Submitted by Ronan Manly, BullionStar.com

In mid-August Reuters published a story titled ”China curbs gold imports as trade war heats up”, claiming that the Chinese authorities had been ”severely restricting gold imports since May” by reducing the monthly gold import quotas that are handed out to a group of Chinese and foreign banks by China’s central bank, the People’s bank of China (PBoC).

Speaking on Condition of Anonymity

Reuters said it had verified its claims by talking to seven unidentified ”sources in the bullion industry in London, Hong Kong, Singapore and China”, who in summary had said that ”quotas have been curtailed or not granted at all for several months”. According to the Reuters sources quoted, “there are virtually no import quotas now issued in China” and “next to nothing was imported by banks in June and July”. Quite dramatic if true.

These sources also speculated that the motive for the claimed gold import quota restrictions was to ”help limit the amount of money leaving the country amid a plunge in the value of the yuan”.

A week later on 22 August, Reuters published a follow-up article titled ”China eases restrictions on gold imports: sources”, claiming that its bullion industry sources, which by then consisted of ‘three people with direct knowledge of the matter in London and Asia”, were now saying that the PBoC had ”began to issue quotas again last week” but that these quotas were ”less than usual”. According to one of the sources ”some [gold import] quotas have been given”. According to another source, there had been a ”partial lift” of the quota restrictions.

Coincidentally, or even bizarrely as regards timing, the Reuters stories suggest that in the very week that Reuters claims the Chinese authorities were restricting gold import quotas, i.e. the week of 12 – 16 August, the very same Chinese authorities then decided to lift said gold import quota restrictions. Be that as it may, but there is a troubling feature of mainstream financial media articles such as these Reuters articles, and that is that it is impossible to verify the claims within the articles, for the very fact that the sources they use are not identified.

The use of unidentified sources, as Reuters seems so fond of using, begs the question, why? The answer, according to Reuters, is that these sources were ”speaking on condition of anonymity because they are not authorized to speak to the media”. So that’s ten sources in the bullion industry that Reuters used for its two articles, none of which are authorized to speak to the media, but all ten of which chose to breach their internal compliance rules and proceeded to speak to the media. Quite a record.

The 14 August Reuters story also contained the following quote about comparative Chinese gold import figures for various periods during 2019 and equivalent periods during 2018:

”Chinese customs figures show it imported 575 tonnes of gold in the first half of the year, down from 883 tonnes in the same period of 2018.

In May, China imported 71 tonnes, down from 157 tonnes in May 2018. In June, the last month for which data is available, the decline was even sharper, with 57 tonnes shipped compared with 199 tonnes in June last year.”

Running the Numbers

While we can’t verify the anonymous sources used by Reuters for obvious reasons, i.e. they are anonymous, we can however verify the import figures that Reuters quotes, using recently published Chinese gold import data. This is because in late 2018, Chinese customs authorities in quite an interesting move, began publishing granular monthly data of both China’s non-monetary gold imports and non-monetary gold exports. Non-monetary gold refers to any gold that is not central bank gold. Central bank gold (monetary gold) across the world gets an exemption from cross-border trade reporting. This is for the simple reason that central bankers do not want market transparency as it would, not surprisingly, reveal their real influence of the gold market. But that’s another story.

Back to non-monetary gold. The General Administration of Customs of the People’s Republic of China (GACC) now publishes gold import and export data on its website in a series of interactive tables in English, which can be found here. This covers gold imported into mainland China.

The gold that we are interested in here is covered by traded products code HS7108, which is ”gold unwrought or in semi-manufactured forms, or in powder form”. HS71081200, gold in unwrought form, is the main category imported into China. HS71081300, gold in other semi-manufactured form, is also relevant here, as its material in the total quantity of gold imported into China. HS71081100 is gold powder and is not really relevant to the analysis since its imported in very small quantities.

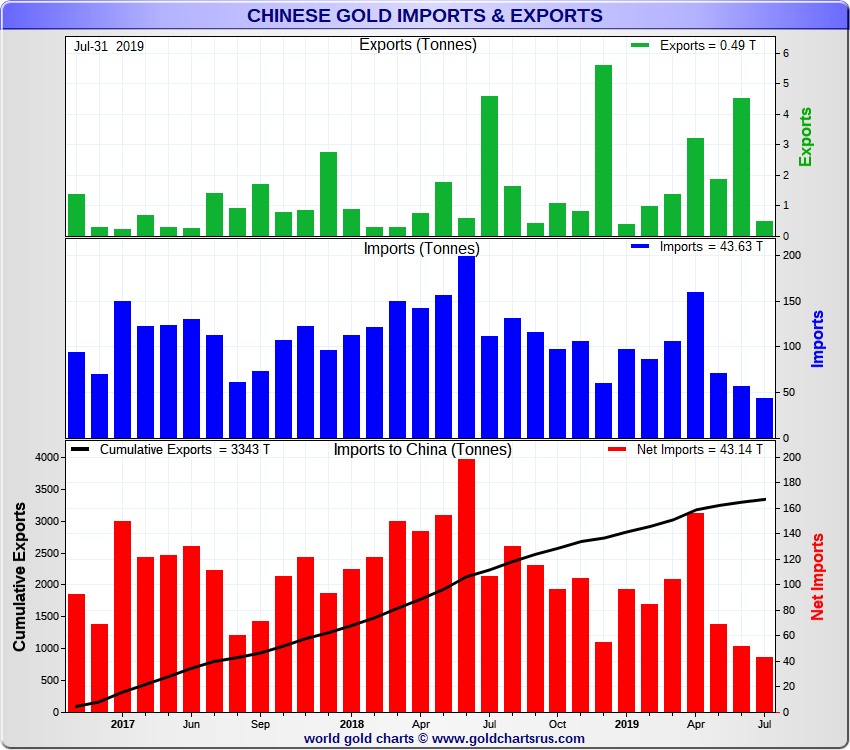

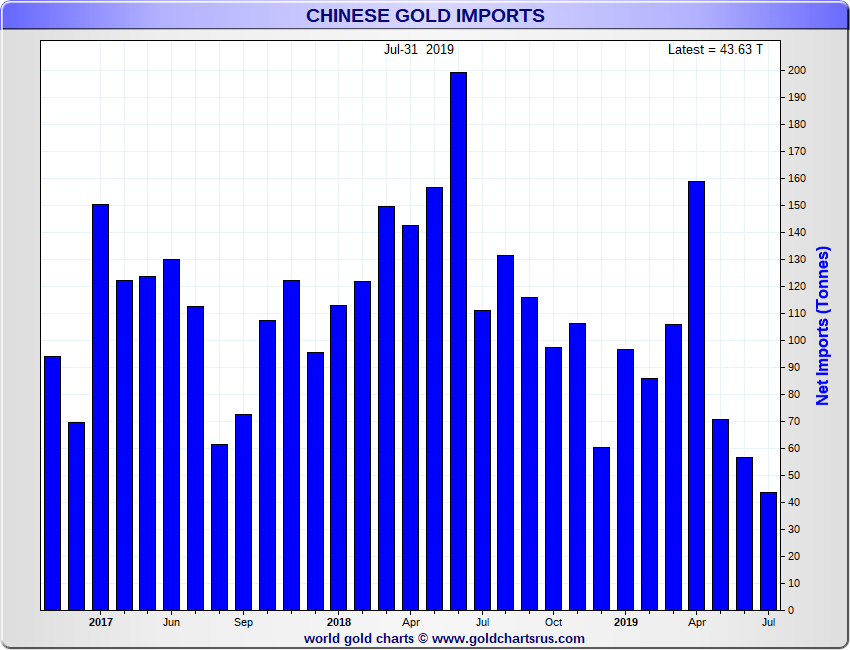

When Chinese customs began publishing monthly gold import in late 2018, it also retrospectively published all the monthly gold import figures for 2017 and 2018, so there are now, at the time of writing, 31 months of Chinese non-monetary gold import data available, i.e. from January 2017 to July 2019, data which is useful for month-to-month and year-to-year comparisons, and which allows the construction of the interesting charts featured here, created by Nick Laird of the unique GoldChartsRUs.com website.

Prior to this official Chinese gold import data being published, the quantity of gold being imported into China had to be estimated. At times this was done very accurately by the likes of Matt Turner of Maquarie Bank, who used various methods, including adding up the gold export figures of other countries to China – at least for those countries that published their gold export figures.

2018 – A Bumper Year for Gold Imports

Turner, in his commentary for the LBMA magazine earlier this year, was probably the first person to draw attention to this new official Chinese gold import data, but unfortunately he didn’t provide a link to the actual trade database. What he did find though was that:

”in 2017, according to the official data, China imported 1,270 tonnes of gold. In 2018, that rose to a huge 1,506 tonnes of gold. Almost all of this comes under the subcategory HS710812, which is unwrought gold, but there is a small amount of HS 710813 or semi-manufactured gold.”

Doing a quick spot check of Matt’s figures,and running some queries in the Chinese trade and customs database, my results say that 1262 tonnes of gold were imported into China during 2017. This is when you include HS codes 71081200 and 71081300. Matt Turner got 1270 tonnes for the same two HS codes. I am not sure why the 8 tonne difference, perhaps some data has been subsequently adjusted, but in the overall picture, it’s not material.

Turning to 2018, and using same two HS codes above, my query results say that 1505.7 tonnes of gold were imported during 2018. Matt Turner said 1506 tonnes, so that’s identical. Therefore, we can say that the data in this Chinese trade data database is that same as that used by Turner since it produces the same results over independent queries.

So how do the Reuters stories above stand up to the results from the newly revealed database? Recall again that the Reuters 14 August article, ”China curbs gold imports as trade war heats up”, states that:

”Chinese customs figures show it imported 575 tonnes of gold in the first half of the year, down from 883 tonnes in the same period of 2018.

In May, China imported 71 tonnes, down from 157 tonnes in May 2018. In June, the last month for which data is available, the decline was even sharper, with 57 tonnes shipped compared with 199 tonnes in June last year.”

Did Reuters get its data from the same customs and trade database? We can check. For the 6 months from January to June 2019, my query results of the trade database say that China imported 575 tonnes of gold. This tallies exactly with the Reuters figure of 575 tonnes for H1 2019. The H1 2018 Reuters figure of 883 tonnes also aligns perfectly since I get 883.17 tonnes when querying for the two relevant HS codes.

The May 2019 number from Reuters of 71 tonnes also checks out OK. I get 70.8 tonnes. As does the Reuters figure of 157 tonnes from May 2018. I get 156.8 tonnes. Similarly for June 2019, Reuters says 57 tonnes. I get 56.8 tonnes. For June 2018, Reuters says 199 tonnes, I get 199.3 tonnes.

Therefore, we can say that Reuters is quoting its gold import figures from the same database that can be found here -> http://43.248.49.97/indexEn

Down but not Out

Now that the July 2019 data is in, we can see that 619 tonnes of non-monetary gold have been imported into China over the seven months of 2019 from January to July inclusive. Over the similar period in 2018, a total of 994 tonnes of gold were imported, and for the seven month period in 2017 the total was 802 tonnes.

Therefore, total gold imports over January – July 2019 are 37% lower than during January – July 2018, and 23% lower than during January – July 2017. But when breaking the seven month period down further into two periods from January to April and from May to July (the period in which the lower import quotas are said to have put into effect), that the drop is more startling.

Over January to April 2019, China imported 448 tonnes of gold. This was actually higher than the 436 tonnes of gold imported into China over January – April 2017, and not too far off the 527 tonnes of gold imported into the country over January – April 2018. But looking at the May – July period, China imported 366 tonnes over May -July 2017, 467 tonnes between May and July 2018, but only 171 tonnes over May -July 2019. In percentage terms, the 2019 May – July gold imports are 114% lower than the same period in 2017, and a whopping 173% lower than in the same period in 2018. So there is substance to what Reuters is reporting about lower gold imports into China since May.

However, the dramatic claims by some of Reuters anonymous sources that “there are virtually no import quotas now issued in China” and “next to nothing was imported by banks in June and July” are far off the mark, because there has still been 171 tonnes of gold imported over those three months, which any way you measure it is still a very sizable amount.

Reuters has a partial explanation for the continual gold import flow, which is that according to “4 of it sources” …”[gold] imports have not fallen to zero because some banks may still be receiving some quotas, and other import channels, such as refineries receiving semi-pure mined gold, remain open”.

But still, all we can say from these figures is that non-monetary gold imports dropped between May – July 2019. The figures do not explain why. Interestingly, but not surprising, the Chinese central bank declined to comment for the Reuters stories.

Reuters sources say that the Chinese authorities want to reduce capital outflows to steam yuan weakness, and so have reduced import quotas to stem capital outflows in US dollars. But is this really the reason?

Reducing gold imports by 100 tonnes would be worth about US$ 4 billion at at average gold price of $1300 per troy ounce, and about US$ 4.5 billion at an average gold price of US$ 1400 per troy ounce, a range of prices which were prevalent in June and July. So if the Chinese authorities shrunk gold imports by between 200 and 300 tonnes from May to July (and into mid-August) they might have succeeded in holding back between US$ 8 billion and US$ 13 billion to tweak the Chinese balance of payments. But this is not a whole lot in terms of China’s huge monthly trade flows. For example, China’s total imports for July were $175.5 billion.

There are a number of other reasons why the PBoC might want to restrict gold imports. These include:

1. to reduce gold supply because local Chinese gold demand is weak

2. to provide cover for channeling gold imports into monetary gold holdings

It is therefore worth looking at the reaction of the local market to possible import gold restrictions and the motivations for why the Chinese authorities might want to limit gold imports into the world´s biggest gold market. Let’s look briefly at 1 and 2 above and then conclude.

Supply, Demand, and SGE Premiums

Over the period November – December 2016 and again in March 2017, Reuters (surprise, surprise) also reported here and here that there were gold import restrictions into China. The motivations for these quota restrictions were, according to Reuters, to “curb gold imports in a bid to limit yuan outflow” and “to control the capital outflows”.

During those times in Nov – Dec 2016 and March 2017, Shanghai Gold Exchange (SGE) price premiums spiked. This suggested a correlation with gold supply constraints in an environment of consistent demand. Commenting on this phenomenon in 2017, I wrote:

“In theory, an expansion in the SGE price premium could have been caused by a combination of limited supply or higher demand, or both. The below chart for 2016 (lower panel) illustrates the emergence of this premium in early November, with the premium rising rapidly from less than 0.5% at that time to nearly 3.5% at one point in December, but still ending the year in the 2% range.”

“In the case of March, it appears that premiums rose again for the very same reason that was attributed to the sharp rise in late 2016, i.e. the re-emergence of supply constraints brought on by more stringent gold import restrictions.”

However, in the last few months, and specifically during the May – August 2019 period, SGE premiums have not spiked. They have remained relatively flat, mostly below the 1% level, and the premiums have been for the most part lower than those recorded in March and April.

So if SGE premiums did not spike in the presence of reduced gold imports, what does this mean? Well firstly it would suggest that there is not a supply constraint, and that the gold supply needed by the Chinese domestic market is being supplied by local supply plus the lower levels of gold imports. Said a different way, it could mean that local gold demand has not been high enough for take all actual supply, and not high enough to generate a spike in premiums.

But we could go even further. What if local gold demand has been so weak that in the absence of lower gold imports, it would have caused a drop in SGE premiums? What if the Chinese authorities want to keep SGE premiums at a certain level, such as fluctuating around the 1% level. They could do so by meddling with gold import quotas to maintain these premiums, delibrately shrinking supply to meet the lower demand. In background discussions, this was suggested as a possibility by Bron Suchecki and may be worth considering.

Why would the Chinese authorities try to maintain a certain range of SGE premiums such as 1%? Well, possibly to give a free lunch to favoured gold importing banks who do the importing and onward selling, or alternatively to make the Chinese gold market look stronger that it really is for image reasons. Shrinking the import quotes and dampening gold imports would keep the premiums levitating, premiums which might otherwise collapse if demand is not keeping them up.

PBoC Gold Reserves – Central Bank Chanelling

Another possibility to explain the recent lower Chinese gold imports, and which is admittedly just speculation, is that the same volume of imported gold is still coming into China, with the difference not as non-monetary gold, but as monetary gold. In that case it would not show up in the customs and trade statistics. What if the Chinese central bank and the Chinese state have been diverting some of the country’s recent gold imports to China’s strategic gold reserve stash?

For example, if 994 tonnes of gold was imported into China from January – July 2019 (the same amount that was actually imported during January – July 2018), and all of this was non-monetary gold, then 994 tonnes would show up in the cross-border trade data. But if the 2019 trade statistics are only showing 619 tonnes (as the database is showing), then there could still have been 994 tonnes imported, but with 375 tonnes imported as monetary gold – gold which is exempt from trade reporting.

By adjusting the gold import quotas lower, gold imports could be channeled to the the vault of the central bank, while providing the necessary cover to create the illusion that lower quotas are the culprit for the decline. Given that nobody much believes the official low-ball figures for China’s official gold reserves, stranger things have happened than the Chinese state temporarily diverting some of the country’s gold imports for the coffers of its gold vaults in Beijing.

To conclude, for those interested, you can play around with the gold import data here, including seeing data as granular as source countries of China’s gold (e.g. Switzerland) and the Chinese locations where the gold is imported to (e.g. Beijing) -> http://43.248.49.97/indexEn

This article was originally published on the BullionStar.com website under the same title “Chinese Gold Imports – better data, lower flows, unanswered questions”.

via ZeroHedge News https://ift.tt/34hcwBL Tyler Durden