal debt jubilee through inflation.

Inflation benefits debtors, allowing them to borrow in dollars and repay in dimes.

And since the US government is the biggest debtor in the history of the world, it stands to gain the most from inflation.

Inflation: The Ultimate Debt Jubilee

That’s why I believe the federal debt jubilee will come in the form of a massive wave of inflation.

The coming debt jubilees could wipe out trillions in liabilities while unleashing previously unimaginable inflation.

That could trigger the largest wealth transfer in history.

Remember, debt doesn’t exist within a vacuum. It’s a liability for the borrower and an asset for the lender.

Those storing wealth in government currencies, bonds, and other paper assets will be the biggest losers.

Debtors and owners of scarce, unencumbered, hard assets will be the big winners.

It’s certainly not a just outcome.

Prudent savers shouldn’t have to pay for the excesses of debtors.

But notions of what is just or not didn’t stop Biden’s student loan jubilee—and they won’t stop the coming jubilees.

Prepare Now for the Coming Reset

Although it will be an unfortunate outcome for many people, there is simply nothing anyone can do now.

The debt levels have already reached a critical point, and the government may soon see jubilees as a politically expedient option.

That’s why it’s crucial to recognize the reality of this Big Picture and position yourself accordingly.

That means owning scarce and valuable assets that are not simultaneously someone else’s liability.

Crucially, this excludes fiat currency in bank accounts.

Remember, fiat currency is the unbacked liability of a bankrupt government.

Further, once you deposit currency into a bank, it is no longer yours. Technically and legally, it is the bank’s property, and what you own instead is an unsecured liability of the bank.

In an era of jubilees in which debts are wiped clean, you won’t want to be on the other end of unsecured liabilities or IOUs of any kind.

I believe this “reset” could happen soon—and it won’t be pretty for many.

Most people have no idea how bad things could get—or how to prepare.

That’s why I’ve published a detailed guide called The Most Dangerous Economic Crisis in 100 Years: The Top 3 Strategies You Need Right Now. Click here to download the free PDF.

Tyler Durden

Tue, 12/24/2024 – 13:30

via ZeroHedge News https://ift.tt/EI9sNg0 Tyler Durden