Chinese Military Exercises Threaten To Invade Taiwan

Tyler Durden

Wed, 07/15/2020 – 21:10

Authored by Lawrence Franklin via The Gatestone Institute,

China’s People’s Liberation Army (PLA) is currently staging a military exercise across from the Taiwan Strait that looks as if it plans to culminate in an amphibious assault on an island in the South China Sea. Taiwan’s military — evidently fearing, with good reason, that the exercise may be a cover for an actual Chinese plan to seize another island in the region, Pratas (Dongsha), claimed by both the People’s Republic of China (PRC) and Taiwan — has declared a state of emergency. The PLA exercise also looks as if it is preparing China’s air, naval and marine assets required for an invasion of Taiwan.

In 1996, China initiated a similar crisis in the Taiwan Strait by staging an amphibious assault military exercise. After President Bill Clinton deployed two powerful US aircraft carrier-led battle groups, China discontinued its aggressive posture toward Taiwan. Strategic analysts judged that the Chinese decision was the fruit of a realistic assessment that it could not overcome the US ability to defend Taiwan.

The Chinese Communist Party (CCP), under current Chairman Xi Jinping, appears to be threatening war in a renewed effort to bring Taiwan under Communist Chinese control. The CCP considers Taiwan to be a Chinese province, an integral part of the mainland that ultimately must rejoin it, and the only remaining part of China yet to be returned after the Communists defeated the Nationalists in 1949. For China, it is unfinished business from 70 years ago. China has isolated Taiwan by requiring that all countries who want to have normal diplomatic ties with China must have no state-to-state links with Taiwan. Although the US consents to this diplomatic requirement, it also continues to provide Taiwan with weapon systems, enabling the island to defend itself against any Chinese invasion. US President Donald J. Trump recently authorized the latest sale of US weapons — including advanced heavy torpedoes — to Taiwan. Trump, earlier in his tenure, also approved the sale of anti-aircraft Stinger missiles, Abrams tanks, and F-16 fighter jets.

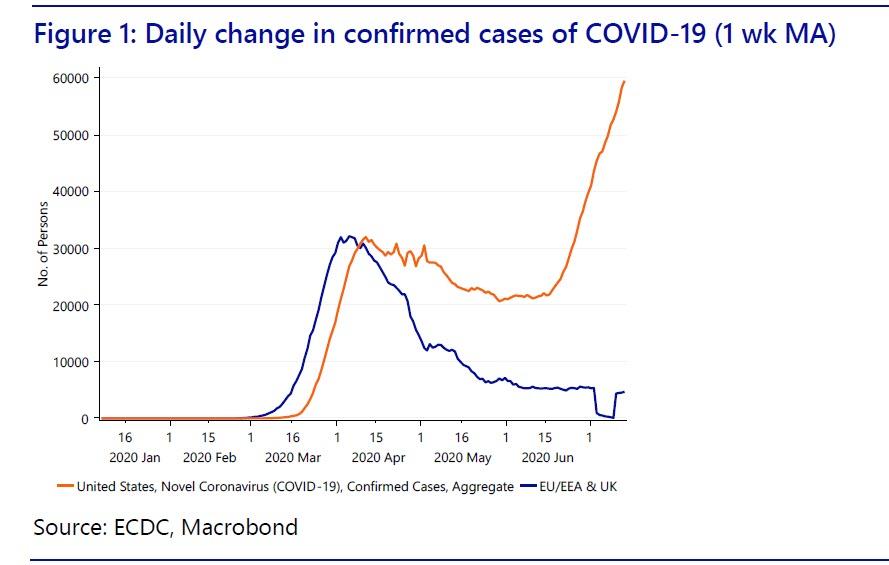

Many foreign specialists on China seem to discount the possibility that the Chinese are willing to risk war with the West to subdue Taiwan. Serious consideration should nevertheless be given to the Chinese Communist Party’s (CCP) determination to incorporate the “secessionist” province despite the danger of a conflict, especially if China considers the US distracted by the fallout of the Wuhan coronavirus that China unleashed on the world, and American voter squeamishness before a presidential election in four months.

The CCP views Taiwan as an existential threat to continued Communist rule in China. Taiwan’s vibrant democracy is the alternate model to the CCP’s totalitarian rule. Despite China’s efforts to cut Taiwan off from the world, the country remains an economically successful and politically free society, less than 90 miles from the Chinese coast.

Millions of mainland Chinese have visited Taiwan, a practice which could stimulate pressure by Chinese citizens on the Communist regime for liberalizing political reforms. If China assesses that its growing military power could quickly reduce Taiwan’s ability to defend itself or that the West has lost the will to defend the island, CCP Chairman Xi might direct the PLA to launch an invasion.

China also doubtless took stock of the free world’s obliging passivity the past few weeks as Beijing seized Hong Kong. Not one country lifted a finger to stop them. The move was in explicit violation of China’s 1997 Joint Declaration with the United Kingdom to maintain “one country, two systems” until 2047.

Presently, China seems to be assessing the West’s resolve to defend Taiwan, while simultaneously attempting to instill fear in the administration of Taiwan’s President Tsai Ing-wen. China initiated this latest aggressive posture toward Taiwan shortly after President Tsai’s May 2016 election, possibly anticipating that Taiwan could declare formal independence from China. In recent months, the PLA’s deployment of air and naval assets near Taiwan have been violating the island’s airspace and territorial waters. China’s aggressive moves have included its deployment of Air Force H-6 bombers and SU-30 and J-11 fighter jets. China’s ongoing 79-day military exercise (May 14 – July 31) opposite Taiwan is being orchestrated by the PLA’s Southern Theater of Command, headquartered in Nanning, the capital city of China’s Guangxi Zhuang Autonomous Region in the south. The exercise features the dual deployment of the Chinese Navy’s two aircraft carriers, the Shandong and the Liaoning, just across the narrow Taiwan Strait in China’s Bohai Sea. The exercise is utilizing air-cushioned boats, amphibious assault vehicles, landing barges, and ground attack helicopters. Reportedly, the ongoing PLA military exercise will conclude with an amphibious assault by Chinese Marines upon Woody Island (Yongxing) in the Philippine Sea, south of Taiwan. Woody Island is occupied by Chinese troops is also claimed by Taiwan and Vietnam (which calls the island Phu Lam).

In response to China’s threatening exercise, Major General Lin Wen-Huang, Chief of Taiwan’s Joint Operations, asserted that Taiwan’s military had plans and preparations in place. General Lin, perhaps fearing that the actual target of the PLA amphibious assault is the Taiwan-occupied island of Pratas (Dongsha), 548 kilometers southwest of Taiwan, reinforced the island’s small Coast Guard contingent with hundreds of Taiwanese Marines from the 99th Brigade.

Taiwan’s armed forces maintain close communication with the US military. In a “cross-strait” confrontation between Taiwan and China, American air and naval assets would be granted complete access to Taiwanese airfields and ports. The Trump Administration, signaling China not to assume dominance in the South and East China Seas, has conducted seven such “Freedom of Navigation” missions through the Taiwan Strait in 2020, and the US Navy has already deployed three aircraft carrier battle groups in the South China Sea.

China’s Communist leaders should not miscalculate that the US is too immersed in domestic distractions to defend Taiwan militarily against any possible plans to threaten the island’s sovereignty.

via ZeroHedge News https://ift.tt/3eyKm8U Tyler Durden