1000s Of Cases But Zero Hospitalizations In Colleges: Good News But States Force Draconian Lockdowns

Tyler Durden

Wed, 09/09/2020 – 18:40

Authored by Daniel Horowitz via ConservativeReview.com,

Remember the goal of flattening the curve?

Ensuring that hospitals weren’t overrun? Well, what do you call a scenario where thousands of cases result in zero hospitalizations? I’d call it the ultimate flat curve – or downright flat line.

Yet rather than recognizing the detection of mild cases among college students as portents of good news, universities continue to sow panic for no good reason.

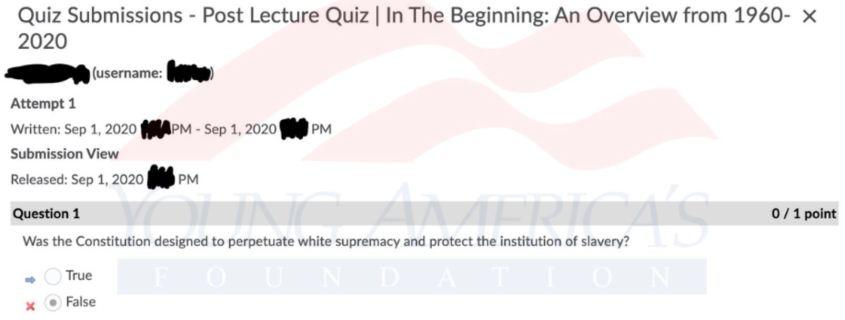

If we had in place the strict eligibility threshold for COVID-19 testing that we had in March when tests were scarce, we quite literally would not know the “epidemic” of mild and asymptomatic cases on college campus even exists. After being open for weeks, college campuses have no reported deaths or even hospitalizations that I can find. You might say that’s because they’ve done such an amazing job preventing cases. Nope: They have tons of reported cases. Dr. Andrew Bostom, a cardiovascular and epidemiology researcher, posted a spreadsheet on twitter of all the cases in 17 state university systems as of September 4:

1/ Very Reassuring U.S. Return To Campus C19 News: ZERO reported C19 hospitalizations despite >11,000 students testing C19+, i.e., being declared “C19 cases” pic.twitter.com/XrGlWddlsd

— Andrew Bostom (@andrewbostom) September 5, 2020

There is not a single hospitalization among them. How is this an emergency situation? If anything, the fact that there are so many cases is a blessing, because, with such a young population, these cases are a de facto vaccine, creating herd immunity without danger.

Despite this blessing, the University of Arizona has hired a private security company to “patrol and ensure compliance of health and safety directives” on campus, essentially turning the campus into a prison and criminalizing the lives of young adults who have near-zero risk from the virus. They must be suffering the epidemic of the century there in order to warrant such heavy-handed policing, right?

Well, according to Dr. Richard Carmona at the College of Public Health at the University of Arizona, they found a few “cases” at a sorority house and “were able to identify, very early, before anybody was symptomatic, that there were sick people in their dorm.”

The horror! Some asymptomatic cases. What are they going to do during the flu season when even young people actually get sick for a week? The entire purpose of counting cases during an epidemic is because they might predict mass casualties. During this pseudo-epidemic on college campuses, they need to count cases to even know they exist. But if they don’t result in serious illness, then what is the purpose of counting them more than rhinovirus colds?

Then there is the issue of what exactly these PCR tests are detecting. Many of them could be false positives, insignificant viral loads, or the dead RNA of a virus that passed weeks ago still being carried around in the student’s nasal passages. There is no metric for any of this being monitored in the testing. The irony of the University of Arizona using positive testing of benign cases as the baseline for such draconian measures is that so many of those tests turn out to be false positives. Out of the 13 positive results among members of the university’s athletics department last week, 11 of them turned out to be false upon retesting.

But evidently, negative tests aren’t even enough to escape to clutches of tyranny. Last Monday, Ohio Health Director Lance D. Himes signed an order requiring even students who test negative to be isolated in a quarantine house on campus. It includes asymptomatic individuals or even those merely “exposed” to a COVID-positive individual. They’d be barred from exiting the quarantine house without written permission from a health official, and individual universities would decide whether parents are even allowed to visit them. This is a mandate for de facto prison – all for an “epidemic” built on false or notional positives with no health risks beyond the ordinary bugs that spread on campuses every year.

By sending your children to Ohio’s public colleges, you are essentially sending them off to jail, because it’s nearly impossible for them not to be quarantined. Ohio State University is conducting mandatory random testing of 8,000 students each week via their “surveillance testing program.” Based on everything we know about false positive or old dead viral RNA, it’s a near-certainty that the testing will net dozens of people every week. Now, this order will force numerous friends and dorm-mates to be confined as well.

It’s becoming self-evident every week that the virus that is really spreading is an incorrigible psychosis. Rather than confining our youth for a cold that might not even spread in its asymptomatic form, perhaps its time to start confining some of the public health officials … to a mental health facility.

via ZeroHedge News https://ift.tt/2Rhkpl3 Tyler Durden