China’s Biological Weapons Labs In America

Authored by Gordon Change via The Gatestone Institute,

China has been maintaining at least two facilities — one in California and the other in Nevada — that are part of a biological weapons program.

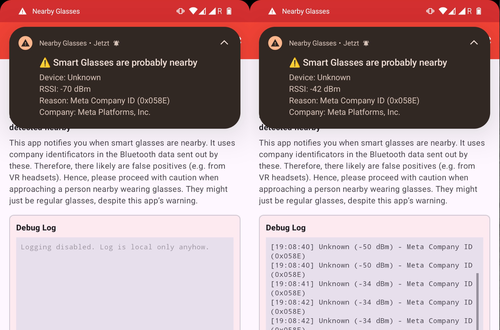

A Declaration of Arrest Report, issued by the Las Vegas Metropolitan Police Department in connection with the detention of Ori Solomon on January 31, states that there is a “deeper conspiracy” between an illegal biological lab in Reedley, California and a residence containing apparently dangerous substances in Nevada.

On January 31, Las Vegas SWAT and federal agents raided a home on the eastern outskirts of the city and seized over a thousand vials of an unknown substance or substances. Those vials have been sent to an FBI lab in Maryland for analysis.

A housecleaner tipped off authorities after she and others temporarily residing at the home got “deathly ill.”

Solomon was the property manager of the location.

Jiabei Zhu, a Chinese national also known as Jesse Zhu, Qiang He and David He, is the listed agent of a company, David Destiny Discovery LLC, that is the registered owner of the Las Vegas house along with Zhaoyan Wang, his business partner and the mother of his child.

Zhu will go to trial in April on federal charges for the operation of the lab in Reedley, near Fresno in the Central Valley.

Fortunately, in California, Code Enforcement Officer Jesalyn Harper in December 2022 noticed a garden hose connected to a supposedly abandoned building.

She entered the structure and discovered what appears to have been a secret biological weapons laboratory. Inside, Harper found Chinese nationals working in white coats.

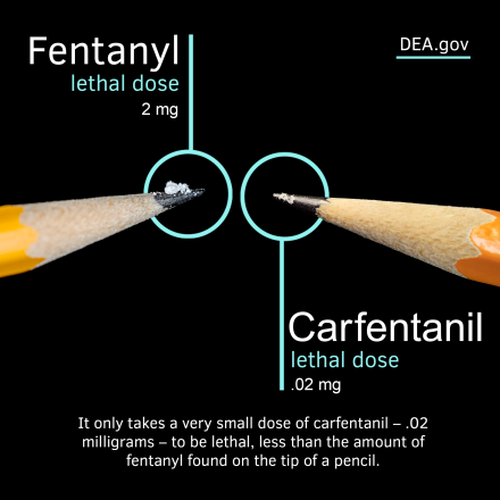

The lab stored nearly a thousand transgenic mice — 773 live and more than 175 dead — “genetically engineered to catch and carry the COVID-19 virus.”

Authorities also found medical waste and chemical, viral, and biological agents. There were on-site at least 20 potentially infectious pathogens, including those causing coronavirus, HIV, hepatitis, and herpes.

The lab contained a freezer labeled “Ebola.” The freezer held unlabeled sealed bags used to store high-risk biological materials. Researchers at the Wuhan Institute of Virology are studying Ebola, which has a natural fatality rate of 50%, undoubtedly to weaponize it.

The Reedley facility was run by Chinese fronting for parties in China. Among the fronts is Zhu.

In 2024, Brandon Weichert, author of Biohacked: China’s Race to Control Life, in comments to Gatestone, called the Reedley facility a “kamikaze lab,” which was “unsecured, poorly contained, makeshift, containing a couple dozen pathogens near a population center.”

There are reasons to be alarmed.

First, as Weichert noted at the time, the Reedley facility could not be a “one-off.” Now, we know that he was right. There is — at least — a second location, the “deeper conspiracy” as the Las Vegas police termed it.

Moreover, the Chinese regime is behind that conspiracy. Wang fled to China sometime in 2023. While there, she kept tabs on the Las Vegas home by, for instance, monitoring cameras at the location.

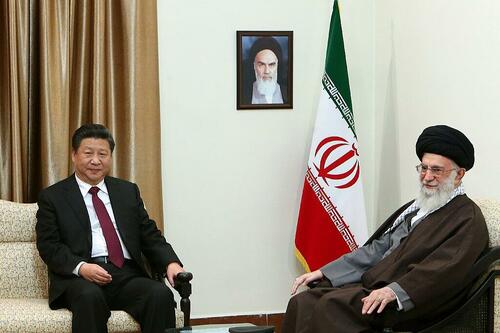

Zhu was also a top official at one of China’s state-controlled companies that had links to the People’s Liberation Army. According to recent reporting, he has maintained business relations with parties connected to the Chinese regime.

All this demonstrates that China’s Communist Party, which could have ordered Zhu and Wang to shut down the effort after the discovery of the Reedley lab, allowed it to continue. Among other things, the continuation of the effort suggests there is a broader effort to spread disease in the United States.

Second, Zhu operated the Reedley and Las Vegas facilities with malign intent.

Zhu, according to Canadian court statements, told a co-conspirator in an earlier theft of U.S. intellectual property that these efforts would help “defeat the American aggressor and wild ambitious wolf!” “The law is strong,” he added at the time, “but the outlaws are ten times stronger.”

These statements were included in the Las Vegas Declaration of Arrest Report. As a recent analysis states, “the declaration reveals, for the first time, the full scope of what U.S. investigators believe they are dealing with: not merely a rogue lab operator, but a PRC-trained biologist with state-linked corporate ties, a proven history of stealing American technology for Beijing’s benefit, and language that investigators now treat as evidence of ideological motivation.”

As Weichert said of the Reedley lab two years ago, “It is, I believe, a part of a large Chinese military operation to spread disease throughout the American population.”

He is undoubtedly correct. A quarter century ago, General Chi Haotian, China’s defense minister and vice chairman of the Party’s Central Military Commission, reportedly gave a secret speech advocating the extermination of Americans. “It is indeed brutal to kill one or two hundred million Americans,” he said. “But that is the only path that will secure a Chinese century, a century in which the Communist Party leads the world.”

Chi’s plan was to use disease for this purpose.

The FBI now appears to be concerned about the extent of the Chinese effort. It executed a search warrant on the Reedley facility on February 8th.

Have U.S. authorities now discovered everything? “We need to know if there is a third biological weapons location and maybe a fourth,” Blaine Holt, a retired U.S. Air Force general who now specializes in civil preparedness measures, told Gatestone this month. “We are on notice that the Chinese regime is preparing to spread disease in America. We have been very slow off the mark and have absolutely no time to lose. The Chinese regime could give the go-signal at any moment.”

Tyler Durden

Fri, 02/27/2026 – 23:25

via ZeroHedge News https://ift.tt/hTKMVQ7 Tyler Durden