Will The US Obsession With Sanctions Destroy The Dollar?

Authored by Ryan McMaken via The Mises Institute,

When the US places financial sanctions one one country, it de facto sanctions many other countries as well — including many of its allies.

This is because not all countries and firms are interested in participating in the US sanctions-based foreign policy.

Sanctions, after all, have become a favorite go-to strategy for American policymakers who seek to isolate or punish foreign states that don’t cooperate with US international policy goals.

In recent years, the US has been most active in imposing new sanctions on Russia and Iran, with many consequences for US allies who are still open to doing business with both of those countries.

The US can retaliate against organizations that violate US sanctions in a variety of ways. In the past, the US has sued firms such as the Netherlands’ ING Groep and Switzerland Credit Suisse. Both firms have paid hundreds of millions of dollars in fines in the past. The US has been known to go after individuals .

US bureaucrats like to remind firms that penalties await them, should then not buckle under US sanctions plan. In November 2018, for example, US Secretary of State Michael Pompeo announced :

I promise you that doing business in Iran in defiance of our sanctions will ultimately be a much more painful business decision than pulling out of Iran.

Fear of sanctions has caused some firms to stop work mid project, such as when Swiss pipe-laying company Allseas Group abandoned a $10 billion pipeline that was nearing completion.

Not surprisingly, these firms — who employ people, pay taxes, and contribute to economic growth — have put pressure on their governments to protest the mounting interference from the US into private trade.

As a result, some European politicians are increasingly looking for ways to get around US sanctions . In a tweet last week, Germany’s deputy foreign minister Niels Annen wrote “Europe needs new instruments to be able to defend itself from licentious extraterritorial sanctions.”

Another “senior German government official” concluded, “Washington is treating the EU as an adversary. It is dealing the same way with Mexico, Canada, and with allies in Asia. This policy will provoke counter-reactions across the world.”

But how is the US so easily able to sanction so much of the world, including companies in huge and influential countries like Germany?

The answer lies in the fact the US dollar and the US economy remain at the center of the international trade system.

SWIFT: How the US Sanctions the World

By the waning days of the Cold War, the US dollar had become the dominant currency in the non-communist world, thanks to the Bretton Woods agreement, the petrodollar, and the sheer size of the US economy.

Once the Communist Bloc collapsed, the dollar was poised to grow even more in importance, and the world’s financial institutions searched for a way to make global trade and investing even faster and easier.

Henry Farrell at The National Interest describes what came next:

Financial institutions wanted to communicate with other financial institutions so that they could send and receive money. This led them to abandon inefficient institution-to-institution communications and to converge on a common solution: the financial messaging system maintained by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) consortium, based in Belgium. Similarly, banks wanted to make transactions in the globally dominant currency, the U.S. dollar. … In practice, the physical infrastructure, for a variety of efficiency reasons, tended to channel global flows through a small number of central data cables and switch points.

At the time, Europe was still years away from creating the euro, and it only seemed natural that a centralized dollar-transfer system be developed for all the world.

SWIFT personnel have always maintained their organization is apolitical, neutral, and only interested in providing a service. But geopolitical realities have long intervened. Farrell continues:

The centralizing tendencies meant that the new infrastructure of global networks was asymmetric: some nodes and connections were far more important than others. … What this meant was that a few states—most prominently the United States—had the latent ability to transform the global economic infrastructures … into an architecture of global power and information gathering.

By 2001, the power of this centralized system had become apparent. And in the wake of 9/11, the US used the “War on Terror” and an opportunity to turn SWIFT into an enormous international tool for surveillance and financial power.

In his book Treasury’s War: The Unleashing of a New Era of Financial Warfare Juan Zarate shows how the US Treasury officials pressured SWIFT and its personnel to provide the US government with the means to use this international financial “plumbing” to deprive the US’s enemies of access to markets.

This started out slow, and SWIFT officials were concerned it would become widely known that SWIFT was becoming politicized and largely a tool of the US and US allies. Nevertheless, the American regime pressed its advantage, and by 2012 “for the first time ever, SWIFT unplugged designated Iranian banks from its system, in accordance with a European directive and under the threat of possible US legislation.”

This only strengthened worries among both world regimes and the world’s financial institutions that the basic technical infrastructure of the international financial system was really a political tool.

The World Searches for Alternatives

Naturally, Russia and China have been highly motivated to find alternatives to SWIFT. But even perennial US allies have grown far more wary of leaving the financial system in a place where it can be so easily dominated by the US regime. If Iranian banks can be “unplugged” so easily from the global system, what’s to stop the US from taking similar steps against German banks, French banks, or Italian banks?

This, of course, is an implied threat behind US demands that European companies not try to work around US sanctions or face “punishment.” From the US perspective, if Germans refuse to kowtow to US policy, then there’s an easy solution: simply cut the Germans off from the international banking system.

Consequently, Germany’s Foreign Minister Heiko Maas announced in 2008

“We must increase Europe’s autonomy and sovereignty in trade, economic and financial policies … It will not be easy, but we have already begun to do it.”

By late 2019, the UK, France, and Germany had put together a workaround called “INSTEX” designed to facilitate continued trade with Iran without using the dollar and the SWIFT system built upon it. Belgium, Denmark, Finland, the Netherlands, Norway and Sweden have joined the system as well.

As of January 2020, however, the cumbersome system remains unused. But we remain in the very early stages of European efforts to get a divorce from the dollar-dominated financial system. The INSTEX system has been devised, for now, for a limited purpose. But there is no reason it cannot be expanded in the future. The short-term prospects for a functional system are low. Longer-term, however, things are different. The motivation for a long-term workaround is growing. The Trump administration has embraced showmanship that looks good in a short-term news cycle, but which encourages US allies to pull away. Farrell continues:

Unlike Obama, Donald Trump did not use careful diplomacy to build international support for [new sanctions] against Iran. Instead, he imposed them by fiat, to the consternation of European allies, who remained committed to the [Iran agreement put in place under Obama]. The United States now threatened to impose draconian penalties on its allies’ firms if they continued to work inside the terms of an international agreement that the United States itself had negotiated. The EU invoked a blocking statute, which effectively made it illegal for European firms to comply with U.S. sanctions, but without any significant consequences. SWIFT, for example, avoided the statute by never formally stating that it was complying with U.S. sanctions; instead explaining that it was regrettably suspending relations with Iranian banks “in the interest of the stability and integrity of the wider global financial system.”

All of this is viewed with alarm by not only Europe, but by China and Russia as well. The near-constant stream of threats by the US administration to impose ever harsher limits and sanctions on both China and Europe has pushed the rest of the world to accelerate plans to get around US sanctions. After all, as of mid-2019, the US had nearly 8,000 sanctions in place against various states and organizations and individuals. The term now being used in reference to American sanctions is “overuse.” It was one thing when the US imposed sanctions in some extreme cases. But now the US appears increasingly fond of using and threatening sanctions regularly, without consulting allies.

This makes continued US dominance in this regard less likely as allies the world pour more and more resources into ending the US-SWIFT control of the system. In a 2018 report, “Towards a Stronger International Role of the Euro,” the European Commission described U.S. sanctions as “wake-up call regarding Europe’s economic and monetary sovereignty.”

The effort still has a long way to go, but perhaps not as far as many think.

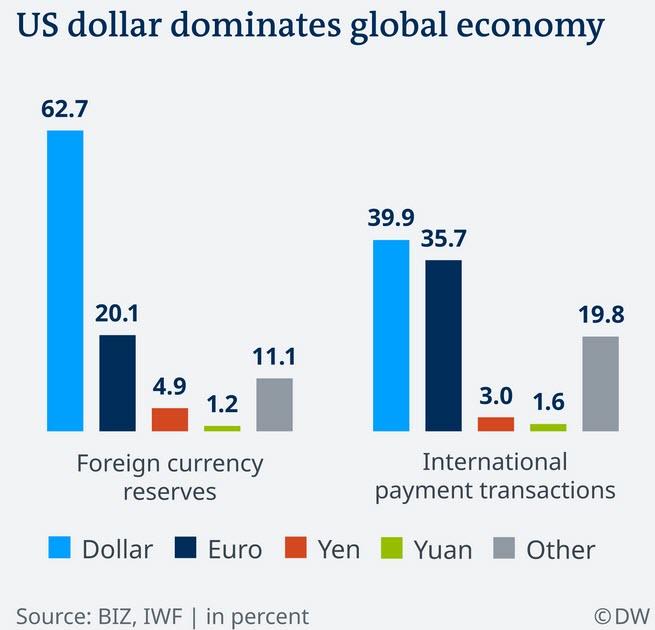

The dollar remains far ahead of the euro in terms of the dollar’s use as a reserve currency, but the dollar and the euro are move evenly matched when it comes to international payment transactions.

If the rest of the world remains sufficiently motivated, more can certainly be done to rein in dollar-based sanctions. Indeed, in 2019, former US Treasury Secretary Jacob Lew admitted:

the plumbing is being built and tested to work around the United States. Over time as those tools are perfected, if the United States stays on a path where it is seen as going it alone…there will increasingly be alternatives that will chip away at the centrality of the United States.

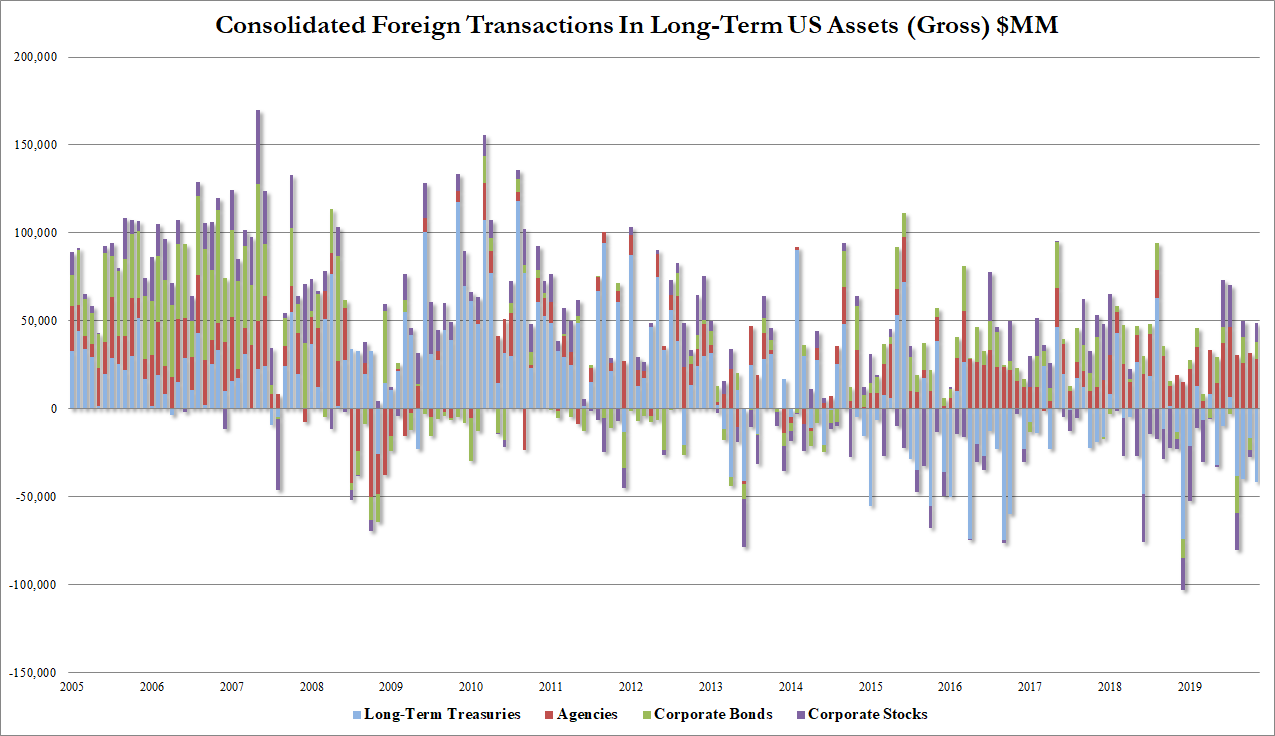

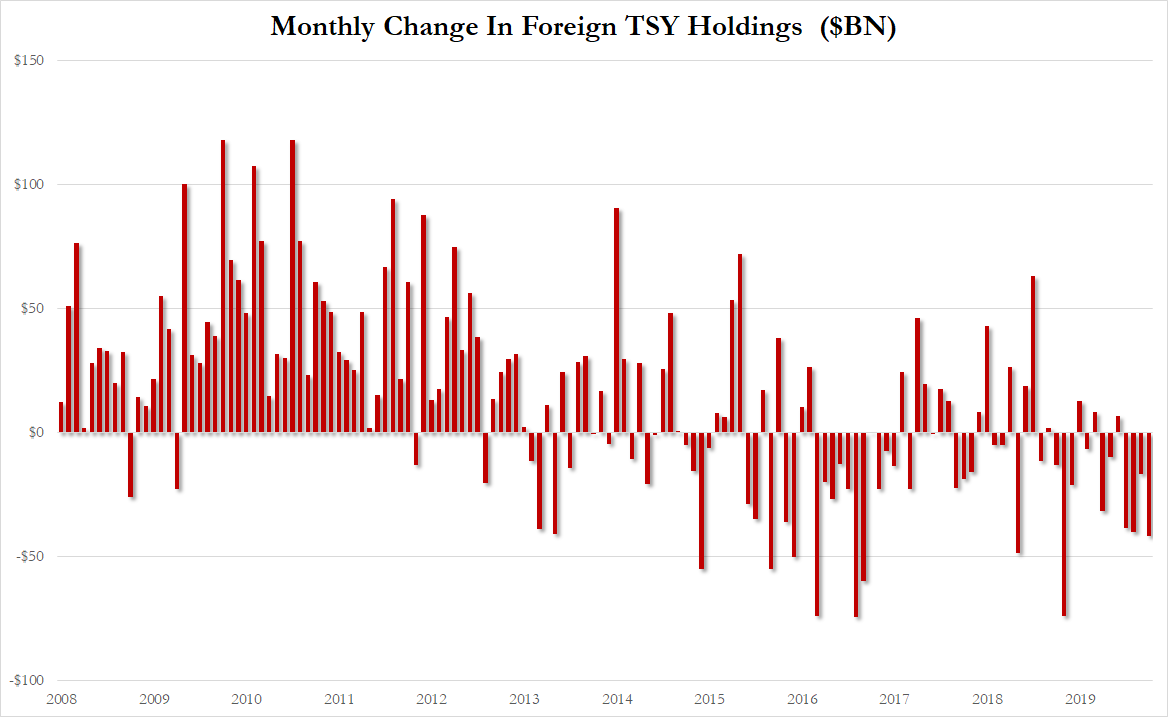

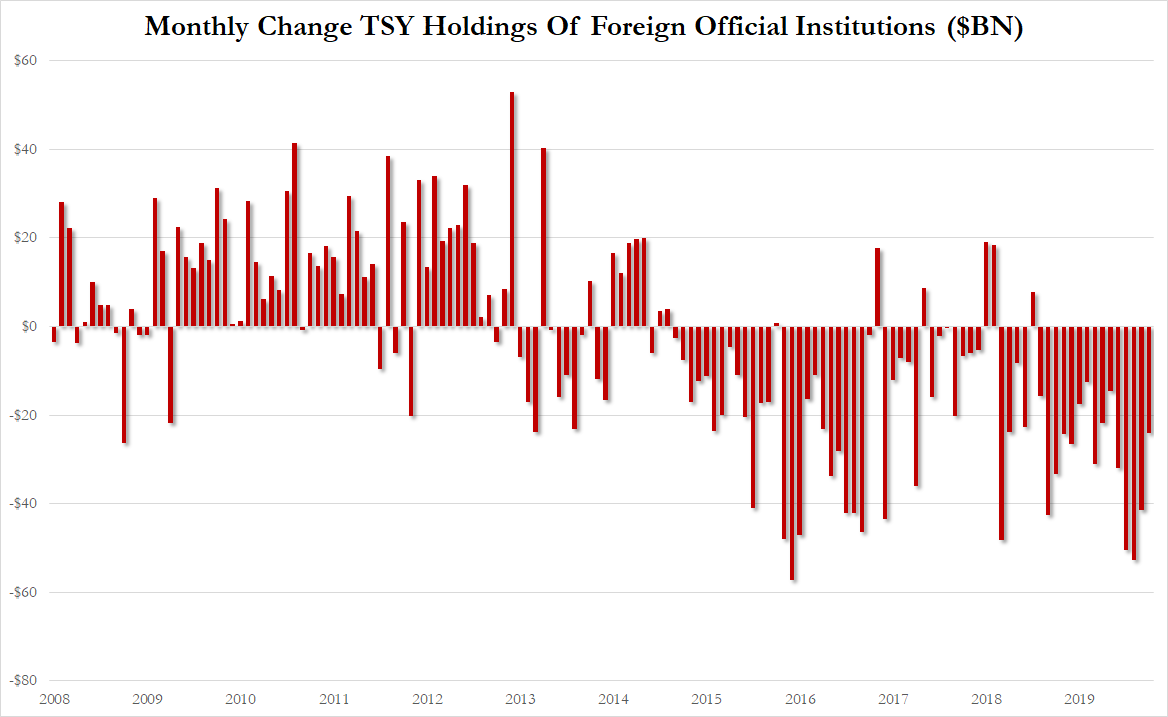

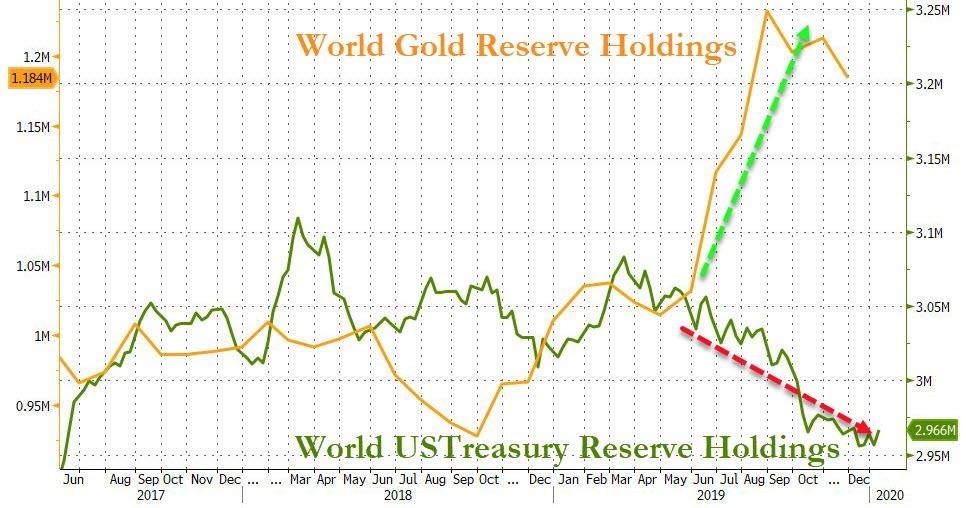

If the US finds itself not longer at the center of the global financial system, this will bring significant disadvantages for the US regime and US residents. A decline in demand for the dollar would also lead to less demand for US debt. This would put upward pressure on interest rates and thus bring higher debt-payment obligations for the US regime. This would constrain defense spending and the ability of the US to project its power to every corner of the globe. At the same time, central bank efforts to drive interest rates back down would bring a greater need to monetize the debt. The resulting price inflation in either consumer goods or assets would be significant.

The fact none of this will become obvious next week or next month doesn’t mean it will never happen. But the US’s enthusiasm for sanctions means the world is already learning the price of doing business with the United States and with the dollar.

Tyler Durden

Thu, 01/16/2020 – 17:50

via ZeroHedge News https://ift.tt/38aEBM7 Tyler Durden