Powell In 2014: “A Large Balance Sheet Might Prove A Magnet For Trouble Over Time”

Two years ago, when the Fed released the transcripts from its 2012 FOMC sessions, we first disclosed several passages stated by then governor Jerome Powell which almost convinced us that the former Carlyle partner would not pursue the catastrophic bubble-bust policies that had been enacted by his predecessors.

As a reminder, this is what Powell, who replaced Janet Powell as Fed chair in early 2018, said during the October 23-24, 2012 FOMC meeting – just one month after the Fed announced QE3:

I have concerns about more purchases. As others have pointed out, the dealer community is now assuming close to a $4 trillion balance sheet and purchases through the first quarter of 2014. I admit that is a much stronger reaction than I anticipated, and I am uncomfortable with it for a couple of reasons.

First, the question, why stop at $4 trillion? The market in most cases will cheer us for doing more. It will never be enough for the market. Our models will always tell us that we are helping the economy, and I will probably always feel that those benefits are overestimated. And we will be able to tell ourselves that market function is not impaired and that inflation expectations are under control. What is to stop us, other than much faster economic growth, which it is probably not in our power to produce?

And then the punchline:

[W]hen it is time for us to sell, or even to stop buying, the response could be quite strong; there is every reason to expect a strong response. So there are a couple of ways to look at it. It is about $1.2 trillion in sales; you take 60 months, you get about $20 billion a month. That is a very doable thing, it sounds like, in a market where the norm by the middle of next year is $80 billion a month. Another way to look at it, though, is that it’s not so much the sale, the duration; it’s also unloading our short volatility position.

Ah yes, the Fed’s “short volatility position” something which vol sellers over the past several years have grown to love and admire – occasional inverse VIX disasters like February 2018 notwithstanding.

But it was something that Powell said next that was an even more remarkable admission:

My third concern—and others have touched on it as well—is the problems of exiting from a near $4 trillion balance sheet. We’ve got a set of principles from June 2011 and have done some work since then, but it just seems to me that we seem to be way too confident that exit can be managed smoothly. Markets can be much more dynamic than we appear to think.

…

When you turn and say to the market, “I’ve got $1.2 trillion of these things,” it’s not just $20 billion a month— it’s the sight of the whole thing coming. And I think there is a pretty good chance that you could have quite a dynamic response in the market.

In retrospect, this observation by Powell turned out to be quite prophetic: after all, who can forget Powell’s “autopilot” comment on the Fed’s quantitative tightening, i.e., balance sheet unwind, which together with the Fed’s 2018 rate hikes, sent the S&P to a mini bear market when stocks tumbled in the last few months of 2018: “quite a dynamic response in the market” indeed, and one which forced Powell just days later to reverse on the Fed’s entire tightening policy and, several months later, to launch QE4.

Which, of course, is especially ironic in light of what Powell said next in the October 2012 FOMC meeting, which as we said earlier, almost gave us the impression that Powell was just the man to unwind a decade of capital misallocation even if meant the bursting of the biggest asset bubble in history:

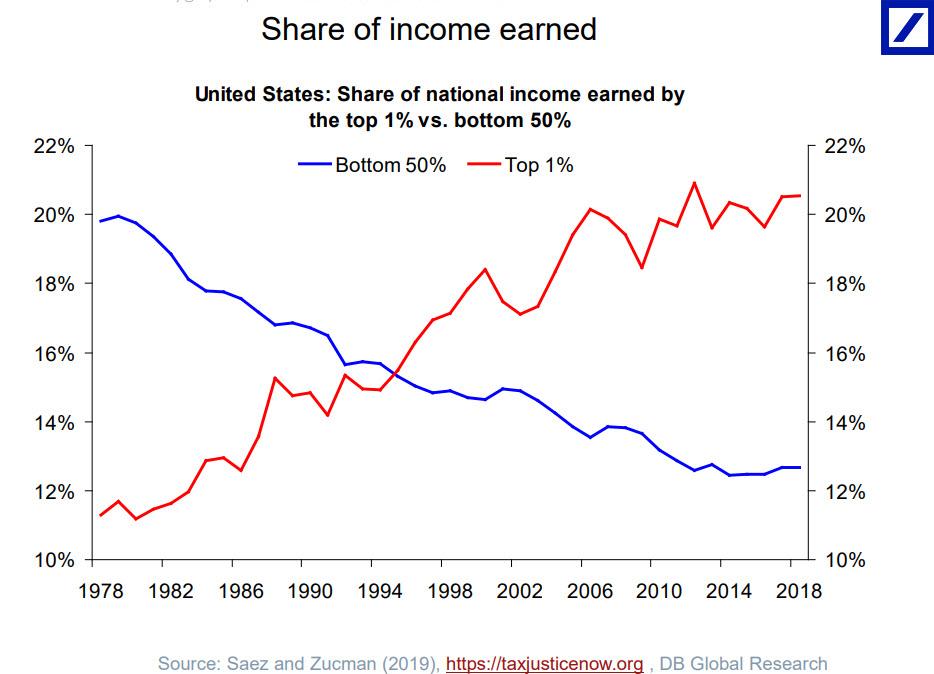

I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.

Either year, one failed attempt at normalization and one QE4 NOT QE later launched by the very same Jerome Powell, and we can now safely scrap the “almost”: it is now without a doubt that the Fed is, as Powell said, “blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road” and that “investors really do understand now that we will be there to prevent serious losses.”

And they have Fed Chair Powell to thank for that, whose historic flipflop will be one for the history books when the asset bubble finally bursts. But until then, contrary to his now iconic warning, it was Powell who took it upon himself to make it very “easy” for investors to make money and the Fed’s only job is to make sure they “have every incentive to take more risk, and they are doing so.“

* * *

With all this in mind, let’s fast forward to the transcripts of the 2014 FOMC meetings, which the Fed declassified on Friday, and where we got some more delightful pearls of wisdom and warnings from the current Fed chair, who now appears hell bent to do absolutely every single thing he so prudently cautioned his colleagues he Fed should not do.

For the purpose of this article, we will focus on the transcript of the FOMC April 29-30 2014 meeting, which was remarkable in that it was the first one where the Fed extensively discussed the Fed’s rate “liftoff” policy which would, after several delays, finally took place in December 2015 when the Fed hiked by 25bps from the “zero bound”, and then proceeded to hike another eight times before eventually cutting rates three times in the summer of 2019 (with stocks at all time highs). Nested inside a lengthy discussion of Powell’s view of the mechanics of liftoff – which focused on his view of the floor vs corridor system and where Powell concluded that “an administered floor approach may be simpler and cheaper than a corridor with a market rate” – Powell made the following statement:

I kind of think that a large balance sheet might prove to be a magnet for trouble over time, and those two considerations pull me in opposite directions, I admit. So I tentatively land on a floor system with the smallest possible balance sheet. But that brings you to the really interesting question, I think, that Governor Tarullo and Governor Stein were all over, and that is the use of the balance sheet for financial-stability purposes. Very, very interesting questions, and I don’t have a lot to add on them here today, but I think those are the things we are going to be talking about for years to come.

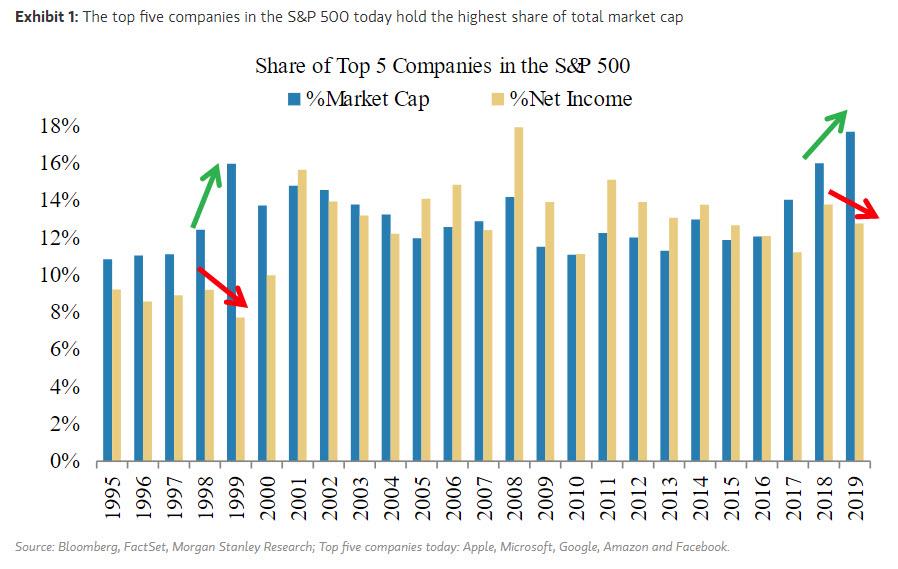

Well he was right, because almost six years later, not only are we still talking about these “things”, but the use, and role, of the Fed’s balance sheet for financial-stability purposes, has never been more topical at a time when the Fed’s balance sheet has grown by over $100 billion per month in the past 4 months, allegedly to stabilize the repo market but in reality to unleash a historic market melt-up that has sent us to the highest, and most overvalued, S&P on record.

Amusingly, a little later in the same April 2014 meeting, Powell, a former private equity professional, shared some views from the perspective of a PE professional.

As long as we’re talking about private equity, I do keep in reasonably close touch with what’s going on out there. I would say that prices are high, leverage is high, and equity is low—in all cases, not as bad as it was in 2007. Prices might be in the mid-9s. We talked about leverage. Equity contributions are in the low 20s. So, again, not as bad as in 2007, but, in all cases, it’s getting stretched.

This was in 2014, six years ago. Anyway, back to Powell, and the following delightful snippet why a decade of covenant lite deals means the zombies will ravage the world for a much longer time than most expected:

The other really important difference is that rates are incredibly low. They swap out a lot of the floating-rate debt anyway at very low rates. You put all of this into the mix—I’m not at all sure that there’s a big wave of defaults being cooked up here because coverage ratios are pretty good. Certainly, the equity returns are under a lot of threat. But there are no covenants. It’s going to be really hard to default or fail to pay.

In response to this summary, former Richmond Fed president Jeffrey Lacker had the perfect laconic summary: “No dysfunction to worry about.” None whatsoever.

Which brings us to the punchline: Powell’s parting words from the April 2014 FOMC, which as in the case of Oct 2012, were delightfully prophetic:

I see financial conditions as a potential risk down the road. The risk of continued rising froth in fixed-income markets, followed by a correction that could halt progress, is a real one. If this starts to have the feel of a classic credit cycle, then the level of damage when the cycle turns is hard to predict.

To summarize, after years of warning about the potentially catastrophic consequences of a giant balance sheet, ultra low rates and super easy monetary policy, Powell – now in charge of the world’s most important central bank (as Trump’s twitter account reminded him every so often) – gazed into the abyss of tighter financial conditions, higher rates and a smaller balance sheet… and quickly did everything he himself had warned years ago against doing.

Oh, and speaking of the Fed’s “magnetic” balance sheet, 4 months after his face to face with the “abyss”, Powell managed to undo more than half of the Fed’s entire “normalization.”

Tyler Durden

Sun, 01/12/2020 – 19:03

via ZeroHedge News https://ift.tt/30csATF Tyler Durden