Futures Slide Amid Fears WallStreetBets Will Again Steamroll Greenwich

Late last night when futures were sliding by 1% following Robinhood’s flipflop and its decision to allow trading of the most-shorted stocks after all which sent names such as GME, AMC and others soaring, and which now trade as a mirror image to the most popular hedge fund stocks…

… we joked that futures were sliding amid renewed fears that the short squeeze army was coming to streamroll the hedge fund capital of Greenwich in the latest chapter of the Wall Street vs Wall Street Bets battle.

ES -1% amid rising dread that WSB will steamroll Greenwich tomorrow

— zerohedge (@zerohedge) January 29, 2021

And while we were joking, this quickly became the dominant narrative overnight, with Reuters reporting this morning that “Wall Street set for weak open on hedge fund-retail battle“…

… as S&P futures and European stocks fell “as a Wall Street battle between hedge funds and retail investors” reversed yesterday’s furious rally, while risk appetite was also cooled by a row in Europe over COVID-19 vaccine supply.

And while S&P 500 futures recouped some ground in European trade after dropping as much as 1%, were down 0.5% as of 730am. Nasdaq 100 futures fell 0.7%. World stocks fell 0.4% towards three-week lows set in the previous session, and were heading for a weekly fall of more than 2%.

The stand-off between the daytrading hordes and short hedge funds comes after central bank and government stimulus have injected trillions in stimulus into stock markets creating the biggest bubble ever, encouraging involvement by retail investors, and making stocks extremely susceptible to a bubble burst.

“There’s fear in terms of the volatility,” said Derek Halpenny, head of research for global markets at MUFG. “Specific trades in pockets of the market can spread into the broader market.”

After shares in GameStop, AMC Entertainment and BlackBerry plunged more than 40% on Thursday after several online platforms imposed buying halts, they rebounded even more on Friday as Robinhood and Interactive Brokers eased the restrictions on Friday. GameStop shares nearly doubled and AMC Entertainment was up 55% in U.S. pre-market trade.

“Any hedge fund will be carefully looking at all their shorts after this week and regulators will look very carefully at collective retail trading,” Deutsche Bank analysts said.

In Europe, the Stoxx Europe 600 index declined, though it pared losses after data from three of the euro area’s largest economies suggested the region can avoid a deeper recession, while still facing headwinds from extended coronavirus lockdowns. Curiously, unlike the US, European shorts actually dropped perhaps as news that the short-squeeze army had been unleashed again was slow to cross the Atlantic. Swedish retailer Hennes & Mauritz AB fell after warning it’s still in “crisis mode,” with 40% of stores shut. British bootmaker Dr. Martens Plc jumped as much as 26% as it began to trade in London.

Delays in COVID-19 vaccine production have snowballed into a spat between Britain, the European Union and drugmakers over how best to direct limited supplies. AstraZeneca offered eight million more doses of its COVID-19 vaccine to the European Union, after it unexpectedly announced cuts in supplies last week. But the bloc said that was far short of what was originally promised, an EU official told Reuters on Friday.

Asian stocks fell for a fourth straight session on the last trading day of January, on track for the worst weekly loss since March. Chipmakers and suppliers were the largest drags on the regional benchmark, with Samsung Electronics falling 2%, TSMC down 1.7% and Tokyo Electron slumping almost 5%. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1%, on course for a weekly loss of 4.4%. Japan’s Nikkei fell 1.9%, recording its first weekly loss of the year. Better-than-expected earnings in some Asian semiconductor-related companies failed to boost sentiment. Korean chipmaker SK Hynix’s fourth-quarter earnings more than tripled and beat estimates, and in Japan, Advantest’s operating income also exceeded expectations as the testing device maker raised its forecast. Chinese stocks slid as a money-market rate in China surged to the highest in almost six years, reflecting tight liquidity in the financial system. Vietnam shares rebounded from its worst day since 2001 while Philippine stocks fell most since August.

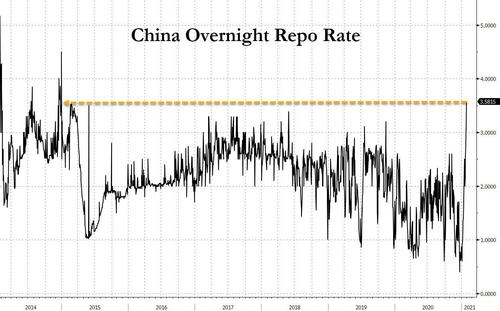

The PBOC injected 100 billion yuan into the financial system on Friday, following a week of reducing liquidity, which had sparked concerns the central bank was in fact tightening monetary policy. That,however, proved insufficient to lower overnight repo rates, which have soared to a 5 year high.

In FX, the Bloomberg Dollar Spot Index advanced, and was set for its best week since October. The greenback climbed versus most peers; the Norwegian krone reversed a loss after Norges Bank announced a higher rate of krone buying in February. The euro also inched higher after reversing an earlier loss, while German bonds declined, with the yield curve steepening after ECB policymaker Gabriel Makhlouf said an interest-rate cut isn’t warranted right now. Aussie heading for its worst week since October, pushed down by drops in stock futures and oil; sales versus the kiwi over vaccine concerns also weighed on the currency. The yen fell to its lowest in nearly two months on flow- driven trades.

In crypto, Bitcoin soared above $37,000, after Elon Musk mentioned the cryptocurrency in his bio page on Twitter

In rates, Treasuries were on the back-foot into early U.S. session, following wider losses across core European bonds as bets for monetary easing fade following comments by ECB’s Gabriel Makhlouf. Yields were higher by up to 3bp across long-end of the curve, steepening 2s10s, 5s30s by 2bp-3bp; 10-year yields around 1.07% — back to little changed on the week after breaching 1% Wedensday and Thursday — with bunds, gilts trading cheaper by 0.5bp and 1bp in the sector. Bunds underperform after ECB’s Gabriel Makhlouf says that an interest-rate cut isn’t warranted right now.

Market Snapshot

- S&P 500 futures down 0.8% to 3,750.25

- MXAP down 1.4% to 204.13

- MXAPJ down 1.1% to 686.56

- Nikkei down 1.9% to 27,663.39

- Topix down 1.6% to 1,808.78

- Hang Seng Index down 0.9% to 28,283.71

- Shanghai Composite down 0.6% to 3,483.07

- Sensex down 1.1% to 46,337.49

- Australia S&P/ASX 200 down 0.6% to 6,607.36

- Kospi down 3.0% to 2,976.21

- Brent futures up 0.5% to $55.80/bbl

- Gold spot up 0.5% to $1,851.88

- U.S. Dollar Index up 0.3% to 90.71

- German 10Y yield rose 5.6 bps to 0.509%

- Euro little changed at $1.2115

- Italian 10Y yield fell 3.5 bps to -0.525%

- Spanish 10Y yield rose 21.9 bps to 0.089%

Top Overnight News from Bloomberg

- Cargill Inc and Deutsche Bank AG are among a group of major foreign companies under probe in Taiwan for speculating on the surging local currency last year, hindering the central bank’s efforts to rein in a rampant foreign-exchange market

- Three of the euro area’s four largest economies rounded off the pandemic year suggesting the region can avoid a deeper recession, while still facing headwinds from extended coronavirus lockdowns. GDP in Spain unexpectedly increased 0.4%, defying expectations for a 1.4% drop. In another surprise, Germany also recorded growth, while output in France fell less-than-forecast after consumer spending rebounded sharply in December

- Italy’s former premier Matteo Renzi, who triggered the collapse of Italy’s government, said he wants a new cabinet soon to avoid new elections

- Beijing is so fearful of speculative manias that authorities are creating the biggest liquidity crunch in more than five years, roiling Chinese stocks and bonds and freezing a key funding market

A quick look at global markets courtesy of Newsquawk

Asian equity markets steadily deteriorated as the initial emboldenment from the rebound on Wall St, where the major indices atoned for their recent weakest performance in 3 months, gradually faded on month-end and with overnight newsflow dominated by earnings results and data releases. ASX 200 (+0.6%) failed to sustain early gains and finished negative despite better-than-expected private sector credit data with the downturn led by underperformance in the financials and mining sectors, while Nikkei 225 (-1.9%) was lifted at the open amid a weaker currency but then reversed course as participants also digested a heavy slate of earnings and economic data including mixed Tokyo inflation numbers and a larger than anticipated decline for Industrial Production. Hang Seng (-0.9%) and Shanghai Comp. (-0.6%) were initially kept afloat after the PBoC injected liquidity into the market, although the gains were later pared as today’s CNY 98bln net injection failed to allay liquidity and policy tightening concerns which saw money market rates continue to creep higher to push the overnight repo rate to its highest since 2015. Finally, 10yr JGBs were lower following similar pressure in T-notes and after the BoJ Summary of Opinions pointed to the likelihood of a more flexible approach to yield curve control in the March review such as permitting the 10yr yield to trade at a wider range around the 0% target which would effectively allow yields to increase more before the central bank steps in.

Top Asian News

- Hong Kong’s Economy Contracts Record 6.1% in Pandemic Year

- GameStop, AMC Trades to Resume at Chinese Online Brokers

- Taiwan’s GDP Growth Outpaces China’s for First Time in 30 Years

- Bank of Japan Paves Way to Buy Less Shorter-Term Debt Next Month

European equities see losses across the board (Euro Stoxx 50 -0.7%), but have clambered off worst levels after the downbeat APAC reverberated into Europe. US equity futures meanwhile remain pressured with more pronounced losses seen in the tech-heavy NQ (-1.6%) vs the value-driven RTY (-0.4%) – with month-end flows also to factor in amidst the heat the earnings season. Macro developments for stocks have been scarce during the final European session thus far as traders look ahead to the US open, with the Reddit hype likely to steal the limelight again as trading platforms are lifting trade bans on Gamestop (+107% pre-market), AMC (+62% pre-market), albeit further platform issues will be watched for given the sheer volumes expected. On this note, US Senate panel is to hold a hearing on the current state of the stock market in wake of the GameStop situation, while reports also noted that the New York AG office is reviewing Robinhood app activity. Back to Europe, sectors are mostly lower with no real risk bias telegraphed, whilst the breakdown sees Telecoms and Autos outpacing whilst Healthcare, and Finance resides on the other end of the spectrum. The gains in the Telecoms sector are led by heavyweights Ericsson (+9%) post-earnings, whilst Nokia (+4.9%) cheers the trading lift ban imposed by various retail platforms. In terms of individual movers, AstraZeneca (-1.1%) is weighed on by threats of legal action by the EU regarding the vaccine dispute. Daimler (+1%) underpins the Auto sector after reporting results significantly above guidance and market expectations. Other earnings related movers include BBVA (-2.6%), Caixabank (+2.5%) and JC Decaux (+2.8%).

Top European News

- U.K. Slammed by Experts Over ‘Neo-Victorian’ Food Poverty

- EU Raises Pressure on AstraZeneca Over Covid Vaccine Shortage

- Daimler, BMW and VW Get Little Credit for All the Cash Piling In

- Ericsson Holds On to 2022 Goals Even as Investors Want More

In FX, little sign of salvation or even remote support for the Yen via decent 1.2 bn option expiry interest between 104.40-45 in Usd/Jpy as the pair extends its breach of the 100 DMA through 104.50 to circa 104.94 and well beyond well 104.75, which was the higher from December 2nd 2020. Clearly, 105.00 beckons next before a virtual double bottom from mid-November last year that might offer a bit more in the way of respite (105.14 on November 16 and 105.15 on the preceding Friday). Meanwhile, upward momentum has also been building in Eur/Jpy above 126.50 to just over 127.00 amidst month end tailwinds from rebalancing models flagging a moderate Dollar sell against most majors, bar the Yen, and at least one bank pointing to the obvious attraction of killing 2 birds that the cross provides. Moreover, the Yen has hardly been helped by weaker than forecast Japanese IP or mixed Tokyo CPI data any more than the latest BoJ Summary of Opinions that highlighted rising deflation risks as reason for the Bank to enhance its easing stance.

- USD – Aside from the obvious assistance of Yen depreciation, the Buck is managing to stave off aforementioned sales for portfolio purposes due to safe-haven demand as broad risk sentiment sours again. However, the DXY remains capped below recent recovery highs close to 91.000 within a 90.780-520 range ahead of a final batch of US data to round off January and the first post-FOMC meeting Fed speakers in the form of Kaplan and Daly to glean extract any further policy insight, while also keeping an eye on the Euro as the biggest component of the index following another ECB ‘sources’ piece.

- EUR – Surprisingly strong German jobs data, better than feared GDP and another Eurozone M3 beat did not really register, but the Euro has reacted to latest reports quoting ECB sources pushing back on the notion of a rate cut, and dumbing down on the level of concern over the single currency’s strength – see 10.24GMT post on the headline feed for more details. Eur/Usd is now forming a firmer base on the 1.2100 handle, and eyeing 1.2150 ahead of a series of descending peaks below 1.2200 that also align with 21 and 50 DMA resistance at 1.2170 and 1.2189 respectively.

- NZD/CAD/CHF – All narrowly mixed and rangebound vs their US counterpart, with the Kiwi hovering between 0.7150-84 having failed to retain grasp of 0.7200 on several occasions after getting within a whisker of 0.7250 at one stage, while the Loonie is still holding above 1.2900 following its sharp post-BoC retreat and now seeking some independent impetus from Canadian monthly GDP, albeit rather stale now for November. Elsewhere, the Franc is treading water above 0.8900 and 1.0800 vs the Euro in advance of Monday’s update on Swiss bank sight deposit balances.

In commodities, WTI and Brent front month futures see a choppy session thus far as the contracts nursed losses in early European hours – with the former now around USD 52.50/bbl (vs low 51.96/bbl) and the latter just under USD 55.50/bbl (vs low 54.92/bbl). The two benchmarks see somewhat of a dichotomy, with the US contract outperforming its Brent counterpart, with reports also suggested that the US oil industry is looking to forge a partnership with corn growers and biofuel to push against Biden’s green policy. Furthermore, the week saw substantial surprise draws in both Private Inventories and DoEs which further supports a bullish backdrop. Aside from that, the macro narrative remains the balance between the COVID-impacted demand and OPEC-supported supply. Elsewhere, spot gold and sport silver are supported despite the backdrop for a firmer Dollar, with some potential reflationary play, but one of the main drivers cited by analysts includes the Reddit crowd’s silver influence causing sympathy plays across precious metals. Spot gold resides around USD 1850/oz with its 50 DMA at 1856 and yesterday’s low around USD 1833/oz, whilst spots silver probes USD 27/oz. In terms of base metals, LME copper prices track the broader stock markets lower, albeit trades off lows – with some supply side reports suggested that Peru will also permit mining during COVID-related lockdowns. Finally, China’s steel rebar futures fell 1.4% amid surging inventories.

US Event Calendar

- 8:30am: Dec. Personal Spending, est. -0.4%, prior -0.4%

- 8:30am: Dec. Personal Income, est. 0.1%, prior -1.1%

- 8:30am: Dec. PCE Core Deflator YoY, est. 1.3%, prior 1.4%; PCE Core Deflator MoM, est. 0.1%, prior 0%

- 9:45am: Jan. MNI Chicago PMI, est. 58.5, prior 59.5, revised 58.7

- 10am: Dec. Pending Home Sales YoY, est. 20.2%, prior 16.0%, Pending Home Sales (MoM), est. -0.5%, prior -2.6%

- 10am: Jan. U. of Mich. Expectations, est. 74.1, prior 73.8; Mich. Sentiment, est. 79.3, prior 79.2; Current Conditions, est. 87.7, prior 87.7;

DB’s Jim Reid concludes the overnight wrap

After this tumultuous week, risk assets recovered yesterday from their major declines on Wednesday, with the S&P 500 advancing +0.98%, as it came off its biggest fall since October. Markets retreated a fair bit into the close though with the S&P up as much as +2.1% intraday. On top of this futures in Asia have given up all these gains (-1.28%) with the Nikkei (-1.70%), Hang Seng (-0.48%), Shanghai Comp (-0.28%) and Kospi (-3.31%) also all down. Sentiment in the Asian session is also being dragged down by a cash squeeze in China as the cost of overnight borrowing in the country rose 28 bps to 3.3302% today, the highest in almost six years, as the country’s lenders sought out cash for end-of-month regulatory checks and tax payments. The rise in the rate came even as the PBOC added $15bn of short term cash to the banking system, less than expected. Futures on the Nasdaq are down -1.47%. In keeping with the risk off the US dollar index is up +0.30%.

In terms of the latest on the Reddit-fuelled rally for certain companies, there were some initial signs that the reversal might be beginning yesterday, as GameStop’s share price ended the session down -44.3%, having briefly become the biggest stock on the Russell 2000 with a market cap of $35.7bn at the intra-day peak. Indeed over the last 24 hours the stock price ranged from 513 in pre-market trading to 112 at the lows before closing at 193. In after hours trading it was back up +61.2% to $312.

A big part of the collapse was after brokerages such as Robinhood and Interactive Brokers heavily restricted trading in several of these r/wallstreetbets names, with Robinhood also increasing margin requirements for certain securities. It didn’t go down well in the forum and many lawmakers from both sides of the aisle expressed concerns at these restrictions for retail investors. I can’t help but think this week will have long term consequences. It’s shaken up the system and there will be some permanent changes to the ways investors, especially hedge funds and retail, act. Surely any hedge fund will be carefully looking at all their shorts after this week and regulators will look very carefully at collective retail trading. After the close Robinhood’s CEO Tenev said they restricted buying of certain stocks due to its financial position, saying “it is not negotiable for us to comply with our financial requirements and our clearinghouse deposits.” This came as Bloomberg said that the company has to drawn down credit lines with banks.

Overnight, Robinhood has said that its clients would be able to make limited purchases of some of the companies that it blocked, without providing any further details. This news helped push reddit favourites up again in afterhours trade with GameStop (+61.2%), AMC (+31%), Blackberry (+12.55%), Koss Corp. (+62%) and Express Inc. (+32%) all up after mostly slumping yesterday.

Over the past two days the crowd seemed to be moving on to other more widely held names. American Airlines saw their shares go up +31.3% in early trading yesterday before it was added to the Robinhood list of untradeable stocks and the stock had to settle for a +9.30% gain on the day – still its best since early November when the Covid-19 vaccines were approved for use in the US.

There were some other beneficiaries as the day traders moved on to other assets, with silver surging +4.89% as this was picked up as a potential asset to target by the Reddit crowd. They also picked out First Majestic Silver Corp as a short-squeeze candidate and the company’s shares rose +49% in early trading before the price action settled at +20.2% on the day. Fascinating that we’re moving into other asset classes.

Moving on, some good news on the vaccine front came through just after the US close. Novavax’s Covid-19 vaccine was found to be effective in large trials in the UK and South Africa, though it was more effective in the former. It was 89.3% effective in preventing symptomatic Covid-19 in the UK, following a final-stage study with more than 15,000 residents. In South Africa, a trial of over 4,400 people showed that the vaccine was 60% effective in those who were HIV negative and 49.4% effective overall. Novavax rose 20% in after-market trading following the news and is a big deal for the US and UK, with the former having a deal for 100mn doses and the latter having an order for 60mn doses. It won’t come on stream for several weeks though. The South African strain continues to be a problematic mutation and although these numbers prove it can be battled by current vaccines, countries are still going to be more careful post vaccinating the vulnerable than they would have been without it, especially on their international borders. Indeed in a bit concerning news on the virus, Reuters reported overnight that researchers in Brazil have said that they found two patients infected with different strains of the new coronavirus at the same time. This they believe raises concerns that coexistence of different strains in the same person’s body can speed up mutations of the virus. However, the findings are not published in a scientific journal or are peer reviewed.

Haven assets suffered from the risk-on moves yesterday, and core sovereign bonds lost ground on both sides of the Atlantic. Yields on 10yr US Treasuries were up +2.9bps to 1.045% (fairly stable overnight), and southern European debt outperformed in Europe, with the spreads of 10yr Italian yields over bunds narrowing -2.6bps to a one-week low. Bunds themselves underperformed, seeing a +0.7bps rise in yields, while those on OATs (+0.3bps) and gilts (+1.8bps) similarly moved higher. Over in foreign exchange markets, the dollar index shed -0.21%, and the Japanese Yen was the worst-performing G10 currency, weakening -0.12% against the US dollar.

Back to vaccines, the main other news yesterday was that Germany’s vaccine commission recommended that the AstraZeneca vaccine was only used for those aged 18-64, and not in the 65+ group, marking a contrast from the UK where it was approved for use in all adults. They didn’t feel they had enough data to approve for the elderly. Given its use in the UK however, where over 10% of the population has already been diagnosed, we should find out pretty quickly how effective it is on the most elderly age groups. We should now hear from the EMA regulator today as to whether the Oxford/AZN vaccine has been approved in the EU at large and it will be interesting if they follow the German’s regulators approach to over 65s. If they do the continent will likely be further delayed in their vaccine roll out and it will make this week’s public battle with the company a little odder.

Meanwhile Reuters reported that Paris and two other regions in France would stop giving out first doses due to limited supplies, and so as to get the second dose to those already vaccinated. The country’s government continues to weigh implementing lockdowns again in the face of the new variants, though no resolution was delivered yesterday. Separately in the US, state health officials in South Carolina said that two cases of the South African variant had been diagnosed, which is the first time that this variant has been confirmed in the country. Elsewhere restrictions continue to be rolled back across the US, with Ohio yesterday relaxing its state-wide curfew. The governor promised to revisit other restrictions in two weeks dependent on the path of infections. Many of the largest US states have now eased restrictions in the past two weeks, citing lower case counts and less burdened healthcare systems.

In terms of yesterday’s data, sentiment was supported by stronger-than-expected data on weekly jobless claims from the US, which fell to 847k (vs. 875k expected) in the week through January 23. Furthermore, the continuing claims for the week through January 16 fell to their lowest level since the pandemic began, at 4.771m, with the insured unemployment rate also at a post-pandemic low of 3.4%. Otherwise, US GDP in Q4 grew at an annualised rate of +4.0% (vs. +4.2% expected), meaning that GDP for the full year in 2020 contracted by -3.5%. That marks the worst annual performance for the US economy since 1946, and is bigger than the -2.5% contraction in 2009. Elsewhere, German inflation surged to +1.6% in January on the EU-harmonised measure, which is the highest rate since February 2020. That was supported by one-off factors such as the end of a temporary reduction in value added tax and a higher minimum wage.

To the day ahead now, and data releases include the preliminary Q4 GDP readings from Germany and France, as well as German unemployment data for January and the Euro Area’s M3 money supply for December. Meanwhile in the US, there’s personal income and personal spending for December, the final January reading of the University of Michigan’s consumer sentiment index, pending home sales for December and the January MNI Chicago PMI. Central bank speakers include the Fed’s Kaplan and Daly, and earnings releases include Eli Lilly, Chevron, Charter Communications, Honeywell and Caterpillar.

Tyler Durden

Fri, 01/29/2021 – 08:23

via ZeroHedge News https://ift.tt/3ac0GMZ Tyler Durden