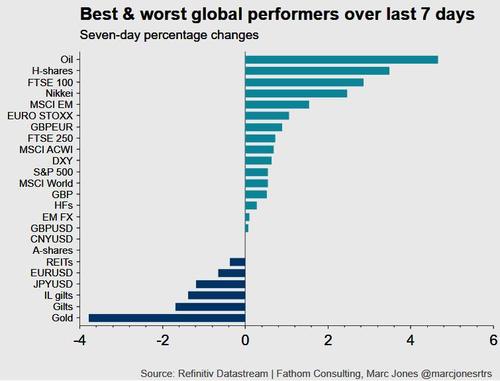

Global stocks struggled to avoid a second day of declines on Thursday as hints of surging inflation led by a one-year high in oil prices and the strongest copper prices in nearly a decade kept traders in check after a boisterous run up that pushed world stocks to 12 consecutive record highs. After a soggy close to the Wednsday session, S&P futures turned lower, trading down -0.4% as 10Y yield resumed their rise, trading at session highs of 1.29% while Asian stocks equities extended losses after a disappointing Chinese markets reopen.

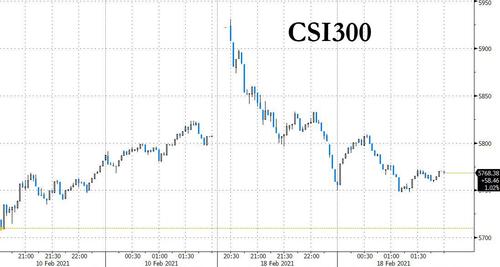

China’s CSI 300 index which reopened after the week-long Lunar new year, reversed a 2.1% gain to 1% loss after the PBOC unexpectedly drained 260 billion yuan ($40.31 billion) from money markets, raising concern about backdoor policy tightening. The ChiNext index fell as much as 3.3%. Hang Seng, Topix and Kospi were all deep in the red while the Taiex outperformed on U.S. chip help request.

In Europe, stocks also slipped as declines in banks offset gains in commodity producers. Shares in Credit Suisse Group AG fell 1.4% after it reported a fourth-quarter loss. Offsetting the broader decline, the Stoxx Europe 600 Basic Resources Index (SXPP) rose as much as 2.8% and headed for the highest level since July 2011 with Rio Tinto, Boliden and KGHM among the best performers as copper hit a fresh 8-year high, while iron ore surged to highest in almost two months as Chinese traders returned from holiday and Australian peer Fortescue Metals Group provided a bullish outlook. European drillers and miners rose 2.5% to offset disappointing earnings numbers from companies including Airbus and Orange. Some of the biggest outperformers within the diversified miners were Rio Tinto +3.7%, BHP +2.5%, Glencore +3%, Anglo American +2.4%. Here are some of the biggest European movers today:

- Temenos shares surge as much as 17%, the most in just over three years, as analysts say the Swiss software firm’s 2021 guidance is reassuring and welcome its medium-term targets.

- Acciona shares jump as much as 10% to the highest since September 2008 after the Spanish group says it is considering an IPO for its renewables arm, a move welcomed by analysts.

- Airbus shares slip as much as 4.6%, the most since January 25, as analysts say the plane manufacturer’s weak guidance for 2021 overshadows another strong quarter of trading.

- Orange shares drop as much as 5.9%, the most in more than six months, as analysts say its outlook is complicated by the partial investment of a tax rebate.

- Varta shares plummet as much as 15% with Commerzbank saying the firm’s top line beat is poor quality and that its guidance is weaker than expected.

- Nel shares drop as much as 14%, the most since September 21, with Pareto saying the electrolyzer maker’s earnings missed as it continues to make investments.

- Barclays shares fall as much as 5.2%, the most since December 21, as analysts say a vague outlook for 2021 from the U.K. bank overshadows a strong trading performance in the fourth quarter.

Earlier in the session, Asian stocks declined weighed down by some of the region’s largest technology-related stocks. Food delivery giant Meituan, social media and gaming behemoth Tencent and chipmaker Samsung Electronics were among the biggest drags on the MSCI Asia Pacific Index, which was set for its worst drop since Jan. 29. One of China’s largest companies, Kweichow Moutai, saw its shares fall the most since Jan. 15, or 4.6% Thursday morning in Shanghai, after China National Radio doubted local authority’s nomination of the company’s chief engineer to be a member of the Chinese Academy of Engineering. The nomination of a researcher on spirits brewing isn’t in line with China’s strategy of using science and technology to revitalize the nation, the radio says in a commentary.

Also hurting China’s mood, the PBoC injected 20bln yuan through 7-day reverse repos with the rate maintained at 2.20% for a net drain of CNY 260bln, although the PBoC later announced to conduct CNY 200bln of 1yr MLF at rate of 2.95% vs prev. 2.95%.

Elsewhere, the Philippines’ benchmark led losses among key national equity gauges, with measures in Japan, Hong Kong and South Korea also falling at least 1%. China’s CSI 300 fell, erasing an early jump as trading resumed following Lunar New Year holidays. The Taiex gained after a Bloomberg report that U.S. President Joe Biden’s top economic adviser has sought the Taiwanese government’s help in resolving a global semiconductor shortage. Stocks also rose in Vietnam.

Emerging-market stocks broke their longest winning streak since June as investors seized an opportunity to cash in some gains. In South Africa, shares were set for their worst day in three weeks after a study showed that Pfizer’s vaccine might not be effective against the country’s aggressive COVID variant.

While equity markets were mostly subdued on Thursday, there remains a growing concern that rising borrowing costs could dent corporate profits just as the economy recovers from the pandemic. Government bond yields were taking a breather after the inflation-driven sell-off in global fixed income, although the commodities charge kept petro-currencies like the Canadian dollar, Norwegian crown and Russian rouble edging higher. The yield on the benchmark 10-year Treasury traded near 1.29%, rising from earlier lows of 1.255%.

“The clear theme right now is the reflation rotations and gyrations in markets all over the place,” said Arnab Das, Invesco’s global market strategist.

Still, with vaccines being rolled out and economic activity picking up around the world, investors continue to bet on share market gains while shifting more into cyclical stocks: “This just looks like a pause and reflation trade is likely to resume,” said Mark Nash, head of fixed-income alternatives at Jupiter Asset Management. “The Fed focusing on downside risks gave markets the green light to carry on.”

Indeed, Fed officials didn’t see the conditions for reducing their massive asset-purchase program being met for “some time” at their January policy meeting, Wednesday’s FOMC Minutes showed.

In FX, the pound led group-of-10 gains against a weaker dollar, which halted a two-day advance amid a steadying of the Treasury market. Sterling rose 0.7% to $1.3947, accelerating gains after it rallied to the strongest level versus the euro since March at 86.533 pence, amid continued optimism over its vaccine rollout. The greenback fell against all G-10 currencies; the Norwegian krone eased from a strong open as crude oil prices slipped from their highest levels since January 2020.

“Treasury yields are driving the dollar and that trend remains intact today,” said Masakazu Satou, a currency adviser at retail foreign-exchange brokerage Gaitame Online Co. in Tokyo. He expects the U.S. 10-year benchmark’s rise to pause, as the market needs “more fundamental signals that the U.S economy is improving for it to test 1.5%”

“The USD could have some growth support in the near term, but higher U.S. inflation and huge borrowing needs still look like unavoidable headwinds” said Rodrigo Catril, senior foreign-exchange strategist at National Australia Bank Ltd.

USD/NOK was down 0.3% around 8.4652 as the rally in Brent crude petered out, having earlier dropped as much as 0.4%, while the USD/JPY was down 0.2% to 105.69. “The dollar-yen rate weakened on position adjustments” following the decline in U.S. yields, and after meeting a solid technical barrier around 106.20-106.30, said Gaitame’s Satou

Elsewhere, the world’s best-performing currency this year – the Turkish lira – climbed another 0.5% as the central bank maintained its 17% interest rates and reiterated it could raise them again if needed.

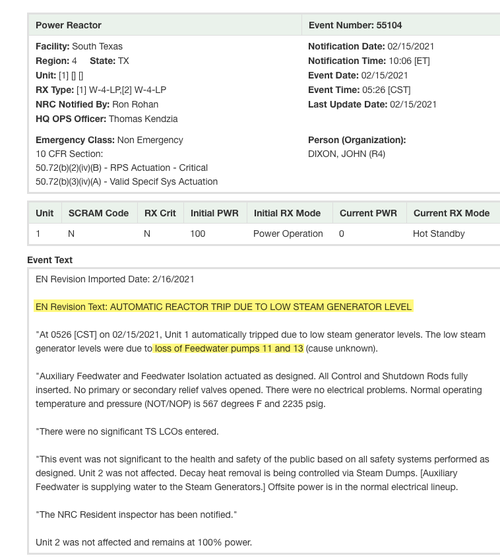

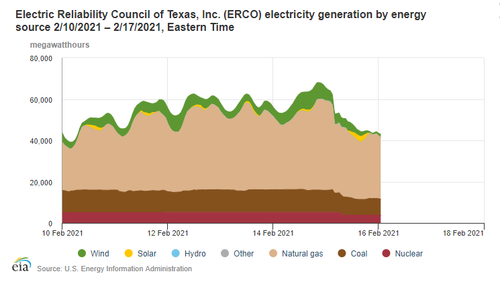

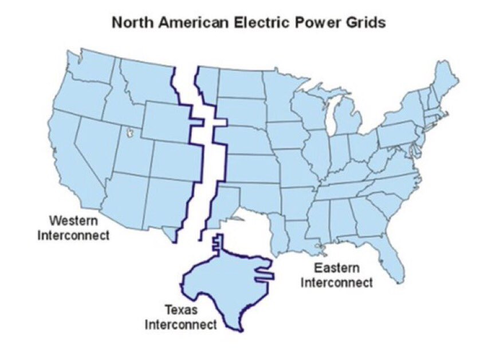

Meanwhile, the historic deep freeze in Texas continued to drive up oil prices too, as the unusually cold weather hampers output in the largest U.S. crude-producing state.

Brent crude topped $65 a barrel for the first time in over a year on Thursday, while WTI rose to $61.80 a barrel. Both are up over 300% since last April.

Elsewhere in commodities, copper prices on the London Metal Exchange rose as much as 2.4% to $8,595 a tonne as well. That is their strongest level since April 2012 and nearly double what they fell to in March last year as COVID worries erupted. Gold snapped a five-day losing streak.

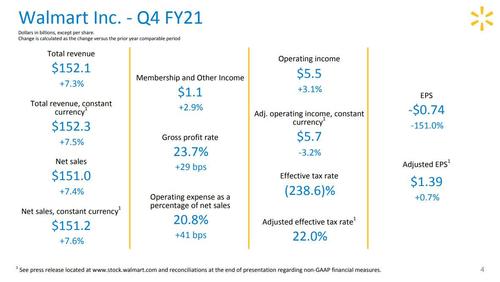

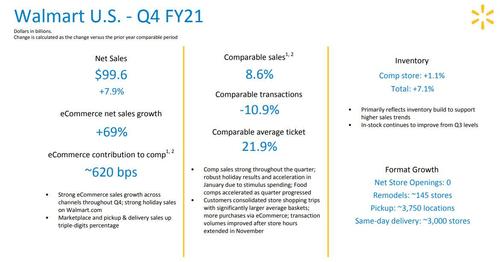

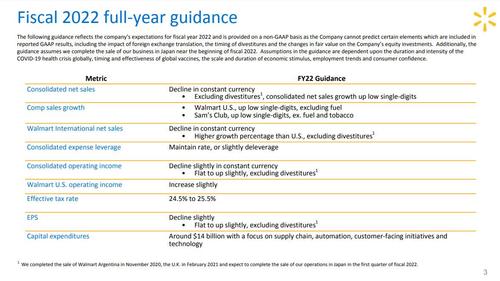

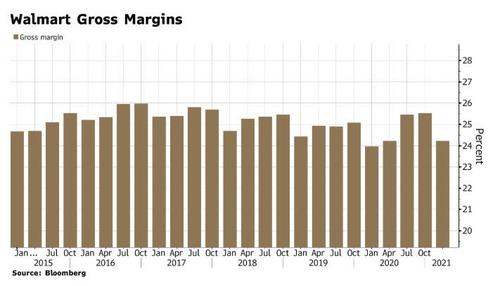

Looking at the day ahead now, and data highlights include the weekly initial jobless claims from the US, as well as January’s housing starts and building permits, and the Philadelphia Fed’s business outlook survey for February. From central banks, the ECB will be publishing the minutes from its January meeting, and we’ll hear from the Fed’s Brainard, Bostic and the BoE’s Saunders. Finally, earnings releases today include Walmart, Marriott International, Roku and Applied Materials.

Market Snapshot

- S&P 500 futures down 0.3% to 3,917.00

- MXAP down 0.8% to 218.95

- MXAPJ down 0.8% to 737.71

- Nikkei down 0.2% to 30,236.09

- Topix down 1.0% to 1,941.91

- Hang Seng Index down 1.6% to 30,595.27

- Shanghai Composite up 0.6% to 3,675.36

- Sensex down 0.6% to 51,402.32

- Australia S&P/ASX 200 little changed at 6,885.87

- SXXP Index little changed at 416.37

- German 10Y yield little changed at -0.36%

- Euro up 0.2% to $1.2065

- Kospi down 1.5% to 3,086.66

- Brent futures up 0.4% to $64.61/bbl

- Gold spot up 0.5% to $1,785.80

- U.S. Dollar Index down 0.2% to 90.75

Top Overnight News from Bloomberg

- A rout in Treasuries this year has changed the equation for Japanese investors in global markets, with the U.S. bonds now offering them almost as much yield as riskier issuers such as Italy

- What began as a power issue for a handful of U.S. states is rippling into a shock for the world’s oil market

- Fresh Covid-19 cases for the past week were the lowest since October, according to data from Johns Hopkins University

- ECB officials are finally building a consensus about how they might start delivering on President Christine Lagarde’s ambition to combat climate change

- EU governments banking on hundreds of billions of euros in recovery funds to revive their economies can start putting forward their plans from Thursday when the bloc’s Recovery and Resilience Facility becomes operationalA lack of ambition in companies’ environmental goals, and investors’ willingness to turn a blind eye, threaten to undermine the credibility of the sustainability-linked debt market

A quick look at global markets courtesy of Newsquawk

Asian equity markets traded indecisively as the region took its cue from a similarly uninspiring lead from the US where underperformance in tech clouded over sentiment and with strong data raising some questions regarding large stimulus. ASX 200 (Unch.) lacked firm direction as participants digested a slew of mixed earnings from several blue-chip stocks including Rio Tinto and ANZ Bank, although energy names were pressured and failed to benefit from the continued upside in oil prices after weaker results from Woodside Petroleum and Origin Energy. Nikkei 225 (-0.2%) was initially kept afloat but with upside later reversed by recent currency inflows and KOSPI (-1.5%) continued to suffer from concerns related to increased infections post-Lunar New Year. Hang Seng (-1.6%) and Shanghai Comp. (+0.6%) were varied as property names and financials dragged Hong Kong lower, while mainland China was lifted on return from the week-long closure with the PBoC conducting a CNY 200bln 1yr MLF operation and MOFCOM also announced that combined sales of domestic retail and catering enterprises rose 28.7% Y/Y to CNY 821bln during the Spring Festival golden week. Finally, 10yr JGBs were higher with prices recovering from the recent selling pressure as yields stabilized although gains were capped after weaker results at the 20yr JGB auction in which the b/c and accepted prices both declined from previous.

Top Asian News

- China Stocks’ Strong Start to New Year Falters Near Record High

- Bank Indonesia Cuts Rates and Outlook as the Recovery Stalls

- Hong Kong Unemployment Hits Highest Level Since April 2004

- Singapore Opens Bubble for Business Travelers at Changi Airport

European stocks kicked off the session mixed (Euro Stoxx 50 -0.2%) following on from a similarly varying APAC lead as Mainland China returned from its week-long Lunar New Year holiday. Meanwhile, US equity futures are trading marginally softer with the tech heavy NQ futures (-0.5%) narrowly underperforming . A divergence is seen between US equity futures and the performance in APAC & Europe, as the latter are also being influenced by a slew of large-cap earnings, whereas in the US Walmart report their earnings today which marks the unofficial end of US earning season. Bourses in Europe continue to follow the mixed trend amidst a lack of fresh catalysts. Sectors are mixed with no distinct risk bias. The Materials sector (+1.1%) is the outperformer which is in part down to base metals prices seeing a rise aided by Mainland China’s return. Consumer Discretionary (+0.4%) resides among the winners after Daimler (+1.5%) amid an overall stellar report and guidance whereby the expects sales, revenues and EBIT in 2021 to be significantly above the prior-year’s level and intends to spin-off Daimler Truck with majority listing on the stock exchange, expected to be completed before year-end 2021. Food & Beverage meanwhile (-0.4%) is pressured after European heavyweight Nestle (-0.3%) announced its FY20 earnings, which holds a 30% weighting in the sector. Financials (-0.7%) is the laggard, with Credit Suisse (-0.2%) and Barclays (-2%) softer following their earnings, with the former noting a major litigation provisions and York impairment and the latter disregarding share-buyback and dividend announcements. Continuing with earnings, Airbus (-4.0%) are lower after reporting a depleted year-end order book. Away from earnings, ThyssenKrupp (-4.0%) opened lower after Co. ended discussions with Liberty Steel regarding the potential sale of ThyssenKrupp’s steel unit but it is now flat on the session. Richemont (+0.6%) and Swatch (+0.8%) are seeing moderate gains despite Swiss watch exports trending lower in Jan at -11% Y/Y vs prev. -2.5% Y/Y.

Top European News

- Virus Spread in England Falls Sharply Ahead of Johnson Review

- Barclays Cautions on Outlook as Trading Beat Fuels Buyback

- Kosovo May Decide on Uniting With Albania, Kurti Tells Euronews

- Thyssenkrupp Ends Steel Sale Talks With Liberty Over Value

In FX, sterling has rebounded firmly with Cable retesting resistance above 1.3900, partly on the back of a broad Buck downturn that has culminated in the index reversing further from Wednesday’s 91.057 pinnacle to 90.685 and back near the 21 DMA (90.658 today) which now forms support ahead of 90.500. However, the Pound is also up on favourable cross flows as Eur/Gbp resumes its relentless decline after a tame bounce to 0.8700 and is now sub-0.8670. Elsewhere, the Aussie is back over 0.7750 vs its US counterpart and edging nearer 1.0800 against its Antipodean rival in wake of a somewhat mixed labour report in terms of outward appearance, but with internals better than the headline and jobless rate encouraging.

- NZD/EUR/CHF/JPY/CAD – Notwithstanding, the aforementioned Aud/Nzd trajectory, the Kiwi has reclaimed 0.7200+ status vs its US namesake ahead of NZ PPI data, while the Euro has breached resistance and offers said to be situated at 1.2050 to peer beyond 1.2170, but decent option expiry interest between 1.2065-75 (1.1 bn) could hamper further progress towards 1.2100 where even larger expiries lurk (2 bn up to 1.2110). Similarly, the Franc has clawed back losses relative to the Greenback from almost 0.9000 to circa 0.8964 following Swiss trade data showing a much wider surplus, but steeper fall in watch exports, the Yen is rebounding further from under 106.00 to probe 105.70 and away from 106.00-105.95 (1 bn) option expiries at this stage, and the Loonie is back on the 1.2600 handle, albeit marginally before Canadian retail sales on Friday.

- SCANDI/EM- The Sek has not derived much support or traction from firmer than expected Swedish inflation data as Eur/Sek holds above 10.0000 awaiting developments on the COVID-19 front after the country proposed a lockdown decree yesterday (suggesting it could be enacted for the first time since the pandemic broke), while the Nok is pivoting 10.2250 vs the Eur in the run up to Norges Bank Governor Olsen’s Annual Speech later today with little impetus from flat oil off new peaks. Meanwhile, mixed trade in EM currencies as the PBoC returned from Chinese Lunar New Year to set a softer Cny midpoint fix and drain 7-day liquidity before injecting 1 year funds, with the Cnh currently around 6.4550 vs 6.4300 earlier. USD/TRY has moved below the 7.00 mark following the CBRT announcement, where rates were left unchanged at 17.0% as expected and remarking that additional tightening will be delivered if required.

In commodities, WTI and Brent Apr’21 futures are waning off overnight highs in early European hours following their most recent run to fresh recovery-phase highs, bolstered by the most recent (and delayed) Private Inventory figures which printed a deeper than expected draw of 5.8mln bbls (vs exp. -2.4mln). Meanwhile, the complex remains elevated by the underlying fundamentals of mass vaccinations and OPEC+ tweaks, with the Texas deep freeze also keeping prices propped up as a lion’s share of Texan output is shuttered. Analysts at ING suggest that it is clear the impact from the cold weather is more severe than markets initially expected, with a clear demand hit amid refiners having shut or decreased operations. “It is estimated that around 3.6mln BPD of refining capacity has been idled, and for now at least, crude oil production losses appear to exceed the fall in refinery operating rates”, the bank says, adding that “there is the risk that it takes several days for operations to return to normal after the big freeze.” This weather phenomenon is likely to be reflected in next week’s inventory and production figures as trades eye today’s EIA release as a scheduled energy-specific catalyst, with the headline forecast to draw 2.429mln bbls. Turning to OPEC, yesterday’s address by the Saudi Energy Minister hinted that the Kingdom is seeking a more conservative approach – backed by the WSJ sources yesterday. Eyes on this front will remain on whether the group can come to an accord as preferences diverge against the backdrop of higher oil prices. It is also worth being cognisant of any developments that could knock the demand recovery hopes – with some reports suggesting that India may implement a fresh lockdown in some regions due to increasing cases and positivity rates. WTI resides just under USD 61.50/bbl (vs high USD 62.25/bbl), while its Brent counterpart dipped back below USD 65/bbl (vs high USD 65.50/bbl). Other risk events on the slate today include the ECB Minutes and weekly US jobless/continued claims. Elsewhere, precious metals see somewhat of a divergence with spot gold reaping reward from the softer Buck as prices attempt a recovery from YTD lows (around USD 1,768/oz) ahead of the 30th Nov 2020 low at USD 1,764/oz. Elsewhere, base metals surged overnight as mainland China returned from its week-long holiday, with Dalian iron ore leaping some 7% and Shanghai copper rising over 5% to near-10yr highs amid rosy demand prospects, a softer buck and supply concerns.

US Event Calendar

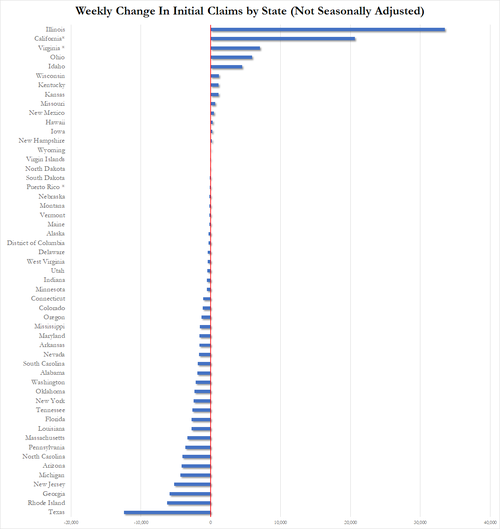

- 8:30am: Feb. Initial Jobless Claims, est. 770,000, prior 793,000; Continuing Claims, est. 4.43m, prior 4.55m

- 8:30am: Jan. Import Price Index YoY, est. 0.4%, prior -0.3%; MoM, est. 1.0%, prior 0.9%

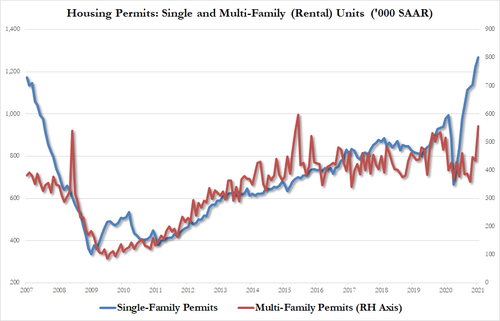

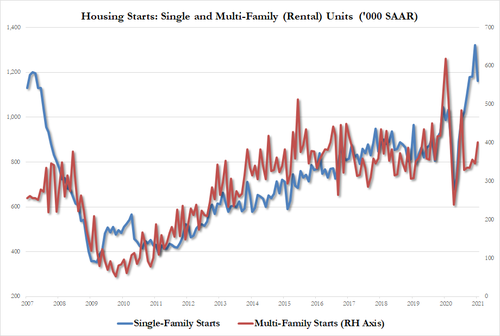

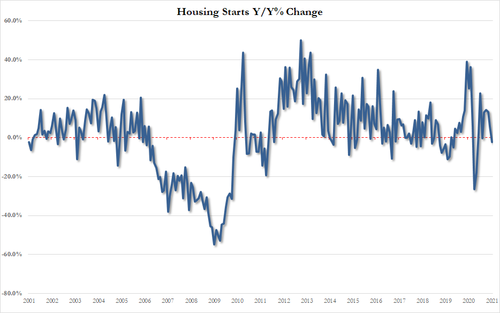

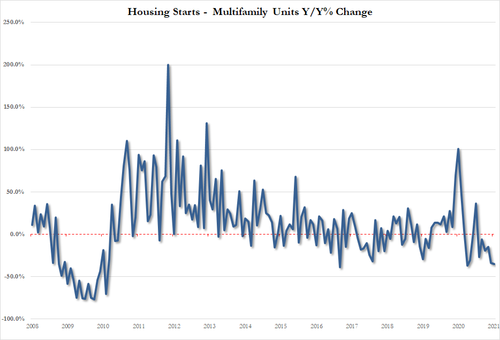

- 8:30am: Jan. Housing Starts MoM, est. -0.5%, prior 5.8%; Building Permits MoM, est. -1.4%, prior 4.5%, revised 4.2%

- 8:30am: Jan. Export Price Index MoM, est. 0.8%, prior 1.1%; YoY, prior 0.2%

- 8:30am: Jan. Housing Starts, est. 1.66m, prior 1.67m; Building Permits, est. 1.68m, prior 1.71m, revised 1.7m

- 8:30am: Feb. Philadelphia Fed Business Outl, est. 20.0, prior 26.5

- 9:45am: Feb. Bloomberg Economic Expectation, prior 39.5; Bloomberg Consumer Comfort, prior 44.9

DB’s Jim Reid concludes the overnight wrap

Even though I’ve been working from home for 11 months now it was still quite surreal to come downstairs to make myself a cup of tea yesterday to find the TV room in pitch darkness and three children aged 5 and under plus a dog huddled up to their mum watching Harry Potter. Oh and with popcorn scattered everywhere. Bad weather, lockdown and half term left them with little option. My wife loved Harry Potter and is trying to get our kids into it. So far she’s on film 2 and five year old Maisie is petrified and keeps running out of the room. Meanwhile the three year old twins don’t bat an eyelid at all the scary bits. So we’re trying to work out if they are too young to be scared, are budding psychopaths, or if Maisie is a little more sensitive. All answers from your own experiences gratefully received.

Yesterday the market got its own scare which further confirmed to me that this will be a complicated year for markets with investors having to work out what happens when huge forces collide. Vaccines, reopenings, pent-up demand, major stimulus, huge liquidity, strong economic growth, supply bottlenecks, return to work of retail investors, and extreme valuations in some corners of the market (including the ginormous tech sector) being the main highlights. Calibration will be tough.

Indeed yesterday was a confusing day as before the strong US data (more below) global yields were continuing to climb with 10yr USTs hitting 1.33% (having been 1.11% last Thursday). However after a blow out Retail Sales and PPI release (more below) yields suddenly and sharply reversed before closing at 1.27%. Risk assets were also weak but the US climbed steadily back to near flat after Europe went home.

In trying to explain the moves it was perhaps the case that the yield rises in recent days were starting to slowly bite for risk assets (equities and commodities starting to stall) and that the strong data tipped us over the edge and the associated risk off then helped bonds rally. As I said all a bit complicated. It is also slightly possible that the stronger data might have reduced the recent higher expectations for the US stimulus package but that might be a stretch as an explanation.

In the end the S&P 500 finished nearly unchanged (-0.03%), after being down as much as -0.82% early in the trading session. Before this the STOXX 600 (-0.74%) had its worst daily performance so far this month having closed before sentiment turned in the US. Tech stocks led the declines on both sides of the Atlantic, with Semiconductors (-1.67%) and Tech Hardware (-1.62%) the main laggards in the S&P while the STOXX 600 Technology sector pulled back -2.15% as it rounded off its worst 2-day performance this year. Staying with tech, by the close the NASDAQ had shed -0.58%, but was down as much as -1.73% intraday, while the more concentrated NYFANG fell -1.48% on the day – its first daily loss in February. What kept the S&P afloat was the rotation theme we have seen in recent weeks with Energy (+1.45%), Retailing (+1.16%) and Telecoms (+3.04) in particular doing the heavy lifting.

Asian markets are generally trading weaker this morning with the CSI 300 (-0.36%) and Shenzhen Comp (-0.25%) paring early gains to trade down as they reopened post a week long holiday. The Shanghai Comp is trading up though at +0.80%. In terms of other Asian markets, the Nikkei (-0.13%) and Kospi (-0.82%) both are trading down while the Asx (+0.01%) closed the day broadly flat. Futures on the S&P 500 are also down -0.13% as we type. Elsewhere, Bitcoin is trading down -0.26% as we type after it climbed to an all-time closing high of $52,400 (+7.85%) yesterday. Meanwhile oil prices rose further yesterday and are up another c. 1% this morning as both Brent Crude ($65.20) and WTI ($61.80) are trading at their highest levels in over a year.

US yields are fairly flat overnight after coming off their one-year, pandemic highs yesterday with 10yr breakevens retreating -2.7bps to 2.22% more than real yields. The move saw the yield curve flatten (2y10y down -2.8bps) as the aggressive bear steepening of the last week took a break. Over in European bonds it was much the same story as in the US, with yields on 10yr reversing sharply after the US data with bunds down -2.0bps, and a noticeable widening in peripheral spreads, as the Italian (+3.5bps), Spanish (+1.4bps) and Greek (+6.0bps) spreads over 10yr bunds all moved wider.

In terms of that retail sales report, the January number from the US came in at +5.3% month-on-month, well in excess of the +1.1% advance expected, and topping every estimate on Bloomberg. That’s the strongest monthly rise since June, though the report was bolstered by the arrival of stimulus checks, as well as an easing of restrictions in some places. The question will be whether we get some payback in February, not least given the incredible weather disruption in parts of the US right now that has continued to leave millions without electricity. On that, the disruption there is likely to be more widespread, with Samsung Austin Semiconductor having halted their operations, something that isn’t likely to help with the current global semiconductor shortage. Overnight, Bloomberg has report that President Biden’s top economic adviser, Brian Deese, has sought help from Taiwan’s government to resolve the global semiconductor shortage that’s impacting production at US car manufacturing plants. The report also added that Deese and the US National Security Adviser Jake Sullivan are both helping to try to address bottlenecks in auto companies’ supply chains.

Back to the messy data and the January reading of PPI in the US was much higher than expected, with the headline figure rising +1.3% (vs +0.4% expected), while the core reading rose +1.2% MoM (vs +0.4% expected). One of the most salient underlying data points was the massive health care print at +0.93% MoM, which was the second highest on record and pushed YoY health care inflation in the PPI to 3.7% – the highest it has been since Dec 2007. Our US economics team indicated that this is very important from the Fed’s perspective as health care is 20% of the core PCE index.

That said the minutes of the latest Fed meeting minutes showed that the US central bank is not overly concerned about inflation – a sentiment that investors have heard from various Fed Governors repeatedly over the past few weeks. There was an emphasis on looking through “temporary factors affecting inflation—such as low past levels of prices dropping out of measures of annual price factors” or relative price increase in certain sectors. The committee did acknowledge that downside risks over the medium term from the pandemic had been mitigated by the vaccine and the recent change in the outlook for fiscal support. Outside of the inflation discussion there was little new information. The other focus for investors is any potential tapering, but again the Fed has put that discussion off for some time.

Later today, we’ll get the ECB minutes from their own January meeting, when they emphasised the significance of symmetry around the PEPP envelope by elevating it within the policy statement. And there’ve been some questions since the meeting as to whether the ECB’s reaction function to inflation pressures has changed. The account may provide some insight there.

Last night also saw Mario Draghi’s government win a confidence vote in the Senate by an overwhelming 262-40 margin. In his first speech as Prime Minister, Draghi laid out an ambitious agenda, telling lawmakers that they had “the responsibility to start a new reconstruction, as governments did after World War II”. He also struck a notable pro-EU tone, calling the euro “irreversible”, backing a common EU budget to support states in recession, and saying that “Without Italy there is no Europe. But, outside Europe there is less Italy.” Today, Draghi faces another confidence vote in the lower house of Parliament, but the broad support for his government means that’s also expected to pass easily.

In terms of the latest on the pandemic, German health minister Jens Spahn that the more infectious UK strain now accounted for over 22% of infections in the country, which compares to nearly 6% under two weeks ago. On top of that, a further 1.5% of cases were the South African strain. In France, the government has extended the duration of the quarantine for those who test positive to 10 days in the northeastern region of the country where there is a greater density of cases due to the new variants. Over in the US, the bad weather across much of the country has affected vaccine distributions and delayed deliveries to various regions. New York City, for example, announced that the city could potentially run out of doses by the end of yesterday. Across the other side of world and in a first of its kind, Indonesia has decided to make vaccinations mandatory for those eligible to get one. The Indonesian government will fine citizens who refuse the vaccine and will delay or halt the provision of social assistance and administrative services.

Overnight we also saw news from a lab study that the Pfizer-BioNTech vaccine stimulated roughly two-thirds lower levels of neutralising antibodies against the South African variant. The results were published in the New England Journal of Medicine and are part of tests of the vaccine against a lab-created virus that had all the mutations found in the South African variant. Further, the report added that Pfizer/ BioNTech’s vaccine still offers significant levels of neutralising antibodies against the variant. Pfizer and BioNTech said in a statement that there’s no real-world evidence that the South African variant can elude their shot. Still, they said they’re getting ready to develop an updated vaccine or booster if need be. In more positive news, the New England Journal of Medicine published results from another study showing that the Pfizer vaccine had a first dose efficacy of 92.6% as against the previously reported efficacy of 52.4%. The efficacy number of 52.4% was arrived at by examining the data for the first 2 weeks after the first dose was administered, when immunity would have still been mounting and the new research used documents submitted to the Food and Drug Administration to derive the vaccine efficacy beginning from 2 weeks after the first dose to before the second dose.

Wrapping up with yesterday’s other data, and US industrial production rose by a stronger-than-expected +0.9% in January (vs. +0.4% expected), although the previous month’s reading was revised three-tenths lower. Over in the UK, the CPI reading for January surprised slightly to the upside with a +0.7% reading (vs. +0.6% expected), while year-on-year house price growth in December rose to +8.5%, its highest in over six years.

To the day ahead now, and data highlights include the weekly initial jobless claims from the US, as well as January’s housing starts and building permits, and the Philadelphia Fed’s business outlook survey for February. Meanwhile in Europe, we’ll get the advance Euro Area consumer confidence reading for February. From central banks, the ECB will be publishing the minutes from its January meeting, and we’ll hear from the Fed’s Brainard, Bostic and the BoE’s Saunders. Finally, earnings releases today include Walmart and Applied Materials.