Authored by James Rickards via The Daily Reckoning,

Remember all those “green shoots?”

That was the ubiquitous phrase used by White House officials and TV talking heads in 2009 to describe how the U.S. economy was coming back to life after the 2008 global financial crisis.

The problem was we did not get green shoots; what we got was more like brown weeds.

The economy did recover, yes, but it was the slowest recovery in U.S. history.

After the green shoots theory had been discredited, Treasury Secretary Tim Geithner promised a “recovery summer” in 2010.

That didn’t happen either.

The recovery did continue, but it took years for the stock market to return to its previous highs and even longer for unemployment to come down to levels that could be regarded as close to full employment.

And after the worst of the 2020 pandemic (so we hope), we’ve gotten the same happy talk. But those hopes have been dashed, which the latest jobs numbers bear out.

Can monetary and/or fiscal policy lift us out of the new depression? Let’s first take a look at monetary policy.

Fed money printing is an exhibition of monetarism, an economic theory most closely associated with Milton Friedman, winner of the Nobel Memorial Prize in economics in 1976. Its basic idea is that changes in money supply are the most important cause of changes in GDP.

A monetarist attempting to fine-tune monetary policy says that if real growth is capped at 4%, the ideal policy is one in which money supply grows at 4%, velocity is constant, and the price level is constant. This produces maximum real growth and zero inflation. It’s all fairly simple as long as the velocity of money is constant.

But money velocity is not constant, contrary to Friedman’s thesis. Velocity is like a joker in the deck. It’s the factor the Fed cannot control.

Velocity is psychological: It depends on how an individual feels about her economic prospects. It cannot be controlled by the Fed’s printing press. It measures how much money gets spent from people to businesses.

Think of when you tip a waiter. That waiter might use that tip to pay for an Uber. And that Uber driver might pay for fuel with that money. This velocity of money stimulates the economy.

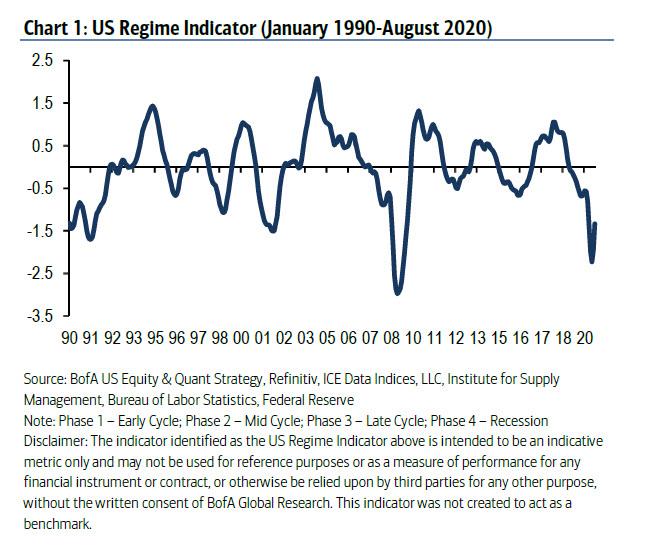

Well, velocity has been crashing for the past 20 years. From its peak of 2.2 in 1997 (each dollar supported $2.20 of nominal GDP), it fell to 2.0 in 2006 just before the global financial crisis and then crashed to 1.7 in mid-2009 as the crisis hit bottom.

The velocity crash did not stop with the market crash. It continued to fall to 1.43 by late 2017, despite the Fed’s money printing and zero rate policy (2008–15). Even before the pandemic, it fell to 1.37 in early 2020.

It can be expected to fall even further as the new depression drags on. As velocity falls, the economy falls. Money printing is impotent. $7 trillion times zero = zero. There is no economy without velocity.

The factors the Fed can control, such as base money, are not growing fast enough to revive the economy and decrease unemployment.

Spending is driven by the psychology of lenders and consumers, essentially a behavioral phenomenon. The Fed has forgotten (if it ever knew) the art of changing expectations about inflation, which is the key to changing consumer behavior and driving growth. It has nothing to do with money supply.

The bottom line is, monetary policy can do very little to stimulate the economy unless the velocity of money increases. And the prospects of that happening aren’t great right now.

But what about fiscal policy? Can that help get the economy out of depression? Let’s take a look…

We’re seeing more deficit spending in 2020 than the past several years combined. The government will add more to the national debt this year than all presidents combined from George Washington to Bill Clinton.

This spending explosion comes on top of a baseline budget deficit of $1 trillion. Combining the baseline deficit, the approved spending and the expected additional spending brings the total deficit for 2020 to over $3 trillion at the minimum.

That added debt will increase the U.S. debt-to-GDP ratio to over 120%. That’s the highest in U.S. history and puts the U.S. in the same super-debtor’s league as Japan, Greece, Italy and Lebanon.

The idea that deficit spending can stimulate an otherwise stalled economy dates to John Maynard Keynes and his classic work The General Theory of Employment, Interest and Money (1936).

Keynes’ idea was straightforward.

He said that each dollar of government spending could produce more than $1 of growth. When the government spent money (or gave it away), the recipient would spend it on goods or services. Those providers of goods and services would, in turn, pay their wholesalers and suppliers.

This would increase the velocity of money.

Depending on the exact economic conditions, it might be possible to generate $1.30 of nominal GDP for each $1.00 of deficit spending. This was the famous Keynesian multiplier. To some extent, the deficit would pay for itself in increased output and increased tax revenues.

Here’s the problem:

There is strong evidence that the Keynesian multiplier does not exist when debt levels are already too high. In fact, America and the world are inching closer to what economists Carmen Reinhart and Ken Rogoff describe as an indeterminate yet real point where an ever-increasing debt burden triggers creditor revulsion, forcing a debtor nation into austerity, outright default or sky-high interest rates.

Reinhart and Rogoff’s research reveals that a 90% debt-to-GDP ratio or higher is not just more of the same debt stimulus. Rather it’s what physicists call a critical threshold.

The first effect is the Keynesian multiplier falls below 1. A dollar of debt and spending produces less than a dollar of growth. Creditors grow anxious while continuing to buy more debt in a vain hope that policymakers reverse course or growth spontaneously emerges to lower the ratio.

This doesn’t happen. Society is addicted to debt, and the addiction consumes the addict.

The endpoint is a rapid collapse of confidence in U.S. debt and the U.S. dollar. This means higher interest rates to attract investor dollars to continue financing the deficits. Of course, higher interest rates mean larger deficits, which makes the debt situation worse. Or the Fed could monetize the debt, yet that’s just another path to lost confidence.

The result is another 20 years of slow growth, austerity, financial repression (where interest rates are held below the rate of inflation to gradually extinguish the real value of debt) and an expanding wealth gap.

The next two decades of U.S. growth would look like the last two decades in Japan. Not a collapse, just a slow, prolonged stagnation. This is the economic reality we are facing.

And neither monetary policy nor fiscal policy will change that.