“Let’s Look What’s In The Trade Deal, And What Is Not”

Submitted by Michael Every of Rabobank

What’s the Deal

After a signing ceremony by US President Trump and Chinese Vice Premier Liu at the White House the much-awaited details of the ‘Phase 1’ trade deal were finally released. While the S&P500 rose prior to the White House event, there were no major new aspects to the deal, so stock prices fell back again.

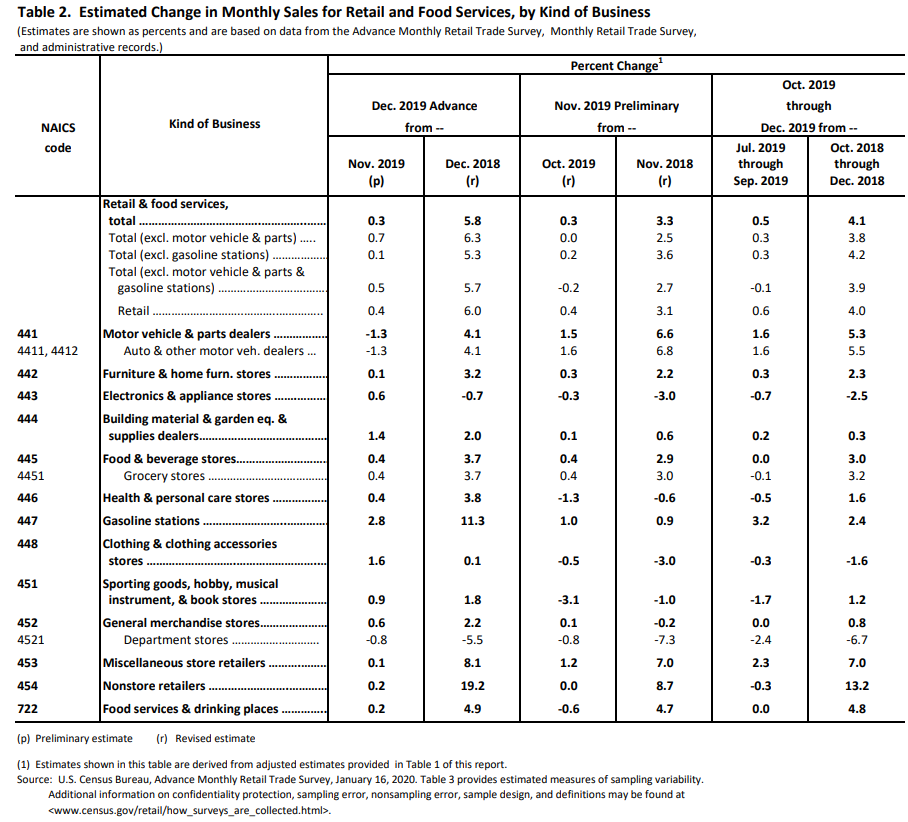

According to the document (Chapter 6) China shall ensure the purchase of an additional – on top of the 2017 baseline – $200bn worth of US goods and services over a two year period, from 1 January 2020 through 31 December 2021. This package consists of $77.7 bn in manufactured goods, $32.0 bn in agricultural products, $52.4 bn in energy, and $37.9 bn in services (see Annex 6.1 of the document). Moreover, China pledges to respect intellectual property rights, will open its financial services sector to the US, and refrain from currency manipulation.

In exchange for these Chinese concessions, the US did not carry out its plan for additional tariffs on $156 bn of Chinese goods on 15 December 2019, and will halve the 15% tariffs on $120 bn of Chinese consumer goods (such as cell phones, toys and laptops) implemented on 1 September 2019. However, the earlier 35% tariffs on $360bn of Chinese industrial goods and components remain in place. Moreover, the US Treasury department decided recently to no longer call China a currency manipulator.

What to make of this deal?

First let’s look at what is in the deal, and second at what is not. The Chinese purchases of goods are beneficial to US companies, but at the cost of other countries, and the agreement is only for two years. According to the document “the parties project that the trajectory of increases … will continue in calendar years 2020 through 2025.” Well, ‘to project’ does not sound as firm as ‘shall ensure.’ So are we going to see a repetition of the 2019 turmoil caused by the phase 1 trade negotiations after those two years? Or is this supposed to be solved in the phase 2 deal that is very unlikely to be made? What’s more, while the remaining tariffs provide leverage for US trade negotiators, they are still a tax on US importers and US consumers of Chinese goods.

What’s not in the deal is a credible implementation of China respecting US intellectual property rights. Keep in mind, they made promises before. Of course, the document (Chapter 1) is full of pledges. However, the most concrete step is that China will within 30 working days make an Action Plan to strengthen intellectual property protection (Article 1.35). What is also lacking from the deal is the end of China subsidizing its state owned enterprises. So on one key trade issue, China has made promises again and on the other it did not even have to.

In terms of overall enforcement of the deal, Chapter 7 describes the creation of a Trade Framework Group to discuss the implementation of the trade agreement every six months, which shall be led by the US Trade Representative and a designated Vice Premier of China. Each party shall establish a Bilateral Evaluation and Dispute Resolution Office, headed by the USTR (US) and the Vice Premier (China). If one party believes that the other party is not sticking to the agreement, the complaining party may submit an appeal to the Bilateral Evaluation and Dispute Resolution Office of the other party. The dispute procedures are actually a highway to the exit: ‘if the party complained against considers that the action of the complaining party was taken in bad faith, the remedy is to withdraw from this agreement by providing written notice of withdrawal to the complaining party.’ This means that if one party is not satisfied with the implementation of one aspect of the deal, the whole deal collapses. So while the Phase 1 deal is a temporary equilibrium, it is an unstable one.

After all the turmoil we have been through last year, this deal has failed to address the key conflicts between the US and China. Basically, the Chinese are going to buy more stuff from the US, but only in the next two years, in exchange for lower tariffs. Meanwhile, the Chinese business model that is characterized by violations of intellectual property rights and government subsidies of state-owned enterprises is likely to remain intact.

Tyler Durden

Thu, 01/16/2020 – 10:06

via ZeroHedge News https://ift.tt/30sJAVy Tyler Durden