Yesterday, July 28, JPMorgan held a conference call for clients in which it laid out the outlook for the US elections using external strategists and consultants “and not necessarily the opinions of J.P. Morgan research analysts.” The bank was quick to note that its research team “remains explicitly nonpartisan and does not advocate for any particular candidate or policy platform”, although we doubt Jamie Dimon will cry if Trump loses. The conference call was closed to members of the press. The summary report below presents the issues discussed in the calls without direct attribution to the speakers or their institutions.

Key dates to watch include:

-

the official release of the Democratic platform at the Democratic National Convention, which will take place from August 17-20.

-

The Vice Presidential selection will likely take place in the first half of August, immediately before the convention.

-

The first televised presidential debate is scheduled for September 29.

Below are the top 10 Top 10 takeaways from the conference call:

-

There was a consensus from all three external speakers that the Democrats would sweep the Presidency, Senate and House, with odds of a Biden victory placed as high as 85% by one speaker. The November elections will effectively be a referendum on Donald Trump. While Trump’s supporters remain loyal, Biden is ahead of Trump by around 9 to 10%-pts in major polls and Biden’s disapproval rating with voters has remained low.

-

Trump’s re-election prospects will be defined by the three C’s: culture, competence and China. COVID-19 is preventing a return to “business as usual,” with Trump losing the culture war. Trump’s handling of the COVID-19 pandemic has raised questions about his competency to manage a crisis and has weakened the “cult of personality” that was much of his attraction. Trump and Biden are likely to spar on who will be toughest on China.

-

Biden will act as a unifier and is likely to appoint a mixed and diverse cabinet that will incorporate more progressive elements of the party. Elizabeth Warren is likely to receive a prominent role in the cabinet or potentially as Chair of the Senate Banking Committee or Attorney General as she is the proxy for the progressive wing of Democratic Party. The leading Vice Presidential candidates appear to have narrowed to Kamala Harris or Susan Rice. The next Treasury Secretary is unlikely to come from Wall Street with compromise candidates favored and an aversion to having a billionaire assume the position.

-

Biden’s “Build Back America” plan is decidedly centrist, and he has rejected the most progressive Democratic proposals, including Medicare for All, the Green New Deal and defunding the police.

-

Expect higher taxes, a turn on energy policy back to renewable energy, increased infrastructure spending and the possibility of student debt forgiveness under Biden. Biden is likely to propose both corporate and personal tax increases during his first year in office. The next president will take office with $3trn (potentially $4trn if the latest stimulus bill is passed) in unfunded spending added to the federal deficit. Neither candidate has outlined how the deficit will be funded.

-

Consensus that anti-China rhetoric is here to stay and likely to intensify as part of the election campaign strategy on both sides. There was no appetite for bipartisan consensus focused on engagement, with arguments that President Xi is taking a different approach from previous leaders, embracing a nationalist, authoritarian approach. Trump has consistently attacked Biden as being too weak on China, and Trump takes pride in being the first major leader to stand up to China.

-

The US-China conflict will extend beyond trade issues to technology and finance, including limiting the access by Chinese corporates to US capital markets, as well as greater focus on strengthening human rights and democracy initiatives.

-

Biden will focus on rebuilding multilateral and international relationships with the world by reaching out to Europe and rejoining the Paris Agreement on climate, re-engaging NATO, and Pacific allies like Japan and Korea. Part of the strategy for countering China will likely include teaming up with the EU and Mexico against China on trade issues.

-

Increased regulation under Biden remains a real possibility. There is considerable scope in Dodd Frank to effect policy and impact oversight regulation, particularly as Randal Quarles’ term as Vice Chair for Supervision ends in October 2021 (even as his role as board member for the Federal Reserve continues until 2032). Pressure will also be strong to adopt anti-trust measures to limit the size of megatech companies and collect higher taxes.

-

J.P. Morgan US equity research views a Biden victory as neutral or slightly positive in contrast to the market consensus that a Democrat victory in November will be negative for equities. However, speakers pointed out that the cost of higher taxes is underpriced and could be as much as a 10 to 12% hit to EPS. The JPM equity research team highlights that increased spending on infrastructure and an increase to the minimum wage as well as a reduction in the uncertainty that has been associated with the Trump administration’s style of governing would offset much of the tax implications, which strategists estimate would be an earnings drag of ~$9 for S&P 500 EPS.

And here is the summarizing commentary as put together by JPM strategists:

Campaign Strategy and Outlook and Execution Risk in the Elections

Going into November, the speakers are looking for a Democratic sweep, but not a landslide. Pre-COVID-19, the conviction level of a Biden victory in November was at 60% but now stands at 85% after the current administration’s handling of the virus and the subsequent economic fallout. Biden remains ahead in national polls by around 9 to 10%-pts. More importantly, he is ahead in some of the key swing states by 4%-pts or higher.

2020 is a bigger challenge for President Trump, because personal attacks have been less effective against Biden, and Trump has not grown his base and faces heavy criticism for his management of the pandemic. This presents challenges for congressional Republicans, because this election is being treated as a referendum on Trump. In 2016, Hillary Clinton was particularly vulnerable to Trump’s personal attacks as she had the second highest unfavorability as a presidential candidate in history (behind only Trump); conversely, Biden’s unfavorability is relatively low which may explain why Trump’s attacks have not seemed to stick. Meanwhile, first term presidents have historically used their first 18 months in office to broaden their support, but polling affirms that Trump has not achieved this. This makes it critical for Trump to energize his traditional base, which appears to be his approach in recent national issues, which would have been the case even if the COVID-19 pandemic had not unfolded. The extent to which American life can be restored to normalcy under COVID-19 (e.g. the NFL season, return to school) will strongly influence a visceral sense of how well or poorly COVID-19 has been handled. If Trump loses, the bigger concern centers on attempts to undermine institutions and delegitimize his loss, rather than an outright challenge of results or refusal to vacate the White House. Meanwhile, any actions taken between elections and inauguration will be subject to the Congressional Review Act.

China policy going into the election will be a “race to the bottom” in a competition to see who will be the strongest anti-China candidate. Trump has attacked Biden as being too weak on China, and this is a vulnerability as Biden’s long standing position has been for free trade and a multilateral approach. So to counter this, watch for concrete policy commitments to be made by Biden to bolster his credibility on standing up to China. If elected, Biden could choose to “pocket” the cumulative measures that Trump has enacted against conflict.

What would a Biden Administration Look Like?

The next President will be in a radically different position next year as they will be inheriting a $3trn increase in the federal deficit (potentially $4trn if the latest stimulus bill is passed), an economy that is unlikely to be in a strong recovery and a vaccine that will unlikely be available until middle of next year at the earliest. This will ultimately affect what Joe Biden is going to be able to achieve if he does become President, but he sees himself as a great unifier. He has spent his career in the Senate and as Vice President working with different groups who are at odds today (e.g. law enforcement and civil rights groups). He will likely downplay the culture wars in his outreach to the populist wing of the party. Over the last four months, he has used his personal relationships to work constructively with the progressive wing. His team has set up a Biden-Sanders Unity Task Force, and the report that they issued on July 8 contains very little that should cause concern for the markets and business community. The unity report does not embrace Medicare for All, the Green New Deal or defunding the police, yet it was fully endorsed by the Sanders team. Biden has shown that he can deal with the populist wing without lurching to the extreme left, and this is likely reflective of how he will build his cabinet and move forward with his policies next year.

Biden has adopted the moniker of “Build Back America” and has put forth a decidedly centrist economic plan that focuses on building infrastructure, supply chains, and enhancing domestic trade, with the first priority to strengthen the American economy. Biden is unlikely to be doctrinaire or ideological when it comes to trade agreements, but instead will focus on the practicality of agreements. He will also likely emphasize rebuilding international relationships by reaching out to Europe, NATO, and Pacific allies like Japan and Korea. Foreign policy will be a key and immediate focus by his administration, despite some concerns that the domestic agenda will dominate, given the impact on the domestic trade front.

There have been reports that Biden is favoring Kamala Harris and Susan Rice for the Vice President position while Elizabeth Warren is more likely to be considered for a cabinet position or a Senate leadership role, where she would still have outsized impact. Elizabeth Warren is seen as a proxy for progressives broadly when it comes to financial regulation, and therefore will have broad leeway for initiatives on areas for which she has been very passionate about, particularly over consumer protection issues. In a number of her prospective future roles, either as Treasury Secretary or Senate Banking Committee Chair, she would have significant power over how regulation is implemented. In particular is the potential replacement of Randal Quarles in his role as Vice Chair for Supervision when his term in that role expires in October 2021 (even as his role as Federal Reserve board member continues until 2032).

Market Implications of a Biden Victory

Markets though have not been as focused on the election as they were in the last 20-30 years given the impact of the COVID-19 crisis and are instead focusing on any positive news around advanced therapeutics and vaccines. The most underpriced risk today in the US equity market is the amount by which corporate tax may go up in the case of a Democratic sweep. Be cautious on the complacency around this issue given that Biden sees higher taxes as a moral responsibility to address widening inequality. He also wants to embark on up to $2trn in infrastructure programs, including green energy, and other job programs to get the economy back up and running, which will need to be funded by raising taxes. In the case of a Democratic sweep, it is likely that Biden will try and push through both corporate and personal tax increases using reconciliation with the Senate in a simple majority during his first year in office.

The market consensus view is that a Democrat victory in November will be a negative for equities; however, we see this outcome as neutral to slightly positive for equities. It remains to be seen how much of Biden’s campaign agenda is implemented if he is elected and what the make-up of his cabinet will look like.

History suggests that challengers to an incumbent typically campaign at an extreme only to converge to the

center post-election. Additionally, Biden’s proposed policy priorities were introduced in a healthy economy

during the primaries which took place pre-COVID-19. Given the current economic weakness, business recovery

and job growth are likely to be prioritized over policies that could dampen economic growth and perhaps even

jeopardize the desired 2022 midterm election outcome. A more diplomatic approach to domestic and foreign policy will likely result in lower equity volatility and risk premia. Regardless of how policies and polls evolve in

coming months, especially in the run-up to the Democratic National Convention in mid-August, investors are

assessing the cost/benefit of all major proposed economic policies with wide confidence bands.

Higher statutory tax rates would be an earnings headwind but would also require significant political will to push tax rates significantly higher. A partial reversal of the Tax Cut and Jobs Act (TCJA) benefits would be a significant headwind for earnings, which has been a catalyst for effective tax rate falling sharply to ~18% (vs. 26% pre-TCJA) which in turn resulted in an EPS growth of 12-14% in 2018 (or $16-18 EPS). Assuming Democrats reverse half of the statutory tax rate benefit from 21% to 28%, we estimate this would be an earnings drag of ~$9 for S&P 500 EPS. The second order impact of this change would be lower capital expenditure and buybacks. However, if the statutory rate increase is accompanied with the implementation of a “minimum tax” and/or reduction in GILTI deduction, it could create an additional $4-5 impact on EPS and a potential $14 hit to EPS. While higher corporate taxes are becoming a consensus election risk, it is worth noting that the tax rate has been drifting lower since the 1960s, and it would require significant political will to push tax rates significantly higher. In other words, headline risk might be greater than actual policy similar to many scares that have come before it (e.g. healthcare costs, antitrust).

Infrastructure spending should be a priority for Biden and could fulfill multiple agenda priorities such as increasing employment in a post-COVID-19 economy, expanding use of alternative energy and green technologies, and updating and expanding existing public transportation, power and communication systems. Size and scope will ultimately determine the fundamental impact, but a $1 trillion plan over five years with S&P 500 companies grabbing 50% of spending (directly and indirectly) at 8% of profit margins would imply an EPS benefit of $1/year. Further, increasing the federal minimum wage, while neutral to positive for S&P 500 companies, would be a negative hit to margins for the broader economy and would likely contribute to further drive inequality between companies that are able to absorb higher wages vs. those with lower pricing power / scale. Softening on tariffs could be a significant offset to higher taxes. Tariffs were the largest headwind for global growth in 2019 and had a cumulative effect of ~$12 on EPS. Therefore, if Biden is able to achieve bilateral easing of tariffs with increased purchases of goods by China, it could be a significant offset to higher taxes.

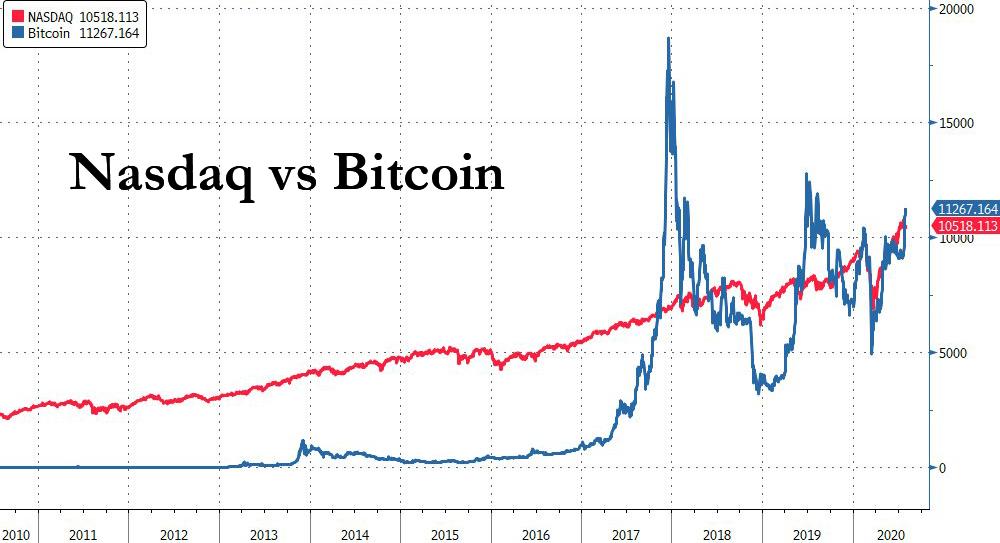

The Tech sector has been at the epicenter of multi-year secular growth, and with the global digitalization boom accelerated by COVID-19, it is now trading at premium. However, nominal growth and inflation prospects remain structurally low, and investors will continue to pay a bigger premium for innovation. Though a significant inflation shock is the biggest risk to the tech trade, technology continues to be one of the largest weapons that the US possesses, and the tech companies are systemically important and are backed by strong fundamentals.