The V-shaped recovery has officially concluded, with eminis hitting 4,383 this morning, touching reaching their all time high from the second week of July (technically that was 4,384) as markets propel higher on earnings optimism despite mixed economic data and worries over Covid variant. At 7:30 a.m. ET, Dow e-minis were up 170 points, or 0.49% and S&P 500 e-minis were up 21.5 points, or 0.49%.

Nasdaq 100 e-minis were up 72 points, or 0.48%, trading above 15,000 points for the first time. Nasdaq futures hit a record high on Friday, helped by megacap technology stocks and strong earnings from social media companies Twitter and Snap, with investors eyeing business activity data later in the day.

Twitter gained 6.3% in premarket trading after it reported upbeat revenue growth, as the social media platform rolled out ad-targeting improvements to help brands reach potential customers. Snap Inc. (SNAP) climbs 17% in premarket trading with the social-media firm’s 2Q results and guidance well ahead of analyst expectations, affirming its position as a top pick in digital advertising, and notching the highest growth rates since late-2017. Strong results from the social media firms set a positive precedent for Facebook Inc, which rose 2.8% ahead of its second-quarter results next week. Other major tech names, including Amazon.com, Apple Inc, Microsoft Corp, and Google-owner Alphabet Inc, were up between 0.4% and 1.4%.

On the other end, Intel fell 1.9% after the chipmaker said it still faces supply chain constraints and gave an annual sales forecast that implied a weak end of the year. Industrial conglomerate Honeywell rose 0.8% after posting a 32% rise in quarterly profit, helped by improving demand for aircraft parts. Schlumberger rose 1.5% after it reported a rise in its second-quarter profit. Other premarket movers:

- NRx Pharmaceuticals (NRXP) jumps 33%, pointing to a second day of double-digit gains, on plans to make a commercial formulation of a still experimental Covid-19 therapy, Zyesami (aviptadil), in million dose quantities.

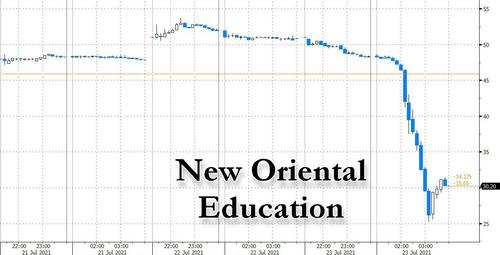

- Shares in U.S-listed Chinese education stocks slump in premarket trading following a report that China is said to consider turning tutoring firms into nonprofits. New Oriental Education (EDU) sinks 42% and TAL Education (TAL) plummets 50%, while Gaotu Techedu (GOTU) plunges 55%.

- Twitter (TWTR) shares rise 5.5% with its 2Q results topping expectations. KeyBanc says its execution remains strong and Truist flags a “robust” product pipeline on the horizon for the social-media company.

“One of the most under-appreciated things about the equity markets right now is just how much these earnings have risen, and how much analysts have had to revise their earnings estimates up,” Tracie McMillion, head of global asset allocation strategy at Wells Fargo Investment Institute, said on Bloomberg Television. She added she’s tracking the delta variant in case it affects consumer behavior.

In Europe, the Stoxx 600 index headed for a fourth day of gains, with all industry sectors in the green. Telecommunications were among the biggest gainers after an upbeat report from Vodafone Plc, while car-parts maker Valeo’s earnings beat boosted the automobile sector. Yields on core European bonds rose after the European Central Bank’s dovish tilt. Here are some of the biggest European movers today:

- Valeo shares gain as much as 8.8% after 1H results, which Morgan Stanley says were “solid” with Ebit well ahead of consensus. The company also confirmed its full-year guidance.

- Skanska rises as much as 7.6%, most since Nov. 9, after the Swedish construction company’s 2Q operating profit beat estimates.

- Dassault Aviation gains as much as 8% in Paris after the company reported 1H results, with adj. net sales that beat estimates. Berenberg noted a strong rebound in business-jet orders.

- Vodafone rises as much as 4.4%, the sharpest gain in more than five months, after the telecom operator posted a sales beat, with analysts saying the update could boost sentiment.

- Ultra Electronics soars as much as 34%, the most ever, and hits a record high after the U.K. defense firm said it was “minded to recommend” a new GBP2.58b takeover offer from Cobham.

- Signify drops as much as 9%, the most since March 2020, after 2Q results which both Morgan Stanley and Citi say were a miss on adjusted Ebita.

- Scatec falls as much as 19% after 2Q results missed estimates.

Earlier in the session, Asian share markets were in a mixed mood on Friday after a volatile week in which sentiment over global growth waxed and waned with every new headline on the Delta variant.Hong Kong stocks slid as potential penalties for ride-hailing giant Didi Global Inc. sapped sentiment toward Chinese tech firms.

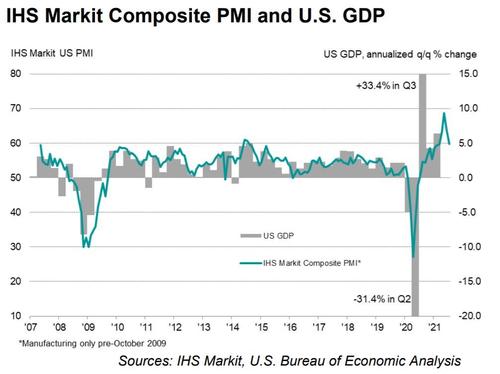

“In the face of headwinds from the Delta variant of the COVID-19 virus, the global economic expansion is moving forward—albeit more tentatively than a month ago,” said Sara Johnson, executive director of global economics at IHS Markit. “Outlooks in advanced countries with high vaccination rates remain bright, but near-term prospects in emerging and developing countries with low vaccination rates are murkier.”

That diverging outlook was reflected in MSCI’s broadest index of Asia-Pacific shares outside Japan which slipped 0.4%, leaving it down 1.1% on the week so far, led by Vietnam and Hong Kong, amid growing concerns about the economic impact from the spread of the delta variant. The MSCI Asia Pacific Index fell 0.6%, dragged by a broad-based selloff of defensive and cyclical sectors, including consumer staples and consumer-discretionary names. Chinese education stocks plunged, dragging the Hang Seng Tech Index lower by 3%, as the country considers asking companies that offer tutoring on the school curriculum to become non-profit. Stocks in Vietnam and the Philippines were also among the top decliners as Southeast Asian nations struggle to control Covid-19 outbreaks. The rapid spread of the delta variant continues to hurt regional shares, with the MSCI Asia Pacific Index down more than 8% from a February peak. The gauge is set for a third week of losses in four.

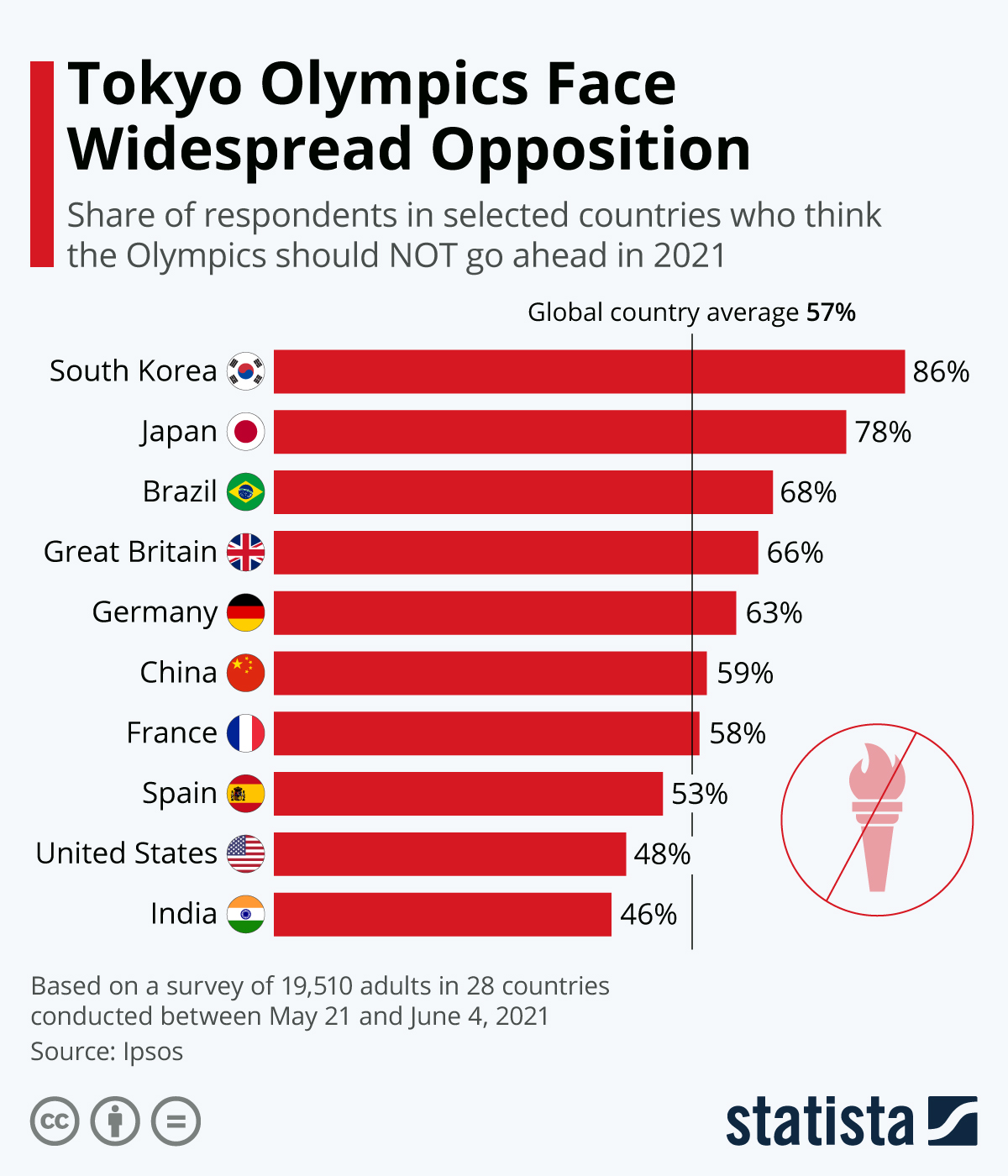

“Cyclical heavy-weighted stock indices like Singapore and Thailand” are more likely to underperform against their regional peers, said Kelvin Wong, an analyst at CMC Markets (Singapore). “Slow vaccination roll-outs in some Asian countries and the delta variant are likely to reinforce the ‘Peak Growth’ narrative theme play, which could be detrimental to cyclical stocks.” Shares in India edged higher in a volatile session, even as most quarterly earnings announced so far in the country have missed analysts’ estimates. Japan’s stock market is closed as the Summer Olympics officially begins in Tokyo, but was off 1.7% for the week and a whisker away from a seven-month trough.. It will be the first time in history that the games are held without spectators due to Covid-19 restrictions.

Investors are now looking ahead to the Federal Reserve’s policy meeting next week where more discussion about tapering is expected, though Chair Jerome Powell has repeatedly said the labor market remains well short of target. He also still argues that the recent spike in inflation will prove fleeting, which may be one reason bond markets have been rallying so hard.

Meanwhile, the Summer Olympics officially begin in Tokyo, though for the first time in history events will be held without spectators due to Covid-19 restrictions. In the U.S., a recent rise in infections shows no signs of abating as the delta variant spreads through unvaccinated sections of the population.

In rates, the 10Y Treasury yield traded around 1.29%, 0.8bp higher on the day having hit a five-month low of 1.128% early in the week. Treasuries were narrowly mixed in early U.S. session, with long-end yields cheaper by ~1bp, steepening the curve amid subdued futures activity especially during Asia session with cash trading remaining closed for holiday and scant price action. 10-year yields are little changed on the week despite having touched lowest level since February on Tuesday as virus developments called into question economic growth assumptions. Losses were bigger for bunds and gilts as European stocks advance amid solid PMI data and haven demand is unwound. German 10-year bonds performed even better, with yields dropping seven basis points so far this week to -0.42%, the lowest since mid-February. The rally was helped by a dovish tilt from the European Central Bank overnight when it pledged not to raise rates until inflation was sustainably at its 2% target.

“Currently the ECB is forecasting inflation at 1.4% in 2023, and it anticipates a very gradual recovery towards target thereafter,” noted analysts at ANZ. “The guidance implies the ECB will not get caught up in future global tightening cycles unless it is justified by euro area dynamics. The policy puts the ECB at the dovish end of the global central bank hawkometer.”

That outlook has contributed to a steady decline in the euro to $1.1773 , near the four-month trough of $1.1750 touched earlier in the week. This helped lift the dollar index to its highest since early March, and it was last at 92.818 . The Bloomberg Dollar Spot Index is up 0.3% on the week. The euro has also been struggling against the safe-haven Japanese yen and hit its lowest in four months this week before steadying at 129.68 yen . With all the action in the euro, the dollar has been relatively steadier on the yen at 110.24 . The New Zealand dollar and Swedish krona led G-10 currency gains, while moves were mostly muted with Japan shut for a holiday

In commodity markets, gold dipped to $1,802 an ounce and was 0.4% easier on the week. Base metals have fared much better as strong demand meets restricted supply. Oil prices have also been buoyed by speculation demand will outpace supply in coming months even after OPEC+ agreed to expand production. Brent was last off 27 cents at $73.52 a barrel, after jumping overnight, while U.S. crude lost 25 cents to $71.66 per barrel.

Looking at the day ahead, the main highlight will likely be the release of the flash PMIs for July from around the world, whilst other data includes the UK’s retail sales for June. Otherwise, earnings releases include Honeywell, NextEra Energy and American Express, and today also marks the start of the Olympic Games in Tokyo.

Market Snapshot

- S&P 500 futures up 0.4% to 4,376.75

- STOXX Europe 600 up 0.5% to 459.01

- MXAP down 0.6% to 201.70

- MXAPJ down 0.7% to 675.50

- Nikkei up 0.6% to 27,548.00

- Topix up 0.8% to 1,904.41

- Hang Seng Index down 1.4% to 27,321.98

- Shanghai Composite down 0.7% to 3,550.40

- Sensex up 0.5% to 53,095.99

- Australia S&P/ASX 200 up 0.1% to 7,394.35

- Kospi up 0.1% to 3,254.42

- Brent futures down 0.3% to $73.56/bbl

- Gold spot down 0.1% to $1,805.41

- U.S. dollar index little changed at 92.86

- German 10Y yield rose 1.8 bps to -0.407%

- Euro little changed at $1.1782

- Brent Futures down 0.3% to $73.59/bbl

Top Overnight News from Bloomberg

- Negotiations between the European Union and the U.S. to recognize each other’s vaccination passes are struggling to make headway due to the absence of a federal certification system in America

- Companies across Europe are stepping up price hikes to cope with mounting cost pressure and business disruption, adding to the alarm bells about an inflation spike that could spell trouble for the economy

- Britain’s economy showed signs of slowing in July as euphoria following the easing of restrictions eased and a resurgence of the coronavirus caused widespread staff shortages

- Spreads are blowing out between short-term German debt and its peers after the European Central Bank signaled it may not raise interest rates for years

A more detailed look at global markets courtesy of Newsquawk

Asian stocks traded mixed with the region indecisive following on from a choppy performance stateside and with the continued absence of Japanese participants, as well as rising COVID-19 cases adding to the subdued mood. ASX 200 (+0.1%) swung between gains and losses with strength in tech, healthcare and consumer stocks offset by weakness in the top-weighted financials and commodity-related sectors, while the mood was also kept tentative by New Zealand PM Arden’s announcement to pause the trans-Tasman travel bubble for eight weeks and after New South Wales Premier Berejiklian flagged an extension to the Sydney lockdown beyond July 30th. KOSPI (+0.1%) was positive as earnings took centre stage including the nation’s largest bank KB Financial Group which topped forecasts for Q2 net, although gains for the index were limited by rampant infections which has forced the government to extend social distancing rules for another two weeks. Hang Seng (-1.5%) and Shanghai Comp. (-0.7%) were negative whereby healthcare led the declines across defensives and property developers were pressured after Chinese banks tightened mortgage lending in various cities, while local authorities also bolstered measures aimed at curbing home prices. In addition, tensions continued to linger ahead of US Deputy Secretary of State Sherman’s visit to China from Sunday with the US said to be disappointed by China’s response to the WHO plan for a phase two probe of COVID origins and stated that this is not a time for China to be stonewalling.

Top Asian News

- Zomato Soars 80% in Debut of India’s New Tech Generation

- Chinese Startup Meicai Said to Mull Hong Kong IPO Amid Crackdown

- Malaysia Apologizes for ‘Human Error’ Over Empty Covid Jab

- Condom Maker Lifestyles Is Said to Mull $500 Million Sale

Bourses in Europe remain on the front foot as the region holds onto the gains seen at the open (Euro Stoxx 50 +0.8%), although momentum has somewhat stalled with this week’s risk events out of the way, with sights now set on next week’s FOMC. US equity futures also conform to the mild risk appetite with broad-based gains across the majors. News flow has remained light and Flash PMIs varied, with the EZ largely topping forecasts whilst the UK disappointing, but nonetheless, the Delta variant themes resonated across all releases alongside the likelihood of higher costs feeding through to higher consumer prices in coming months. Sectors are predominantly in green with no overarching theme. Autos top the charts, closely followed by Basic Resources, Tech, and Retail, whilst Oil & Gas, Travel and Media lag. In terms of individual movers, Vonovia (+0.1%) and Deutsche Wohnen (-1.3%) came under pressure amid source reports the latter’s takeover will likely fail and the 50% vote threshold likely not be reached. Venovia said it is still counting shares tendered by Wohnen shareholders and the result is expected on Monday. In terms of earnings-related movers, Vodafone (+2%) is underpinned after topping revenue forecasts. Valeo (+7.5%) extends its earlier gains after constructive earnings but warned of rising raw material prices.

Top European News

- Isolation Scrapped for Key Workers Over U.K. Shortages

- ECB 2% Goal Must Be 12-18 Months Away Before Hike, Villeroy Says

- KPMG’s Banking Audits Aren’t Good Enough, U.K. Watchdog Says

- Gold Steadies on ECB’s Support Pledge, Mixed U.S. Economic Data

In FX, the Dollar is firmer almost across the board after recovering from several bouts of selling pressure on Thursday post-ECB and IJC that pushed the index down to within a whisker of 92.500 at one stage before a firm, late bounce. The DXY is hovering just under 93.000 within a 92.964-777 band vs yesterday’s 92.926-504 range, and looking for further direction from Markit’s preliminary US PMIs beyond outside influences that may well prompt more pronounced price action in the interim, like a marked change in overall risk sentiment or yield and curve backdrop. On that note, the Yen looks very vulnerable as the general market mood continues to improve and Treasuries bear-steepen at the end of a second consecutive Japanese market holiday, with Usd/Jpy now approaching 110.50 having breached a series of recent highs just shy of 110.40 plus the 21 DMA that comes in at 110.42 today and tested, but respected or rejected 110.00 a couple of times. Similarly, the Pound seems prone to another fall following fades at fractionally lower peaks vs the Greenback and Euro, not to mention far from flash UK PMIs, as Cable pulls back below 1.3750 and Eur/Gbp rebounds through 0.8550.

- CHF/CAD – Also unwinding residual safe haven premium and losing out due to unfavourable rate dynamics, the Franc has retreated to 0.9200 vs the Buck and nearer 1.0850 than 1.0800 against the Euro, while the Loonie has lost some traction from oil awaiting Canadian retail sales for some independent impetus as it meanders inside 1.2600-1.2550 extremes.

- NZD/EUR/AUD – All marginally divergent against their US rival, with the Kiwi benefiting from another change in crosswinds vs the Aussie after a slide in Australia’s services PMI under the key 50.0 threshold and NSW’s Premier warning that Sydney’s lockdown will have to be extended again beyond next Friday due to conditions in parts of the city deemed to be at national emergency levels. Nzd/Usd is holding above 0.6950, whereas Aud/Usd has backed off from 0.7400 and Aud/Nzd from just over 1.0600. Elsewhere, the Euro is still keeping afloat of 1.1750, and with the aid of upbeat German preliminary PMIs that underpinned the Eurozone prints following sub-consensus French readings. However, Eur/Usd is capped into 1.1800 where 1 bn option expiries reside.

- EM – Very little reaction to standard 2-way, but basically stable Yuan mantra from China’s FX regulator, understandably, but the Zar has extended post-SARB and Eskom power shutdown declines and the Rub is looking for guidance from the CBR that is expected to hike 50 bp amidst comparative calm in Brent crude prices between Usd 73.97-32/brl.

In commodities, WTI and Brent front-month futures have been consolidating within tight ranges overnight after yesterday’s settlements with a gain of over USD 1.50/bbl apiece. The overnight holding pattern came amid a lack of fresh catalysts and with Japanese players away from their desks due to a domestic holiday. The demand picture remains at the helm of COVID variant developments and the race to double-vax (and a possible booster jab), whilst the supply side of the equation holds some near-term certainty with the OPEC+ quotas set and the next meeting slated for September. In the absence of developments that impact the supply/demand balance, crude prices are likely to take a cue from the broader market sentiment, with WTI meandering around USD 71.75/bbl and within a relatively tight USD 71.46-79 band. The Brent contract trades on either side of USD 73.50/bbl in a USD 73.32-86 intraday range, with the arb between the two front-month contracts steadier around the USD 2/bbl mark. Elsewhere, spot gold has been contained within a USD 10/bbl range throughout most of the session in the absence of news flow and with key risk events out of the way, but the yellow metal resently dipped below USD 1,800/oz. LME copper briefly reclaimed the USD 9,500/t handle as the constructive risk appetite throughout the week (so far) alongside the rosy demand fundamentals. That being said, IHS in their Flash EZ PMI release noted “Supply chain delays remain a major concern for manufacturing, however, constraining production and pushing firms’ costs higher. These higher costs have led to a near record increase in average selling prices for goods and services, which is likely to feed through to higher consumer prices in coming months.” – highlighting some fears that prompted China’s crackdown on the surge in base metal prices.

US Event Calendar

- 9:45am: July Markit US Composite PMI, prior 63.7

- 9:45am: July Markit US Services PMI, est. 64.5, prior 64.6

- 9:45am: July Markit US Manufacturing PMI, est. 62.0, prior 62.1

DB’s Jim Reid concludes the overnight wrap

It’s your last chance this morning to respond to our latest monthly survey, link here. This month we ask a number of questions about covid restrictions to judge how you feel about how life is progressing and will progress over the coming months. We also ask whether the UK has done the right or wrong thing by lifting all legal covid restrictions. In addition, we ask all the normal regular and market directional questions. All responses gratefully received. It should only take 3-4 minutes to complete and is totally anonymous.

It may be the Olympic Opening Ceremony this morning, but markets failed to take the ‘faster, higher, stronger’ motto to heart yesterday, with investor risk appetite starting to show signs of slipping back again after the recent bounceback. Although the ECB dominated attention, some weaker-than-expected US data served to dampen sentiment ahead of next week’s Fed meeting, whilst residual concern about the delta variant’s spread and the prospect of tighter restrictions remained in the background for a number of key economies.

Starting with the ECB, the main headline was that the Governing Council updated their forward guidance in light of the recent Strategy Review, taking into account their new symmetric 2% inflation target. In the statement, the ECB said that they expect interest rates to remain “at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon”. So given that the ECB’s latest forecasts in June pointed to headline HICP inflation at +1.5% in 2022 and +1.4% in 2023, it’s implying that there’s still a long way to go before rate hikes would be consistent with the inflation outlook. Indeed, the statement said in addition that this “may also imply a transitory period in which inflation is moderately above target.” Meanwhile in their reaction piece (link here), our European economists have now pushed back the timing of the strategic PEPP exit decision from September to December, as a result of President Lagarde still saying that PEPP exit would be premature and the uncertainty of the new delta variant.

In response to the ECB, sovereign bond yields moved lower across the continent, with those on 10yr bunds (-3.2bps), OATs (-3.9bps) and BTPs (-5.1bps) all hitting their lowest levels in at least 3 months. There was also a noticeable tightening in spreads, with the gap between Italian (-2.0bps) and Spanish (-2.6bps) 10yr yields over bunds both coming down on the day, while the Euro (-0.20%) closed at a 3-month low against the US dollar of $1.177. That said, press reports indicated that there wasn’t complete consensus on the Governing Council around the new approach, with Bloomberg saying that Bundesbank President Weidmann and Belgian Governor Wunsch were against the new forward guidance and were concerned about making an overly long-term commitment to keeping monetary policy loose.

Speaking of central banks and inflation, yesterday DB Research put out the second note in our “What’s in the tails?” series, where our research group is considering alternative viewpoints of interest. This edition looks at heightened inflation risks in Germany, where the ECB’s policy of achieving 2% inflation across the Euro Area as a whole means that inflation within Germany could exceed the 2% mark for several years without triggering an ECB policy response. Indeed, this scenario is made even more likely by the fact that the ECB has announced it will wait until they’re fully convinced their policy has worked before adjusting, making such a scenario even more likely. You can read the latest note here.

Although European equities put in another decent performance yesterday, with the STOXX 600 up +0.56%, US indices were more subdued as the S&P 500 only rose +0.20%. Tech stocks outperformed on both sides of the Atlantic, with the NASDAQ up +0.36% and the more concentrated NYFANG+ index gaining +0.46%. Furthermore, after the close both Snap and Twitter reported earnings that beat estimates, which saw both rise in after-hours trading, and also support Facebook and Google’s share prices. However, small-cap stocks lost ground yesterday after their best 2-day performance since January, with the Russell 2000 down -1.55%. And reflecting the broader cautious tone, yields on 10yr Treasuries declined another -1.0bps to close at 1.278% on the back of lower real yields.

Staying on the US, the potential infrastructure bill continued to move toward the finish line with the bipartisan group of Senators agreeing on a portion of funding that will come from delaying Trump-era Medicare regulation. Senator Joe Manchin, one of the moderate Democrats at the centre of the negotiations, declared that there was “an agreement on 99%” of the bill with the pay-fors lined up. Many Senators are expecting the legislation to move forward early next week with votes from both parties needed. Lastly, Senate Majority Leader Schumer announced that he would push to delay the Senate’s August recess – currently set to start on August 9 – to finish working on the bill.

Updating our screens overnight, Asian markets have similarly put in a subdued performance, with the Hang Seng (-0.99%) and Shanghai Comp (-0.65%) each losing ground, whilst the Kospi (+0.10%) and India’s Nifty (+0.16%) have made modest gains. In Japan, markets are closed for a public holiday, and outside of Asia, futures on the S&P 500 are up +0.24%.

Looking ahead now, the main highlight today will likely be the release of the flash PMIs from Europe and the US, which should give us an initial indicator of how their economies have fared into the start of Q3. Back in June, the final Euro Area composite PMI hit a 15-year high of 59.5, while the US number came in at 63.7, which was its second-strongest on record, so it’ll be interesting to see if that momentum has been maintained, particularly given the recent uptick in Covid-19 cases and concerns about the delta variant. Overnight, we’ve already had the flash numbers from Australia, which showed a material weakening in the services PMI given the imposition of lockdown in various regions, which fell to a contractionary 44.2 (vs. 56.8 last month) and brought the composite reading down to 45.2 (vs. 56.7 last month). As we’ve seen in other regions however, manufacturing activity was relatively shielded, with the PMI there still at 56.8 (vs. 58.6 last month), and above the crucial 50-mark that separates expansion from contraction.

One asset class that put in a relatively strong performance yesterday was commodities, with Bloomberg’s commodity spot index up +0.85% in its 3rd consecutive advance, leaving it within 1% of its high for the decade back in June. Oil prices supported the rebound, as Brent Crude (+2.16%) and WTI (+2.29%) moved back into positive territory for the week following Monday’s rout. However, one of the most notable moves yesterday was in coffee prices, which surged +10.03% yesterday to a 6-year high thanks to a major frost in Brazil hurting production. So you might start to see inflation showing up in the price of your morning coffee as well now.

Turning to the pandemic, we had some brighter news from the UK yesterday as the number of new daily cases came in at 39,906, which means that the 7-day average of cases now stands at 46,460, down from 47,696 the previous day. That’s the first decline in the 7-day average since May 18, so the big question now is whether this will be sustained given the reopening on Monday, to which we should find out the answer in the coming days. As previously discussed, we think that the UK is an interesting case study to watch, since their vaccination programme is relatively advanced (over two-thirds of adults are fully vaccinated), while the vast bulk of legal restrictions have now been removed, with even nightclubs open again. So if the UK can make it through the summer without seeing pressure on its health service, that’ll offer a positive signal to other countries as to where you can potentially get to with high vaccination rates.

In terms of what’s going on elsewhere, Portugal announced that it would be extending restrictions to further municipalities in light of a recent rise in cases. Chancellor Merkel said at her summer press conference that cases could double in less than two weeks, as was seen in France – where yesterday they announced cases were up over 133% in a week. Separately, Italy announced that some activities, such as indoor dining, will be restricted for residents who are not vaccinated against Covid-19 or recently tested negative. And over in the US, weekly cases were up over 225k in the last week with the CDC projecting cases are likely to increase to over 305k per week by mid-August. States with relatively lower vaccination rates are unsurprisingly driving much of the current case growth, with Florida, Missouri, Arkansas, and Louisiana the current hot spots in terms of cases per capita over the last week. Finally in Asia, Singapore has said that it will postpone its annual independence day celebrations to August 21 from August 9 in order to control the spread of the virus, and South Korea has also decided to extend its current social distancing restrictions in the greater Seoul area for another two weeks.

On the data side, we had a number of weaker-than-expected US releases yesterday, most notably with a poor set of initial jobless claims for the week through July 17, which surprised noticeably to the upside with a 419k reading (vs. 350k expected). That’s a +51k increase from the previous week, marking the biggest weekly increase since March, whilst the prior week’s number was also revised up +8k. Otherwise, existing home sales for June came in at an annualised rate of 5.86m (vs. 5.90m expected), the Chicago Fed’s National Activity index was at 0.09 in June (vs. 0.30 expected), and the Kansas City Fed’s manufacturing activity index for July came in at 30 (vs. 25 expected).

To the day ahead now, and the main highlight will likely be the release of the flash PMIs for July from around the world, whilst other data includes the UK’s retail sales for June. Otherwise, earnings releases include Honeywell, NextEra Energy and American Express, and today also marks the start of the Olympic Games in Tokyo.

Not coming up with his own stories is usually a good idea for Shyamalan, but here it makes no difference. Old is based on (or “inspired by,” a classic dodge) a graphic novel by French writer Pierre Oscar Lévy. The book, called Sandcastle, is about a Mediterranean beach where time mysteriously speeds up so fast that visitors find themselves living out their whole lives in a single day (with death signaling the end of their vacations). The author offers no explanation for this place—what it is, what caused it—which makes the story’s inherent horror all the more horrifying.

Not coming up with his own stories is usually a good idea for Shyamalan, but here it makes no difference. Old is based on (or “inspired by,” a classic dodge) a graphic novel by French writer Pierre Oscar Lévy. The book, called Sandcastle, is about a Mediterranean beach where time mysteriously speeds up so fast that visitors find themselves living out their whole lives in a single day (with death signaling the end of their vacations). The author offers no explanation for this place—what it is, what caused it—which makes the story’s inherent horror all the more horrifying.