Daily Briefing – September 15, 2020

Tyler Durden

Tue, 09/15/2020 – 18:10

via ZeroHedge News https://ift.tt/3hyUL6m Tyler Durden

another site

Daily Briefing – September 15, 2020

Tyler Durden

Tue, 09/15/2020 – 18:10

via ZeroHedge News https://ift.tt/3hyUL6m Tyler Durden

Warning: Misleading Silver Supply And Demand Data

Tyler Durden

Tue, 09/15/2020 – 18:05

Submitted by Jan Nieuwenhuijs of Voima Gold

Every year the Silver Institute publishes silver supply and demand numbers that suggest the market is in a deficit or surplus, although there is no correlation between their “market balance” and the price of silver. Investment decisions based on the Silver Institute’s supply and demand data can turn out badly.

In a previous article we have discussed that gold trades more like a currency than a commodity. An approach of a gold market balance, which produces a surplus or deficit, is therefore not appropriate nor indicative of price direction. Because silver is both a monetary metal and an industrial commodity its supply and demand dynamics require special attention. My conclusion is that silver, just like gold, trades more like a currency than a commodity.

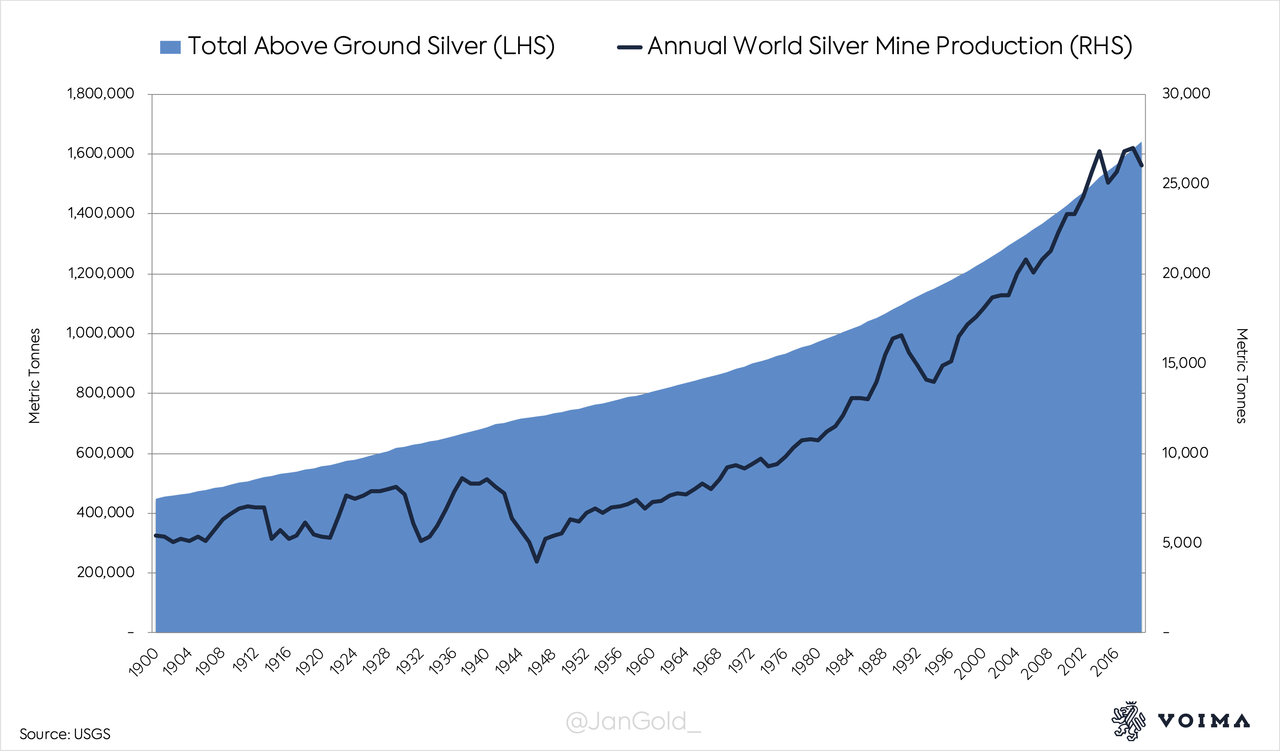

In ancient Sumer, roughly 5,000 years ago, silver was a unit of account, a medium of exchange for large purchases, and a store of value. Silver has been used as money in countless civilizations ever since. Because silver is durable and valuable very little gets lost. More than 90% of all silver ever mined is still above ground.

Since the 19th century silver is also being used for industrial applications. Currently, CPM Group estimates that half of all above ground silver is in industrial products, and the other half is in coins, jewelry, silverware and investment bars. The total above ground amount of silver is about 1.6 million metric tonnes.

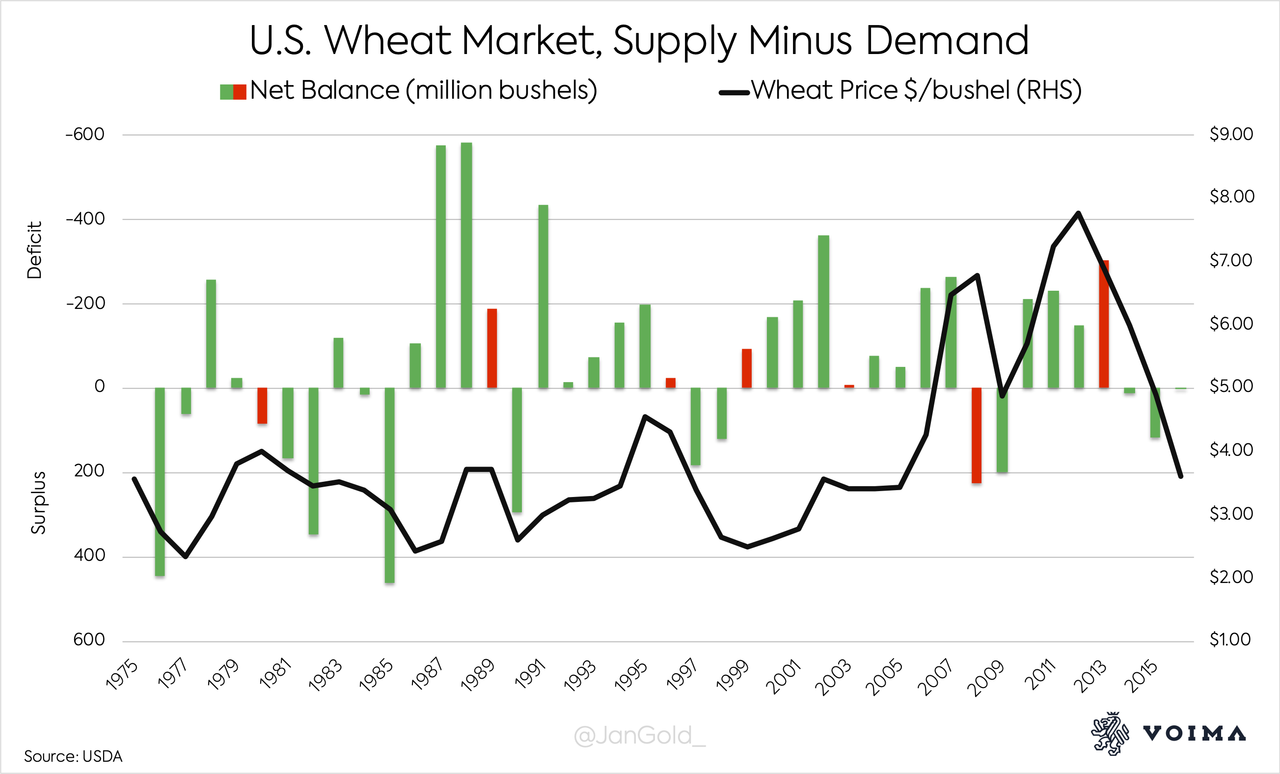

For perishable commodities a market balance, calculated by subtracting demand from supply, is indicative of price direction. This is because annual production is far larger than above ground stocks. When wheat demand rises, wheat supply can’t be quickly expanded—as there are no vast stocks that can enter the market—and the price has to go up. The wheat market balance tells us if there is a surplus or deficit in the market that will either decrease or increase the price of wheat.

Below is a chart that shows the wheat market’s net balance (supply minus demand). The Y-axis is inverted for more clarity. Whenever a surplus/deficit matches price direction the chart bar is colored green; if it doesn’t match the chart bar is red. You can see that most chart bars are green, and nearly all red bars signal at a price turning point.

For monetary metals, however, this approach is not suitable. The reason is the stock to flow ratio (STF), which is calculated by dividing above ground stocks by annual production. Silver’s STF is approximately 30. Annual silver mine production is 26,000 tonnes, and 800,000 tonnes of silver is in jewelry, coins and bars, which comprises the stock (at the right price this can enter the market as supply). For the sake of simplicity I choose not to count above ground silver that is in industrial products as stock.

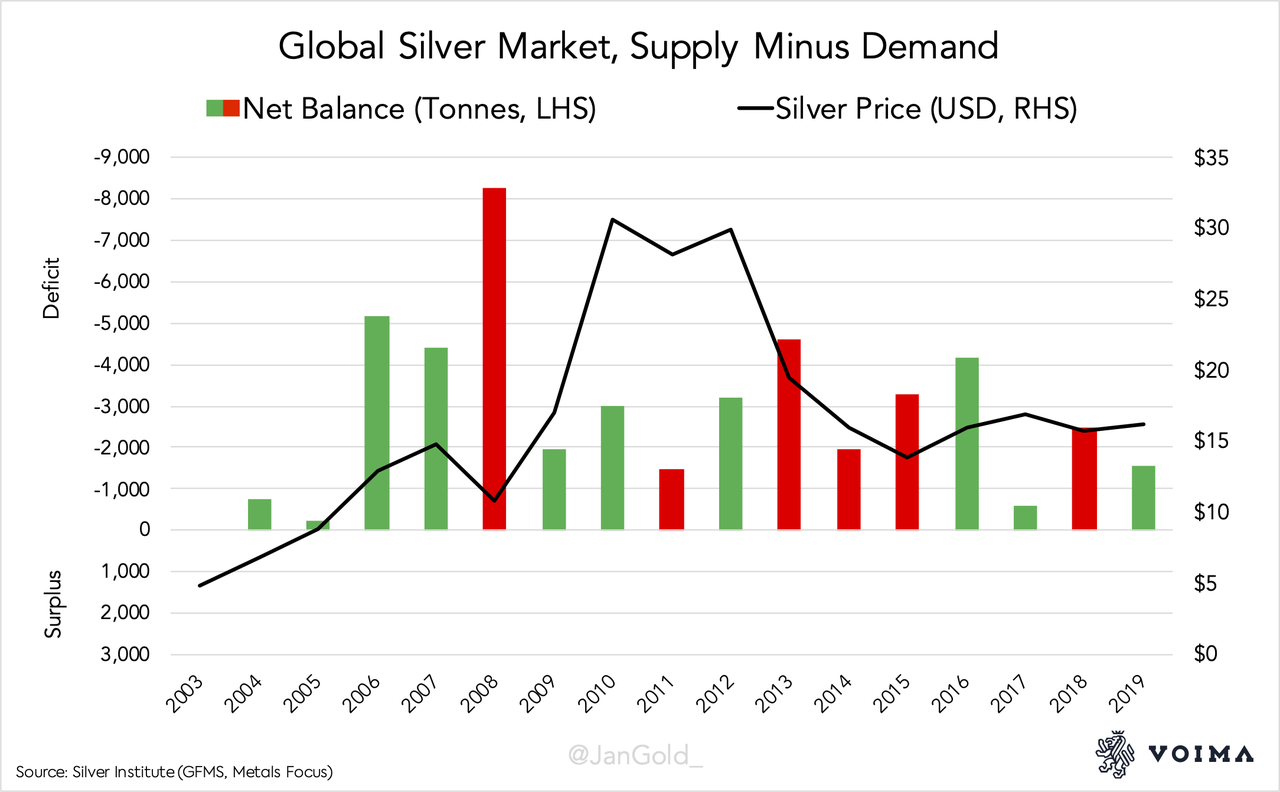

Below is a chart that shows the silver market’s net balance as disclosed by the Silver Institute’s most recent World Silver Surveys. You can see that for the past 16 years the market was permanently in deficit, while the price went violently up and down. This reveals that the net balance disclosed is misleading.

Yet, in the Silver Institute’s World Silver Survey 2018 it reads: “In the silver market, as for any commodity, physical imbalances both explain and influence price action…” In my view, for monetary metals there can’t be physical imbalances, because at the right price there is always enough metal.

For perishable commodities the forces of supply and demand put a strain on available stocks, which moves the price. But when stocks greatly exceed annual production, in the case of silver, it is mainly trade in stocks that sets the price. Silver trade is not limited to what the Silver Institute measures as supply (mainly mine output) and demand (mainly newly fabricated products). Worth mentioning is that the Silver Institute doesn’t disclose the actual amount of above ground silver, which is 1.6 million tonnes according to both the United States Geological Survey (USGS) and CPM Group. Instead, the Institute publishes identifiable bullion inventories that account for roughly 60,000 tonnes. No wonder most people are confused about silver’s STF.

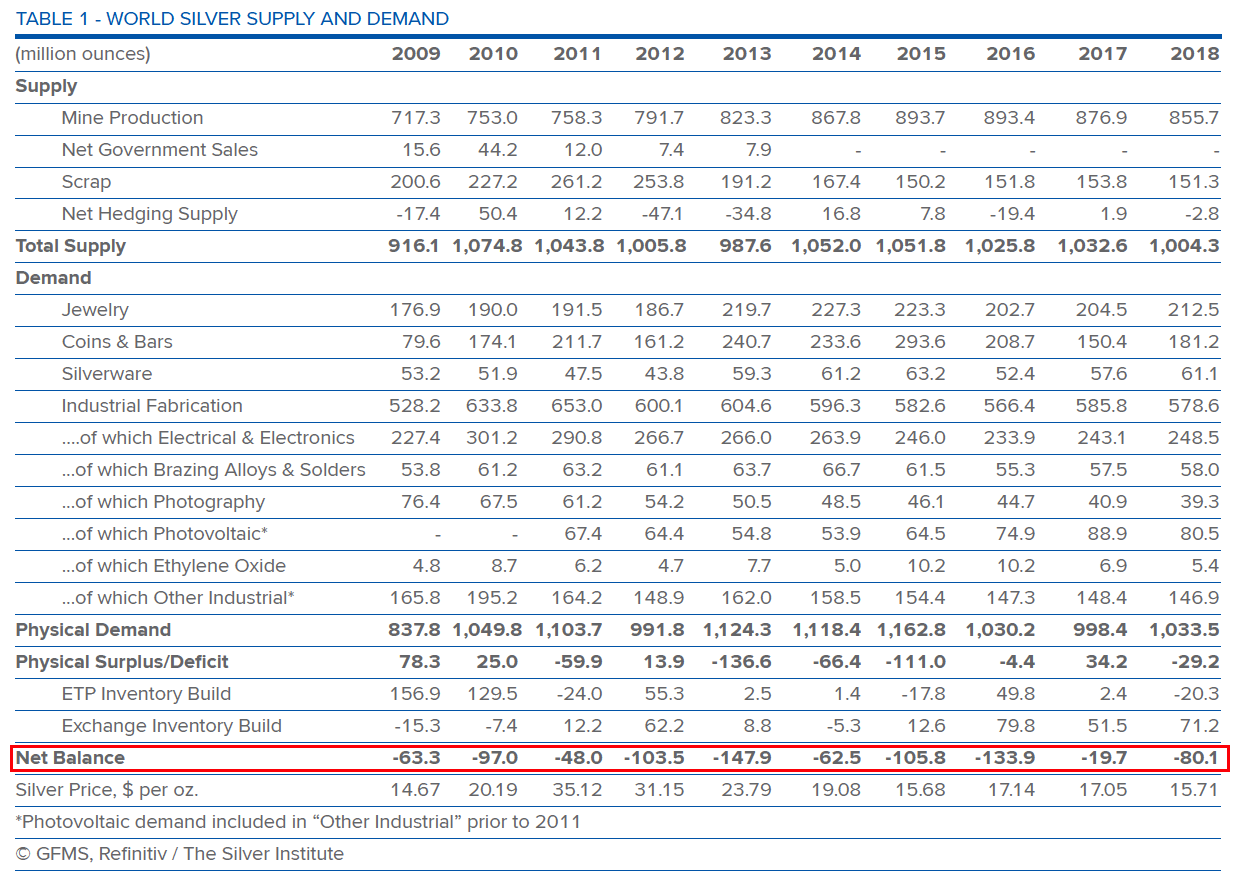

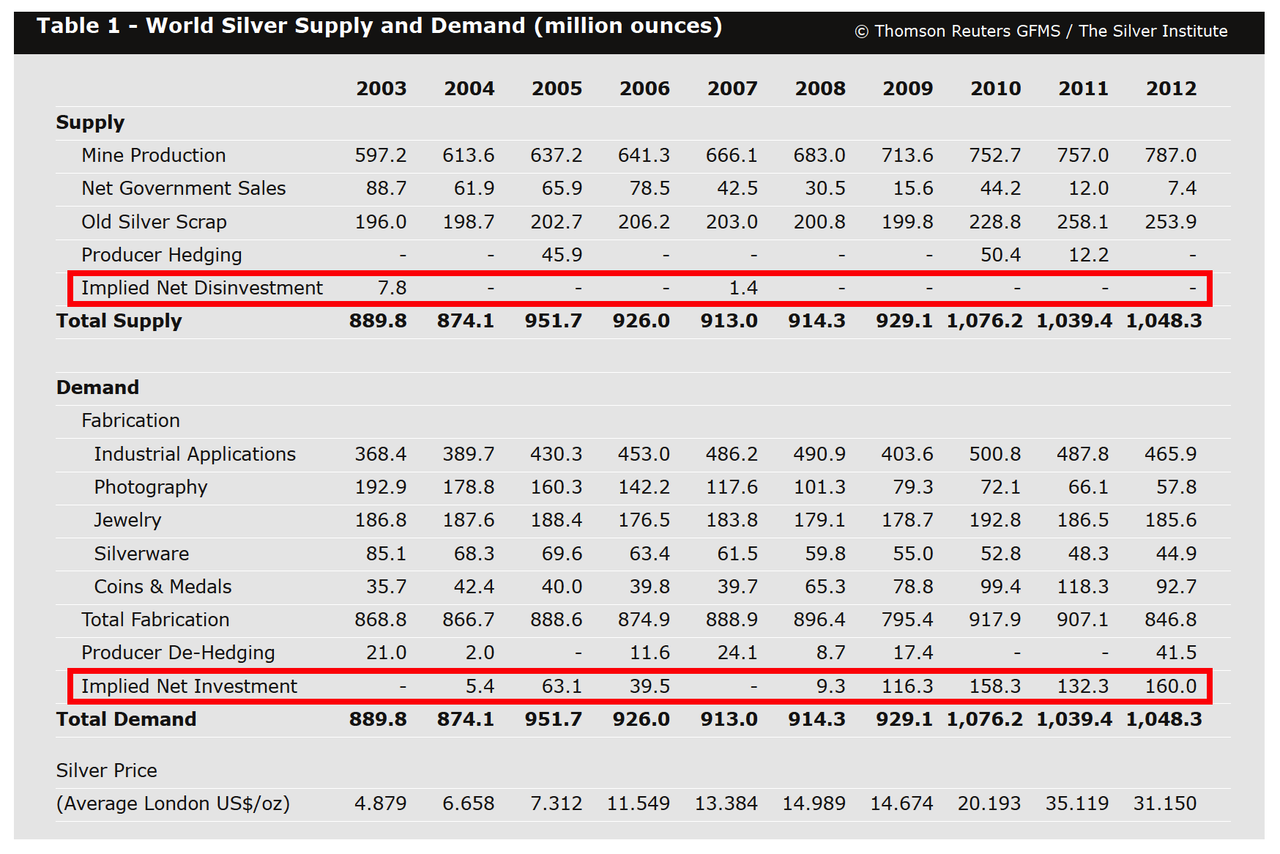

The Silver Institute has repeatedly changed their methodology in the past decades. Before 2013 there wasn’t a net balance disclosed in the World Silver Surveys. In those years, the difference between supply and demand was referred to as an implied net investment or implied net dis-investment.

A market surplus was referred to as an implied net investment, and vice versa. To me this is odd, because when supply exceeded demand, the residual surplus (implied net investment) was supposedly a reason for the price to rise. In 2007, the Institute wrote: “The higher trading range [price went up] has to a large extent been supported by continued investors interest in the metal. … as our relatively modest net implied investment number for 2006 indicates, sentiment has tended to remain overwhelmingly positive.” This methodology was not accurate, as evidenced by the fact that from 1985 through 2012 implied net (dis)investment was positively correlated to the direction of the silver price only 54% of the time.

In 2013 the Silver Institute changed its methodology. Not only was the “net balance approach” adopted (exhibit 4), the numbers were also changed. Previous years of implied net investment (surplus), were flipped into negative net balance years (deficit). This can be seen by comparing the data for 2009, 2010, 2011 and 2012 in exhibit 4 and 5.

The above shows the difficulty for consultancy firms of presenting a market balance for what is chiefly a currency (monetary metal). My message is not that the Silver Institute’s reports are useless; they contain all sorts of valuable data. I’m just skeptical of any conclusion derived from a silver market balance—surplus or deficit. To me it makes more sense to focus on variables that also drive the price of gold—such as inflation, risk, and interest rates—to get a feel for silver sentiment. Note the correlation between gold and silver in the below.

Sources:

via ZeroHedge News https://ift.tt/2RrixX8 Tyler Durden

US Issues Sweeping Travel Warning For China & HK: “Arbitrary Detention & Prolonged Interrogations”

Tyler Durden

Tue, 09/15/2020 – 17:45

In the latest move taking aim at China over the Hong Kong national security law, and part of the broader tit-for-tat being waged between diplomats, the Trump administration is again telling American citizens they are at risk of “arbitrary detention” and “arbitrary enforcement of local laws” if they travel to Hong Kong or mainland China.

A newly updated State Department advisory warns that China imposes “arbitrary detention and exit bans” in order to compel cooperation with investigations in order to “gain bargaining leverage over foreign governments,” as well as pressure Chinese nationals abroad to return.

The advisory states further: “U.S. citizens traveling or residing in the [People’s Republic of China] or Hong Kong, may be detained without access to U.S. consular services or information about their alleged crime. U.S. citizens may be subjected to prolonged interrogations and extended detention without due process of law.”

China “unilaterally and arbitrarily exercises police and security power in Hong Kong” it says of the semi-autonomous city-state. It warns that US citizens are “strongly cautioned to be aware of their surroundings and avoid demonstrations.”

However, following the worst of the coronavirus pandemic appearing to be long gone in China, with the United States now for months being the global epicenter, the State Department reduced its travel advisory for China from level 4 (or “Do not travel”) to a less ominous level 3 (or “reconsider travel”).

The Chinese foreign ministry slammed the new advisory on Tuesday, calling it “unwarranted political manipulation”. Ministry spokesperson Wang Wenbin said, “China has always protected the safety and legal rights of foreigners in China in accordance with law. China is one of the safest countries in the world.”

“Of course, foreigners in China also have an obligation to abide by Chinese laws,” he added.

Recently a couple of high profile Australian citizens, one of which works as a television anchor for a Chinese state news agency, were detained in China have had little to no access to lawyers or outside communications.

via ZeroHedge News https://ift.tt/2FD5xLp Tyler Durden

California’s Governor Makes Ominous Prediction For America

Tyler Durden

Tue, 09/15/2020 – 17:25

Authored by Simon Black via SovereignMan.com,

California’s governor made a rather ominous prediction this weekend when he told an interviewer that “California is America. . . fast forward.”

He was talking specifically about the wildfires that have ravaged his state – a warning that the natural disasters that natural disasters will soon plague the rest of the country too, thanks to climate change.

But his comment should really be taken more broadly… because California really is a snapshot of America in the near future.

Just like America, there are a lot of incredible things about California. It’s home to some of the biggest, most ‘innovative’ tech companies in the world. It has a large, educated, highly skilled population.

Just by itself, the state is the 5th largest economy in the world. It’s a powerhouse. Or, at least, it should be. It has all the promise of America – Hollywood, Silicon Valley, sunshine, Disneyland, and endless possibilities… the place where dreams can come true.

And then there’s reality.

Yes, the state is ablaze and air quality has turned toxic. But that doesn’t even scratch the surface of the problems.

(The wildfires are indicative of a bigger problem, though. It’s not like wildfires are a rare occurrence in California. They happen every year. Yet somehow this government always gets caught with its pants down.)

Just look at the state’s electricity situation: the fifth largest economy in the world can’t manage to keep the lights on! And the state has to resort to rolling blackouts like some third-world country.

Last week the Mayor of Los Angeles tweeted–

“It’s almost 3pm. Time to turn off the major appliances. . .”

It sounds like a joke. But this actually happened: the mayor of one of America’s largest cities told people to turn the lights and appliances off because they can’t produce enough electricity.

Bear in mind that California’s electricity rates are among the highest in the country. So people pay dearly for shoddy public services.

According to the Wall Street Journal, the electricity deficit reached up to 50% of total consumption last month– which is pretty extraordinary.

Of course, the politicians always blame some evil boogeyman… climate change, in this case. They claim that the month of August was very hot, and the excess electrical demand from too many air conditioners was too much for the grid to bear.

Really? August was hot? Is this honestly a surprise to these people?

But just like the wild fires, the failed electrical grid doesn’t even begin to tell the real story.

The school system has gone totally bananas– California leads the way in intellectual jihad, firing university professors for expressing views that don’t conform to the Twitter mob, and now mandating an Ethnic Studies course at public universities.

California was the first in the nation to legislate wokeness in business; the state now has laws which tell shareholders who they can/cannot elect to the Boards of their own companies.

Business regulations are out of control; the state has long since bent the knee to labor unions, which create massive excess business costs for anyone who dares to be an entrepreneur in the state.

And for anyone who is lucky enough to start a business and become successful despite constant obstacles and roadblocks put up by the state, the government rewards you with the highest tax rate in the country.

But even though the wealthiest 1% of Californians account for nearly HALF of the state’s total tax revenue, the government feels entitled to squeeze them even more.

Now the state’s legislators wants to raise taxes on the wealthy from 13.3% to 16.8%.

PLUS they want to hit people with a wealth tax… and make the whole package retroactive.

They even want to continue to tax former Californians who LEAVE, essentially creating the first state Exit Tax in the United States.

The list goes on and on… from the state’s critical (and ridiculously mismanaged) water shortages to the homeless epidemic to the high cost of living.

California was also home to some of the worst, most incomprehensible Covid lockdowns in the country.

Politicians told people that wet sand was OK, dry sand was not OK.

They arrested a guy for surfing, entirely by himself, for violating social distancing edicts rules, but then praised peaceful protesters who packed together like sardines.

But the biggest issue with the state, by far, is what I call the tyranny of the elite.

These are the single-minded people who are convinced in their righteousness, whether for the environment, social justice, public health.

It doesn’t matter how pitiful their results are. It doesn’t matter that every shred of objective evidence says their idiotic policies and ideas are dead wrong.

Their ideas have bankrupted the state (whose budget deficit exceeds 30% of revenue!), plundered the electrical grid, destroyed the forests, etc.

Yet they refuse to accept reality, and continue racing down their destructive path.

But Californians themselves are starting to understand what’s happening.

The most recent Census data only goes to 2018. But in that year alone, nearly 700,000 people left California for other states. And it was the 7th year in a row where people fleeing the state handily exceeded the people moving there.

That trend probably accelerated in 2019 and hit warp speed this year.

Real estate websites like Zillow and Redfin show a surge of Californians looking at property outside of the state, and some cities (like San Francisco) have twice as many homes on the market compared to this time last year.

People are starting to understand that there are more options out there. And they’re right.

California is in big trouble. And, like the governor said, it’s a sign of things to come in the US.

Fortunately, feudalism is dead. We’re not medieval serfs anymore, tied to the land and forced to remain.

There are plenty of options out there– place where you can move, live, work, invest, thrive, and be happy.

It just takes a little bit of education… and the will to take action.

* * *

On another note… We think gold could DOUBLE and silver could increase by up to 5 TIMES in the next few years. That’s why we published a new, 50-page long Ultimate Guide on Gold & Silver that you can download here.

via ZeroHedge News https://ift.tt/32vJHma Tyler Durden

Drudge Report Continues Historic Readership Collapse, Down 40% Year Over Year In August

Tyler Durden

Tue, 09/15/2020 – 17:05

Matt Drudge’s Drudge Report website continues what has been a historic crash in viewership in August.

The site’s traffic in August fell to 63 million readers, down from 66 million in May, according to True Pundit. Just months ago, in September 2019, the site was regularly garnering 95 million readers.

Comscore data also put Drudge’s viewers at 1.488 million unique visitors in July, down 38% from July of 2019, according to The Wrap.

About a year ago, in August 2019, the site was posting “well over 100 million” readers. The site’s recent numbers mark a steep 40% decline year over year. They also mark Drudge’s lowest numbers in decades.

The slide comes after many conservatives, including President Donald Trump, have asserted that the site had given up its long held conservative ideology. Recall, just hours ago, President Trump tweeted that his people have “all left Drudge,” referring to the media mogul as a “confused MESS”.

Our people have all left Drudge. He is a confused MESS, has no clue what happened. Down 51%. @DRUDGE They like REVOLVER and others!

— Donald J. Trump (@realDonaldTrump) September 14, 2020

“Such an honor! Drudge is down 40% plus since he became Fake News. Most importantly, he’s bleeding profusely, and is no longer “hot”. But others are! Lost ALL Trumpers,” Trump wrote in another Tweet.

“Matt Drudge is now firmly a man of the progressive left,” Tucker Carlson said at one point. And – not unlike the NFL – the change in Drudge’s proverbial game plan is starting to show up in the ratings.

Recall, it was reported by Rasmussen in 2019 that Drudge had sold the site and was “no longer involved in its operations”, though details around his involvement remain fuzzy.

But think TruePundit said it best when they concluded: “Obviously. Drudge — if he is even still running the site himself at this point — remains uninterested in slowing the bleeding. And the site isn’t just bleeding out, it is hemorrhaging.”

via ZeroHedge News https://ift.tt/3hD7sNk Tyler Durden

America Under The “Macroscope”: The Decade Ahead

Tyler Durden

Tue, 09/15/2020 – 16:45

Authored by Sune Sorensen via BFICapital.com,

Niels Bohr, my fellow countryman and Nobel laureate in Physics and father of the atomic model, is quoted as saying, “Prediction is very difficult, especially if it’s about the future!” However, change is the only constant and change is not an event; it is a process and as such, we can explore what such processes may look like. From there, we can map out different paths to major change and from that vantage point, we can monitor for signals that may help us determine the probable direction of travel in the key economic, financial, and social spheres. As investors and business owners, we can thus position ourselves to manage the risks and harness the opportunities.

In this exploration of the decade ahead, I will be putting the US under the ‘macroscope’ as it remains the key cog in the global economic and financial machine. It has been dominant on most fronts for the last 70 years, and in terms of financial flows and asset markets performance, it has been ‘exceptional’ for the last decade. However, many of the considerations I’ll raise will also be applicable to various degrees to the other key components of the global economy and all are interconnected at historically high levels.

As we exited the Great Recession in the early 2010s after unprecedented monetary and fiscal measures, there was much talk of the onset of the ‘Japanification’ of all developed economies. Many observers are expecting this to finally set in during the 2020s. The human mind likes to put neat labels on complex things and then file them away in an orderly spreadsheet-like mental space never to be questioned and thought much about again. This approach comes with great risk of a rude awakening in the real world. The US is not Japan – culturally, politically, economically, or financially. There are certainly overlaps: financial repression at the monetary level, debt dependency, centralization and zombification have gradually gained the upper hand in the financial and economic spheres during the last decade. The Covid-19 crisis has been an accelerant for all of these trends, and its effects will be with us long after the virus. While the monetary playbook has been the same, it’s the reactions to its outcomes that should be considered. Politically, culturally, and socially, the US is a very different place and, in my view, it’s those differences rather than the similarities that will be most important in terms of shaping the outcomes for the next decade.

These political and social forces will turn ‘ice into fire’ as the 2020s get underway. The current “Molotov Cocktail” zeitgeist smells more like the late 1960s to early 1970s to me: coming out of increasingly unpopular foreign entanglements (Vietnam then – ‘War on Terror’ now), with the nation’s social fabric stretched to its breaking point, and matters of race and inequality dividing society across rural/urban and generational lines, only a short time after what felt like major social and economic progress. A world still shaped in the image of the ‘Washington consensus’, looking increasingly out of consensus and confused by the messages coming out of the ‘shining city on a hill’. As the 1970s got underway, it was clear that there were deep political and social problems. The late-60s were marked by riots in major US cities, the military was deployed on US streets, and protesting students were shot and killed by the Ohio National Guard at Kent State University. These were truly partisan times, while several high-profile civil rights leaders were assassinated, as was a presidential candidate.

Once it became clear that crackdowns and displays of hard power were only making matters worse, the chosen solution was to throw money at the problems. The ‘guns vs. butter’ debate turned into the ‘guns and butter’ framework that has been with us ever since. The political economy set in and fiscal measures became the answer to all ills. Debt became the remedy and central banks were co-opted to monetize it. In 1971, President Nixon abolished the post WWII Bretton Woods system and severed the USD’s final links to gold, thereby removing cumbersome restraints. The price was paid via the currency and eventually through exceedingly high levels of inflation. In 1972, an embattled Nixon left office in disgrace, after the fallout from the Watergate scandal.

So where are we heading? Well, ‘history rarely repeats, but it does rhyme’ on occasion. The upcoming US presidential election is obviously on the forefront of most people’s minds. It may come to be a seen as a point of departure, but the dynamics of the 2024 election may prove more consequential in terms of actual policy changes beyond the rhetoric.

In 2020, the Millennial and Gen Z generations will numerically match the Boomer and Silent Generation in the electorate (if they come out to vote) and this trend will obviously only continue to tilt more and more in their favor, even with the quirks of the Electoral College for presidential elections factored in. Without getting into the party politics of it, one can clearly see the interests of this rising electorate majority. Millennials, who are now in their early 30s, own just 3% of the total US household wealth, according to the Federal Reserve. The Boomer Generation entered their late 30s in the 1990s with 21% of the household wealth and they currently hold 57% of it.

People tend to vote in line with their interests, especially in times of economic crisis, so fiscal spending focused on areas important to the younger generations and broader wealth redistribution measures would appear to be baked into the cake. The top marginal tax rate for individuals in the years between 1965 and 1981 was 70% and finally in 1978, faced with double digit inflation rates, income tax brackets were adjusted for inflation leading to fewer people being directly taxed at the highest rates. Currently, personal and corporate tax rates are at relatively low levels. Considering the current debt and fiscal dynamics alone, it is hard to see how they are not heading for significantly higher levels in the years ahead. Add in political sentiments and the required spending to get the economy back on track and you are looking at a fraught landscape.

The witches’ brew…

In the last decade, global monetary policy has been loose, but fiscal policy was relatively tight. The last couple of years in the US were the exception, with tax cuts and fiscal spending combined with relatively tighter monetary policy. Now both have been unleashed in the face of the Covid-19 crisis. Fiscal spending is politically hard to scale back, let alone stop, once you get started, and as we have seen, once monetary policy gets going and becomes a key driver of asset prices, that also becomes impossible to rein in.

The risk going forward is that there is a sense of ‘the boy who cried wolf’ attached to inflation risk, after many observers made strongly-worded predictions about high to hyper-inflation being just around the corner when those first rounds of QE were unleashed back in ‘08. Populations seeking simple, painless solutions to complex, difficult issues tend to find politicians who will make promises of exactly that. The ‘answer’ would appear to be ‘MMT’ by another name with never-ending ‘temporary’ fiscal programs paid for by more and more debt, which in turn is bought by the central bank spiced up with some ‘tax the rich’ efforts for good measure.

In the mid-1960s, US inflation was below 2% before exploding into double digits in the mid-1970s. Will this ‘rhyme’ with the 2020s? The ingredients are all there. What is for sure is that most central banks have lost their independence and are increasingly a tool for government policy. With global levels of debt reaching a record $258trln in Q1 2020, it will be very painful to raise interest rates and any policy errors will be felt far and wide.

This is a volatile brew that has been simmering for a while and may come to a boil in the decade ahead. Investors need to think about these dynamics – social, political, economic, financial – and make sure they are prepared to face the risks and harness the opportunities.

With financial repression set to spread beyond the monetary policy domain, ‘how you own’ will be as important as ‘what you own’, so make sure your vessel can weather the storm. On the investment front, it starts with comprehensive risk management and global cross asset class strategies. Finding companies supported by decade-long mega trends powered by innovation and with a proven ability to navigate change, and then building positions upon market disruptions when most are fearful, will be key.

It’s also worth noting that currently ‘Real Assets’ relative to ‘Financial Assets’ are at their lowest point since records began in 1926. Precious metals, productive land (farm & forestry) and real estate in stable jurisdictions might be a good place to start as you look to protect what is rightfully yours on the path ahead. On a final note, always stay humble and nimble and operate with a margin for error for optimal outcomes.

via ZeroHedge News https://ift.tt/3iFqUdS Tyler Durden

WTI Extends Gains After Huge Crude Draw

Tyler Durden

Tue, 09/15/2020 – 16:34

Oil prices rallied to one-week highs after China economic data provided some hope for a rebound in demand, which outweighed any anxiety caused by the EIA who warned the market outlook has grown “even more fragile” with a resurgence of the pandemic.

Despite how “depressing the IEA report was, there’s hopeful signs this morning about positive sentiment in the manufacturing sector,” said John Kilduff, a partner at Again Capital LLC.

“Beyond transportation, you really need industrial demand to kick in, factories to be hopping, for there to be a market increase in consumption.”

All eyes again on inventories for the next move.

API

Crude -9.517mm (+1.27mm exp)

Cushing -789k (+2.608mm) exp)

Gasoline +3.762mm (-160k exp)

Distillates -1.123mm (+600k exp)

Against expectations of a modest build, API reported a major 9.5mm barrel crude inventory draw last week (and a surprise gasoline build)…

Source: Bloomberg

WTI rallied back above $38 intraday today and held around $38.30 ahead of the print, and extended gains after the big crude draw…

“You’re probably going to see steady increases, especially in crude, for the next couple of months, unless you get a real pickup in economic activity in the U.S.,” said Michael Lynch, president of Strategic Energy & Economic Research. “It’s the usual seasonal build, compounded by the fact that demand still remains” below normal.

via ZeroHedge News https://ift.tt/2H3MhaK Tyler Durden

Isn’t It Obvious We Need A New System?

Tyler Durden

Tue, 09/15/2020 – 16:20

Authored by Charles Hugh Smith via OfTwoMinds blog,

Why do we tolerate such a corrupt, undemocratic, exploitive, elite-dominated system? Because we have no other choice? No, we do have a choice.

Isn’t it obvious that we need an alternative economic system that isn’t controlled by corporations, the government and the central bank for the exclusive benefit of insiders and elites? Isn’t it obvious that the current system has failed the majority of participants, and hence the ubiquitous sensations of:

1) being ignored by the insiders / elites who run the current system to their own benefit

2) being trapped in an economy that’s been stripped of social / upward mobility

3) being stripmined / exploited by domestic and globalized elites

4) disgust / frustration with the self-enriching political class that serves corporate/elite/insider interests above all else.

My 50 years of work have given me a ringside seat in how the economy has changed from inclusive to extractive. My jobs have ranged from agricultural field worker to running my own yard service to hospitality to construction to print media (free-lancer) to financial services (quant shop) to non-profit education to political rabble-rousing (unpaid) and my current profession as marginalized, misfit author-blogger (my specialty appears to be getting shadow-banned by Big Tech monopolist extractors).

My colleague Mark Jeftovic explains how systems can be inclusive or extractive. Systems that automatically bail out the greediest, wealthiest socially-useless speculators via the Federal Reserve are not just extractive, they’re exploitive and predatory. The Reversion Will be Mean.

Extractive systems are also intrinsically fragile in crises as the trapped / exploited behind the oars tend to abandon ship at the first chance, and the real-world sinews of the economy have been weakened by the bailouts and financial engineering. In effect, the fragile, brittle shell doesn’t need much of a shock to implode. (If you want to see this process in real time, look around you.)

Yes, finance was extractive in 1970, but it was a much smaller part of the economy. Back then, finance was less than 5% of the economy. Now, by some measures, it’s a third of the economy.

Yes, corporations bought political influence and exploited everything within reach but their reach wasn’t as global and their rapacity not quite as refined. Sociopathic exploitation such as stock buybacks and Big Pharma advertising directly to consumers were illegal.

The economy was not dependent on endless asset bubbles and bailouts of the most venal speculators. The Federal Reserve whines that it has to bail out the greediest scum of the nation again and again and inflate one asset bubble after another because otherwise this sucker’s going down.

Over the past 50 years, the ladders of upward mobility have splintered. Now making all the sacrifices to follow the conventional script (get a college diploma, etc.) don’t lead to secure employment. The fundamental backdrop of the economy is that labor’s share of the economy is in permanent decline: the value of labor has been in a freefall, a freefall masked by bogus “low inflation” and other trickery. (See chart below)

In 1970, costs for essentials were low and regulatory burdens on small business were modest. You could rent an apartment for a week’s pay or less. (Even in expensive Honolulu I could rent a studio apartment for half a week’s pay.)

Even in the mid-1980s, I could get a building permit for an entire house in one day; now the process takes weeks or even months.

Now costs and regulatory burdens have soared to crushing levels. This plays perfectly to government bureaucracies, which have monopolies on the power to raise junk fees, penalties, etc. at will, and Corporate America, whose core drive is eliminate any and all competition so profits can soar on the basis of monopoly, not on superior products or services.

People feel ignored because they are ignored. People feel trapped because they are trapped. People feel stripmined because they are being stripmined. People feel angry at the political Establishment because they no longer live in a democracy.

Can we be honest for a change and admit that ours is an extractive system in which anything goes for the wealthy and powerful and winners take most?

The few pockets of the economy not under the thumb of corporations, government or the central bank– for example, the cash / informal economy–are still dependent on corporations, government and the Fed for their currency, government subsidies and products/services.

Isn’t it obvious that we need an alternative system that isn’t run for the benefit of elites and insiders? What would such a system look like?

One, it would be voluntary / opt-in. Nobody would be forced to participate. All anyone would need to bring is a willingness to be useful and belong to something doing good work on behalf of the community rather than a bunch of parasitic, predatory billionaires.

Two, it would be self-organizing, meaning there is no ruling body that can be corrupted. Bitcoin is a real-world example of a self-organizing system. There is no cabal at the top who can be corrupted; bitcoin is distributed and decentralized. It is self-organizing, as is Nature.

Three, the operations of the system would be automated so human bias would have few opportunities to carve out unearned privileges. Note that most of the systems you interact with are fully automated. (Try reaching a human being in customer service.) The only difference is these systems are secret “black boxes” designed to maximize the profits of cartel-monopoly corporations, not serve the nation or its communities. They only serve the owners, 2/3rds of whom just so happen to be the top 0.1%.

Open-source software runs a great many enterprises and systems and does so without secret “black box” algorithms known only to the exploiters.

Four, it would have its own money, a cryptocurrency that comes into being in only one way: as payment for useful, purposeful labor that benefits the community in some way. All the technology for such a labor-backed cryptocurrency is already in hand.

My 50 years of work in a variety of sectors and jobs has made such a system “obvious” to me, and so I’ve written a book (A Hacker’s Teleology) to explain how such a system would work and why it’s “obvious.” You can read excerpts of the book in this free PDF and read the story behind the book and the Introduction.

Why do we tolerate such a corrupt, undemocratic, exploitive, elite-dominated system? Because we have no other choice? No, we do have a choice. The first step to outline the values, processes and goals of an alternative system that actually works for everyone and our planet.

I’ve taken a stab at outlining such a system, so why not check it out? If you can come up with a better one, then get it out there for the rest of us to study.

We do have a choice. But we have to take it. If we’re unwilling to make any systemic changes, then we truly are trapped–not by them (whomever they might be) but by our own unwillingness to accept that systemic change is now necessary if we’re to have a future that’s beneficial to all.

My new book is available! A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet 20% and 15% discounts end September 30 (Kindle $7, print $17)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

* * *

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook coming soon) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

via ZeroHedge News https://ift.tt/33vFm1v Tyler Durden

Kim ‘Krashdashian’ Breaks The Market Despite SPACs, Snowflake, & Soaring Zombies

Tyler Durden

Tue, 09/15/2020 – 16:00

Buffett barreling into Snowflake’s IPO, yet more SPACs, WTO Ruling against US (in favor of China), a snooze-fest Apple event with no iPhones, a continuing collapse in Exxon, Kim ‘Krashdashian’ ‘freezing’ her Facebook/Instagram account, and the rise of the zombie firm… all add up to one thing…

All of which ended up with Nasdaq dramatically outperforming (note the divergence at the cash open – Nasdaq bid, Small Caps dumped)… Kim K Krashed stocks briefly but he standard buying-panic stomped into markets in the last 10 mins (The Dow and Small Caps barely green)…

The Dow scrambled to end the day +1 point!!! But was unable to get back to 28k…

Quite a swing at the cash open again…

Source: Bloomberg

Stocks and Yuan slipped at around 0945ET when WTO headlines hit (ruling against US on China tariffs)…

Source: Bloomberg

Although that drop is negligible compared to the recent yuan resurgence to its strongest since May 2019…

Source: Bloomberg

Meanwhile, XOM down 11 days in a row (equal to longest streak ever – 01/2020 and 08/2013) pushing it up to a 9.5% dividend yield (and near 900bps spread to 10Y)…

Source: Bloomberg

Facebook was flambéd when Kim Kardashian called on her followers to freeze their accounts…

AAPL was monkeyhammered after a snoozefest product launch…

Banks were battered after JPM comments, erasing yesterday’s gains…

Source: Bloomberg

Another crazy day in quant factor land with a panic-divergence at the cash open (buy momo, sell value) then a reversion again…

Source: Bloomberg

Treasuries were unchanged on the day (longer-end slightly offered) despite the vol in stocks (a second day of extremely tight range in yields)…

Source: Bloomberg

The dollar ended modestly lower after bouncing back during the day session…

Source: Bloomberg

Mixed picture in cryptos today with Ethereum down and Bitcoin gaining…

Source: Bloomberg

Gold ended the day unchanged…

Oil was higher ahead of tonight’s API inventory data with WTI back above $38…

Finally, thanks to The Fed’s folly, the number of ‘zombie’ companies in the US has soared back near the 2000 peak…

Probably nothing!

via ZeroHedge News https://ift.tt/35KD15L Tyler Durden

Biden’s Multi-Trillion-Dollar Budget Is The Biggest Increase In Decades

Tyler Durden

Tue, 09/15/2020 – 15:42

Authored by Mike Shedlock via MishTalk,

Biden unleashed his budget plans. Let’s have a look.

Biden rejected progressive spending plans but now Hones Multi-Trillion-Dollar Budget

Joe Biden won the Democratic presidential nomination running as a moderate, rejecting the big-government plans of progressive rivals as unaffordable.

The former vice president has proposed a total of $5.4 trillion in new spending over the next 10 years, according to an analysis published Monday by the Penn Wharton Budget Model, a nonpartisan group at the University of Pennsylvania’s Wharton School. That includes historically high allocations for sectors from education and health to child-care and housing.

Mr. Biden’s proposed budget is more than double that of Hillary Clinton, the 2016 Democratic nominee. It is a fraction of the $30 trillion to $50 trillion spending plans that progressive Sens. Bernie Sanders and Elizabeth Warren laid out during the Democratic primary. But since effectively sealing the nomination in March, Mr. Biden’s plan has grown in response to the pandemic, the lockdowns, and the resulting recession.

Over fiscal years 2021 – 2030, the Biden platform would raise $3.375 trillion in new tax revenue while increasing spending by $5.35 trillion.

Under the Biden tax plan, households with adjusted gross income (AGI) of $400,000 per year or less would not see their taxes increase directly but would see lower investment returns and wages as a result of corporate tax increases. Those with AGI at or below $400,000 would see an average decrease in after-tax income of 0.9 percent under the Biden tax plan, compared to a decrease of 17.7 percent for those with AGI above $400,000 (the top 1.5 percent).

The largest areas of new net spending are education at $1.9 trillion over ten years and infrastructure and R&D at $1.6 trillion over ten years.

In total, including macroeconomic and health effects, the Biden platform increases federal debt by 0.1 percent in 2030 before decreasing debt by 1.9 percent in 2040 and 6.1 percent in 2050; GDP decreases by 0.4 percent in 2030, sees no change in 2040, and increases by 0.8 percent in 2050.

Implement a Social Security “Donut Hole”,

Repeal elements of the Tax Cuts and Jobs Act (TCJA) for high-income filers,

Raise the top rate on ordinary income,

Eliminate stepped-up basis,

Tax capital gains and dividends at ordinary rates,

Limit itemized deductions,

Raise the corporate tax rate,

Impose a minimum tax on corporate book income,

Raise the tax rate on foreign profits,

Eliminate fossil fuel subsidies,

Eliminate real estate loopholes,

Impose sanctions on tax havens.

Those provisions are described in detail in PWBM’s analyses of the Biden’s original tax plan and his updated tax plan.

Party progressives, meantime, are satisfied—for now. “Where Biden has moved is an important set of steps forward,” says Washington Democratic Rep. Pramila Jayapal, the co-chair of the Congressional Progressive Caucus. “Do we want more?” she says. “Absolutely.”

Regarding point 4 above, rest assured no federal debt decreases will ever happen and the deficit will be worse, no matter who wins.

And the Progressives will never be happy until they turn the US into a socialist mecca like Venezuela.

via ZeroHedge News https://ift.tt/3c2dpCg Tyler Durden