Public Forums & The First Amendment: Can Streets Be Painted With ‘Black Lives Matter’ Messaging?

Tyler Durden

Tue, 07/07/2020 – 19:30

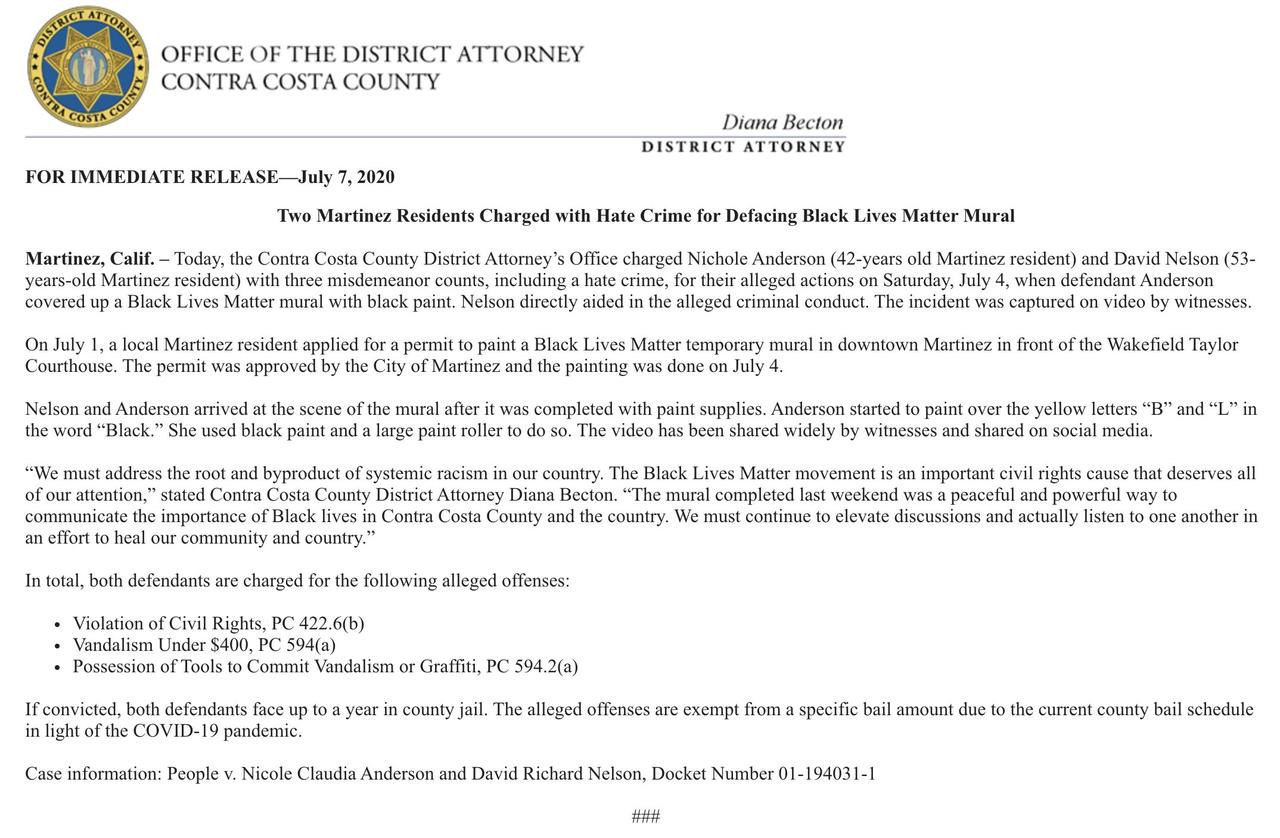

Update (2130ET): In a stunning update, the Martinez couple caught on video painting over the “approved” Black Lives Matter mural on July 4th…

…are being charged with a hate crime.

* * *

Authored by Mark Glennon via Wirepoints.org,

Are Black Lives Matter supporters free to paint those words and its slogans on public streets? Do others have a right to put up contradictory views or cancel out BLM messages?

Those questions should be trending, given recent headlines, but they are yet to be discussed in the press. Perhaps that’s because answers are unclear, at least as far as I can tell.

Removing “Black Lives Matter” in Martinez, CA

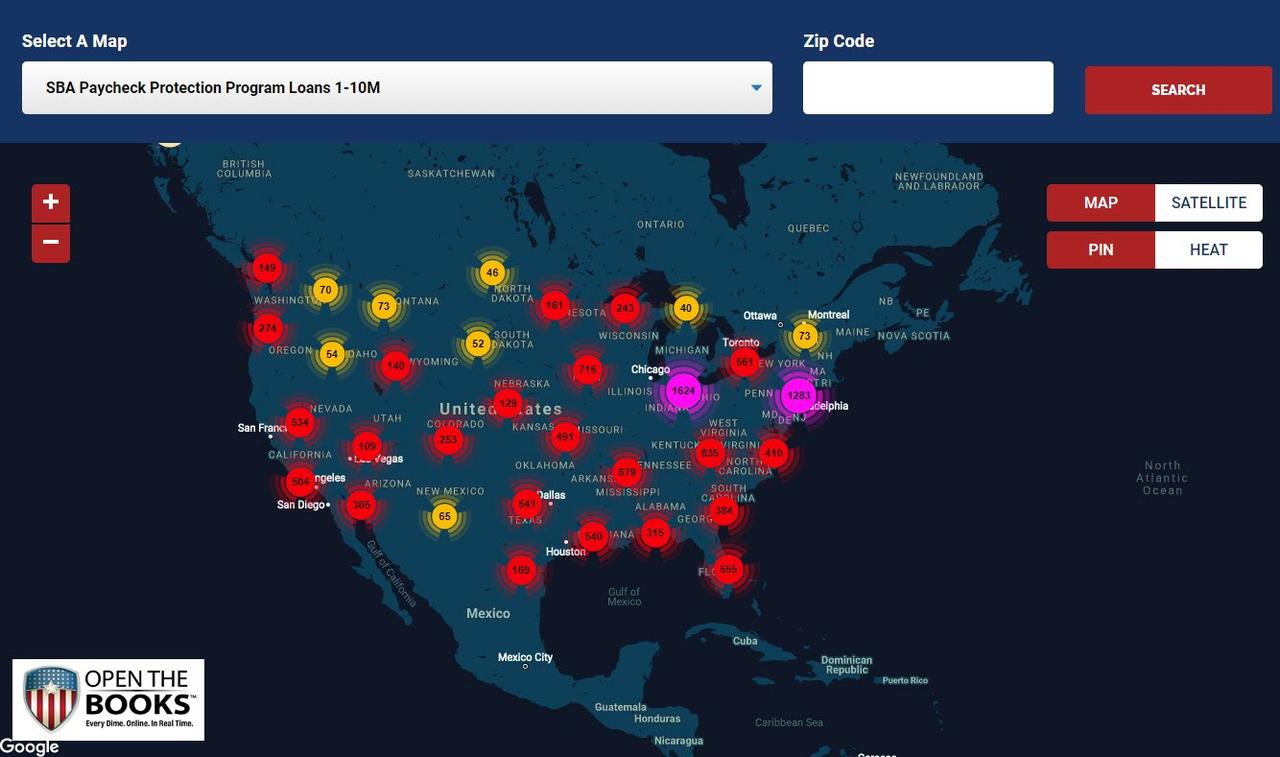

“From Cleveland to Montpelier, Vt., BLM street slogans have been defaced,” says The Washington Post in a Monday story about two people in Martinez, California who painted over “Black Lives Matter” that had been painted on a public street. Major streets in New York and Washington, D.C. have been amond thosee painted with Black Lives Matter.

Locally, the words Black Lives Matter and Defund EPD, which had been painted on Evanston streets, were splattered with white paint this past weekend in what appears to be an attempt to deface the words, according to various news reports.

Who has what rights to paint public streets?

The starting point is what’s called the public forum doctrine. That doctrine, which courts have recognized under the First Amendment for over 80 years, requires “viewpoint neutrality” when government creates a public forum for speech. Under that doctrine, when government excludes a speaker from a public forum – such as a park or a podium at a government meeting – doing so may violate the speaker’s First Amendment rights if the exclusion is based on the content of the speech or the speaker’s viewpoint.

It’s under that doctrine that courts have denied government officials, including President Trump, the right to block critics on social media. Officeholders are obviously free to say what they want. But if they choose to go on a public forum like Twitter that allows responses, those officeholders cannot block reactions they don’t like.

By letting people paint messages on public streets, cities probably would be deemed to have created a forum, so it might seem that neutrality demands that competing messages be allowed. Or since contesting messages might make a mess of the streets, perhaps dissenters would defend erasing them by claiming neutrality can be preserved that way.

But not so fast.

Courts also recognize something called the government speech doctrine, which basically says the government itself can express whatever viewpoint it chooses. So, if the BLM messaging is the city’s own or the city blessed it, it’s probably protected.

If you are confused, you should be. The conflict between the public forum and government speech doctrines has been variously described as either a contradiction or a paradox. A Boston College legal journal put it this way:

[T]he government must show that it is not discriminating against a viewpoint. And yet if the government shows that it is condemning or supporting a viewpoint, it may be able to invoke the government speech defense and thereby avoid constitutional scrutiny altogether. Government speech doctrine therefore rewards what the rest of the First Amendment forbids: viewpoint discrimination against private speech.

Making things still murkier in Martinez and Evanston are the facts about whether the government was itself speaking. If it was private citizens and not the government, the government speech defense would not apply.

In Martinez, community members reportedly did the original Black Lives Matter painting though they had a city permit to do so.

“Defund EPD.” Source: Daily Northwestern.

In Evanston, it appears the city supported the Black Lives Matter painting but not the Defund EPD message, according to the Daily Northwestern, and those who painted the latter may face charges.

I’ll leave it there on how courts would deal with these cases and let First Amendment experts speculate further.

As a matter of policy, however, it certainly seems the government should stay away from divisive messaging unless they deliver it in forums where debate can be robust. Painting streets is no such forum.

Many will say, of course, that there is nothing divisive in BLM messaging and that dissenting views should be disregarded. Much of the press will go along with that, reporting the dissenters as vandals or racists. The San Francisco Chronicle headline on the Martinez incident was “Black Lives Matter mural in Martinez vandalized in ‘hateful and senseless’ act.” And in The Washington Post, the headline was, “Calling racism a ‘leftist lie,’ white vandals target California Black Lives Matter slogan.”

But the division BLM inflames is real and will grow. BLM Chicago recently retweeted a video of Fred Hampton with the message, “we not gon fight capitalism with black capitalism, we gon fight it with socialism… we’re going to fight their reactions when all us people get together and have an international proletariat revolution!” Hampton was a Black Panther leader killed in a 1969 police raid in Chicago.

And over the weekend BLM Chicago promoted training sessions on abolishing the entire police and prison system, which included “black only” sections.

We wrote more about them and the national BLM organization’s extremism earlier. Their supporters have their legal rights, but the facts are coming out.

Race relations are being set back by fifty years and BLM is part of the reason why.

via ZeroHedge News https://ift.tt/3iEtqkF Tyler Durden