One year after bashing cryptocurrencies, and lashing out at Facebook and Google at the 2018 Davos conference, warning the two companies are a “menace” and “monopolistic” and predicting it’s “only a matter of time before the global dominance of the US IT monopolies is broken,” moments ago during his much-anticipated speech at this year’s Davos event, Soros took aim at an even greater adversary, one which even Donald Trump might agree with: China.

Soros started his prepared remarks by cautioned “the world about “an unprecedented danger that’s threatening the very survival of open societies”, before warning about the dangers of artificial intelligence in the hands of “authoritarian regimes such as China” and called President Xi Jinping “the most dangerous” opponent of open societies.

“The instruments of control developed by artificial intelligence give an inherent advantage of totalitarian regimes over open societies,” the former hedge fund manager said on Thursday evening at Davos.

Reminding listeners that last year when he “spent most of my time analyzing the nefarious role of the IT monopolies” Soros said “an alliance is emerging between authoritarian states and the large data rich IT monopolies that bring together nascent systems of corporate surveillance with an already developing system of state sponsored surveillance. This may well result in a web of totalitarian control the likes of which not even George Orwell could have imagined.”

While Soros’ ideological critics may have a chuckle at the irony that the billionaire supporter of Hillary Clinton is the one warning about Orwellian control, we would not be surprised if even president Trump found himself agreeing when Soros said today that he wants “to call attention to the mortal danger facing open societies from the instruments of control that machine learning and artificial intelligence can put in the hands of repressive regimes. I’ll focus on China, where Xi Jinping wants a one-party state to reign supreme.”

The focus of Soros’ criticism had to do with China’s social credit system, which we have discussed extensively in the past. As a reminder, in November, the “Beijing Further Optimization of the Business Environment Action Plan (2018-2020)” was distributed to all district committees, district governments, municipal party committees, local government ministries and commissions bureaus, various head offices, multiple people’s organizations, colleges, and universities. The report detailed Beijing’s ambitious plan to control each of its 22 million citizens based on a system of social scoring that punishes behavior it does not approve, with the full implementation of the program to be rolled out by 2020. In short, people with great social credit will get “green channel” benefits while those who violate laws will be punished with restrictions and penalties.

China is doing the same at the national level as well, and it represents the development Soros is most worried about:

All the rapidly expanding information available about a person is going to be consolidated in a centralized database to create a “social credit system.” Based on that data, people will be evaluated by algorithms that will determine whether they pose a threat to the one-party state. People will then be treated accordingly.

The social credit system is not yet fully operational, but it’s clear where it’s heading. It will subordinate the fate of the individual to the interests of the one-party state in ways unprecedented in history.

While noting that China isn’t the only authoritarian regime in the world, Soros said it was “undoubtedly the wealthiest, strongest and most developed in machine learning and artificial intelligence. This makes Xi Jinping the most dangerous opponent of those who believe in the concept of open society. But Xi isn’t alone. Authoritarian regimes are proliferating all over the world and if they succeed, they will become totalitarian.”

China’s social credit system is “frightening and abhorrent,” says George Soros in Davos speech. Watch more here: https://t.co/BgXtqTro7d pic.twitter.com/YG3v85KrTu

— Bloomberg TV (@BloombergTV) January 24, 2019

Soros said that what we found “particularly disturbing” is that the instruments of control developed by artificial intelligence give an inherent advantage to authoritarian regimes over open societies. “For them, instruments of control provide a useful tool; for open societies, they pose a mortal threat.”

I use “open society” as shorthand for a society in which the rule of law prevails as opposed to rule by a single individual and where the role of the state is to protect human rights and individual freedom. In my personal view, an open society should pay special attention to those who suffer from discrimination or social exclusion and those who can’t defend themselves.

By contrast, authoritarian regimes use whatever instruments of control they possess to maintain themselves in power at the expense of those whom they exploit and suppress.

Soros then goes on in great detail to explain why his previous efforts to establish an “Open Society” in China were met with abject failure.

In retrospect, it’s clear that I made a mistake in trying to establish a foundation which operated in ways that were alien to people in China. At that time, giving a grant created a sense of mutual obligation between the donor and recipient and obliged both of them to remain loyal to each other forever.

This being Soros, of course, he did not waste an opportunity to take a jab at Russia – where he is just as unwelcome as he is in China:

I’ve been concentrating on China, but open societies have many more enemies, Putin’s Russia foremost among them. And the most dangerous scenario is when these enemies conspire with, and learn from, each other on how to better oppress their people.

Soros then went on the next part of his speech: “what can we do to stop them“, and by “we” Soros arguably means all those who believe that Soros’ approach to enforcing an “open society” style democracy anywhere in the world is the right one.

His answer:

The first step is to recognize the danger. That’s why I’m speaking out tonight. But now comes the difficult part. Those of us who want to preserve the open society must work together and form an effective alliance. We have a task that can’t be left to governments.

So admitting that his own foundation is hopeless to infiltrate China, Soros then poses what he considers the most important question for open societies: “what will happen in China?”

The question can be answered only by the Chinese people. All we can do is to draw a sharp distinction between them and Xi Jinping. Since Xi has declared his hostility to open society, the Chinese people remain our main source of hope.

Here Soros sees “ground for hope”, suggesting that all China’s population needs to revolt against its authoritarian society is a gentle push:

As some China experts have explained to me, there is a Confucian tradition, according to which advisors of the emperor are expected to speak out when they strongly disagree with one of his actions or decrees, even if that it may result in exile or execution.

This came as a great relief to me when I had been on the verge of despair. The committed defenders of open society in China, who are around my age, have mostly retired and their places have been taken by younger people who are dependent on Xi Jinping for promotion. But a new political elite has emerged that is willing to uphold the Confucian tradition. This means that Xi will continue to have a political opposition at home.

And while Soros highlights China’s setbacks with implementing its Belt and Road plan, including recent pushback in Sri Lanka, Pakistan and Malaysia, Soros, ironically, find an ideological supported in none other than his own arch enemy in the US, Donald Trump:

Most importantly, the US government has now identified China as a “strategic rival.” President Trump is notoriously unpredictable, but this decision was the result of a carefully prepared plan. Since then, the idiosyncratic behavior of Trump has been largely superseded by a China policy adopted by the agencies of the administration and overseen by Asian affairs advisor of the National Security Council Matt Pottinger and others. The policy was outlined in a seminal speech by Vice President Mike Pence on October 4th.

Of course, Soros finds Trump’s “brute force” response not sophisticated enough, and adds that “simply declaring China a strategic rival is too simplistic. China is an important global actor. An effective policy towards China can’t be reduced to a slogan.”

It needs to be far more sophisticated, detailed and practical; and it must include an American economic response to the Belt and Road Initiative. The Pottinger plan doesn’t answer the question whether its ultimate goal is to level the playing field or to disengage from China altogether.

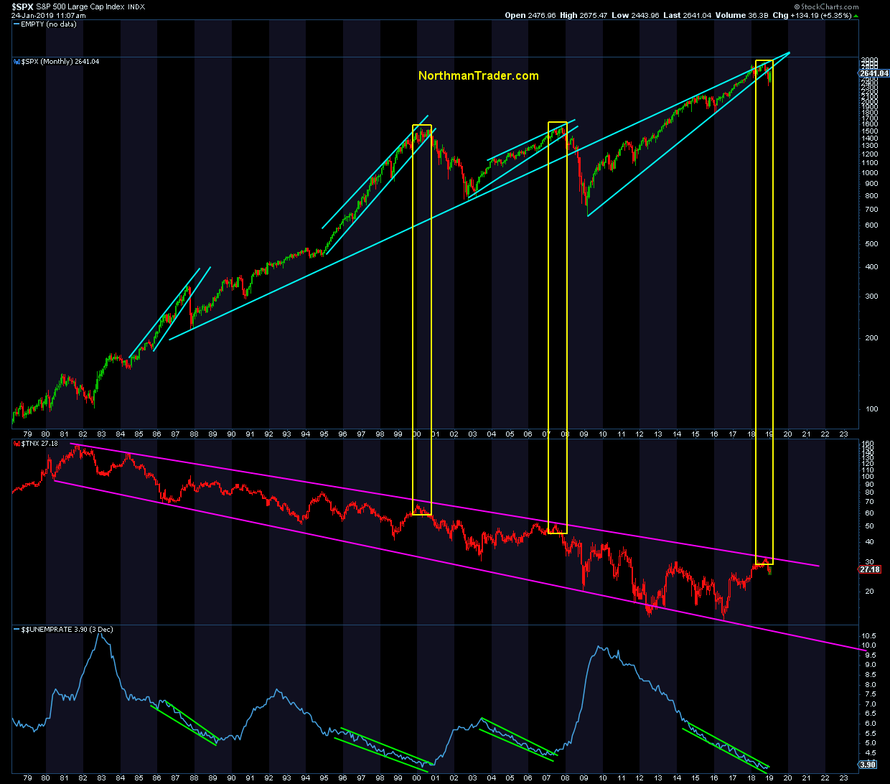

Soros also notes that China is clearly aware, and Xi Jinping fully understood “the threat that the new US policy posed for his leadership. He gambled on a personal meeting with President Trump at the G20 meeting in Buenos Aires. In the meantime, the danger of global trade war escalated and the stock market embarked on a serious sell-off in December. This created problems for Trump who had concentrated all his efforts on the 2018 midterm elections. When Trump and Xi met, both sides were eager for a deal. No wonder that they reached one, but it’s very inconclusive: a ninety-day truce.”

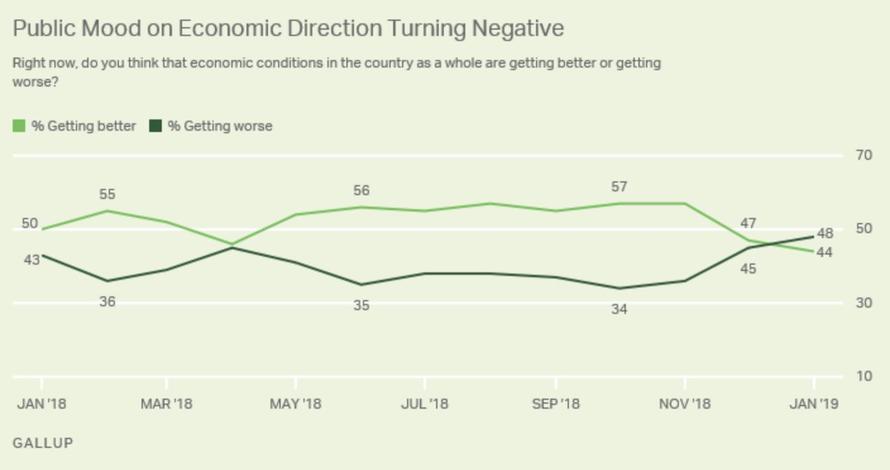

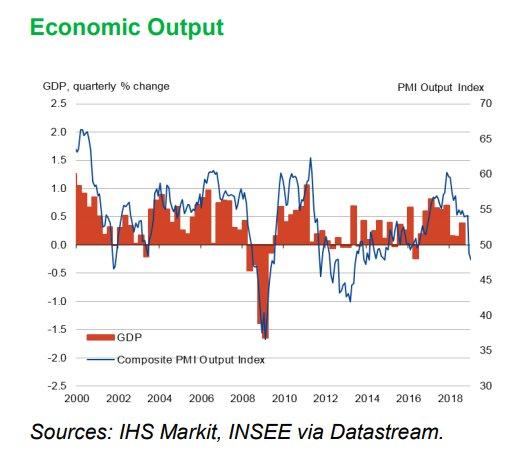

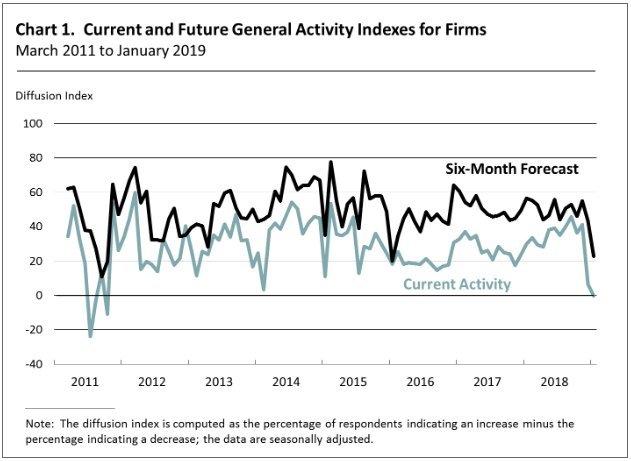

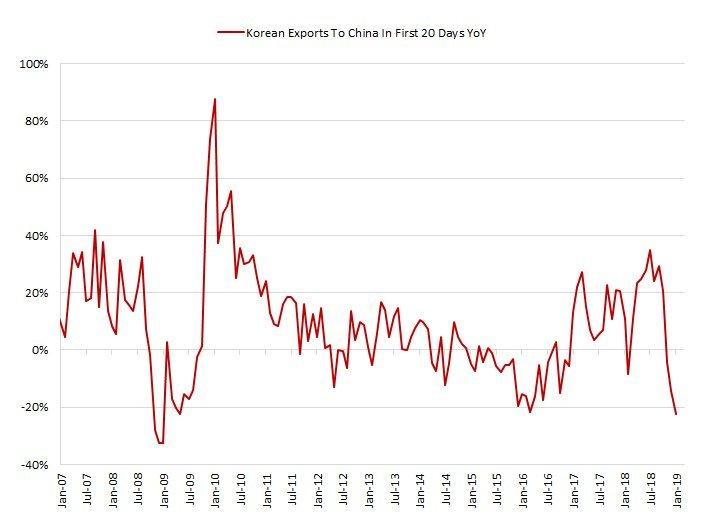

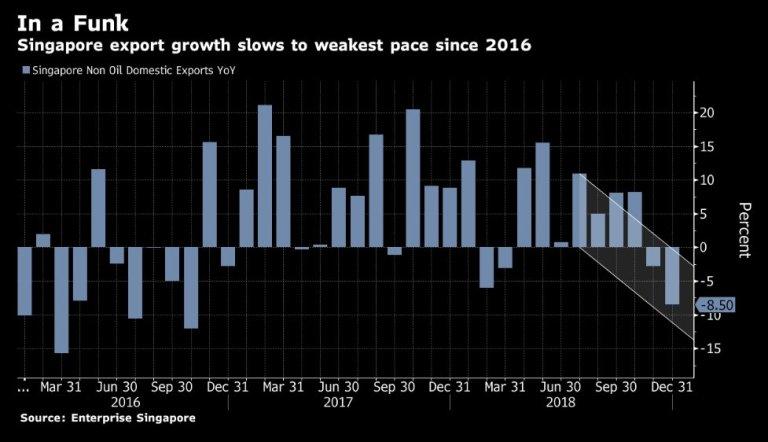

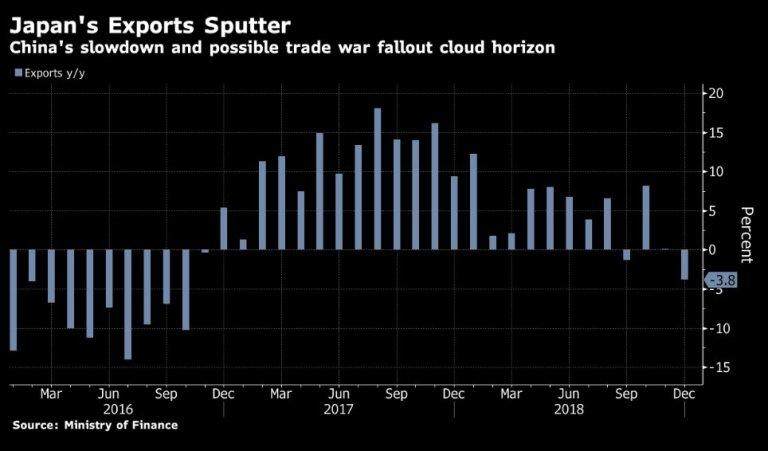

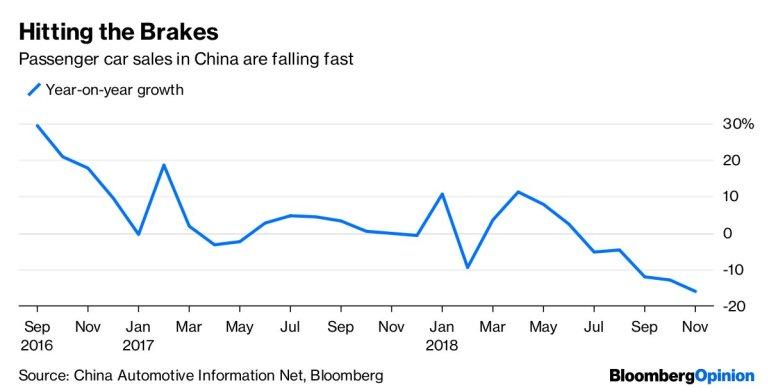

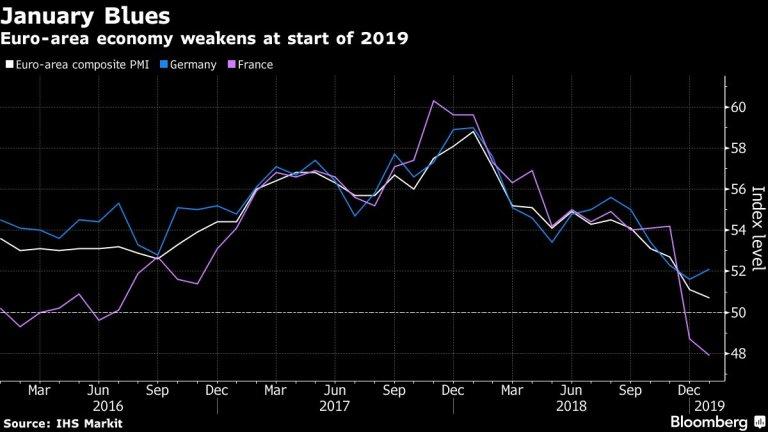

In the meantime, there are clear indications that a broad based economic decline is in the making in China, which is affecting the rest of the world. A global slowdown is the last thing the market wants to see.

So what is Soros’ recommendation? Why apply the Open Society framework to China the same way it has been applied to every other nation in the past: crash their stock market, sink their economy with the hope of eventually destabilizing the ruling regime while discretely endorsing a different political system.

The unspoken social contract in China is built on steadily rising living standards. If the decline in the Chinese economy and stock market is severe enough, this social contract may be undermined and even the business community may turn against Xi Jinping. Such a downturn could also sound the death knell of the Belt and Road Initiative, because Xi may run out of resources to continue financing so many lossmaking investments.

While we are confident that Soros would find particular delight in China’s ongoing economic slowdown and its market troubles, what we found especially interesting is that Trump’s ongoing crackdown on Chinese tech companies appears to be straight out of the Open Society playbook, to wit:

On the question of global internet governance, there’s an undeclared struggle between the West and China. China wants to dictate rules and procedures that govern the digital economy by dominating the developing world with its new platforms and technologies. This is a threat to the freedom of the Internet and indirectly open society itself.

Last year I still believed that China ought to be more deeply embedded in the institutions of global governance, but since then Xi Jinping’s behavior has changed my opinion. My present view is that instead of waging a trade war with practically the whole world, the US should focus on China. Instead of letting ZTE and Huawei off lightly, it needs to crack down on them. If these companies came to dominate the 5G market, they would present an unacceptable security risk for the rest of the world.

And here, something fascinating: instead of praising Trump for being the one leader who has dared to challenge the US-China status quo more than any other president in history, Soros attacks Trump, saying that “regrettably” the US President “seems to be following a different course: make concessions to China and declare victory while renewing his attacks on US allies. This is liable to undermine the US policy objective of curbing China’s abuses and excesses.”

In other words, according to Soros, Trump is not doing enough to prevent Chinese technological dominance!

Who would have though that of all people, it was Soros who thought that Trump is not doing enough to crack down on China…

Which brings us to Soros’ conclusion:

My key point is that the combination of repressive regimes with IT monopolies endows those regimes with a built-in advantage over open societies. The instruments of control are useful tools in the hands of authoritarian regimes, but they pose a mortal threat to open societies.

China is not the only authoritarian regime in the world but it is the wealthiest, strongest and technologically most advance. This makes Xi Jinping the most dangerous opponent of open societies. That’s why it’s so important to distinguish Xi Jinping’s policies from the aspirations of the Chinese people. The social credit system, if it became operational, would give Xi total control over the people. Since Xi is the most dangerous enemy of the open society, we must pin our hopes on the Chinese people, and especially on the business community and a political elite willing to uphold the Confucian tradition.

And yet before anyone declares Trump and Soros BFFs, the billionaire democrat donor makes it quite clear that in addition to seeking the replacement of Xi, he would be even more happy if Trump were also gone, because since “we are in a Cold War that threatens to turn into a hot one” if “Xi and Trump were no longer in power, an opportunity would present itself to develop greater cooperation between the two cyber-superpowers.”

Cooperation… which would only be made possible and dominated by “something similar to the United Nations Treaty that arose out of the Second World War.“

In other words an organization modeled after Soros’ very own Open Society.

Soros’ complete remarks delivered to the World Economic Forum can be found here.

via ZeroHedge News http://bit.ly/2BcLAGr Tyler Durden

New York is known for its incredible food scene, but legislators in the Big Apple may have bitten off more than they can chew with the newest minimum wage hike.

New York is known for its incredible food scene, but legislators in the Big Apple may have bitten off more than they can chew with the newest minimum wage hike.

An American anchorwoman for Iran state television was recently arrested, and later released, by the Federal Bureau of Investigation (FBI). The FBI has remained silent on the details surrounding Marzieh Hashemi’s arrest.

An American anchorwoman for Iran state television was recently arrested, and later released, by the Federal Bureau of Investigation (FBI). The FBI has remained silent on the details surrounding Marzieh Hashemi’s arrest.