Will Venezuela Go To War Over Oil?

By Viktor Katona of Oilprice.com

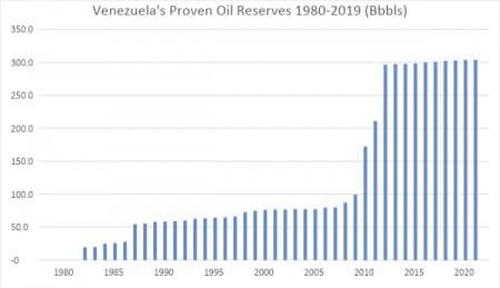

January 2021 is still far from over yet the pages of Oilprice already boast 6 articles about Guyana being the hottest drilling spot in the world. This is hardly surprising, considering the hot streak that ExxonMobil had over the past 5 years, with new companies coming in and stepping up the drilling game. The interest globally attributed to Guyana has aggravated Venezuela’s long-standing grievances over the disputed Essequibo province – before 2015 the Venezuela vs Guyana oil standoff was akin to a David vs Goliath story but now, with Guyana building up its oil reserves tally and continuing to attract new investors, the balance has become a lot more nuanced. Amidst all of this, Venezuelan President Nicolás Maduro has pledged to reconquer Essequibo. At first glance, the proposition that Venezuela should go to war over a disputed territory, let alone with Guyana, seems rather dubious. Venezuela boasts the world’s largest proven oil reserves, totalling roughly 304 Bbbls (see Graph 1), i.e. more than all of North America combined, more than Iraq and Iran combined. Guyana’s reserves are a fraction of that, barely reaching 3% with its 9-10 Bbbls. However, behind the dry facade of data and statistics, there lies an entire universe of human emotions, oftentimes led astray due to their subjective nature and in this particular realm, Caracas is the one frustrated and concerned. Guyana is adding one major discovery after another (the recent failure of Hassa-1 notwithstanding), whilst the Venezuelan national oil company PDVSA keeps on struggling to make ends meet.

Graph 1. Venezuela’s Proven Oil Reserves 1980-2019 (billion barrels).

The dispute over Guayana Esequiba (alternatively dubbed the Essequibo Region) is one of the most complex remaining, mixing colonial legacies with modern-day grievances. It all began in 1840 when the British Empire demarcated the heretofore undisputed and unsettled frontier between British Guiana and Venezuela, by means the “Schomburgk Line”. To no one’s surprise Venezuela rejected the British claim, however, unwilling as they were to get mired in a protracted conflict, both sides agreed to disagree in 1850 and vowed not to colonize the then-largely uninhabited region. Despite arbitrations and negotiations, the question of who should control the Essequibo Region remained unsolved by the time of Guyana declaring itself independent in 1966. Caracas recognized the independent Guyana, however only its territories located to the east of the Essequibo River, maintaining its claim that all the territories to the west are part of Venezuela.

One of the most protracted territorial disputes globally, the discovery of oil offshore Guyana might have been the factor missing to propel the issue forward. ExxonMobil, the operator of Guyana’s Stabroek offshore block, was subject to maritime harassment by the Venezuelan Navy and had one of its surveying vessels detained in 2013. However, when Exxon discovered the Liza field in 2015, closer to the Guyanese-Surinamese frontier and hence were beyond the Venezuelan maritime claim, the stakes turned really high. Guyana had official proof that its offshore was not sub-commercial as was previously thought (initially companies appraised the shallow waters of Guyana and found no commercial deposits) and with the help of a US major could now count on high-level backing for its border case.

With every new discovery on the Stabroek block, Venezuela’s opposition to Guyana taking the left bank of the Essequibo River was becoming increasingly untenable. Concurrently, the good neighbor relations of the Chavez era when Guyana was member to the continent-wide Petrocaribe movement and even participated in barter deals to satisfy its crude needs, went downhill fairly quickly.

Yet there is another factor that most certainly contributed to Caracas now striking such a belligerent tone – US sanctions against Venezuela. Not only did the tightening of screws on President Maduro’s political allies and relatives blunt the political prospects of Juan Guaido, it also led to the entry of Venezuela’s military (that remained loyal to Maduro amidst the worst humanitarian suffering) into the Latin American country’s oil industry.

Any future US administration will most probably seek to safeguard ExxonMobil’s assets in Guyana. A first sign of this – in the first days of 2021 the commander of the US Southern Command arrived in Guyana for a 3-day visit, to celebrate the launch of joint US-Guyanese coast exercises. According to top-ranking officials in the Guyanese army, Georgetown is intent on fortifying its military ties with the United States, including but not limited to arms purchases. Concurrently, Venezuela formed a new parliament which will no longer be controlled by the Guiado-style opposition – the pro-Maduro National Assembly will inevitably become more aggressive in its narrative and overall behavior. Part of the aggression might result from the UN Court of Justice’s ongoing review of the Essequibo case, the decision of which was already declined by Caracas before its actual deliverance.

So, will there be a war between Venezuela and Guyana? Such a scenario seems unlikely now.

First, Maduro might wait to see what the new Biden Administration has to offer, how will it tackle the Venezuelan conundrum.

Second, there is very little reason to heat up tensions now, when no final decision had been taken, the peak of confrontation should be around 2023/2024 when the ICJ is assumed to deliver its opinion on the legal status of the Essequibo Region.

Third, even if the ICJ rules in favor of Guyana which seems quite likely, Venezuela remains unlikely to trigger a military response, for fear of actual US retaliation. It is one thing to foil an amateurish coup attempt by a private military company (Operation Gideon in May 2020), an altogether different one to deal directly with the US military.

Tyler Durden

Mon, 01/25/2021 – 11:46

via ZeroHedge News https://ift.tt/2LToKMx Tyler Durden