West Virginia Introduces Bill To Sell Machine Guns To American Citizens

Submitted by Gun Owners of America,

State Legislators in West Virginia have just introduced a bill, authored by Gun Owners of America, that would authorize the State to sell machineguns to citizens.

Currently, newly manufactured machineguns are banned for civilian ownership thanks to an amendment slipped into the 1986 Firearm Owners Protection Act.

Known as the “Hughes Amendment”—named for Representative William J. Hughes, a Democrat from New Jersey—this amendment banned all civilian ownership of machineguns made after May 19, 1986.

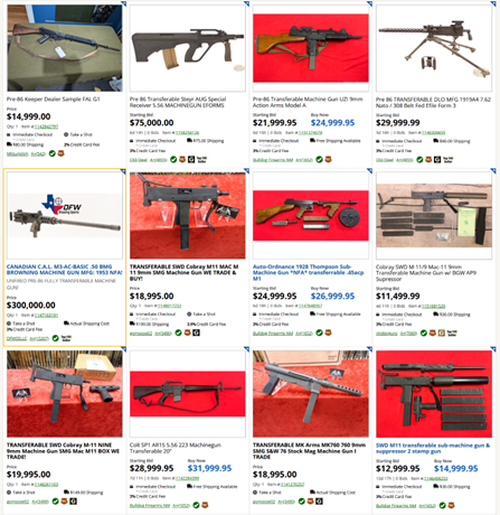

While machineguns made and registered prior to the ban date can still be transferred, the law of supply and demand has created a massive disparity, as most ordinary Americans simply cannot afford these much sought after items.

Interestingly, though, the language of the Hughes Amendment specifies that the machinegun ban doesn’t apply to the government, which includes state and local governments.

Specifically, 18 USC Section 922(o) reads:

This subsection does not apply with respect to—

a transfer to or by, or possession by or under the authority of, the United States or any department or agency thereof or a State, or a department, agency, or political subdivision thereof.

Well, we at Gun Owners of America had a thought. What if the States wanted to sell machineguns to their citizens—that is, what if they were to engage in a “transfer … by … a State”?

That certainly would comport with the historical tradition in the United States, where governments have sold military arms to the civilian populace since the Founding. And, of course, arming civilians with machineguns aligns with the prefatory clause of the Second Amendment, which reads:

“A well regulated Militia, being necessary to the security of a free State.”

What could be a better and more of a “well regulated Militia” than a citizenry armed with machineguns?

According to 922(o), a state government may lawfully “transfer”—that is, sell, give, loan, etc.—machineguns to ordinary citizens. And after the transfer is complete, those citizens may lawfully possess them, so long as the transfer was made by the State government.

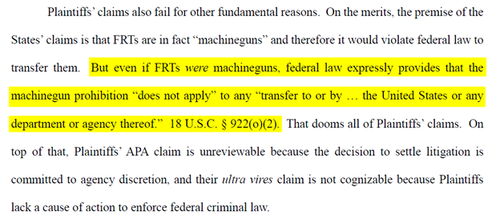

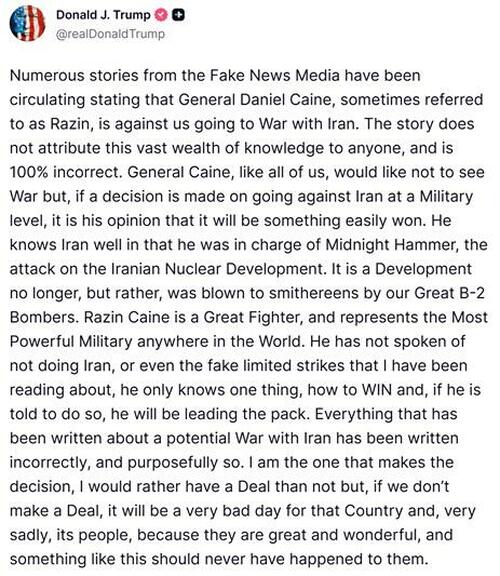

But you don’t have to take our word for it. The Department of Justice recently made the very same argument in a court filing. The case is State of New Jersey v. Bondi, which is being litigated in the US District Court for the District of Maryland.

The case involves ATF’s return of Forced Reset Triggers to their original owners after a judge in Texas ruled that these triggers are not machineguns, as ATF had previously claimed. A forced reset trigger, or FRT, is a device that increases the rate of fire for semi-automatic rifles by (like the name entails) forcing the “reset” of a trigger so that a shooter can pull the trigger more quickly and thus fire more rapidly.

These FRTs were at one point classified as machineguns by ATF, and agents were sent out to confiscate them. But, in the aftermath of Cargil v. Garland, and a subsequent settlement with the manufacturer of these devices, they again have been recognized as semi-automatic triggers. And so, ATF was forced to return them to their rightful owners.

Of course, anti-gun jurisdictions didn’t like that. So, they sued to prevent the return of the FRTs to their owners in their respective states.

And in a filing in the case, the Department of Justice defended its return of FRTs. DOJ argued that, even if FRTs were machineguns, ATF could still give them back to their owners, because federal law doesn’t apply to the transfer of machineguns by the government.

In other words, DOJ has already made the legal argument to support the West Virginia bill that we had introduced. DOJ has already admitted that the transfer of a machinegun by the government does not offend federal law.

And as DOJ’s filing clearly acknowledges, once that “transfer” from the government has occurred, the gun owner’s subsequent possession of the “machinegun” would also be lawful under Section 922(o).

Summed up, the exemption from the ban on machineguns follows the firearm, not who possesses it.

This is why our legislation, now officially introduced by our allies in West Virginia, would create State-Operated Machinegun Stores.

This state-run entity would be tasked with purchasing machineguns and conducting transfers to qualified members of the general public, much like how many states open and operate liquor stores.

Read the bill here…

This is a huge victory for GOA and our members.

* * *

We’ve been working to gut the National Firearms Act for decades. Last year, GOA spearheaded efforts in Congress to repeal most of the NFA’s taxes. Then, we filed suit to challenge the registration requirements with our One Big Beautiful Lawsuit. Now, we’re tackling the prohibition on machineguns with West Virginia.

If you hate the National Firearms Act or gun control in general, GOA is your one stop shop. We expect that it will be a fight to get this bill passed and into effect, and we’re going to need your help.

Consider supporting our efforts and becoming a member of Gun Owners of America. We won’t stop fighting until the Second Amendment is fully restored. No Compromises.

Tyler Durden

Mon, 02/23/2026 – 20:55

via ZeroHedge News https://ift.tt/y9WKnZd Tyler Durden