Trader: “Let’s Truly Hope This Isn’t As Good As It Gets”

Authored by Richard Breslow via Bloomberg,

Today shouldn’t count.

We are coming off a long weekend, but with little joy to show for the extra rest and holiday.

With a lot of the world taking an extra day off there hasn’t been much interest in trading. Or anything else, apparently.

It’s raining in New York City. Which, with all of us locked inside, shouldn’t matter – but it’s added to the list nonetheless.

Markets are sagging and there seems to be a surfeit of people who are feeling crabby.

Tomorrow can be the do-over. At least we had better hope so. We talk a good game about this experience being akin to a marathon, but do need to see some mile-posts pass by.

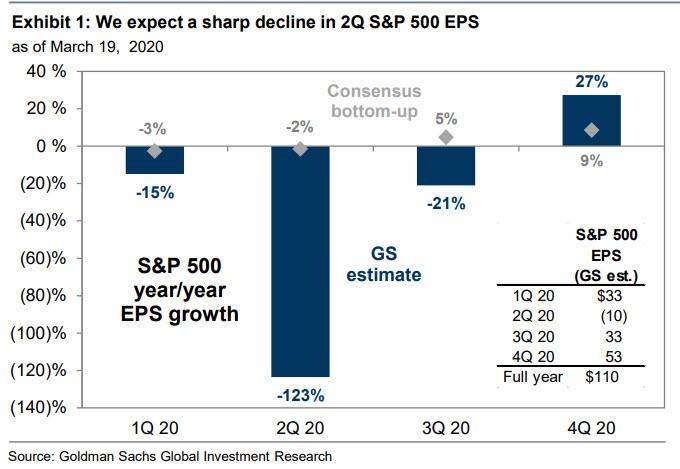

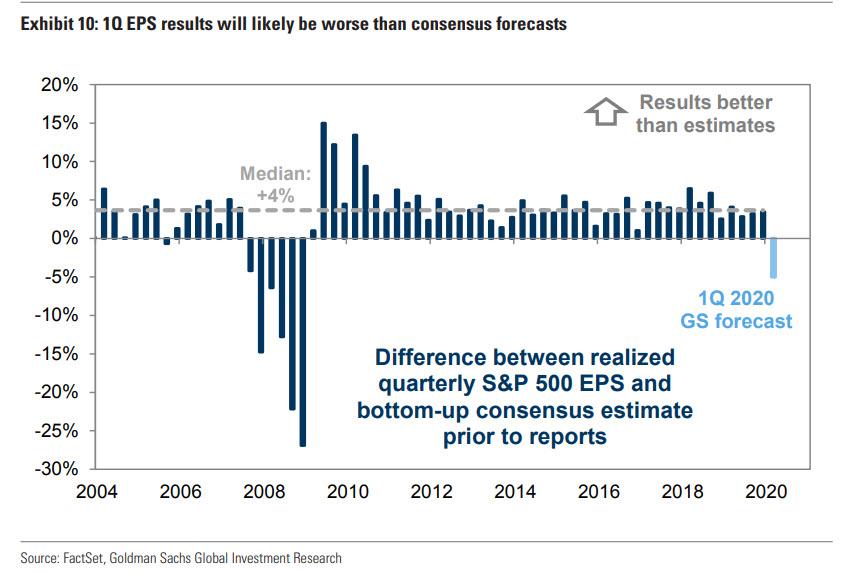

The Fed went over the top last Thursday. They bet a lot on waving their magic wand to save capitalism as we are going to get to know it. Which was impressive, but also risky. They need everyone to accept that they have unlimited firepower. And maybe they do, in buying securities they wouldn’t have touched even 12 years ago. But that isn’t the imperative people are focusing on.

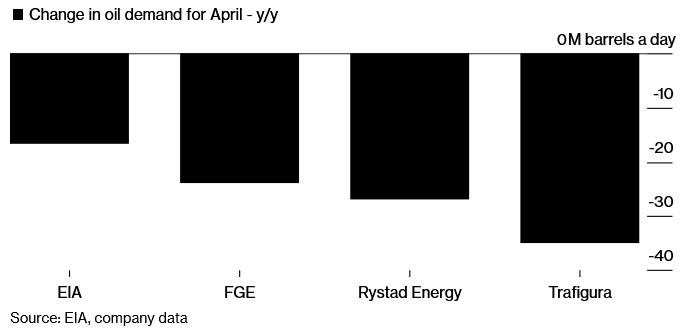

OPEC+ came to what we agreed to call a historic deal. And Brent is trading at remarkably familiar prices in the low $30 range. The EU wants us to believe that they are coming closer together than ever before. Good luck with that. And it’s off, by video conference, to the G-7, G-10, IMF/World Bank meetings this week when all of your problems will be discussed.

Everyone is looking at graphs and praying they will continue to show we’ve peaked. But have no answer to the question of when we can get out again. We seem to have spent a lot of bullets but without the satisfaction of it making anyone feel particularly chuffed. Unless you bought into the market at the beginning of last week. We need one of those turn around Tuesdays commentators love to cite. And not just for capital markets. We’ll call this “Blah Monday.”

It’s entirely possible that today will not be representative of the rest of the week. Equity futures are down, but the cash markets looked pretty good when we closed up and stayed home last week. Give them a chance to show what they are made of when they get going. Futures trading this thinly don’t mean a whole lot.

The S&P 500 back above 2,800 could force a lot of potential buyers to get involved. It’s such a nice pivot level, no matter your inclination. Nothing like a good technical level that’s close.

The dollar has become the currency everyone wants to hate all of a sudden. If you believe that, you have to make the leap of faith that a lot of the world’s economic troubles are being solved. Maybe that’s indeed so. And the central banks can declare mission accomplished. In any case, the resistance zone remains 99.80/100 for the Dollar Index. It’s a good pivot area.

Take everything you see today with a grain of salt. Tomorrow will not only be another day, it will be the real Monday.

Tyler Durden

Mon, 04/13/2020 – 10:10

via ZeroHedge News https://ift.tt/2Rz01g9 Tyler Durden