A Frenzy Of Speculative Excess

Authored by Jesse Felder via TheFelderReport.com,

One For The Ages, Part Tres

Last year I started a series of posts titled, “One For The Ages,” (here are Part One and Part Deux) intended to chronicle what I see as a frenzy in speculative activity in the markets that typically comes around only once in a generation (although it seems my generation has had more than its fair share). This is the third in the series.

J.P. Morgan famously said, “Nothing so undermines your financial judgement as the sight of your neighbor getting rich.” And only in the age of social media could we ever have as many neighbors getting so fabulously rich all at the same time as we do today.

“People posted about how they were making tremendous amounts of money. My brain was scattered, I’d check my phone over 500 times a day, and I became jealous of others making so much money.” https://t.co/dlog8vhgp4 ht @hblodget

— Jesse Felder (@jessefelder) February 11, 2021

We are social creatures. So when those around us begin to behave in a much riskier way, it makes extreme risk taking seem normal.

A sneak peek of one of our top secret trading strategies. h/t @ryanfeller_ pic.twitter.com/V2PFee7vu4

— TikTok Investors (@TikTokInvestors) January 17, 2021

Today, social media makes it seem like we are surrounded by consummate risk takers and so many of us are taking risks in the markets that would seem utterly deranged outside of the context of the larger social group.

‘People may be more likely to participate in riskier activities because they tend to behave according to the norms that surround them. If we’re surrounded by people who behave a certain way, she said, we are more likely to behave the same way.’ https://t.co/wkAxPHb4v9

— Jesse Felder (@jessefelder) February 7, 2021

Combine the social proof of widespread risk taking, magnified by social media, with the addictive properties that a platform like Robinhood is built upon, adapted from social media, then throw in free trading and you have a recipe for a speculative mania like we have never seen before.

‘Robinhood isn’t just informative — it’s also incredibly addictive. Like many apps, it was specifically designed to keep users hooked on an endless feedback loop of action and reward.’ https://t.co/iHs02cxPRA

— Jesse Felder (@jessefelder) February 5, 2021

Oh, yeah. And then give them all free money to play with.

Frothiness in one chart: Stimulus lead to a huge increase in monthly active users at Robinhood. (via BofA) pic.twitter.com/3MJUMEV5mA

— Holger Zschaepitz (@Schuldensuehner) February 15, 2021

It’s not hard to see exactly where all those “stimmy” checks went.

‘Robinhood’s January 2021 trading surge made March 2020 look like a blip.’ https://t.co/JqLOvVPuMY ht @SarahPonczek pic.twitter.com/wzqlm3F76f

— Jesse Felder (@jessefelder) February 5, 2021

They went into Robinhood accounts and then into so-called “blank check companies”…

‘In 2020, SPACs raised $106 billion, five times the prior peak and more than the total from the past 10 years. The number of SPAC offerings in January alone exceeded the last six years combined.’ https://t.co/OC3ZxviGXJ via @SoberLook pic.twitter.com/AiDNu0ncsV

— Jesse Felder (@jessefelder) February 10, 2021

…and if those weren’t speculative enough, they went into meme stocks.

28% of Americans bought GameStop or other viral stocks in January: Yahoo Finance-Harris Poll https://t.co/b6uOVlvlgT ht @peter pic.twitter.com/X4scxRr7oE

— Jesse Felder (@jessefelder) February 10, 2021

And if those near-bankrupt companies weren’t risky enough, they piled into the penny stocks of delisted names…

‘The Nasdaq OTC trading volume spiked in recent weeks. These are the riskiest companies because they do not meet the minimum listing standards (many have been delisted).’ https://t.co/Wd75pqxqaa via @SoberLook pic.twitter.com/nfQiz5tt22

— Jesse Felder (@jessefelder) February 12, 2021

…many of which have already filed for bankruptcy, like Blockbuster.

Blockbuster up 4900% in 2 days…

yup, that blockbuster pic.twitter.com/xbJ4HkY8tb

— Jonathan Krinsky,CMT (@jkrinskypga) January 27, 2021

And if bankrupt stocks weren’t risky enough, there’s the case of a blatant hoax garnering enough speculative interest to achieve a valuation equal to the GDP of the Cayman Islands.

‘He set out to create a coin so ridiculous it could never be taken seriously. Thanks to a flurry of tweets from Elon Musk, it is suddenly worth a total of more than $6 billion.’ https://t.co/ROSYfbS13t

— Jesse Felder (@jessefelder) February 7, 2021

Of course, Robinhood also makes it extremely easy for novice traders to get approved for options trading.

‘Using its app, clients can unlock Robinhood’s most advanced level of options strategies in minutes. They can then instantly start placing wagers on some of the most complex markets available to the investing public.’ https://t.co/NmoA6KVZv6

— Jesse Felder (@jessefelder) February 4, 2021

Those “stimmy” checks sure do buy a lot more call options (most of which are far out-of-the-money and expire in less than a week) than they do outright shares.

‘Speculative trading picked up last June then exploded in August. This go-round, it picked up in November and now has exploded again as we enter February. It’s occurred to such a degree it defies explanation.’ https://t.co/JrJynjWTJm by @sentimentrader pic.twitter.com/tEjlERH2vY

— Jesse Felder (@jessefelder) February 2, 2021

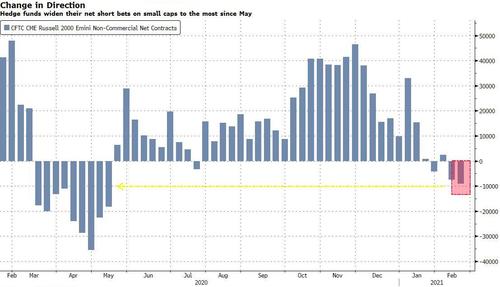

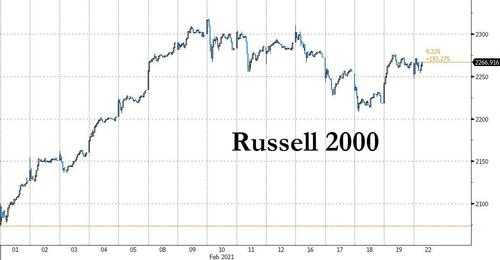

And if you think this new wave of newbie traders isn’t affecting the broad markets, think again.

‘Robinhood traders accounted for over 7% of the variation in stock returns during the second quarter of 2020. Without the Robinhood crowd, the aggregate market cap of the smallest quintile of U.S. stocks would have been over 30% lower.’ https://t.co/QqaEJ58Cjb pic.twitter.com/mCZTGayI5E

— Jesse Felder (@jessefelder) February 12, 2021

Of course, it’s not just retail traders; it’s also wannabe George Soroses at large institutions, “adding fuel to the fire.”

‘All along, professionals long and short have been following the signals from retail traders and trying to get ahead of—or stoke—the momentum.’ https://t.co/3ySFhKiVaQ

— Jesse Felder (@jessefelder) February 4, 2021

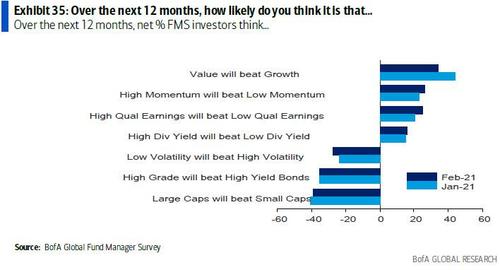

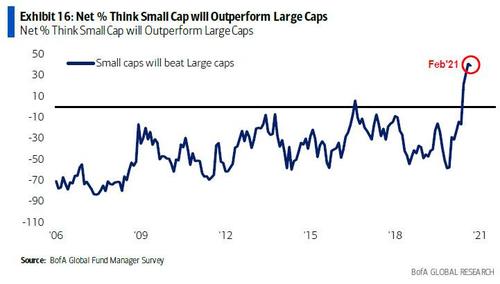

And boy have they gone “risk on” lately.

‘Bank of America clients with $614 billion combined are in the throes of an unprecedented frenzy of risk-taking.’ https://t.co/qOLcOScISS pic.twitter.com/6ZqYQzDJWM

— Jesse Felder (@jessefelder) February 16, 2021

The combination of retail crowding into popular “gamma squeeze” names and institutions following, or more likely front-running them…

‘Last year, Citadel paid $700,000 to resolve claims by the Financial Industry Regulatory Authority that it traded ahead of customer orders in over-the-counter securities.’ https://t.co/Hqv49HfBid ht @jtepper2

— Jesse Felder (@jessefelder) January 31, 2021

…has resulted in an incredible run in the prices of those stocks.

‘Stocks with the highest call option volume have outperformed massively.’ https://t.co/bPDcN1iaBy via @SoberLook pic.twitter.com/C2BPGn6DYH

— Jesse Felder (@jessefelder) February 15, 2021

And this phenomenon isn’t relegated to some obscure group. It can also be seen in the largest stocks in the market.

‘Investors are still buying call options on the “fabulous five.”’ https://t.co/DH4JQbmNK9 via @SoberLook pic.twitter.com/ZFNkbDugJu

— Jesse Felder (@jessefelder) February 3, 2021

Coming back to Soros, the incredible performance of those mega-cap tech stocks over the past year has reflexively created an unprecedented surge in the expectations for long-term earnings growth.

Long-term EPS growth estimates for the US have exploded to new record highs at 24% this month!

Previous peak in 2000 was 19%. pic.twitter.com/oYp4j518sn

— Julien Bittel, CFA (@BittelJulien) February 10, 2021

All told, it appears the current stock market mania has infected everyone from teenagers playing hooky from their zoom classes to day trade options to major institutions trying to piggy back on those trades to analysts tripping over themselves to try to justify the highest valuations in history.

‘With U.S. market cap more than double the level of estimated GDP for the current quarter, “the Buffett Indicator” has surged to the highest-ever reading above its long-term trend.’ https://t.co/9I6h7CELom pic.twitter.com/LgpR5jWKV0

— Jesse Felder (@jessefelder) February 13, 2021

Perhaps it would behoove them to remember another famous J.P. Morgan quote: “I made a fortune getting out too soon.”

Tyler Durden

Mon, 02/22/2021 – 14:37

via ZeroHedge News https://ift.tt/37DzQwG Tyler Durden