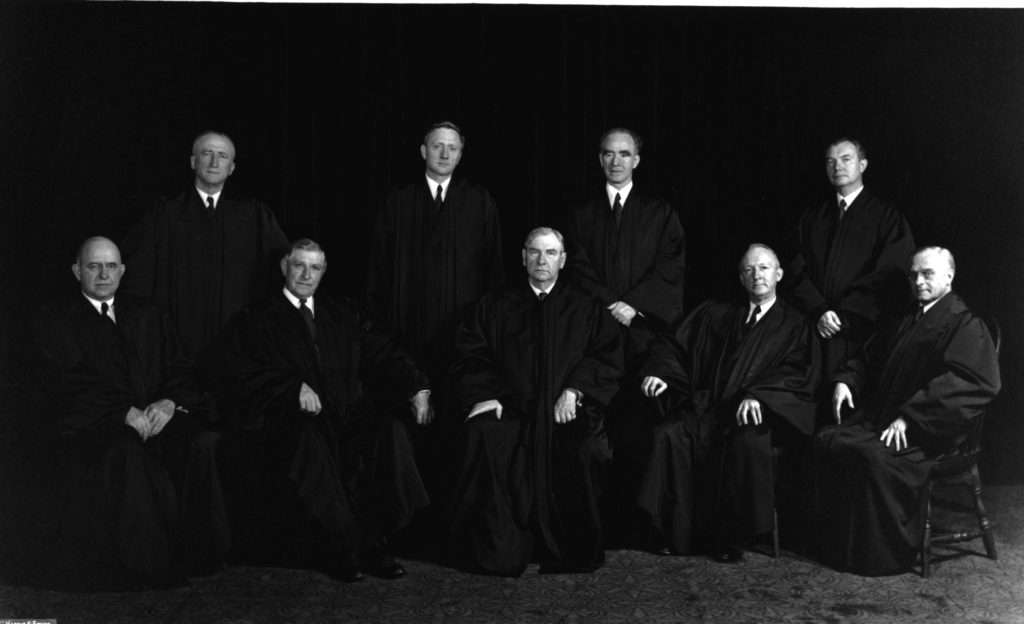

7/29/1942: Supreme Court hears oral argument in Ex Parte Quirin.

from Latest – Reason.com https://ift.tt/39zAECA

via IFTTT

another site

7/29/1942: Supreme Court hears oral argument in Ex Parte Quirin.

from Latest – Reason.com https://ift.tt/39zAECA

via IFTTT

7/29/1942: Supreme Court hears oral argument in Ex Parte Quirin.

from Latest – Reason.com https://ift.tt/39zAECA

via IFTTT

Fears Of “Third Wave” Intensify As China Suffers Biggest Jump In COVID-19 Cases Since April: Live Updates

Tyler Durden

Wed, 07/29/2020 – 06:15

As anxieties about a global “second” (or, in Hong Kong’s case, “third”) wave intensify, health authorities in China have just reported the biggest daily jump in new COVID-19 cases on the mainland in three and a half months on Wednesday when 101 new coronavirus cases were reported by the health commission.

Over the past few months, health authorities have moved quickly, imposing lockdown measures, closing schools and rolling back other freedoms wherever new clusters were discovered be it Beijing, Wuhan, Dalian, Xinjiang, Urumqi or another city. Yesterday, Chinese officials reported a new case in Beijing (the capital city’s first case in 3 weeks) that authorities purportedly linked to an outbreak in the northeastern port city of Dalian.

Wednesday’s total was the highest in over three and a half months, according to the National Health Commission. Most of the infections were tallied in Urumqi, the capital of China’s far-western Xinjiang Province, while one case was reported in Beijing. 27 of the cases were asymptomatic, authorities said, while three were ‘imported’ cases.

As of Tuesday, mainland China had 84,060 confirmed coronavirus cases…while the official death toll remained at 4,634. Inexplicably, China has suspended poultry imports from a BRF-Brazil Foods plant, according to information from China customs published July 29. China has barred imports of seafood from several Latin American (and other international) producers after supposedly detecting COVID-19 on the packaging.

China’s resurgence follows the discovery of a new cluster in Hong Kong that has prompted city officials to adopt the most restrictive social distancing rules yet, including ordering bars and restaurants to close for indoor service, and restricting public gatherings to a maximum of 2 people. The city reported another 118 cases on Wednesday, the 8th straight day that daily new infections surpassed 100.

Of the 118 cases, 113 were locally-transmitted and the remainder were imported. 46 of the 113 cases were of unknown origin. The city’s deaths reached 24.

The measures imposed in Hong Kong are expected to last for at least one week as leader Carrie Lam warned the city is on the brink of a large-scale outbreak.

Elsewhere in the region, the Philippines officially overtook mainland China with the total recorded number of coronavirus disease cases climbing to 85,486 cases on Wednesday, compared to China’s official count of 84,060.

The latest data from the Philippines Department of Health reported another 1,874 cases, bringing the total to 85,486 COVID-19 cases.

Of the total number of infections, 56,528 were counted as active.

Metro Manila topped the list of areas with new COVID-19 cases with 728. 388 new recoveries were recorded bringing the total number of patients to 26,996.

However, the country’s COVID-19 death toll hit 1,962 as 16 new deaths were reported.

Nearly 16.7 million people have been diagnosed with the virus around the world. Some 9.7 million patients have recovered, and more than 659,000 have died, according to data from Johns Hopkins University.

As we await Wednesday’s numbers out of the US and Europe, we expect to see the focus of the international community to start shifting back to Asia.

via ZeroHedge News https://ift.tt/309ILCB Tyler Durden

“Markets Have Turned Into The Most Astounding Circus The World Has Ever Seen”

Tyler Durden

Wed, 07/29/2020 – 06:00

Submitted by The Swarm Blog

In previous articles, I examined the negative externalities of post-Keynesian measures like unlimited monetary easing. First, I explained that such policies were inflating asset prices, squeezing working and middle classes, and thus leading to a core deflationary impact on the rest of the economy (see There Ain’t No Such Thing as a Free Lunch – Part 1). Then, I wrote that too many bailouts might lead to moral hazard and zombie companies, undermining future economic growth (see There Ain’t No Such Thing as a Free Lunch – Part 2).

If such policies tend to weaken the economy, then why assets like stocks, bonds, and real estate keep on rising?

Greed is Good

As already mentioned, bonds and equity markets have been more and more driven by the “Fed put” narrative (see The Fed Put Narrative Era). Besides, households might see the drop of interest rates as a screaming buy signal in the residential real estate space. People have been taught that any correction should be regarded as a huge investment opportunity, so everyone is willing to join the party.

Fear of missing out is a powerful catalyst, especially when wages inflation is so low that all you can do is hope for significant returns on investment markets. If the Fed has our back and if Pelosi is right about “the stock market floor”, then why not taking risks?

Narratives and Fantasy

Even if people love to state that “the market is not the economy”, assets like, stocks, bonds, and property, are supposed to reflect economic values somehow. However, GDP growth has been decreasing for decades in Western economies (see chart below).

Once again, it is important to realize that markets are intersubjective frameworks and that they are driven by narratives. As long as people believe that the dominant narrative is true, extreme valuations may remain a reality. But if doubts arise, then the whole house of cards is likely to collapse, especially as economic fundamentals do not support current levels.

The New Gold Rush

More interestingly, it seems that the market has just entered the “buy everything” moment, with speculative behavior spreading to gold, euro, and even bitcoin.

I have been bullish on gold since 2014, as I have always thought that money printing would reduce the purchasing power of money, pushing precious metals prices higher. However, I think that we should not confuse fundamentals catalysts with FOMO, and I tend to be skeptical about any asset going parabolic, including gold and silver.

In my opinion, people believe that anything, from stocks to metals, can make them rich. But in economics, there is no free lunch. In other words, without economic growth, there might be no wealth creation on the long run.

One could argue that gold price is reflecting a sudden drop of confidence in US dollar. But I tend to disagree with that, as it is not consistent with T-bonds trading at historically low yields.

Moreover, if people were losing confidence in the dollar, then why would they see the euro as a safe haven? It would not make any sense, as the Eurozone appears as a more and more fragile entity.

I agree with the idea that post-Keynesian policies will have a deep and durable impact on the dollar. And I do believe that China will soon unveil a monetary scheme that could challenge the dollar monopoly. However, I do not think that current speculation on gold has anything to do with the end of the dollar.

It is all about greed and FOMO. Nothing new here, and we already know how it will end. But we must admit that asset markets have turned into the most astounding circus the world has ever seen.

However, every fantasy has a price.

via ZeroHedge News https://ift.tt/2CXTuHE Tyler Durden

Sweden Defeated The Coronavirus Without A Lockdown – Now Its Companies Are Reaping The Benefits

Tyler Durden

Wed, 07/29/2020 – 05:30

Progressive critics of the Trump Administration’s response to the coronavirus pandemic like to point to Sweden and portray the Nordic country’s decision to forego lockdowns as a travesty motivated by greed. Such reductive, black-and-white interpretations are inevitably the result of a childlike analysis where every hero needs to have a hero and a villain. But although Sweden’s COVID-19 czar has admitted that he would have changed certain elements of the country’s response if he could go back in time, the country’s decision to skip lockdowns, and keep the country relatively open, has paid off – even if Sweden does have a significantly higher mortality rate than its neighbors (though still lower than all of the worst-hit western European countries).

Sweden’s death-to-infection ratio is relatively high, a reflection of a series of early outbreaks in managed-care homes that led to widespread fatalities among their elderly and vulnerable residents.

Here’s how Sweden compares to the US, Brazil, the UK, and a handful of other countries.

And as the US remains engulfed in an election-year debate about how to handle the crisis, and whether mandatory social distancing orders (like mask-wearing mandates) and, if necessary, more lockdowns should be used to fight the outbreak – views differ widely across people of different political orientations. Even Dr. Fauci, who has said some of the worst-hit areas should “think about” imposing stay at home orders if things get worse, has worded his views very carefully so as not to sound like an imperative. But as Q2 earnings season enters one of its most consequential weeks in the US, the FT pointed out in a piece published earlier that Sweden’s biggest companies have beaten analysts’ expectations across the board.

It was supposed to be a terrible start to the summer. As a debate rages in Sweden over whether its lighter-touch approach to managing coronavirus has been the correct course, most European analysts were braced for dreadful quarterly earnings from the Scandinavian country during the height of the pandemic.

But every day for the past two weeks, Swedish company after Swedish company has beaten expectations. From telecoms equipment maker Ericsson to consumer appliances manufacturer Electrolux via lender Handelsbanken and lockmaker Assa Abloy, Swedish companies have delivered profits well above what the market was expecting, even if in some cases that merely meant a less precipitous decline than analysts had feared.

“I have never seen such a high proportion of companies coming in with better profits than expected. It’s almost every company,” said Esbjorn Lundevall, chief equity strategist at lender SEB. The bumper crop begs the question of how many of the positive surprises are due to Sweden’s more controversial approach to managing coronavirus. Unlike the rest of Europe and North America, the country did not have a lockdown and kept schools and many shops and businesses open – a public health experiment that has attracted global scrutiny and drawn both praise and censure. “Keeping society open, schools open, doesn’t mean that we haven’t been hit. But it does mean that we haven’t suddenly not been able to leave our homes. That has undoubtedly helped companies,” Alrik Danielson, chief executive of Swedish bearings manufacturer SKF, told the FT.

The earnings have pressed some economists to reconsider their GDP projections for the country.

To be sure, while all boats appear to be rising in Sweden’s COVID-19 resistant economy, bolstered by what experts described as a “psychological” disposition among Swedes not to fear things like going to work, or school, or to a restaurant, some industries have benefited more than others.

There’s a split, analysts say, between companies between domestically focused Swedish companies (ex.retail banks) while the country’s manufacturers like Volvo are struggling with higher levels of “uncertainty” due to the global outlook.

Sweden’s economy has performed so well for a handful of reasons. One is its close economic relationship with both China and the US. China’s economy had already slowed to its weakest pace of growth in 29 years when SARS-CoV-2 came bursting out of Wuhan late last year. But thanks to Beijing’s heavy-handed response to the outbreak, the mainland economy has already returned to growth.

That’s good news for Sweden, which exports many heavy and industrial goods, as well as foodstuffs and other products to China, among other things.

The bigger worry, the FT points out, is Europe, especially as more clusters emerge in Spain, Belgium and elsewhere.

All industrial groups have been helped by signs of recovery in China and a robust early rebound in much of Europe, as well as large government support packages to maintain jobs.

The big worry for them now is about whether a second wave of coronavirus hits Europe and the US in the autumn.

“What is the likelihood that you get more lockdowns? What is the likelihood that this fear factor subsides?” asked Mr Danielson. “That is going to be the big question of how quick the recovery will be. Now it’s about psychology, it’s about people.”

He is not alone in thinking that Sweden has a subtle psychological advantage by dint of having stayed more open and having people less scared of working, shopping and socialising outside the home.

Whatever happens in western Europe, Sweden’s outlook has improved dramatically over the last month. New cases have grown rare…

…and deaths are even rarer.

via ZeroHedge News https://ift.tt/2CXKK4i Tyler Durden

Is China’s Massive Three Gorges Dam On The Edge Of Failure?

Tyler Durden

Wed, 07/29/2020 – 05:00

Authored by Bruce Wilds via Advancing Time blog,

The massive flooding taking place in China continues, for some reason, this story has been widely ignored by mainstream media. It is important because China’s massive Three Gorges Dam is in peril. If the dam fails there will be a staggering loss of lives and property. The Three Gorges Dam is around one and a half miles long and just over 600 feet tall. About 400 million people live downstream of the dam and apparently, no plans have been made for their evacuation.

The failure of this dam, which is the largest in the world, would have catastrophic consequences. It is estimated such an event could result in around half a million people being killed. The Asia Times reported several days ago that Beijing has admitted that its 2.4-kilometer Three Gorges Dam spanning the Yangtze River in Hubei province “deformed slightly” after record flooding. The deformation occurred last Saturday when waters from western provinces including Sichuan and Chongqing along the upper reaches of the Yangtze River peaked. At this, point the biggest concern is that rain continues and more is expected.

China’s Three Gorges Dam

The company that manages the dam noted that parts of the dam had “deformed slightly,” displacing some external structures. Seepage into the main outlet walls had also been reported throughout the 18 hours on Saturday and Sunday when water was discharged through its outlets. Wang Hao, a member of the Chinese Academy of Engineering and an authority on hydraulics who sits on the Yangtze River Administration Commission, has assured that the dam is sound enough to withstand the impact from floods twice the mass flow rate recorded on Saturday.

It should be noted that Wang’s remarks stoked a volley of mockery after he said the flooding could be a good thing as the dam would only become more rigid the longer it was steeped up to its top. Below are three new YouTube videos outlining the severity of the situation and a link to a previous article about the Three Gorges Dam posted on AdvancingTime on July 19th.

Link to previous AdvancingTime article.

All this circles back to highlight how decisions are made in China and the quality of construction, or lack of it, that is widespread throughout the country. Because of its size, the failure of the Three Gorges Dam would have broad ramifications for China’s Communist Party and its reputation.

via ZeroHedge News https://ift.tt/3hIlI83 Tyler Durden

A DeKalb County, Georgia, special education teacher has resigned after the school district opened an investigation into comments he made on a social media post that showed a man appearing to kneel on the neck of a toddler. The photo shows a white child pinned to the ground by two people who appear to be black. One of them appears to be kneeling on the child’s neck. The caption reads “blm now.” “Your [sic] doing it wrong!” teacher Brian Papin wrote. “One knee on center of the back one on the neck and lean into it until death! You saw the video!” That’s an apparent reference to a video showing a Minneapolis police officer kneeling on the neck of George Floyd, who died after being detained by cops.

from Latest – Reason.com https://ift.tt/39CgHuJ

via IFTTT

A DeKalb County, Georgia, special education teacher has resigned after the school district opened an investigation into comments he made on a social media post that showed a man appearing to kneel on the neck of a toddler. The photo shows a white child pinned to the ground by two people who appear to be black. One of them appears to be kneeling on the child’s neck. The caption reads “blm now.” “Your [sic] doing it wrong!” teacher Brian Papin wrote. “One knee on center of the back one on the neck and lean into it until death! You saw the video!” That’s an apparent reference to a video showing a Minneapolis police officer kneeling on the neck of George Floyd, who died after being detained by cops.

from Latest – Reason.com https://ift.tt/39CgHuJ

via IFTTT

Turkish Magazine Calls For Revival Of Caliphate

Tyler Durden

Wed, 07/29/2020 – 04:15

The Turkish bar association has filed a criminal complaint against pro-Islam magazine Gercek Hayat for instigated hatred and called for an armed rebellion against the Turkish government, reported RT News.

Ankara Bar Association requested government prosecutors to investigate the magazine’s editor-in-chief, Kemal Ozer, and columnist Abdurrahman Dilipak, claiming their radical newspaper called for an Islamic caliphate.

Gerçek Hayat Dergisi’nin yetkilileri hakkında “Şimdi Değilse Ne Zaman, Sen Değilsen Kim? Hilafet İçin Toparlanın” başlıklı kapağı ile Anayasal düzene karşı yaptıkları saldırı nedeniyle suç duyurusunda bulunulmuştur. https://t.co/PTJU3CdqOb pic.twitter.com/g572Fcrcwt

— Ankara Barosu (@ankarabarosu) July 27, 2020

Gercek Hayat, owned and operated by the pro-government Yeni Safak media group, published a red caliphate flag from the Ottoman Empire on Monday that read: “Get together for caliphate. If not now, when? If not you, who?”

RT News notes a caliphate is a state “dedicated to the cause of Islam, seeking to be a unifying and defending force for all Muslims. The word had received plenty of negative attention in recent times since the terrorist group Islamic State (IS, formerly ISIS) claimed the title for itself.”

“Historically, four major caliphates existed, the latest being the Ottoman Empire. Modern Turkey was founded by Kemal Ataturk on the ruins of this fourth caliphate as a modern secular republic that had cast away the outdated institutions of its predecessor,” RT said.

Gercek Hayat has a little more than 10,000 readers. The red caliphate flag magazine cover was enough for President Recep Tayyip Erdogan’s ruling Justice and Development Party (AKP) spokesperson Omer Celik to tweet a response:

“The Republic of Turkey is a democratic, secular and social state governed by the rule of law,” Celik tweeted, citing the first article of the Turkish constitution.

“It is wrong to create political polarisation regarding Turkey’s political regime. Our republic is the apple of our eyes with its all attributions. The unhealthy debate and polarization on social media since yesterday on our political regime isn’t on Turkey’s agenda.”

Ozer, the magazine’s editor-in-chief, said critics had misread his piece:

“Our journal demands that the countries of Islam come together, just as Europe has come together and established a union, just as others have made similar ones. Our call has nothing to do with any country,” he said.

A recent poll showed the majority of Turkish citizens weren’t excited about the possible return of the caliphate.

via ZeroHedge News https://ift.tt/39DFA9G Tyler Durden

Little Known UK Shale Firm Challenges Fracking Ban

Tyler Durden

Wed, 07/29/2020 – 03:30

Authored by Charles Kennedy via OilPrice.com,

UK’s oil company Aurora Energy Resources plans to challenge the government moratorium on fracking issued at the end of 2019, just a few months after Aurora had applied for permission to frack at a site in Lancashire, northwest England, the Guardian reports.

Aurora Energy Resources has dropped its application to frack two wellbores in Lancashire because of the “de facto ban on shale gas activity,” according to Aurora’s managing director Ian Roche.

In November 2019, the UK government ended support for fracking, after a report from the UK’s Oil and Gas Authority (OGA) concluded that “it is not possible with current technology to accurately predict the probability of tremors associated with fracking.”

The UK government announced in November “a moratorium on fracking until compelling new evidence is provided,” after considering the OGA’s report and after several tremors at the fracking site of Cuadrilla at Preston New Road near Blackpool in Lancashire.

Cuadrilla had to stop fracking operations multiple times at the site, because under UK regulations, in case of micro seismic events of 0.50 on the Richter scale or higher, fracking must temporarily be halted and pressure in the well reduced.

At the time of the moratorium announcement, Cuadrilla’s activities had been suspended since a magnitude 2.9 event was recorded on August 26, 2019.

“On the basis of the current scientific evidence, government is confirming today that it will take a presumption against issuing any further Hydraulic Fracturing Consents,” the UK government said in November, noting that “the shale gas industry should take the government’s position into account when considering new developments.”

Aurora Energy Resources, which applied for permission to frack at the Altcar Moss well site in June, plans to “address this issue” with the moratorium with the Department of Business, Energy and Industrial Strategy, Roche told the Guardian.

“It is clear from recent comments by the minister of state for energy that the government considers the ‘moratorium’ on hydraulic fracturing to be a de facto ban on shale gas activity in the UK. It is therefore perhaps unsurprising that the council officers have felt unable to determine this application,” Roche told the Guardian.

via ZeroHedge News https://ift.tt/33hsVIn Tyler Durden