The Gathering Super Tantrum

Tyler Durden

Fri, 09/25/2020 – 17:00

Authored by Robert Gore via Straight Line Logic blog,

It’s time for a divorce.

Russiagate, impeachment, the coronavirus power grab, riots, overhyped Trump “scandals” that came and went, and nonstop venom, vitriol, and vituperation come together under this label: the Continuing Tantrum. The presidential election is less than two months away, and we’re being promised the tantrum to end all tantrums, a Super Tantrum, if the harpy and the dotard don’t win.

Children don’t have a shadowy cabal and mainstream political, business, and media figures encouraging (and funding) their tantrums. Unlike Continuing Tantrum partisans, children who tantrum can be spanked or put in time out, they don’t burn down cities or launch coups, and some of them grow up.

The cabal and its useful idiots are giving the rest of us a “your money or your life” proposition.

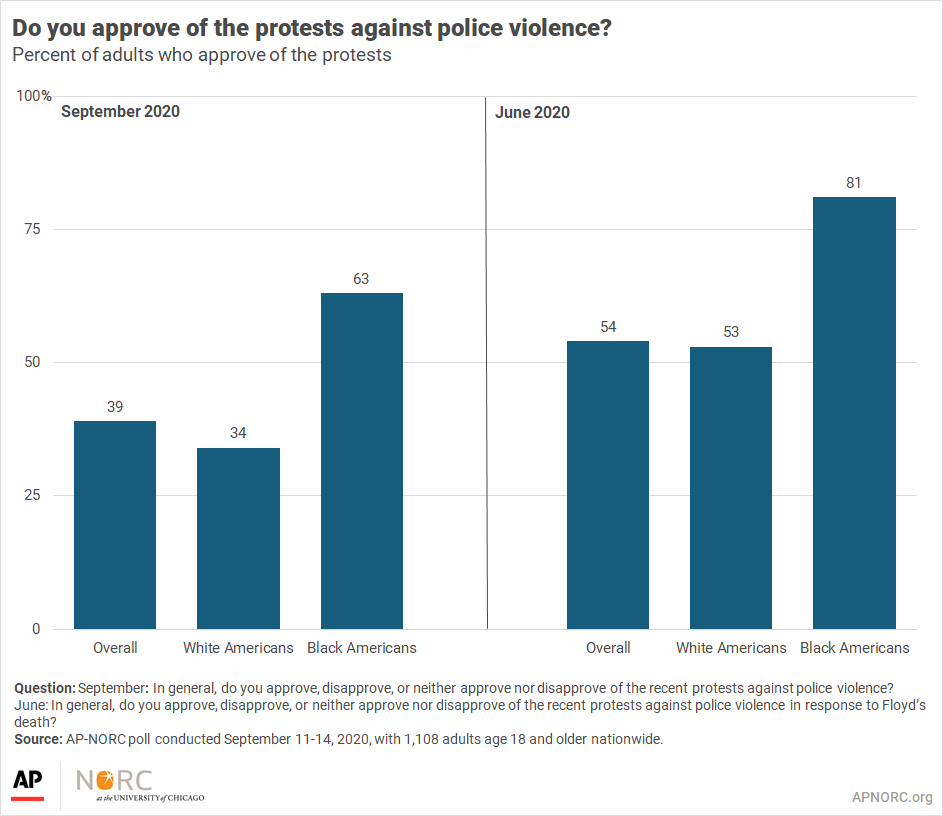

We either elect Harris/Biden or the cabal launches a coup and their thugs destroy the country. Hillary Clinton already has told Biden not to concede under any circumstances. It’s a regime-change operation similar to those the cabal has waged around the globe for decades. BLM and Antifa are kissing cousins to the US’s cat’s-paw Islamic extremists and Ukrainian neo-nazis. Fomenting violence and chaos, they’re the violent cover for their sponsors’ intrigues. Order won’t emerge from their chaos, unless your idea of order is Afghanistan, Iraq, Syria, Somalia, Libya, and Ukraine.

It’s all laid out in the Transition Integrity Project (TIP), a blueprint of how the cabal intends to install Harris/Biden regardless of the actual election results. Couched in the plausible deniability language of war-gaming and projections, every one of its scenarios—other than a clear Harris win—leads to a constitutional bonfire fueled by street violence, court battles, legislative legerdemain, media propaganda, and possible military intervention. Its authors are circumspect, but one man’s war-gaming and projections are another man’s call to action and instruction manual.

The TIP has about the same chance as a poker player drawing to an inside straight. Trump may deserve to be the fifth white male on Mr. Rushmore if for no other reason than he forced the cabal out of the shadows. He has exposed the unholy alliance of scheming bureaucrats, political figureheads, intelligence operatives, military brass, contractors, second-rate academics, media moguls, and Hollywood airheads that presume to rule us. “The Deep State” was a fringe term when Trump became president, now it’s part of the vernacular. With exposure comes ridicule and scorn; it’s nowhere near as smart or competent as once supposed. Russiagate and the impeachment were maladroit melodramas manipulated by mendacious mediocrities.

The cabal places great store in narrative management. Back in the 1960s and 1970s allegations were first voiced, mostly from the fringe, that the FBI and CIA had infiltrated the mainstream media. There were also complaints, always dismissed, about the media’s liberal bias. Trump derangement syndrome has put the liberal bias on full display, nobody even pretends it doesn’t exist. As for intelligence agency infiltration, the owner of the Washington Post has a huge contract from the CIA and television and cable networks hire ex-spooks as commentators.

Narrative management was easy when there were only three television networks and a few “papers of record.” Now it’s much harder to suppress the truth. The intelligence agencies and their media mouthpieces are subject to constant scrutiny from the alternative media. Once it opens people’s eyes, they stay open; regular AM readers don’t return to mainstream lies.

While the cabal protects its own—the most powerful perpetrators of Russiagate and the impeachment attempted coups may escape punishment—the official and media cover afforded cabal skullduggery is nowhere near as effective as it was for, say, the Kennedy assassinations. Back in the media’s halcyon days, it took a decade before any significant number of people started waking up to the truth about the assassinations. Now we see Plot Holes exposed in real time.

Cable networks broke the television networks’ oligopoly and the information dam began springing leaks. Leaks became gushers with the advent of the Internet and sites devoted to independent investigative journalism, scathing commentary, and non-mainstream news aggregation. The cabal tries buying off the rebels, and if that doesn’t work it deplatforms or demonetizes them. Nevertheless, the rebel alliance continues to find ways to circumvent the Empire. New sites and social media alternatives spring up like weeds and bought-off sites like the Drudge Report see precipitous declines in viewership.

The gathering Super Tantrum, given added impetus by the Supreme Court situation, advertises itself as righteous revolution, but it would be the cabal deposing an outsider and installing chosen insiders. A real revolution overthrows insiders, so call this another attempted coup. Give into your kids’ tantrums and you’ll suffer rule by screams. The cabal thinks it can turn violence on for regime-change and off once it’s successful. That’s wishful thinking. Violence is a race to the bottom and the most bloodthirsty win. Coups often devour their sponsors—you get someone to do the dirty work and you become the dirty work.

Parents who cave in to their children’s tantrums ruin any chance they’ll grow into productive, happy adults. If the Super Tantrum steals the election, the America experiment is over. The Harris Democrats will rejigger the rules so they’ll never lose and America will become a one-party banana republic featuring permanent bio-totalitarianism.

California, New York, and Illinois are previews of coming attractions. They increasingly look like collectivist third-world dumps: the favored few ultra-rich, vanishing middle classes, masses of poor, and rampant crime, corruption, squalor, and seething unrest. And this before their underfunded pensions and welfare systems’ inevitable collapse.

If the Super Tantrum coup succeeds, millions of Trump supporters will know they’ve been robbed and see the writing on the wall for what remains of their freedom and way of life. They’ll be angry, and most of them have firearms. There’s no telling how they’ll respond, but probably not with the restraint to which they responded to the riots or the docility to which they responded to coronavirus totalitarianism. They may launch a righteous revolution of their own, or at least a guerrilla war. The US government hasn’t hadn’t much luck with guerrilla wars the last few decades. A once great nation would become ungovernable and unlivable, especially in the urban hellholes.

To paraphrase divorce decrees, the factions can no longer live in comity, a separation is necessary. That conclusion doesn’t have to be universally embraced. It won’t be embraced by those few who disparage the deplorable productive but dimly realize they’re the golden geese. It will be embraced by people fed up with the garbage. Judging by the numbers of refugees fleeing collectivist states, it already has. They’re taking their outdated fondness for families, livable towns and cities, law and order, property and contract rights, voluntary exchange, hard work, deferred gratification, saving, fiscal sobriety, limited government, individual rights, civility, decency, God, guns, and other cherished hallmarks of their civilization with them.

Once they leave, all the children will have are their tantrums.

via ZeroHedge News https://ift.tt/3czcsS4 Tyler Durden