The Sunday Times discovered dozens of billboards with cameras and facial detection software are targeting consumers at shopping malls across the country with personalized ads.

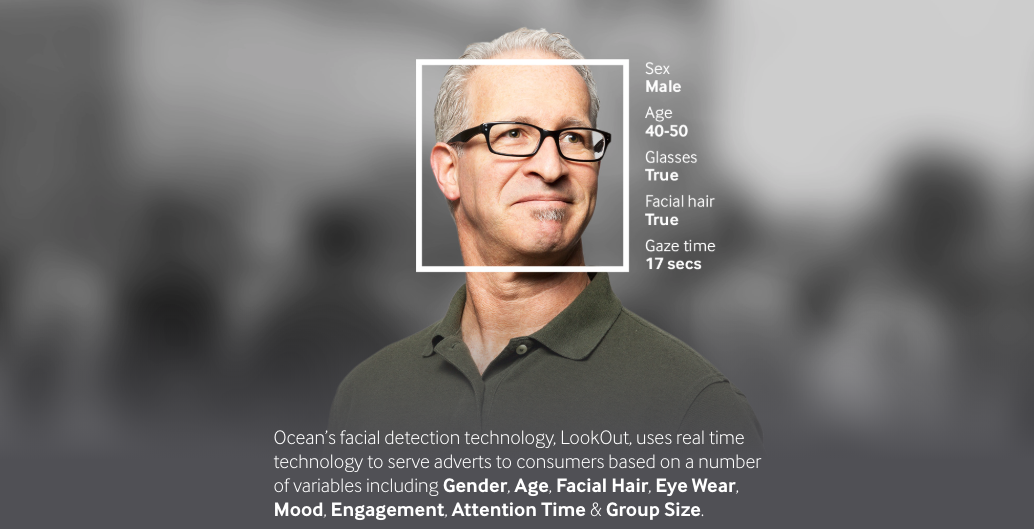

The report found 50 advertising screens with facial detection technology that identifies the age, gender, and mood of consumers, and even monitors their view time behavior of the personalized ads. For instance, millennial men could be standing in front of the billboard; seconds later, a Gillette shaving cream ad is displayed on a giant screen.

Advertisers operating the new system have claimed it fully complies with the Data Protection Act 2018 because no consumer is identified, nor is their data collected or stored.

UK law indicates there is no legal requirement to tell shoppers that they’re being surveilled for commercial purposes.

Ocean Outdoor is the first advertiser to adopt public surveillance technology for smart billboards.

Called the LookOut system, it uses artificial intelligence and cameras to serve adverts to consumers based on gender, age, facial hair, eyewear, mood, and engagement level, stated the Ocean Outdoor’s website.

The company lists several ways in which LookOut can be used:

- Optimization – delivering the appropriate creative to the right audience at the right time.

- Visualize – Gaze recognition to trigger creative or an interactive experience

- AR Enabled – Using the HD cameras to create an augmented reality mirror or window effect, creating deep consumer engagement via the latest technology

- Analytics – Understanding your brand’s audience, post-campaign analysis and creative testing

Ocean Outdoor’s chief executive Tim Bleakley told The Sunday Times: “We pioneered a facial detection technology which identifies the characteristics of the face to allow you to talk to advertisers about mood, gender, emotion and those kind of things.”

“We can measure the level of happiness or sadness. We can measure the dwell time.”

The creepy surveillance technology has already been installed in national supermarket chains like Waitrose Limited and Bleakley said the supermarket’s administrators were able to monitor consumer happiness levels in real-time.

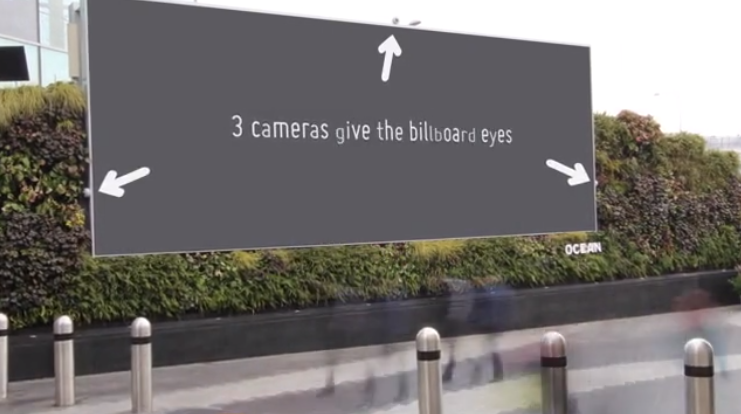

In a promotional video of OutLook, consumers walked past billboards in Westfield. The video says: “3 cameras give the billboard eyes.”

The intelligent billboard’s cameras regularly analyze shoppers and can communicate to advertisers what kinds of people were shopping and when.

Another video showing one of its billboards at Canary Wharf stated that 49% of people who walked by of a given day were wealthy.

Ocean Outdoor plans to use the technology on roadside billboards to determine the model of a vehicle so that adverts based on car price can be be shown on the billboard.

French company Quividi sells facial detection technology says the pictures taken in the OutLook system of consumers are deleted in milliseconds.

Quividi said it could determine someone’s gender with 90% accuracy and age within a five-year bracket.

Mass surveillance with artificial intelligence is now an integral part of the social, economic and political lives of many in the Western world. Advertisers and mega-corporations are spying on British people like never before — as smart billboards with surveillance cameras are the latest evidence a free and open society is a thing of the past.

via ZeroHedge News http://bit.ly/2VzU1GT Tyler Durden