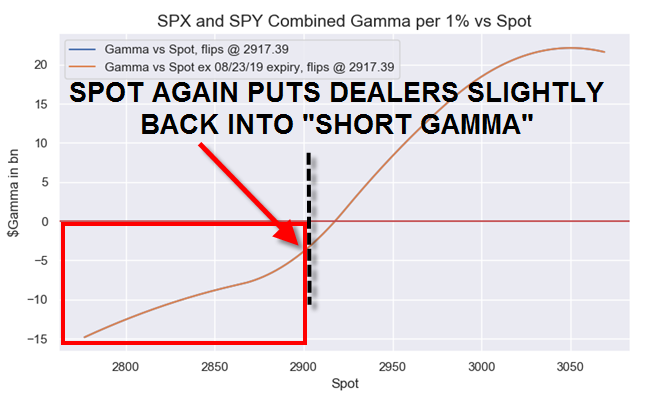

Until just about 11am this, the market was poised on a knife’s edge, trading right on top of the dealer gamma breakeven level. That ended with a bang when Trump unveiled that the US will retaliate to China’s Friday tariff increase “this afternoon” and ordered companies to find “an alternative to China”, in what was clearly a dramatic escalation in the trade war (and potentially currency war, should Trump announce the US will intervene in the FX market to devalue the dollar against the yuan and/or other currencies). The news of Trump’s escalation and mystery afternoon announcement sent markets tumbling…

… and sent the S&P sharply into “short gamma” territory, where selling begets more selling.

The sharp drop in the market today, however, could represent a double whammy because not only does it send stocks lower ahead of a traditionally volatile September, but it pushes risk into levels where in addition to “gamma gravity” kicking in, various quant and systemic investors are once again forced to sell, creating a feedback loop where the lower stocks drop, the more forced selling will be unleashed, etc.

It is this pernicious feedback loop that framed this morning’s note by Nomura’s Charlie McElligott who after warning earlier this week that markets are facing an especially precarious September, warned that what happens today in markets will likely reverberate for quite some time. In retrospect, his warning could not have been more timely.

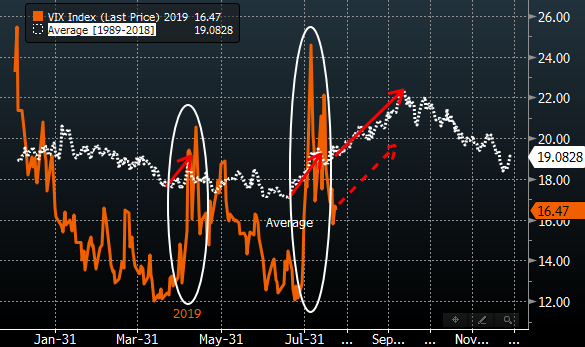

As the Nomura quant writes, “with regards to Equities and the VIX Dealer “Gamma” update, Dealers post-expiry were obviously in a much “cleaner” place and now “long Delta”, something we observed after the “Short Gamma” rip into a VIX options expiry “we tend to see Deltas remain “sticky” for approx. a week or so thereafter.”

But while McElligott correctly called the recent technical “melt up”, he is now growing concerned that the pieces are falling-into-place for a potential “Equities pullback window” during the month of September, particularly with a cacophony of event- and flow- risks mid-month onward which are “clustering”, among which:

- VIX seasonality, with September posting the 2nd best average monthly return for VIX since its inception, +6.9% on avg (2nd to only August at +9.2%) and which is likely a function of still-weak post-Summer holiday volumes/depth of book and tight liquidity/VaR constraints from Dealers into Quarter-End

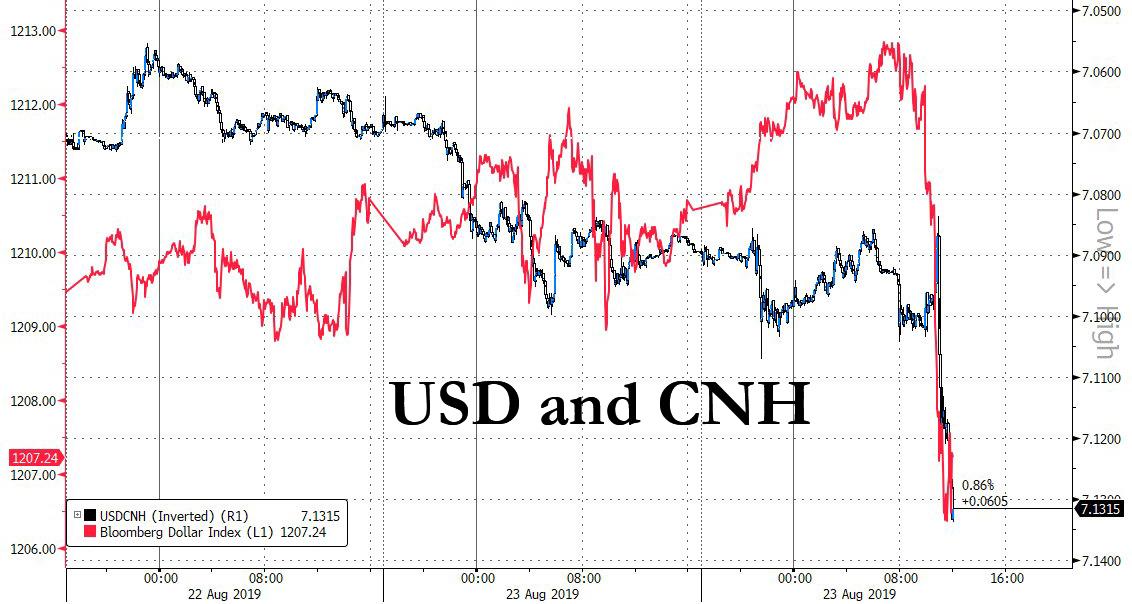

- An obvious macro catalyst to “set it off” in the form of today’s China retaliation – and US counter retaliation which is still pending – weighing on global growth and business sentiment even further CB disappointment risk, most likely via the potential for either the Fed (Sep 18th) or the ECB (Sep 12th) being unable to match markets’ very dovish expectations, with the potential to create an Equities’ “gap down” on perceived de facto “hawkish” message, which would also serve to “tighten” financial conditions (USD up, Yields up, Vol up) and accelerate the USD funding stress dynamic further (unless Trump announces a USD currency devaluation at some point today that is).

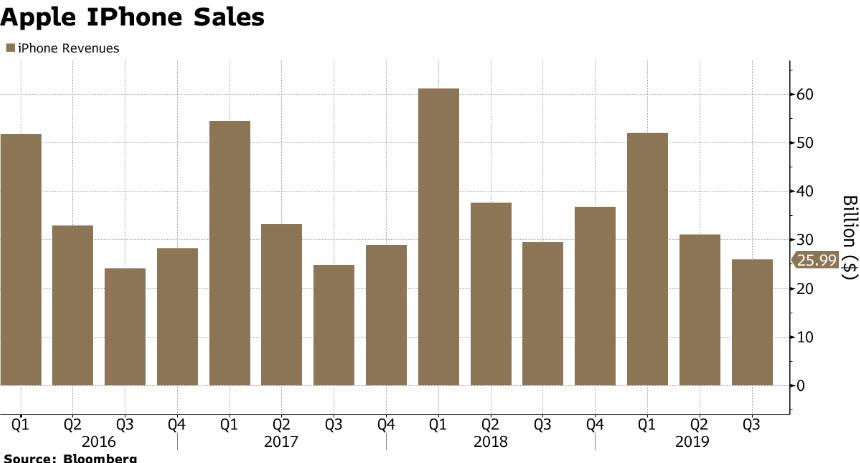

- Buyback blackout: the mid-Sept timing of CB-induced “risk” corroborates too with the removal of a key “demand / stabilizer flow” in US Equities, as well via the commencement of the Q3 EPS season Corporate “Buyback Blackout” around mid- September, as 75% of S&P 500 corporates will see their purchase windows close by Sep 17th

- This “clustering” of risks occurs at the same time we see the Q3 “Quad Witch” Serial Expiry on Sep 21st, meaning almost-certain “Gamma” hedge- related “swing” risk.

Not helping matters is the unpredictable impact of the “whale” vol trader known as the second coming of “50 cent”. According to McElligott, “we have already seen fresh Sep VIX “Call Wing” trading AGAIN, which look a lot like the footprints of the “50 Cent” hedge program (“wingy” VIX Sep 20C and VIX Sep 25C both traded good size this week), which could see us again back in the same spot we were in this past month of August—meaning that Dealers may again have to then go out and buy loads of “crash” protection to offset their VIX “Short Gamma” and which could then keep VIX / Vol of Vol / S&P Skew “jumpy” and indicatively “binary”(just as we experienced since end-July into August).”

The only difference is that unlike last week, when dealers were unwinding the 50 cent trade, and sending vix crashing, this would be the opposite leg, which in turn would result in a buying spree in VIX futs, which in turn sends stocks even lower.

But the key catalyst is the China trade war escalation which as the Nomura quant notes is “weighing on sentiment and growth downside risks further, we may in fact pull-forward this scenario.”

* * *

Which brings us to the “bigger picture” summary from McElligott who notes that what we are experience is really a progression that continues to “rhyme” with other bouts of “crash-down then crash-up” cycles in the modern Equities market structure, which follows the following steps:

- An un-anticipated “macro shock” catalyst (e.g. the most recent Trump tweet tariff escalation in late July, which then kicked-off the August Vol move) then “gaps” markets lower

- From there via said “gap” lower, Dealer options desks’ Gamma position too tends to flip “Short” from downside protection sold to clients (as opposed to a calm / “slow grind higher” market where buyside “Vol Sellers” i.e. Overwriters / “Put Bombers” tend to get Dealers “long Gamma”), while clients often too “dynamically hedge” via pressing shorts in Futs, ETFs or singles (“Net-down”)—all of which exacerbates the violence of the move lower, hence a “feedback loop”

- And on account of said “Short Gamma” into a macro gap down (forcing Dealer desks to short more futures the lower we go), this then too has the tendency to bring Vol Control / Target Vol and Systematic CTA trend “deleveraging” (sell) levels into play—as the ultimate “mechanical / un-emotional flow” accelerant to create the “shock down”

- This “high vol” then tends to “normalize,” both 1) as hedges are monetized (e.g. net long vega via VIX ETNs, clients selling out of S&P downside or Dealers unwinding “crash”) and 2) thanks to the proliferation of “Short Vol” strategies (from Systematic VIX “Roll-Down” to real $ “Yield Enhancement” or “Overwriting”), which then SELL into these elevated volatility levels as attractive entry-points

- Dealers then get “Long Gamma” from these various strategies, i.e. client “Put Sellers” which then makes options desks’ “synthetically short” the mkt and forcing them to buy large notional Delta as hedges (e.g. via buying Equities futures), in-turn acting as a massive market “shock absorber” / “stabilizer” which then bleeds Volatility in a virtuous feedback loop

- Similar + Equities / – Volatility input occurs via Corp Buybacks, which squelch Vol spikes and historically have tended to be most active for these types of “shock down” scenarios (outside of “blackout” periods, but of course Corps can too remain active repurchasing shares via 10b5-1 programs)

- Finally, that “dynamic hedging” of pressed Shorts in futures / ETFs / singles in order to lower ‘Net Exposure’ during the prior drawdown period described then turns into “fodder for a squeeze”

- As markets squeeze higher and price momentum again turns HIGHER / Vol normalizes LOWER, and we then see the Vol Control- / Tgt Vol- / CTA Trend- “rules based” universe then begin adding-back exposure, either “re-leveraging” of longs / covering shorts (CTAs)

- RINSE, REPEAT

In case there is any confusion, we are now entering the “crash down” phase again, and far faster than most had expected.

Finally, for those wondering, here are the latest CTA trigger levels per McElligott. Needless to say, the lower we drop, the most CTAs will either sell or flip even shorter.

One final thought: if it is Trump’s intention to accelerate the Fed’s launch of “some quantiative easing”, then he is doing exactly what he should (as we explained): after all, the Powell Put level is not much lower, and Trump has a free option on whether the Fed chair will cut rates or go all the way and start buying assets again.

via ZeroHedge News https://ift.tt/2L2FhsZ Tyler Durden