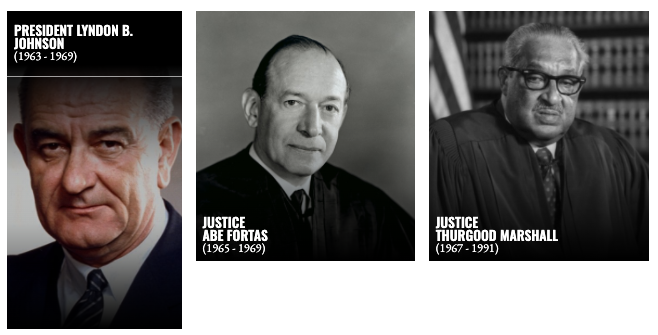

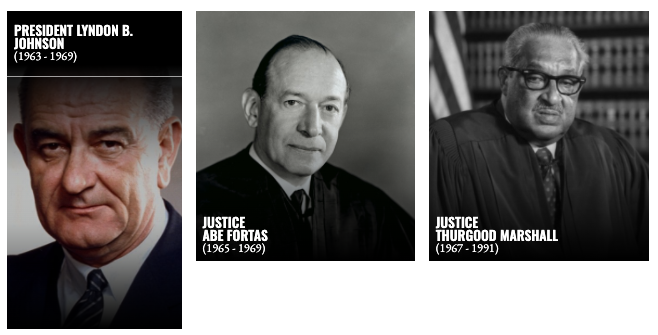

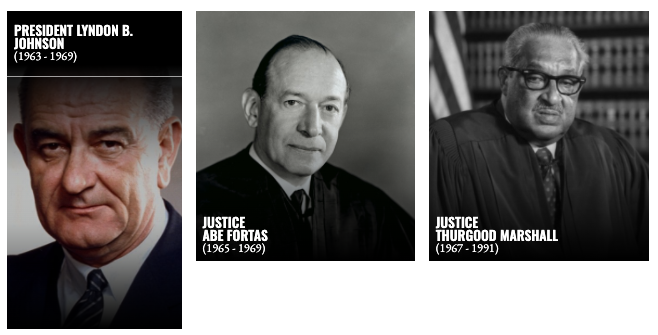

8/26/1964: Lyndon B. Johnson nominated as Democratic candidate for president. He would make two appointments to the Supreme Court: Justices Abe Fortas and Thurgood Marshall.

from Latest – Reason.com https://ift.tt/3gyC1mK

via IFTTT

another site

8/26/1964: Lyndon B. Johnson nominated as Democratic candidate for president. He would make two appointments to the Supreme Court: Justices Abe Fortas and Thurgood Marshall.

from Latest – Reason.com https://ift.tt/3gyC1mK

via IFTTT

8/26/1964: Lyndon B. Johnson nominated as Democratic candidate for president. He would make two appointments to the Supreme Court: Justices Abe Fortas and Thurgood Marshall.

from Latest – Reason.com https://ift.tt/3gyC1mK

via IFTTT

At Least 2 Killed During 3rd Night Of Violence In Kenosha; Grisly Shootings Captured On Video

Tyler Durden

Wed, 08/26/2020 – 07:23

Already, the riots in Kenosha inspired by the police shooting of unarmed Jacob Blake, who was shot in the back while trying to enter a car with his children in the back seat (Blake was hit by 4 of the 7 shots, some reports said he had been armed at one point), have led to the deaths of at least 2 people.

Despite the governor’s decision to declare a state of emergency after a second night of violence, police and the national guard were once again largely absent in a stream of horrifying video from last night’s riots, which at times devolved into open street warfare between groups of rioters and armed people allegedly there to protect property.

Several videos of at least one of the fatal shootings flooded Twitter last night.

Also in the news Kenosha, WI

MAYOR AND GOV refuse National Guard help…Ian Miles Cheong (@stillgray) Tweeted:

Extended footage of the shooting in Kenosha. pic.twitter.com/ErI52KOgNQ— Kirsten W (@QTEAM1776) August 26, 2020

Guy in Kenosha got his arm turned to Swiss cheese chasing down a dude with an AR-15 pic.twitter.com/cwlHtAoZUA

— Mike Roagreser (@BTogetherAlone) August 26, 2020

While video of the other, allegedly involving the same shooter, who was confronted by several other armed citizens.

Extremely graphic: Someone at the #KenoshaRiots was just shot in the head. @livesmattershow was there to record it. pic.twitter.com/dH1t5M4AIK

— Andy Ngô (@MrAndyNgo) August 26, 2020

Police confirmed to the press that they responded to two fatal shootings and at least one non-fatal shooting during the third night of protests inspired by the shooting of Blake.

Evers said he authorized 250 Wisconsin National Guard troops to protect critical infrastructure and assist Kenosha authorities, but once again, these reinforcements stayed clear of local businesses and offered almost no assistance in the protection of private property.

Kenosha officials said another 100 law enforcement officers from surrounding areas were brought in to assist local police. An 8pm curfew was in effect for the area.

“We will continue to work with local, state and federal law enforcement in holding those criminals who are destroying our city responsible,” Kenosha Mayor John Antamarian said in a statement.

And former NYC Mayor Rudy Giuliani had a response.

Kenosha, Wisconsin another city governed by pandering Democrats is burning to the ground.

There are already two dead, many injured and innocent lives and productive businesses that are destroyed.

Biden in seclusion. @realDonaldTrump immediately pushes for National Guard.

— Rudy W. Giuliani (@RudyGiuliani) August 26, 2020

Kenosha police said early Wednesday that they had responded to a report of multiple gunshots just before midnight. Authorities said two people were killed in the shooting, and a third gunshot victim was transported to the hospital with serious, a story that is more or less consistent with the videos we shared above.

An investigation into the shooting is reportedly ongoing. Kenosha County Sheriff David Beth told the NYT that police are investigating whether the shooting resulted from a conflict between demonstrators and a group of armed men there to protect local businesses. CNN reported that armed riot police fired tear gas and pepper spray into the crowd, while Blake’s family pleaded for calm on Tuesday.

One Twitter user shared what she alleged was an interview with the shooter (who can be seen above being chased by another man with a gun) from before the attack. In the interview he can be heard saying he is armed with live ammunition.

VIDEO: The alleged #Kenosha shooter was interviewed earlier in the night who stated he was there to protect property & was carrying live ammunition in his firearm. #KenoshaRiot#KenoshaUprising#KenoshaProtests#KenoshaShooting#KenoshaPolicepic.twitter.com/UJdBV5Uol4 https://t.co/MTrDMN086J

— Saint Patrick, CSP, CRME. (@tuanstpatrick) August 26, 2020

The protests have triggered gatherings of armed citizens, some of whom said they were protecting property against looting.

via ZeroHedge News https://ift.tt/2QpZV9p Tyler Durden

“A Land Of Opportunity” – Dems Whine About Pompeo’s Speech From Jerusalem, First Lady Backs Husband

Tyler Durden

Wed, 08/26/2020 – 06:49

Night 2 of the Republican National Convention picked up right where Night 1 left off, with speeches from First Lady Melania Trump, Secretary of State Mike Pompeo, along with a few less familiar faces, including Covington Catholic student Nick Sandmann and pro-life activist Abby Johnson.

Trump kicked things off by issuing a full pardon to convicted bank robber-turned-activist Jon Ponder, who helps former inmates move on from crime, while Trump and Acting Homeland Security Secretary Chad Wolf (nominated earlier to fill the role on a full-time basis, pending Senate confirmation) also conducted a surprise naturalization ceremony for five newly minted US citizens, eliciting howls of rage from Democrats who accused Trump of abusing his “official capacity” to boost his campaign. But while the president’s actions might seem egregious, all presidents running for reelection have leveraged the powers of the office to varying degrees.

Here’s the Daily Caller’s highlight reel:

Shaking off a flurry of taunts from the mainstream press about last year’s plagiarism incident, First Lady Melania Trump delivered last night’s keynote, highlighting her “Be Best” anti-bullying campaign and speaking out against looters committing acts of violence under the cover of “peaceful protests”.

Covington Catholic Student Nick Sandmann (best known for a “confrontation” with a Native American activist, according to the NYT’s hilariously sanitized description) also delivered a speech in front of the Lincoln Memorial where he blasted cancel culture and the media for “willingly” spreading false narratives about the “confrontation” that the NYT alluded to (Interestingly, the NYT made no mention of Sandmann’s settlements with the mainstream media orgs who defamed him).

Abby Johnson described her transformation from Planned Parenthood employee to the founder of And Then There Were None, a nonprofit dedicated to ending abortion in the US.

In keeping with Trump’s agenda, farmers and small business owners from the Midwest featured heavily in the night.

— Donald J. Trump (@realDonaldTrump) August 26, 2020

— Donald J. Trump (@realDonaldTrump) August 26, 2020

Finally, Secretary of State Mike Pompeo addressed the convention from the American embassy which Trump moved to Jerusalem. Pompeo’s address infuriated Dems, drawing accusations that the Trump Administration had broken with decades of precedent, and possibly federal law, by devoting official resources to campaigning. But as always, the mainstream press failed to understand that these accusations help Trump as much as hurt him, at least in the eyes of the campaign.

“The primary constitutional function of the national government is ensuring your family – and mine – are safe and enjoy the freedom to live, work, learn and worship as they choose,” Pompeo said. “Delivering on this duty to keep us safe and our freedoms intact, this president has led bold initiatives in nearly every corner of the world.”

Tomorrow, we move on to Night 3 – that is, if Democrats don’t successfully impeach Trump and Pompeo for the Jerusalem “stunt” – which of course highlighted the Israel-UAE diplomatic agreement that now stands as one of the administration’s greatest foreign policy accomplishments – by the time the first speaker starts.

via ZeroHedge News https://ift.tt/2FR1ifg Tyler Durden

Buffett, Banquo’s Ghost, & Bullion

Tyler Durden

Wed, 08/26/2020 – 06:00

Authored by James Rickards via DailyReckoning.com,

WE have all been mesmerized by action in the price of gold lately. In the past few weeks, gold rallied over $200 per ounce and traded solidly about the $2,000 per ounce level and hit a new all-time high taking out the previous high from August 2011.

Of course, gold is volatile (well, the paper gold market is volatile) and has its down days alongside the up days. But the trend to much higher prices is firmly in place.

It’s trading at around $1,940 today, but it’ll soon be back to $2,000, and much higher in the years to come.

Everyday investors understand this price action, but the Federal Reserve does not.

Gold reserve requirements on the U.S. money supply were ended in 1968 and the ability of foreign trading partners to convert U.S. dollars to gold at a fixed price was ended in 1971.

Ever since then, central bankers in general and the Fed in particular have banished gold from the conversation and insisted that if you think gold has a place in the monetary system you are a “gold bug,” a moron or worse.

But, like Banquo’s ghost in Shakespeare’s Macbeth, gold keeps showing up as an uninvited guest at the dinner table to haunt the central bankers. Economists may have abandoned gold, but investors have not.

And perhaps the most famous investor of all is now betting on gold…

In the past, Warren Buffett has mocked gold for having no utility. Why dig it out of the ground only to rebury it in a vault?, he has asked.

Incidentally, Buffett’s father, Howard Buffett, was a U.S. congressman. He strongly believed in the gold standard and was one of the last remaining public officials who argued for it after WWII.

The apple fell pretty far from the tree in this case.

But, it seems that Warren Buffett has changed his mind about gold…

Buffett dumped much of his stake in JPMorgan and Wells Fargo bank and made a huge $563 million bet on Barrick Gold.

There are fundamental reasons for this, including the fact that bank earnings are likely to suffer both because of a flat yield-curve (banks can’t make profits on a spread when there is no spread) and accumulating loan losses from the COVID-19 economic collapse and coming defaults.

Of course, Barrick Gold is a beneficiary of rising gold prices which have enabled it to pay off most of its debt so it’s well positioned to go on an acquisition binge buying smaller miners with proven reserves.

But, there’s another way to think about this trade with more profound implications for investors.

Banks create money by making loans and adding the loan proceeds to borrower accounts through a few accounting entries. The banks create paper money.

But, gold miners create money by digging up gold, processing it and selling it to refiners. In other words, the gold miners create hard money.

Buffett is signaling a loss of confidence in the dollar. He’s getting out of the paper money business and into the hard money business.

Economists call this a “liquidity preference.” I call it a sign of the times. If Buffett is moving into hard money in the form of gold, maybe you should too.

But it’s not just Warren Buffett, of course.

Turkey’s central bank has lost its independence and the president of Turkey is demanding low interest rates and more money printing. That’s leading to runaway inflation. Gold is the obvious hedge.

People are also turning to gold in China, South Korea, Germany and elsewhere around the world.

Once again, this proves that everyday investors are the first to act at important economic turning points and central bankers are the last to know.

It’s not too late to add to your gold allocation before new restrictions on gold buying or gold ownership are imposed.

via ZeroHedge News https://ift.tt/2Yz3HSz Tyler Durden

Double-Dip? The Number of Small Businesses Open Re-Plunges

Tyler Durden

Wed, 08/26/2020 – 05:30

New analysis from Opportunity Insights of US business activity reveals the number of small businesses open recently turned lower.

The slump coincides with an overall economic recovery that stalled in late June. About a month ago, we said rapid and record fiscal stimulus, driving the V-shaped recovery in consumer spending, was at risk of losing momentum if government support was removed prematurely (see: “Look Out Below”: Why The Economy Is About To Fly Off A Fiscal Cliff“).

With a fiscal cliff beginning on August 01, many states paused or reversed reopenings because of a reemergence of the virus, fiscal uncertainty remains about how and when the next round of Trump checks will be helicopter dropped to tens of millions of jobless and broke Americans, and an overall economic recovery that is reversing, the weakest companies, many of which are small firms, are closing up shop once more.

We outlined in late July how small business owners were rushing to liquidate their assets on Facebook Marketplace as the environment to operate worsened. The devastation of small firms is shocking, due mostly because mom and pop shops account for 44% of all US economic activity.

Opportunity Insights shows the percent change in the number of small businesses open tumbled from -7.7% on July 4 to -19.5% on August 7.

The decline was widespread, seen in every state.

A heat map shows the percent change in the number of small businesses open suffered the most significant decline in the Northeast.

On Wednesday, the Federal Reserve was cautious in the minutes and questioned the robustness of the economic recovery.

Since small firms are the lifeblood of the US economy, with many now closing for a second time, this can no way suggest a “V-shaped” economic recovery will be seen this year or early next year.

Wall Street misread the shape of the recovery curve thanks to the Federal Reserve and the federal government pumping trillions of dollars into the economy market.

via ZeroHedge News https://ift.tt/3aVOkZj Tyler Durden

UK Govt Scientist Admits Lockdown Was A “Monumental Mistake On A Global Scale”

Tyler Durden

Wed, 08/26/2020 – 05:00

Authored by Paul Joseph Watson via Summit News,

A scientific advisor to the UK government says the coronavirus lockdown was a “panic measure” and a “monumental mistake on a global scale.”

Infectious diseases expert and University of Edinburgh professor Mark Woolhouse acknowledged that the decision to lockdown in March was a “crude measure” that was enacted because “we couldn’t think of anything better to do.”

“Lockdown was a panic measure and I believe history will say trying to control Covid-19 through lockdown was a monumental mistake on a global scale, the cure was worse than the disease,” said Woolhouse, who is now calling on the government to unlock society before more damage is done.

“I never want to see national lockdown again,” he added.

“It was always a temporary measure that simply delayed the stage of the epidemic we see now. It was never going to change anything fundamentally.”

The professor asserts that the impact of the response to coronavirus will be worse than the virus itself.

“I believe the harm lockdown is doing to our education, health care access, and broader aspects of our economy and society will turn out to be at least as great as the harm done by COVID-19,” said Woolhouse.

Richard Sullivan, professor of cancer at King’s College London, previously warned that there will be more excess cancer deaths over the next 5 years than the number of people who die from coronavirus in the UK due to the disruption caused by the coronavirus lockdown, which is preventing cancer victims from getting treatment.

Figures also show that there were more excess deaths during the 2017-18 flu season (around 50,000) than the total number of people in the UK who have died from coronavirus (41,433).

However, a survey conducted last month found that Brits thought around 7 per cent of the population, 5 million people, had been killed by COVID-19.

* * *

In the age of mass Silicon Valley censorship It is crucial that we stay in touch. I need you to sign up for my free newsletter here. Also, I urgently need your financial support here.

via ZeroHedge News https://ift.tt/3aUMKH9 Tyler Durden

The Chicago Police Department has banned protests, even peaceful ones, on the block where Mayor Lori Lightfoot lives. Residents of the area have complained about the efforts cops are taking to keep protesters out, which include barricades in the street and checking people’s IDs before letting them enter the neighborhood. Cops say city and state laws ban protests in residential neighborhoods, but when a local newspaper asked them to list other instances in which they have blocked such protests police did not provide any examples.

from Latest – Reason.com https://ift.tt/2EAk7D2

via IFTTT

The Chicago Police Department has banned protests, even peaceful ones, on the block where Mayor Lori Lightfoot lives. Residents of the area have complained about the efforts cops are taking to keep protesters out, which include barricades in the street and checking people’s IDs before letting them enter the neighborhood. Cops say city and state laws ban protests in residential neighborhoods, but when a local newspaper asked them to list other instances in which they have blocked such protests police did not provide any examples.

from Latest – Reason.com https://ift.tt/2EAk7D2

via IFTTT

New SEC-Backed Crypto Exchange Launches $130MN ‘Security Token’ Offering

Tyler Durden

Wed, 08/26/2020 – 04:15

INX Trading Solutions, a new crypto exchange that’s hoping to displace its competition via close relationships with regulators and more ‘robust’ technology offerings (“we built our own technology; we don’t license it,” the company boasted in a release), has just launched one of the first SEC-approved “security token” offerings in the US.

The company has attracted the attention of the financial press thanks to a hilarious “chart” that we suspect was intended as a light-hearted joke.

But that didn’t stop Bloomberg editor Joe Weisenthal from apparently reached out for comment about the meaning of the “y axis” in the chart above, and the company brushed him off with a “whatever you want it to be.”

When asked by @TheStalwart what the y axis is for this graph from their marketing materials, they said ‘whatever you want it to be’ https://t.co/RUhjChLziy pic.twitter.com/LcISKkhMDZ

— Austerity Sucks (@austerity_sucks) August 25, 2020

Some crypto afficionados, however, believe the project – which is coming to market just as bitcoin and top alt-coin prices have been moving higher – has some built-in advantages that differentiate INX from the ill-fated, scam-level ICOs of yesteryear.

INX has built its own exchange platform, and forged a working relationship with the SEC that could give it an advantage, since American regulators hold the keys to the crypto-asset kingdom, so to speak.

Traditionally, exchanges have been among “the most profitable businesses in the crypto ecosystem”.

Don’t conflate permissionless altcoins that try to compete with bitcoin to this, a regulated security token for a specific company.

This is a very different beast; I find it interesting because historically the most profitable businesses in the crypto ecosystem are exchanges.

— Jameson Lopp (@lopp) August 25, 2020

The company is offering up to 130 million INX Security Tokens in the offering on Tuesday.

* * *

Read the press release below:

INX Limited today announced that the Securities and Exchange Commission (SEC) has declared as effective its registration statement on Form F-1 filed in connection with the initial public offering (the “Offering”) of up to 130 million INX Security Tokens (the “INX Tokens” or “Tokens”). INX has set the offering price at $0.90 per Token with a minimum investment of $1,000. It is anticipated that the Offering will begin on August 25, 2020 at 10am Eastern Daylight Time at https://token.inx.co/

INX intends to use a portion of the net proceeds raised from the sale of INX Tokens in the Offering for the continued development and operation of INX Trading Solutions, a regulated solution for the trading of blockchain assets, including cryptocurrencies, security tokens, and their derivatives, and for the establishment of a cash reserve fund.

A registration statement relating to these securities was declared effective by the Securities and Exchange Commission (SEC) on August 20, 2020. Copies of the registration statement can be accessed by visiting the SEC website at sec.gov. The offering is being made only by means of a prospectus. A final prospectus describing the terms of the offering has been filed with the SEC and forms a part of the effective registration statement. Copies of the final prospectus relating to the Offering may be obtained for free by visiting EDGAR on the Securities and Exchange Commission’s website at www.sec.gov (click here). Alternatively, copies of the final prospectus may be obtained for free by sending an email to INX at investors@inx.co.

via ZeroHedge News https://ift.tt/3lj1FQ7 Tyler Durden